Fha Loan Limits Explained

The FHA loan limit will depend on the county where you are buying a house. The loan limit floor in all counties was raised to $356,362, so no matter where you live, you can buy a house that costs up to $340,000 without having to worry about exceeding the loan limit.

Alaska, Hawaii, Guam, and the U.S. Virgin Islands have significantly higher loan limits than the continental United States because construction costs in these areas are higher.

What Are The Current Fha Loan Limits

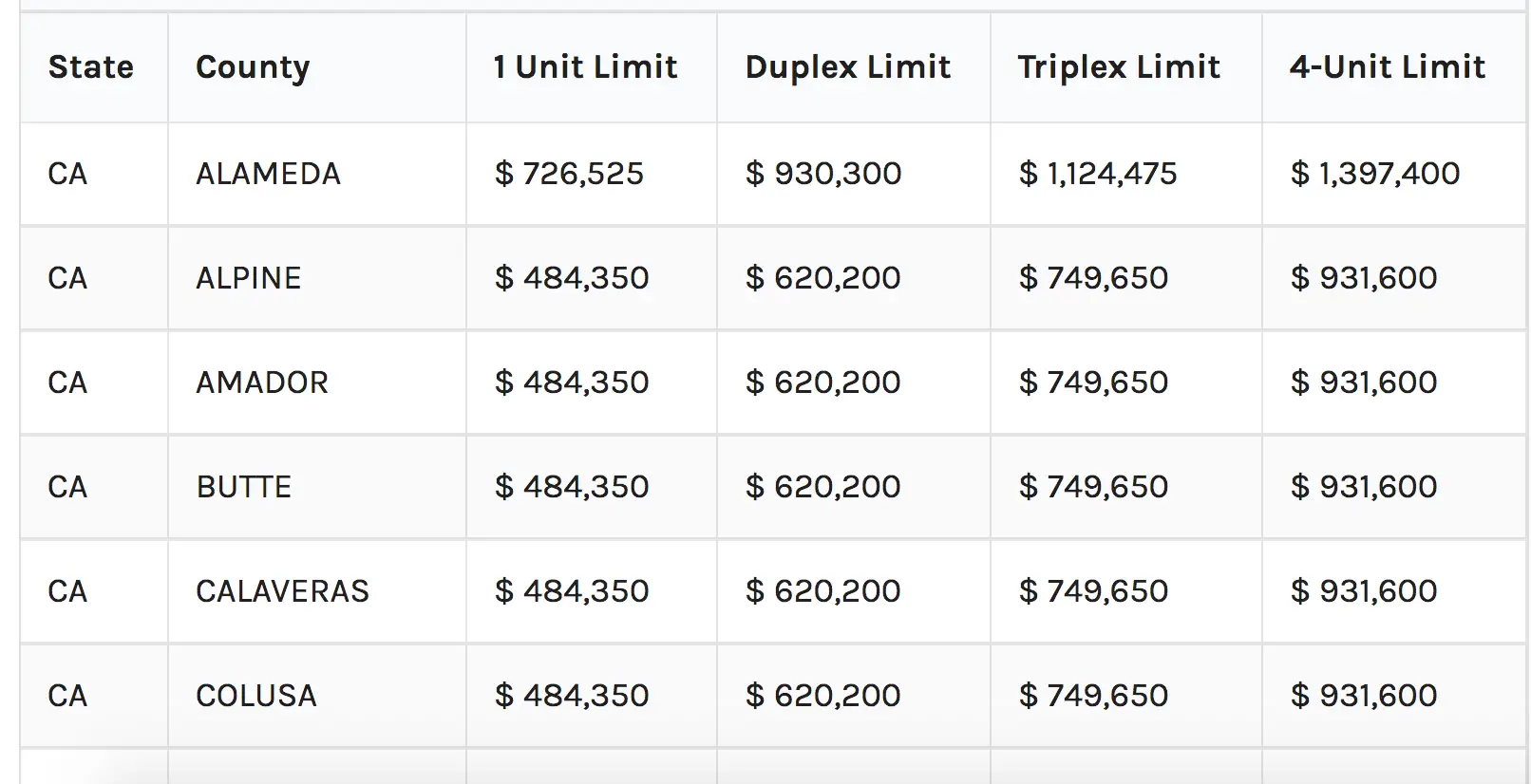

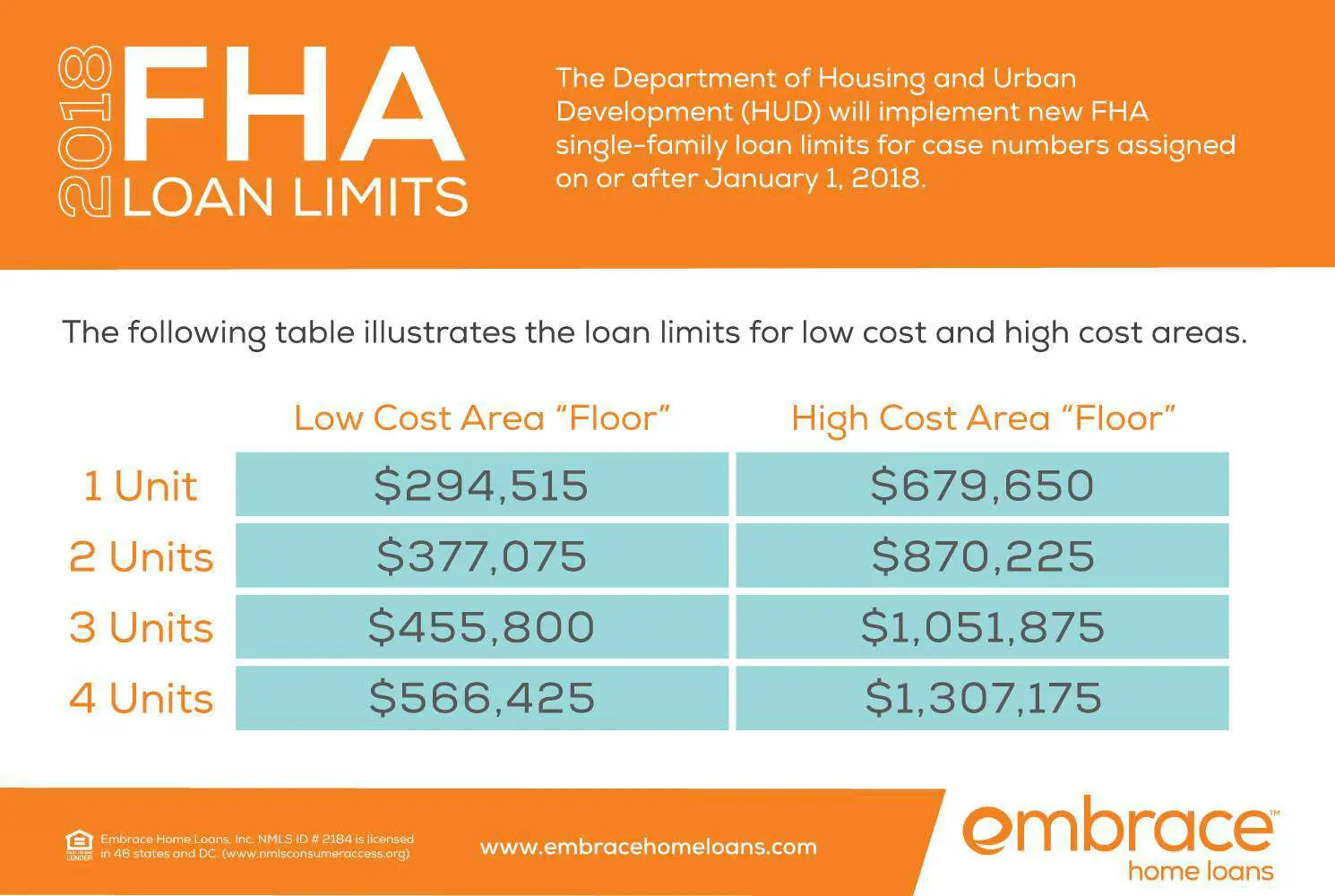

FHA loans may be used to purchase a primary residence, but you arent limited to a single family home. FHA loans can be used to purchase homes of up to four units, says Andrina Valdez, chief operating officer of Houston-based Cornerstone Home Lending.

In addition to the propertys location, the number of units will also impact the loan limit. Below the standard limit and maximum limit for high-cost areas are listed, although some areas of the country have limits that fall in between these two.

| Number of Units |

|---|

How Fha Loan Limits Are Calculated

The FHA loan limit is a percentage of the national limits for conforming mortgage loans. Conforming loans are those that comply with guidelines established by Fannie Mae and Freddie Mac and which are readily saleable on the secondary mortgage market.

FHA’s minimum national loan limit floor is 65 percent of the national conforming loan limit, which is $484,350 for a one-unit property for calendar year 2019. This floor applies to areas where 115 percent of the median home price is less than 65 percent of the national conforming loan limit. Any area where the loan limit exceeds the floor is considered to be a high-cost area.

FHA LOAN LIMITS BY THE NUMBERS

- Numbers

- Number of counties with FHA loan limits greater than $700,000

Read Also: How Much Does An Auto Loan Affect Credit Score

Fha Multifamily Loan Limits

The Federal Housing Administration also backs mortgages on 2-, 3-, and 4-unit properties. These types of homes have higher loan limits than single-family residences.

| $2,253,700 | $2,800,900 |

Although FHA allows multifamily home loans, the property must still be considered a primary residence. That means the homebuyer needs to live in one of the units full time.

In other words, an FHA loan cannot be used to purchase an investment property. However, you can use an FHA mortgage to purchase a 2-4 unit property, live in one unit, and rent out the others.

In this way its possible to get a multifamily loan up to $1.9 million with a low-rate FHA loan and just 3.5% down payment.

What Is The Maximum Loan Amount

A maximum loan amount, or loan limit, describes the total amount of money that an applicant is authorized to borrow. Maximum loan amounts are used for standard loans, credit cards, and line-of-credit accounts.

The maximum will depend on several factors including a borrower’s creditworthiness, length of the loan, loan purpose, whether the loan is backed by collateral, as well as various criteria of the lender.

Also Check: Becu Autosmart

What Is The Maximum Loan Amount For Fha

The FHA home loan is one of the easiest paths to homeownership. The FHA loan program was created during the 1930’s to help low to moderate income individuals and families to purchase homes with a low down payment, flexible credit requirements and reasonable closing costs.

The FHA loan program is open to first and non-first-time home buyers and homeowners. The FHA loan is available to purchase a home and for refinance loans. Currently, the minimum credit score is as low as 500, however, applicants with a under 580 requires a 10% minimum down payment. Home buyers with a credit score at or above 580 only need a 3.5% down payment.Read more about the FHA loan program

History Of The Fha Loan

Congress created the Federal Housing Administration in 1934 during the Great Depression. At that time, the housing industry was in trouble: Default and foreclosure rates had skyrocketed, loans were limited to 50% of a property’s market value, and mortgage termsincluding short repayment schedules coupled with balloon paymentswere difficult for many homebuyers to meet. As a result, the U.S. was primarily a nation of renters, and only one in 10 households owned their homes.

In order to stimulate the housing market, the government created the FHA. Federally insured loan programs that reduced lender risk made it easier for borrowers to qualify for home loans. The homeownership rate in the U.S. steadily climbed, reaching an all-time high of 69.2% in 2004, according to research from the Federal Reserve Bank of St. Louis. As of the second quarter of 2021, it was 65.4%.

Read Also: Apply Capital One Auto Loan

Fha Maximum Loan Limits

The FHA maximum loan limits increased for 2017 in North Texas. Dallas, Collin, Rockwall, and Tarrant counties now have an increased FHA loan limit of $362,250. This means that someone can now purchase a home for $375,388 and qualify with FHAs minimum down payment of 3.5%. FHA loan limits in 2016 were $334,650, in 2015 they were $310, 500, in 2014 they were $287,500, and prior to that they were $271,050. Below is a complete list of counties in Texas with their 2016 FHA max loan amounts.

Heres a link to FHAs County Loan Limit Search so you can lookup the FHA loan limits for any county in America. Enjoy.

Theyre Based On The Conforming Limits Set By Fhfa

FHA loan limits in California are derived from the limits established by the Federal Housing Finance Agency, or FHFA. This agency sets the maximum size for conventional and conforming mortgage products. The Federal Housing Administration takes those conforming limits and applies a formula to determine the maximum FHA loan amount for counties in California.

You May Like: Upstart Second Loan

About The 2022 Fha Loan Limits

In order to get approved for an FHA loan, your mortgage must be within the maximum loan amount the FHA will insure. Known as FHA loan limits, these maximums vary by county.

In 2022, the Department of Housing and Urban Development is increasing FHA loan limits in 3,188 counties while just 45 counties will remain the same.

There are four different pricing tiers for FHA loan limits: a standard tier, a mid-range tier, a high-cost tier, and a special exception tier.

In low-cost counties, FHA loan limits are now capped at $420,680 for a single-family home loan.

In high-cost counties, FHAs single-family loan limit is $970,800.

However, many counties fall in the mid-range category with limits somewhere between the floor and ceiling.

You can look up your local FHA loan limits using this search tool.

How New Fha Loan Limits Are Calculated

The FHA limits loans to 115% of the median home price in a county. A median price is not the same thing as an average price, although the two numbers may be similar. The FHA uses the median price to estimate the typical price of a typical house.

Home prices vary from county to county, so the FHA takes this into account when it sets its county loan limits. For example, the FHA loan limit for New York County is $822,375 in 2021. The loan limit for Niagara County is $356,362. The current median home price in New York City is higher than that in Buffalo, so the limit is higher as a result.

These median home prices are based on the Home Price Index as calculated by the Federal Housing Finance Agency and includes figures for the 50 states and the District of Columbia.

If you are thinking about buying a house, knowing your FHA county loan limit and how much money you might be able to borrow is important. It is also important to decide how much money you can afford to spend on a house. You can use our Mortgage Affordability Calculator to get an estimate of a house price you may be able to afford.

Freedom Mortgage is the #1 FHA lender1 in the United States. Your Freedom Mortgage Loan Advisor can help you explore options to make the right decision about an FHA loan. Get Started todayor call us at .

1. Inside Mortgage Finance, Jan-Mar 2021

Other Insights

Recommended Reading: Drb Loan Consolidation Reviews

Recommended Reading: Refinance Options For Fha Loans

Fha Limits For High Cost Homes

There is a chance that you’ll fall in love with a home that costs more than what the FHA will insure. However, if it turns out that you are able to afford a larger down payment, you can stick with an FHA loan. By putting up more than the minimum 3.5% on the house, borrowers are able to buy a pricier home with the same FHA loan limit.

Another option is to apply for a conforming mortgage. This may work out better since the conforming loan limit is typically higher than the FHA limits in nearly 80% of the counties in the U.S. Buyers with good credit and sufficient income who can afford a larger down payment can benefit from this type of mortgage and may find it less expensive in the long run.

However, some houses may exceed both conforming and FHA loan limits. In such cases, borrowers might want to consider a jumbo loan.

If Theyre So Great Why Doesnt Everybody Get An Fha Loan

When interest rates are low across the board and credit requirements are loose, homebuyers tend not to flock to FHA loans. Thats because they can get favorable interest rates with low down payment requirements from any old lender, and pay less in insurance over the life of the loan.

But when banks boost their down payment, income and credit requirements, as they did after the financial crisis, the popularity of FHA loans rises. Basically, when it is more difficult to get a conventional loan, FHA loans become more popular.

More from SmartAsset

Read Also: Loaning Money To Your S-corp

Loan Limit Increased For 202: Conforming Fha And Jumbo

Summary: In 2022, the conforming loan limits for all Dallas-area counties will go up to $647,200. Anything above that is considered a jumbo mortgage. The FHA loan limit for the DFW area has been increased to $420,680 for 2022.

Home buyers across the Dallas-Fort Worth metro area will have a higher range of mortgage financing to work with in 2022, due to a recent increase in loan limits. Both conforming and FHA limits for the DFW area have been increased for 2022 in response to rising home prices.

What does this mean to you, as a home buyer and borrower? Read on to find out.

What Are Fha Loan Limits

FHA loan limits are the maximum amounts that the FHA will insure for different categories of home mortgage loans for example, single-family homes and duplexes in different counties in each state.

Loan limits, which vary with local housing values and by property type, are calculated and updated annually, and are influenced by the conventional loan limits set by Fannie Mae and Freddie Mac.

An FHA mortgage loan is one issued by an FHA-approved lender and insured by the FHA. Designed for low- to moderate-income borrowers, FHA loans enable borrowers to qualify with lower minimum down payments and lower credit scores than are required for many conventional loans, which are not guaranteed or insured by a government agency.

Read Also: Do Lenders Verify Bank Statements

Fha Loan Limits For 2022

FHA loan limits dictate the maximum amount you can borrow on an FHA-backed home loan. Starting January 1, 2022, that limit will be $420,680 for a single-family home in most parts of the country.

FHA loan limits are even higher in expensive areas, with single-family loans maxing out at $970,800 in expensive metros.

How To Apply For An Fha Loan

Applying for an FHA loan will require personal and financial documents, including but not limited to:

-

A valid Social Security number.

-

Proof of U.S. citizenship, legal permanent residency or eligibility to work in the U.S.

-

Bank statements for, at a minimum, the last 30 days. You’ll also need to provide documentation for any deposits made during that time .

Your lender may be able to automatically retrieve some required documentation, like credit reports, tax returns and employment records. Special circumstances like if you’re a student, or you don’t have a credit score may require additional paperwork.

» MORE: Detailed FHA loan requirements

Read Also: Auto Refinance Calculator Usaa

Fha Streamline Refinance Loan Limits

One perk of having an FHA loan is that you can refinance using the FHA Streamline Refinance program.

The FHA Streamline is a low-doc loan that gives homeowners the ability to refinance without having to verify income, credit, or employment.

When you refinance via the FHA Streamline program, your new loan must be within local FHA loan limits. But this will not be an issue.

Since the FHA Streamline can only be used on an existing FHA loan and no cash-out is allowed you wont be able to increase your loan balance above current FHA mortgage limits.

Other requirements for the FHA Streamline Refinance include:

- You must be making your current mortgage payments on time

- Your current FHA mortgage must be at least 6 months old

- The agency will verify that theres a financial benefit to your refinance. Known as the Net Tangible Benefit clause, your combined rate must drop by at least 0.5%

If you meet these guidelines, the FHA Streamline is a great way to refinance into todays ultra-low mortgage rates and lower your monthly payment.

Fha Announces New Single Family Loan Limits For 2021

WASHINGTON – The Federal Housing Administration today announced the agency’s new schedule of loan limits for calendar year 2021 for its Single Family Title II forward and Home Equity Conversion Mortgage insurance programs. Loan limits for most of the country will increase in the coming year resulting from robust house price appreciation, which is factored into the statutorily mandated calculations FHA uses as part of its methodology for determining the limits each year. The new loan limits are effective for FHA case numbers assigned on or after January 1, 2021.

FHA is required by the National Housing Act, as amended by the Housing and Economic Recovery Act of 2008 , to set Single Family forward loan limits at 115 percent of area median house prices, subject to a floor and a ceiling on the limits. FHA calculates forward mortgage limits by Metropolitan Statistical Area and county.

FHA has seen consistent increases in loan limits during the past few years, putting it in a position to serve a segment of borrowers that may be better-served by the conventional market. FHAs mission is to support low-to-moderate income borrowers, so why does the law permit FHA to insure mortgages up to $822,375? This is a question for Congress and the taxpayers who stand behind FHA to answer, said Assistant Secretary for Housing and Federal Housing Commissioner Dana Wade.

Also Check: Transfer Car Loan To Another Bank

Maximum Fha Loan Amount In Florida Alabama Tennessee And Texas

HUD announced on November 30, 2021 that it would increase FHA loan limits in 2022. These new maximum FHA loan amounts for calendar year 2022 are effective for case numbers assigned on or after January 1, 2022.

Overall, the maximum FHA standard low-cost area mortgage loan limit for a one-unit property has increased from $356,362 in 2021 to $420,680 in 2022! Additionally, the respective loan amounts have also increased for 2,3, and 4 unit properties that are eligible for FHA financing. They are listed here:

- One-unit property: $420,680

- Three-unit property: $651,050

- Four-unit property: $809,150

For a complete list of FHA loan limits visit theFHAs loan limits page, here.

What Is The Fha

The Federal Housing Administration better known as the FHA has been part of the U.S. Department of Housing and Urban Development since 1965. But the FHA actually began more than 30 years before that, as a component of the New Deal.

In addition to a stock market crash and the Dust Bowl drought, the Great Depression saw a housing market bubble burst. By early 1933, roughly half of American homeowners had defaulted on their mortgages.

The FHA was created as part of the National Housing Act of 1934 to stem the tide of foreclosures and help make homeownership more affordable. It established the 20% down payment as a new norm by insuring mortgages for up to 80% of a home’s value previously, homeowners had been limited to borrowing 50%-60%.

Today, the FHA insures loans for about 8 million single-family homes.

» MORE: Facts about FHA home loans

You May Like: Does Advance Auto Rent Tools

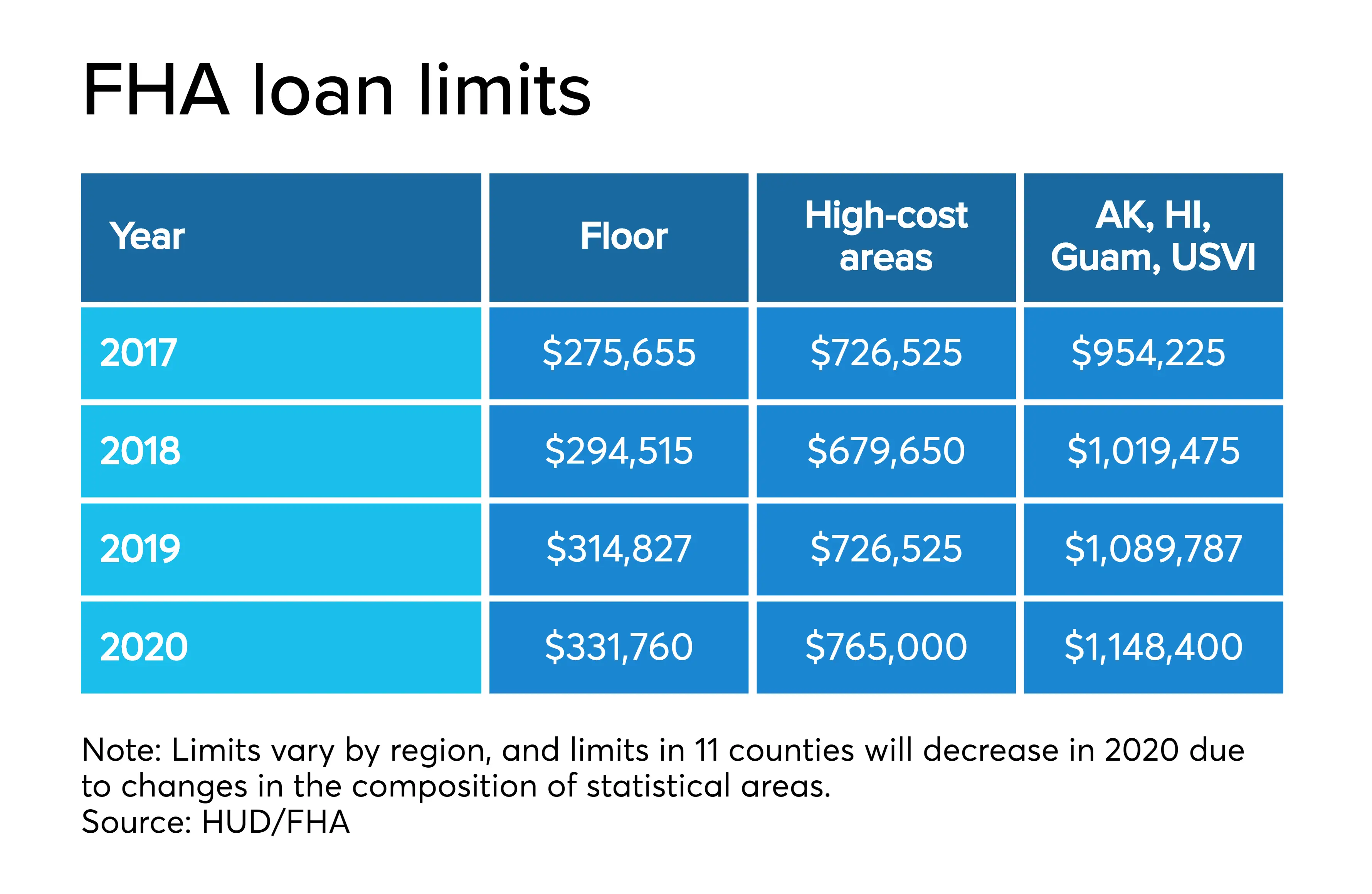

How Loan Limits Have Changed Through The Years

FHA loan limits often fluctuate from year to year based upon the health of the nation’s housing market.

On Dec. 6, 2013, the Department of Housing and Urban Development announced the loan limits for FHA loans on single-family homes would change on Jan. 1, 2014. The housing market was in a state of recovery at that time, so HUD determined that homeowners did not need the FHA-insured loan program as badly as they did during the throes of the Great Recession a few years earlier. As a result, the FHA reduced its loan limits.

The loan limit for areas where housing costs were relatively low remained unchanged, at $271,050, from 2013 to 2014. But loan limits for the highest-cost areas, such as San Francisco and New York, were reduced significantly that year, from $729,750 to $625,500. This caused some controversy. After all, higher limits had been in effect for six years, established by the Economic Stimulus Act of 2008 to ensure that mortgages were still widely available during the Great Recession, when private lending options were limited. Congress had extended the increased loan limits several times through the years, which allowed the FHA to continue to insure loans and ensure the availability of home mortgages for many Americans.