Contacting The Navient Via Social Media

Although there are multiple ways to contact Navient, you still might want to reach out to a representative vial social media site. You can contact them via or. When reaching out to Navient on social media, do not offer too much information, such as account numbers and personal address. Instead, you can request a customer service representative from Navient to contact you.

None of these contact options working? Now what?

If you cannot get a hold of Navients customer service department by calling, emailing, or chatting online, then here are a few other options that might put you in touch with the right department. If you plan on filing a claim against Navient, let us help you file a claim to avoid the hassles of phone calls, emails, and long, drawn-out chat logs.

Take your complaint beyond customer service and get a real resolution.

Who Is Eligible For Navients Services

Basically Navient provides for college and university students. Also, those who have just graduated from their degrees and need financing for their education.

It also functions in the healthcare, portfolio management, credit recovery. Also in the revenue enhancement services for courts, toll authorities and credit unions.

Navient And Public Service Loan Forgiveness

If you have qualifying student loans and you work in the public sector, you might be qualified for Public Service Loan Forgiveness . This comprises anyone working full time in AmeriCorps or as a Peace Corps volunteer.

An important requirement for anyone qualifying for the Navient loan is that youll need to make 120 on-time payments on your eligible loans.

But once youve met all the requirements, you could have your student loans forgiven. This means they will wipe the remaining balance away for good.

Most PSLF applications are being handled by FedLoan Servicing. They will move your loans to FedLoan once youve met the programs requirements.

READ ALSO!!!

Recommended Reading: How To Start Va Home Loan Process

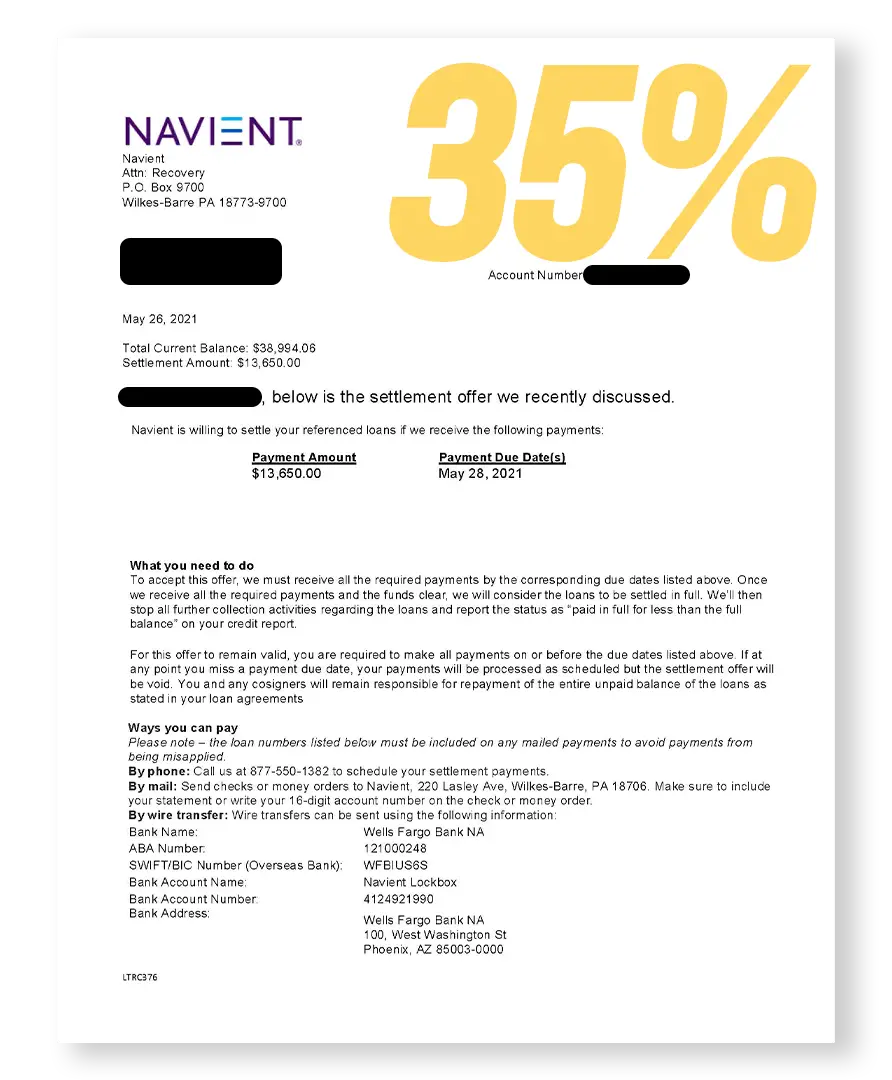

What Next After Settling A Student Loan With Navient

When you settle a student loan with Navient, you’ll receive a debt clearance letter approximately six weeks after your final payment. The letter states that you no longer owe that loan.

The Internal Revenue Service will also send you a 1099-C, also known as a Cancellation of Debt notice at the end of the year. The 1099-C states the unpaid portion of your student loan, which is considered taxable income. So when you file your taxes, you’ll be required to include this portion as part of your income.

However, you can talk to the IRS to discuss your options if you wish to exclude the unpaid portion of the student loan from your tax return.

How To Request A Refund For Student Loan Payments

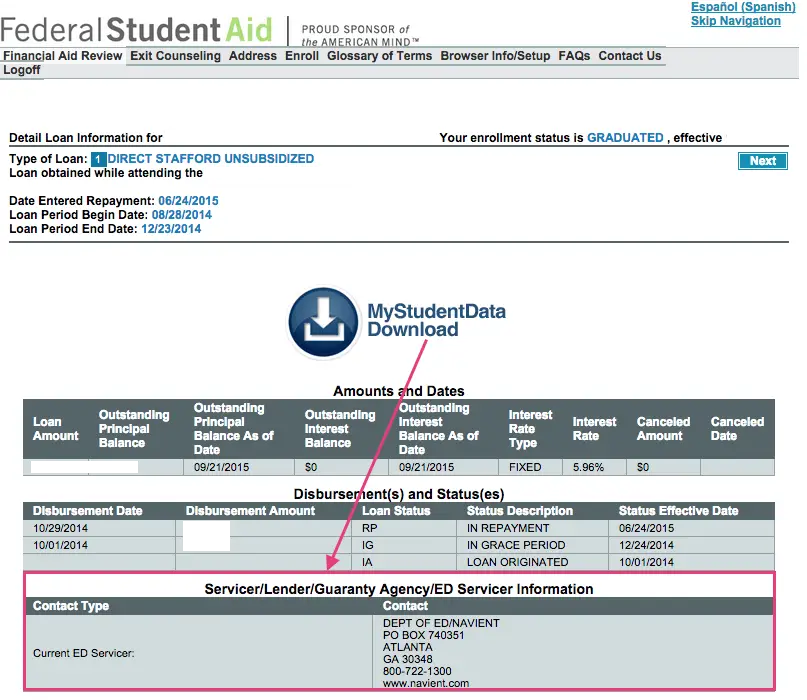

To request a refund of student loan payments that you made during the pandemic, you must contact your loan servicer. If you arent sure who your loan servicer isand it may have changed in the last two yearsyou can sign into your account dashboard on the Federal Student Aid site to find out. Or, you can call the Federal Student Aid Information Center at 1-800-433-3243.

Once you know who your loan servicer is, call the company directly. Below are the phone numbers for each of the federal loan servicers:

- FedLoan Servicing: 1-800-699-2908

- Great Lakes Educational Loan Services: 1-800-236-4300

- Edfinancial: 1-855-337-6884

- ECSI: 1-866-313-3797

- Default Resolution Group: 1-800-621-3115

Be prepared to give the customer service representative your account number and a list of what payments you want refunded. If possible, include transaction numbers for each one and dates when the payments were made.

Also Check: Who Can Use The Va Loan

Youre Eligible For The New Loan Forgiveness Program

Under President Bidens new forgiveness program, federal student loan borrowers who earn less than $125,000 will see their balances drop by $10,000. Borrowers that received Pell Grants are eligible for up to $20,000 in forgiveness if they meet the same income requirements.

If you made payments and paid off your federal student loans during the federal payment freezeor reduced your balance to less than the forgiveness amountyou can get a refund of your payments to maximize the value of this forgiveness opportunity.

For example, lets say you had $10,000 in federal student loans in March 2020. Due to the 0% interest rate, you decided to pay back your loans aggressively and made extra payments throughout the pandemic. Today, your loan balance is $2,000. If youre eligible for Bidens forgiveness plan and didnt take any action, youd qualify for just $2,000 in loan cancellation.

But if you qualify for a refund, you could potentially get $8,000 of your payments returned to you. With your student loan balance returned to $10,000, the government would forgive that full amount. Thanks to this program, youd get $8,000 in cash to use for your other financial goalsand youll still be free of student loans.

Contact Us Sallie Mae

Access Sallie Mae phone numbers and contact details for information related to student loans, savings products, Upromise by Sallie Mae and school assist

Information about federal student aid programs · Help completing the FAFSA · Help in making corrections to your Student Aid Report the document that

For Help Applying for a Student Loan · Phone number 844.422.7502 · Mon Fri: 9 am to 9 pm ET

Borrower payment addresses vary depending on the Nelnet system on which a borrowers loan is stored. Account numbers on borrower statements are preceded by

You may call 800-242-3062 to speak with a Customer Service Representative. Email. Online Inquiries: CONTACT US (select Student Loan Question as the Contact

Student Loans Send all payments to: ZuntaFi PO Box 4500 Aberdeen, SD 57402-4500 Existing Loan Inquiries: Email: [email protected] Phone: 800-592-1270

For general information about federal student financial assistance programs, help completing the FAFSA, and to obtain federal student aid publications, call 800

Contact a loan specialist at the Student Loan Center today. 1-877-304-9302, M-F, 8 am 8 pm, ET or [email protected].

Recommended Reading: Which Loan Should I Pay Off First

Navient Student Loans Phone Number

Navient Student Loans:

Navient Student Loans, a subsidiary of Navient Corporation, is a private student loan corporation that specializes in providing loans to students. The company was formerly known as Sallie Mae and changed its name to Navient in 2014.

For those who are looking for the phone number of Navient Student Loans, here it is! You can call them at 1-888-272-5543.

I Cant Afford My Student Loan Payments What Resources Are Available

If you struggle to afford your federal student loan payments, consider applying for an income-driven repayment plan. Under income-driven plans, payments can be as low as $0 per month. Monthly payment amounts are based on family size and income. Income-driven plans also offer the possibility of loan forgiveness after 20 or 25 years of qualifying payments and can provide valuable interest subsidies.

- The Revised Pay As You Earn plan offers the most generous interest subsidy. Specifically, under REPAYE:

- On subsidized loans, you do not have to pay the difference between your monthly payment amount and the interest that accrues for your first three consecutive years in REPAYE.

- On subsidized loans after these first three years and on unsubsidized loans during all periods, you only have to pay half the difference between your monthly payment amount and the interest that accrues.

More information on income-driven plans is available here. You can also use the U.S. Department of Educations Loan Simulator to explore your repayment options.

If you previously enrolled in an income-driven plan but experienced a loss of income or increase in family size, you may qualify for a new lower payment amount based on your changed financial circumstances.

Massachusetts residents who need help exploring repayment options are encouraged to file a Student Loan Help Request with the Massachusetts Attorney Generals Student Loan Ombudsman at www.mass.gov/ago/studentloans.

Don’t Miss: Bank Loan For Bad Credit

Contact Information For Student Loans

Contact Information for Student Loans · Direct Loans · Federal Direct Consolidation Loan · National Student Loan Data System . Click on Financial Aid

and other Federal or State laws related to student loans . TOLL FREE TELEPHONE NUMBER . Each servicer of a student loan shall maintain a toll

1997 · SchoolsFederal Perkins Loan and National Direct Student Loan borrowers teaching Based Programs Systems Division , telephone number 708-5774 .

Should You Make Extra Payments

If you have extra money in your budget, the answer is definitely YES. This will help you pay off your loans faster and save you money.

You can make extra payments online, by phone, or by mail.

Note that Navient uses the term Overpayment for extra payment, so thats the term you will see in your statement or on its website.

Read Also: Where Can I Cash My Student Loan Check

Who Is Eligible For A Refund

Borrowers who hold eligible federal student loans and have made voluntary payments since March 13, 2020, can get a refund, according to the Department of Education.

For some people, that refund will be automatic. You can get a refund without applying if your payments brought your loan balance below the maximum debt relief amount: $10,000 for all borrowers, and $20,000 for Pell Grant recipients. Borrowers can check their balance in their studentaid.gov account.

For example, if a borrower paid $100 a month for 10 months of the pandemic and their balance is now $8,000, that $1,000 will automatically be refunded. Then they can apply to get the rest of their debt forgiven.

But if a borrower paid throughout the pandemic and still owes $14,000, they wont get an automatic refund. They can, however, apply to have $10,000 of that debt erased.

Another group of people that has to apply for a refund is those who completely paid off their loan balance during the pandemic. If thats you, youre eligible for loan forgiveness, but youll have to request a refund prior to applying for debt relief. Borrowers should confirm their eligibility for the loan forgiveness program prior to requesting a refund.

Borrowers who paid off their loans during the pause will need to request a refund first, then request cancellation, said a spokesperson from the Department of Education.

Eligible federal student loans:

What Is Gethuman’s Relationship To Navient

In short, the two companies are not related. GetHuman builds free tools and shares information amongst customers of companies like Navient. For large companies that includes tools such as our GetHuman Phone, which allows you to call a company but skip the part where you wait on the line listening to their call technology music. We’ve created these shortcuts and apps to try to help customers like you navigate the messy phone menus, hold times, and confusion with customer service, especially with larger companies. And as long as you keep sharing it with your friends and loved ones, we’ll keep doing it.

Navient Contact Info

Recommended Reading: What Are Current Mortgage Loan Interest Rates

Navient Student Loans Login: A Secure Way To Manage Your Debt

As you know, Navient is one of the largest student loan servicers in the United States, servicing over 12 million student loan borrowers. Navient provides a secure online platform for borrowers to manage their student loans, which can be accessed through the Navient Student Loans Login. This platform allows borrowers to view their loan balances, make payments, and update their contact information.

One of the most important features of the Navient Student Loans Login is the security measures in place to protect borrowers personal information. Navient uses industry standard encryption to ensure that sensitive information, such as social security numbers and banking information, is kept secure. Additionally, the platform requires a unique username and password for access, and offers the option to enable two-factor authentication for added security.

Contact Us Edfinancial Services

Contact Edfinancial Services for assistance in managing your student loan account, where to mail your payments, or how to reach a customer service

May 18, 2022 Nelnet is one of seven companies that service federal student loans by collecting and tracking payments. · Your loan servicer is assigned by the

MyFedLoanhttps://myfedloan.orghttps://myfedloan.orgFlag this as personal informationFlag this as personal information

Borrowers can submit problems online. The toll-free phone number is 877-557-2575 and the fax number is 606-396-4821 the mail address is U.S. Department of

Federal Student Loans Defaulted student loans, 800-666-0991 Loan default prevention, 888-215-0196 Renewed eligibility for financial aid (for students in

Students who have questions or are looking for restitution for their student loans can call the Attorney Generals Student Loan Helpline and speak to

May 13, 2021 How to contact Navient · FFELP and HEAL: 272-5543. · U.S. Department of Education student loans: 722-1300. · Private student loans: (

Recommended Reading: How Can I Get Loan Forgiveness

Managing Your Navient Student Loans: A Secure Login Guide

Managing your student loans can be a daunting task, especially when it comes to keeping track of your loan information and making payments on time. Navient is one of the largest student loan servicers in the country, and they offer a variety of tools to help you manage your loans. One of the most important things you can do is to create a secure login to access your loan information.

To create a secure login for your Navient student loans, you will need to visit the Navient website and click on the Sign In button. From there, you prompt to enter your personal information, including your Social Security number and date of birth. Once you have entered this information, you will be asked to create a username and password. It is important to choose a unique and secure password that you will remember, but that others will not be able to guess.

Once you have created your login, you will be able to access your loan information and make payments online. Set up automatic payments, which will ensure that your loans paid on time each month. This can be a great way to avoid late fees and ensure that your credit score stays in good standing.

Navient Student Loans Login: Securely Access and Manage Your Debt Information

Your Student Loan Servicer

We’re here to process your loan payments and help you find lower monthly payment options if you need them. Learn what we do.

Upload Documents Without Logging in to Your Account

Do you need to upload a document? There’s no need to log in. Fill out our form with the requested information and attach your document.

You May Like: What Is Difference Between Secured Loan And Unsecured Loan

What Is A Student Loan Servicer

A student loan servicer collects and manages your student loan payments. If you have federal student loans, the U.S. Department of Education assigns you a student loan servicer when your student loan is disbursed to your college or graduate school. A student loan servicer may be different than your lender. You borrow a student loan from your lender, but you make payments to your student loan servicer.

Student loan servicers can help you with student loan payments, but they are not necessarily acting as your financial advisor. Therefore, its important to understand all your repayment options because your student loan servicer may be acting in its own best interest rather than in yours.

What About Refinancing Into A Private Loan

If youre looking to refinance your federal loans into a private loan, youll need to work with a qualified private lender. These kinds of refinances werent common until recently, but now there are a number of lenders, primarily online, who specialize in student loan refinance, such as SoFi and Earnest. Just remember, you lose access to federal benefits like Public Service Loan Forgiveness, Teacher Loan Forgiveness, and income-driven repayment plans.

If you have private loans you want to consolidate, qualified private lenders can help you there, too. Having a strong credit history will help your case, and youll also need to demonstrate a steady source of income.With a private refinance, unlike federal consolidation, you may be able to land a more favorable interest rate . Interest rates currently range from 3.99% to over 10%, so the better your situation, the better your available offers. Because there are multiple lenders, you canand shouldshop around for rates if you go this direction.

Recommended Reading: How To Get Rid Of School Loan Debt

What Are Your Repayment Options

Although you make your payments to Navient, it is the Department of Education that provides the repayment options. Your options may vary by the type of loan you have.

Here are the standard repayment options:

Standard Repayment Plan

This plan saves you the most money because it allows you to pay off your loan most quickly within 10 years if you have unconsolidated loans, and within 10-30 years if you have consolidated loans. However, since the fixed monthly payments are higher, this is not a viable option for borrowers seeking Public Service Loan Forgiveness . By the way, this will be your default optionif you dont choose a repayment plan.

Graduated Repayment Plan

With this plan, you will start with low monthly payments that will increase every two years. You pay off your loan within 10 years if you have unconsolidated loans, and within 10-30 years if you have consolidated loans. This plan may be a good fit for borrowers whose current income is low but expect an increase over time. Its generally not an option for those seeking PSLF.

Extended Fixed Repayment Plan

If you need to lower your monthly payments, this plan gives you the option to extend your payment period up to 25 years. You will have a fixed monthly payment. To qualify, your outstanding loan amounts must be more than $30,000. This plan is not an option for those seeking PSLF.

Extended Graduated Repayment Plan

Revised Pay As You Earn Repayment Plan Income Sensitive Repayment

Pay As You Earn Repayment Plan