What Credit Score Do Credit Unions Require For Auto Loans

There isnt a minimum credit score that all require for auto loans. It depends on the credit union, the type and age of the car, and the borrowers other qualifications such as employment history and income. The higher your credit score, the lower your rate will generally be. Typically, a credit score over 720 will give borrowers the very best rates.

Recommendations For Auto Loans

While Navy Federal Credit Union can be a solid choice for borrowers, its membership limits who can apply for an auto loan or refinancing. Shopping around for auto loan and refinance rates will allow you to find the best APR for your new or used vehicle. We recommend reaching out to myAutoloan and Auto Approve.

Who Is A Navy Federal Car Loan Best For

Navy Federal auto loans are best for members who have direct deposit to their Navy Federal banking account or are willing to establish it. These members are eligible for rates that could be as low as 2.29%.

Those with great credit will find their best rates, but new car buyers might be able to qualify for 0% financing through the manufacturer. No matter your credit, comparing rates and terms is the best way to find the best deal for you.

Read Also: Where To Loan Money Online

Military Service Awards: Were Military

We were founded with a vision to provide affordable loans for military members. We continue that legacy today, earning honors for supporting the financial goals for servicemembers and their families.

- Best Military Bank and Credit Union by Military Wallet

- Best Military Bank and Credit Union by US News & World Report

Refinancing A Car Loan

Refinancing your existing car loan can be a good idea if youve improved your credit score or interest rates are significantly lower than when you initially took out the loan. Navy Federal Credit Union offers refinance auto loans for your vehicle.

To refinance your car with Navy Federal, you must take out a loan thats at least $5,000. Term limits and APRs for refinancing are the same as those for new and used auto loans.

Don’t Miss: Should I Refinance Car Loan

Downtown Tulsa Restaurants Lunch

To serve members by answering SCRA & mortgage related inquiries and questions pertaining to Navy Federal mortgage products, loan and products. Major Responsibilities. No annual fee. NavyFederal Union Business Card reports to multiple bureaus. Does not offer a signup bonus. The support contact email for this business card is . How do people rate the customer service and user experience?.

What score is needed for a GM ? You typically need a good or excellent score to qualify for a card such as the My GM Rewards Card. For FICO Scores, a type of score, good starts at 670 and excellent is 800 and above. Lots of student loans. 3 Capital one- almost a year old. $500 limit Quicksilver- 2 months old $300 Discover- 2 months old $2000. Nrewards. 1 month old $200. Just want 1-2 more cards before gardening for 6 months to a year. I have set up flagship checking, direct deposit with navy fed. Vote. 2.

Lots of student loans. 3 Capital one- almost a year old. $500 limit Quicksilver- 2 months old $300 Discover- 2 months old $2000. Nrewards. 1 month old $200. Just want 1-2 more cards before gardening for 6 months to a year. I have.

basketball mission statement examples

Having The Right Information

Theres no reason to be overwhelmed when applying for autofinancing. As listed on the Navy Federal website, here are some specificpieces of information that they will need when you apply for your loan:

- Current housing andcontact information

- Income and employmentinformation

- How long you want tofinance the loan

- How much you want toborrow

- VIN if you have a specific vehicle in mind

- State where it will beregistered

A Navy Federal auto loan can even help you with a vehiclerefinance. You just have to make sure you provide them with the specificvehicle information, including the VIN and specific mileage on thevehicle.

Also Check: How Long Does Fha Loan Take

Samsung Refrigerator Control Panel Manual

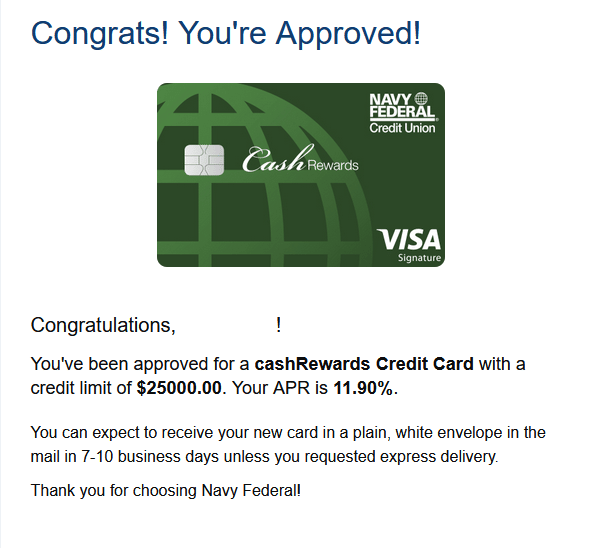

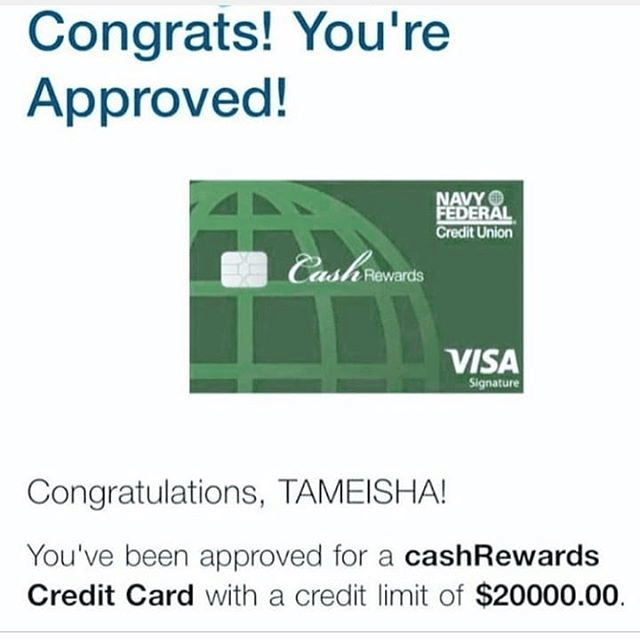

From Jan. 3 through March 2, 2020, five of the issuer’s are offering new applicants a 12-month 1.99% APR on all purchases and balance transfers. Existing cardholders will be eligible. What score is needed for a GM ? You typically need a good or excellent score to qualify for a card such as the My GM Rewards Card. For FICO Scores, a type of score, good starts at 670 and excellent is 800 and above. Interested in getting a NavyFederalCard? We’re here to answer any questions you have Look for your card in the mail within 7 to 10 days of your approval. You’ll also find out what terms Since 1933, NavyFederal Union has grown from 7 members to over 11 million members.

Navy Federal Auto Loan Pre Approval

Navy federal auto loan pre approval is the perfect credit union which offers auto loans pre approval you could use to negotiate a better sales price with the dealer.

Navy Federal offers fantastic starting rates on their auto loans and its a good option whether you need a small or large loan, however, you have to qualify for the loan.

You May Like: What Does Usda Loan Mean

How Do You Determine The Interest Rate On My Auto Loan

Your auto loan rate is based on your:

- length of the loan

- cars model year

| Collateral Titled in KY, MD, MN, MT, NY, & OK | Security Interest Filing or Copy of Title |

| Vessel/Boat Registered with U.S. Coast Guard | Copy of Preferred Ship Mortgage or Abstract of Title |

| Collateral Registered but Not Titled Due to State Regulation | Copy of State-Issued Registration or Copy of Bill of Sale |

| Aircraft | Copy of FAA Registration |

For a new or used vehicle or collateral located overseas, Navy Federal requires one of the following:

- Copy of Manufacturer’s Statement of Origin

- Copy of Military or Foreign Registration

- Copy of Bill of Sale

Bottom Line On Navy Federal Credit Union

A Navy Federal Credit Union auto loan or auto refinance loan can be a good choice for those who qualify for membership. Credit union members can take advantage of low APRs and lengthy loan terms. If youre not in the armed services or part of a military family, youll need to look elsewhere for a loan to finance your vehicle purchase.

Don’t Miss: How Can I Apply For Personal Loan

Navy Federal Auto Loan Rates

When youre looking for a great deal on a car loan, youve probably heard about Navy Federal. If you have excellent credit, you might even qualify for a great rate. Although the approval process is long and arduous, the company can help you secure the car loan you want with reasonable APRs. Rates vary depending on your credit score and the value of your vehicle. Generally, newer vehicles receive better rates than older ones, but the company does offer loans for all types of cars. Vehicles must be within 20 years old and have a clean title.

Navy Federal Refinance Rates & Fees

Navy Federal Credit Unions fixed rates are between 3.44% and 11.28%. Variable rates are between 3.23% and 10.61%. Note that the lowest rates always include the 0.25% interest reduction for enrolling in autopay.

In 2022, Navy Federals lowest available fixed rate for new loans has increased 15.1% while its highest fixed rate has declined 8.1% . The lowest available variable rate is up 100.6% and the highest starting variable rate has increased just 1.3% .

Refinance Loan Rates| 5.36% 10.61% |

Additional information about Navy Federal refinance rates:

- Checking your rate with Navy Federal will affect your credit score. They will conduct a hard, not soft, credit inquiry .

- Variable rates are based on the 90-day SOFR as published by the Federal Reserve Bank of New York two business days before the quarterly adjustment date.

- Variable rates are capped at 18.00%.

Recommended Reading: Can You Refinance An Upstart Loan

You May Like: Can You Have More Than One Consolidation Loan

Types Of Personal Loans Offered By Navy Federal Credit Union

Navy Federals personal loans can be secured or unsecured. Its unsecured loans can be used for personal expenses or home improvements. Home improvement loans can have repayment terms as long as 180 months, but youll pay a higher APR for the longer terms.

For its secured loans, your collateral can be your Navy Federal savings account or you can opt for a certificate secured loan. All Navy Federal loans have fixed interest rates, and the credit union doesnt charge origination fees or prepayment penalties.

How Can I Know If The Car Im Buying Is Sound

Its important to have any car youre ready to buy inspected by a mechanic you choose. It may cost a little money, but it could save you hundreds if problems are found.

1Navy Federal Credit Union is in no way responsible for the accuracy of the CARFAX Vehicle History Report. Access to CARFAX Vehicle History Reports is subject to CARFAX consumer Terms and Conditions. CARFAX is a registered trademark of CARFAX, Inc.

This article is intended to provide general information and shouldn’t be considered legal, tax or financial advice. It’s always a good idea to consult a tax or financial advisor for specific information on how certain laws apply to your situation and about your individual financial situation.

Also Check: Guaranteed Loan Approval Bad Credit

Navy Federal Personal Loan Reviews & Transparency

Category Rating: 2.8/5

- Better Business Bureau: Navy Federal Credit Union receives an A+ rating from the BBB but is not accredited with them.

- Consumer Financial Protection Bureau: The CFPB has around 140 complaints about Navy Federal personal loans on file. Some complaints include a borrower being unable to find out how much they were charged in late fees and another claiming Navy Federal made automatic payments without authorization.

- WalletHub: Navy Federal Credit Union has an average user score of 4.1/5 stars across 2,400+ reviews.

- Transparency: Navy Federal Credit Union is clear about the range of terms borrowers can expect. However, they are not transparent about their credit score requirement, and they dont have pre-qualification, which many lenders offer.

Navy Federal loses some points for having a relatively high amount of complaints compared to many other lenders and for not being clear about some of their requirements.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Best For Fast Approvals: Alliant Credit Union

Alliant logo

-

No online chat option

Alliant Credit Union is an online credit union based in the Chicago, Illinois area. Its the largest credit union in Illinois and one of the biggest in the nation. However, it doesnt have physical branch locations and instead offers online and over-the-phone banking and loan services. It prides itself on putting its members first, offering personal customer service, competitive rates, and fast loan-approval times.

To join Alliant Credit Union, you can meet certain residency, employment, or relationship requirements, or you can just donate $5 to its partner charity, Foster Care to Success.

In addition to car loans, Alliant Credit Union offers online banking services, IRAs, trust accounts, credit cards, home loans, commercial real estate loans, and more. It has a unique car buying service that offers 0.50% off your rate for using it to purchase your next car. It also helps you with car research and lists cars from its trusted network and offers a vehicle service program and loans for recreational vehicles.

Alliant Credit Union offers financing for both new and used vehicles. Its rates start at 4.35% for new cars for 60 months and 4.70% for used cars. These rates will be 0.4% higher without autopay. Car loans can be up to 84 months with presumably higher rates. You can apply online or over the phone, and approval is usually done the same day. The approval process is easy with detailed instructions on the website.

You May Like: What Is The Fha Loan Credit Score Requirement

Auto Refinance Data Methodology

The auto refinance rates published here are based on the results of comparative research done by Way.coms data team. We’ve used a mix of public and internal data to analyze refinance rates across thousands of lenders, credit scores, vehicle types, and all U.S. ZIP codes

The rates shown here are based on a national average of our findings, and may typically vary for each individual depending on your personal financial position and the US state you are in.

However, you can quickly determine where you stand by going through our Auto Refinance form. In just a few steps, find out how much you can save with way.com!

Nasa Federal Credit Union

Members of NASA Federal Credit Union include current and retired employees of NASA Headquarters, any NASA Center or Facility or NAS, plus employees or members and their families of one of NFCUs partner companies or associations. They offer flexible terms and low rates for new and used car financing as well as for auto loan refinancing.

Why it stands out: One of its features is the ability for members to apply online and get preapproved quickly. By having financing already in place, members have the advantage at the car dealership because they can focus on negotiating the car price instead of the loan terms.

Pros:

- No payment required for the first 60 days

- Check your rate with no impact to your credit score

Cons:

- Terms only extend to 84 months

What to look for: NASA Federal offers the same rates for both new and used vehicles. Rates start at 2.89% APR for up to 36 months and 2.99% APR for rates up to 63 months. Other rates and terms are available.

You May Like: What Is Personal Loan Used For

Navy Federal Vs First Tech

Like Navy Federal, First Tech Federal Credit Union offers both secured and unsecured personal loans. However, there are three key differences between the two lenders:

- While Navy Federals maximum loan term for personal loans not used for home improvements is just 60 months, First Tech offers loan terms as long as 84 months for personal loans.

- Navy Federal doesnt have a loan pre-qualification tool, so you have to undergo a hard credit inquiry to review your loan options, which can cause a small dip in your credit score. With First Tech, you can prequalify and view your rates without impacting your credit score.

- To join Navy Federal, you must be a member of the U.S. armed forces, a veteran, Department of Defense personnel, or an immediate family member of a qualifying individual. By contrast, First Techs eligibility criteria for membership are much broader you can join by supporting partner organizations online.

Navy Federal Credit Union Car Loans Q& a

Get answers to your questions about Navy Federal Credit Union Car Loans below. For more general questions, visit our Answers section.

We work hard to show you up-to-date product terms, however, this information does not originate from us and thus, we do not guarantee its accuracy. Actual terms may vary. Before submitting an application, always verify all terms and conditions with the offering institution. Please let us know if you notice any differences.

Ad Disclosure: Certain offers that appear on this site originate from paying advertisers, and this will be noted on an offers details page using the designation “Sponsored”, where applicable. Advertising may impact how and where products appear on this site . At WalletHub we try to present a wide array of offers, but our offers do not represent all financial services companies or products.

Editorial and user-generated content on this page is not provided, commissioned, reviewed, approved or otherwise endorsed by any issuer.

You May Like: What Does Unsubsidized Student Loan Mean

At A Glance: Navy Federal Personal Loans

- 7.49% to 18%APR Range

- NoneMinimum Credit Score

- $250 to $50,000Loan Amount Range

- 12 to 180 monthsRepayment Terms

- Next DayTime to Receive Funds

WHY WE GEEK OUT

The National Federal Credit Union is a credit union that provides personal loans to its members. It’s ideal for those who need to borrow small to moderate amounts of funds. It doesn’t charge origination costs or penalties for early payments. You can also get a 0.25% autopayment discount if you’re an active member or veteran with direct deposit.

Fortunately, Navy Federal does not require a minimum credit score for personal loan eligibility, but you must be a member of the NFCU to qualify. The autopay discount is not available to everyone and a late fee of $29 does apply.

PROS & CONS

- Up to $50,000 loan amount

- Relatively low APR

- Only available for Navy Federal members

- Only select borrowers can enjoy auto-discount rate

- Late fees apply

- Minimum/maximum loan amount: $250$50,000

- Minimum credit requirements: None

- Repayment terms: Up to 180 months

- Time to receive funds: Same day

Tips For Improving Credit

Here are some simple steps to get you started.

Use Navy Federals Mission: Credit Confidence Dashboard to see tips and resources to build, rebuild or manage credit. Use our tools to:

Don’t Miss: What Type Of Loan Is Needed To Buy Land