Heres How Much Financial Aid You Can Get In A Semester

- Heres How Much Financial Aid You Can Get in a Semester

As the cost of postsecondary education goes up, youll likely need to apply for financial aid to help you pay for college, such as student loans. Financial analysts recommend all college-bound students use the Free Application for Federal Student Aid to figure out how much financial aid they can get and for which aid they qualify. In many cases, students qualify for more financial aid than expected.

The FAFSA uses information about your assets to create a number called the expected family contribution . Then, this number is subtracted from the cost of attendance for each school to which you applied and were accepted. The difference creates your FAFSA score, which schools use to offer need-based financial assistance from both grant programs and student loans.

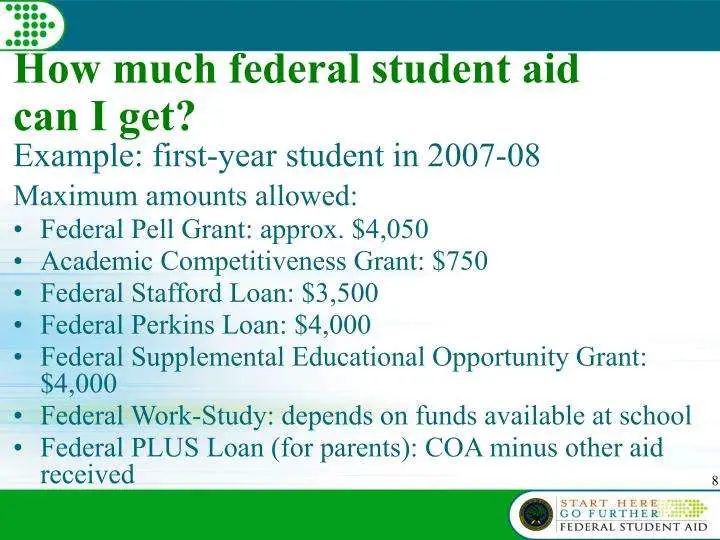

The federal government offers several forms of financial aid, which schools disburse in different amounts. You can use the annual federal guidelines to determine the maximum amount of aid for which you qualify.

Can You Get Student Loans Every Semester

Student loan limits represent a maximum amount that a student can receive in subsidized and unsubsidized loans, both per semester and over the course of a lifetime. If you are receiving financial support from your family, then your student loan limits are: $5,500 per year for a first-year undergraduate.

Student Loan Limits And Next Steps

Student loan limits are in place to make sure that you dont borrow more money than you need to finance your education. Regardless of what path you choose to finance your schooling, youll still be on the hook for paying it back once you graduate.

You can secure a maximum amount of $57,500 in federal loans as an independent undergraduate student. As a graduate student, you can rely on up to $20,500 a year, but no more than $138,500, which includes what you may have already borrowed towards obtaining your undergraduate degree.

If you decide to pursue additional education, such as a second bachelors degree, youll need to figure out how to secure additional funding. To make it work, youll need to consider some alternative solutions.

Your financial aid office is a great place to start. They may be able to manipulate variables in the formula that is used to calculate your loan eligibility. If not, they can help you find the funds that you need from your school or your state through other loan options or by pointing you towards scholarships.

If all of those avenues turn into dead ends, draw from your savings or drop down to part-time status. When all else fails, turn to private loans to make up the shortfall.

Carefully consider all your options before and beyond the student loan maximums. The choices that you make at these critical junctures can either drag you down or set you on a springboard for success.

Also Check: What Is Bayview Loan Servicing

Direct Subsidized And Unsubsidized Federal Student Loan Limits

Subsidized and unsubsidized loans are capped at $31,000 through four years of an undergraduate education if youre a dependent student. As an independent undergraduate student, you can borrow up to $57,500 towards your undergraduate degree.

Dependent undergraduate students can borrow up to $5,500 as a first-year student, depending on financial need. Independent students, or those whose parents have been denied a direct PLUS loan , can borrow up to $9,500 per year. For each of four years of school, you can borrow an additional $1,000 every academic year. Regardless of whether or not you depend on your parents, only $23,000 of your federal student loans will be subsidized.

Additionally, you cant borrow more than the schools cost of attendance. Students can only receive direct subsidized loans during a maximum eligibility period. This is equal to 150% of the published length of the degree program. For example, you can only take out loans for six years if youre enrolled in a four-year bachelors program.

Graduate students can borrow up to $20,500 in federal loans each year. You can borrow a maximum of $138,500 as a graduate student, but that figure includes money youve borrowed as an undergraduate, too. All federal loan programs available to graduate students are unsubsidized.

How Much In Federal Student Loans Can I Get

The first type of loan that students should consider is federal student loans, which are offered and guaranteed through the Direct Loan Program, also known as the William D. Ford Federal Direct Loan Program. This program offers four types of Direct Loans for in-school students, and caps how much you can borrow with each under the following rules:

- Annual limits: The maximum amount that the borrower can take out in an academic year.

- Aggregate limits: The maximum cumulative amount that a borrower can borrow in student loans.

- Cost of attendance: In addition to annual and aggregate limits, the federal government also limits loans by your costs. It will not allow borrowers to take out more student loans than their college program costs.

How much student loans you can get, specifically, will vary by your student status. For example, the Direct Loan program lends less to students who are dependents , or who are in their first or second year of college. For independent students and upperclassmen, the borrowing limits are higher.

Below are the federal student loan limits for different types of Direct Loans, as of March 9, 2021.

*Subsidized loan amounts will also count toward these limits.

So as you want to know how much student loans you can get, pay attention to this letter. It will list the types and amounts of federal student loans youre being offered.

Read Also: Can Other Than Honorable Discharge Get Va Loan

Jail Lawsuit Late Fees Suspension Of Personal And Professional Licenses And Other Side Effects Of Refusing To Pay Your Student Loan Debts

Student loans are one of the most significant financial burdens that many young Americans face. Its all too common for college graduates to find themselves at a point in life where it is difficult to pay their student loans.

Student loan payments can be painful. When youre on a tight budget, keeping up with the minimum payments can be hard when youre just trying to afford rent or groceries.

Making these payments on top of other financial responsibilities can be challenging. As a result, more than 1 million student loan borrowers go into default every year.

Furthermore, a study by the Federal Reserve found nearly one in five student loan recipients were at least 90 days behind on payments.

If money is tight, you may be considering skipping your payments. But what happens if you dont pay student loans? The consequences can be steep.

Unfortunately, there can be many negative consequences of failing to make your student loan payments, including wage garnishment, a drop in your credit score, or a suspension of your professional license.

If you have federal student loans, the consequences of defaulting on your debt can be severe. Private student loan lenders dont have the same options to collect on defaulted loans as the federal government. Although private lenders cant take your tax refund, the consequences can still be quite serious. Since your loans are owned by the government, and private lenders, your loan servicer can take measures to collect what you owe.

Maximum Limits For Direct Plus Loans

Direct PLUS Loans are another source of money for students who need additional funds to afford college. There are two types of PLUS loans: Parent PLUS Loans and Graduate PLUS Loans.

- Parent PLUS Loans are designed for parents of undergraduate students who want to help their children pay for college. Borrowers must be parents of dependent students, have healthy credit, and meet other general eligibility requirements.

- Graduate PLUS Loans are available to independent graduate students who have solid credit and are attending school at least half-time.

You can apply for both types of PLUS loans by filling out the FAFSA and then going to StudentAid.gov and applying for a loan directly on the website. Both loans also offer a wide variety of repayment plans so you can choose one that suits your needs.

PLUS loan borrowing limits are much looser than those on Direct Subsidized and Unsubsidized Loans. You can borrow up to the full cost of attendance, minus any financial aid that youve received, but the rates tend to be higher than Direct Loan rates.

Remember, a colleges cost of attendance includes tuition, fees, on-campus room and board, books, transportation, and other related costs.

Recommended Reading: Va Loan For Land And Manufactured Home

You Repay 9% Of Everything Earned Above 27295 Earn Less And You Don’t Repay

Once you leave university, as long as you haven’t taken out a postgraduate loan to complete a master’s, you only repay your undergraduate student loan when you’re earning above £2,274 a month and then it’s fixed at 9% of everything you earn above that.

Remember, if you take out a postgraduate loan after your undergraduate degree, you pay this back at 6%, as well as repaying your original student loan.

Earnings mean any money from employment or self-employment and, in some cases, earnings from investment and savings.

If you’ve started repaying the loan, but then lose your job or take a pay cut, your repayments drop accordingly. To labour the point somewhat:

If you earn £28,000 in a year, what do you repay?

The answer is £63.45, as £28,000 is £705 above the threshold and 9% of £705 is £63.45.

And if you earn £35,000, what do you repay?

The answer is £793.45. £35,000 is £7,705 above the threshold and 9% of that is £693.45.

Further info on repaying

You’re in a career where salary increases rapidly.

You live at home or get a maintenance grant.

If so, scroll down the table for a better fit. Someone starting on £15,000 but with big salary increases to come should probably look at results for a £20,000-£25,000 starter.

You’re in a career where salary remains static.

You’re likely to spend periods not working .

You’re studying in London and not living at home.

You’re likely to switch to part-time work.

You’re likely to retire during the 30 years.

How Much Money Can I Expect To Get In Federal Student Aid Loans

How much money can I expect to get in federal student aid loans?

I have an expected contribution of $2,500. I have no idea what that means.

Answer : I might suggest one to try this website where one can get from different companies: .

Related :

I have an expected contribution of $2,500. I have no idea what that means.

I have an expected contribution of $2,500. I have no idea what that means.

I have an expected contribution of $2,500. I have no idea what that means.

I have an expected contribution of $2,500. I have no idea what that means.

Read Also: Usaa Student Loans Refinance

How To Get A Student Loan

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Learn more about private student loans

-

Find a student loan: Compare private student loans, types and rates

-

How to apply: Wondering where to apply for student loans first?

Most students 7 in 10 borrow money to pay for college. If you’re one, you have two types of student loans to choose from: federal or private.

If you’re an undergraduate, always start with federal loans. They don’t require a credit history or a co-signer and they offer more generous protections for borrowers, such as income-driven repayment and loan forgiveness, than private student loans do.

» MORE: Your guide to financial aid

Before you borrow, think ahead to how youll repay debt. Put a dollar figure on it by using a student loan payment calculator. This is the bill youll be paying every month for 10 years or longer. Borrow only what you need, and dont take on an amount or an interest rate you cant expect to handle right after graduation.

Here’s how you can get federal and private student loans.

Federal Direct Student Loans

The table below shows the breakdown of the maximum amount you can borrow when taking out Direct Subsidized and Unsubsidized student loans. Note that the total for each year, and cumulatively, includes both subsidized and unsubsidized federal loans. If, for example, your subsidized loan total in year one as a dependent undergrad is $3,500, you are limited to $2,000 in unsubsidized loans for that year. If your subsidized total is less than $3,500, the difference between that and $5,500 can be unsubsidized loans.

The amount you can borrow each year and cumulatively as an undergrad is also affected by your parents’ eligibility to help you by taking out a Direct PLUS loan. If they are eligible, the amount you can borrow in your own name is less. If they are ineligible, due to poor credit, for example, you can borrow more. Amounts for independent undergrads also reflect lack of parent supportas do amounts for graduate and professional students, who are always considered to be independent.

| Dependent Undergrads | Subsidized |

|---|---|

| $138,500 |

The aggregate total for each class of borrower includes all unpaid loan balances for all federal student loans taken. This includes subsidized and unsubsidized FFEL loans, which are no longer available, as well as subsidized graduate level loans dispersed before July 1, 2012.

To apply for federal student loans, you’ll need to submit the Free Application for Federal Student Aid .

Don’t Miss: Loan License In California

Interest Rates: Federal Student Loan

Direct Loans have low fixed interest rates for the life of the loan. The following rates are for loans first disbursed between 07/01/2020 and 06/30/2021:

- Direct Subsidized LoansUndergraduate: 2.75%

- Direct Unsubsidized LoansUndergraduate: 2.75%

- Direct Parent Loan LoanUndergraduate: 5.30%

- Direct Graduate Unsubsidized LoanGraduate and Professional: 4.30%

- Direct Graduate LoanGraduate and Professional: 5.30%

Students From Or Going To Welsh Scottish And Northern Irish Unis May Have Different Rules

Scottish, Welsh and Northern Irish students, including those who decide to study in England, receive their financial support from their “home” devolved administration, so it’s a matter for those governments to decide how they wish to support their students.

Scotland:

Scottish students studying in Scotland pay no tuition fees. English, Welsh and Northern Irish students studying there will be charged up to £9,250 per year, as will Scottish students studying in England, Wales and Northern Ireland.

Northern Ireland:

Northern Irish students studying in Northern Ireland can pay up to £4,395 per year. Those from England, Scotland or Wales will be charged up to £9,250 per year.

Wales:

Tuition fees at Welsh universities are £9,000 for those studying in Wales and £9,250 if studying in the rest of the UK.

You May Like: How Much Commission Do Loan Officers Make

Federal Direct Subsidized And Unsubsidized Loans

If you’re eligible, both of these federal loans can help you pay for college.

The government pays your interest on a Direct Subsidized Loan while youre in school, for the first six months after you leave school, and during a period of deferment.

If you dont qualify for a subsidized loan, you may be able to receive funds through a Direct Unsubsidized Loan. But with this loan, the government does not pay your interest. You are responsible for paying the interest during all periods.

This table from the U.S. Department of Education includes maximum yearly amounts for each type of loan. You’ll see the total for both subsidized and unsubsidized loans.

Direct Graduate Plus Loan

The Direct Graduate PLUS Loan is for graduate and professional students. Interest begins to accrue once the first disbursement is made. If you are denied the GradPLUS Loan based on credit, you are NOT eligible for additional unsubsidized loan funds. After the second disbursement, you will have a 60-day grace period until your first payment is due. You may be able to defer or delay repayment while you are attending school at least half time.

Read Also: Va Requirements For Manufactured Homes

Apply For Student Loans

Once you receive your award letter, you will know how much in federal student loans is available to you. You can then use this student loan calculator to estimate how much you may need to also borrow in private student loans.

When it comes to borrowing, we recommend you exhaust free money like savings, grants and scholarships first. If you still need to borrow, compare federal and private student loans and choose the loans that best fit your needs.

FAFSA is a registered service mark of the U.S. Department of Education and is not affiliated with Discover Student Loans.

Other Options For Paying For College

If your appeal for financial aid is unsuccessful, you do have other options for paying for college. First, make sure to apply far and wide to scholarships.

You could win a scholarship for various reasons, including grades, athletics or community service. Since you dont have to pay back a scholarship, its the best type of aid to help you pay for college.

After youve exhausted the search for scholarships, other gift aid and work-study programs, another option to cover a gap in funding is private student loans. Look for reputable lenders with competitive rates, like College Ave or LendKey.

Keep in mind that youll likely need a cosigner to qualify for a private student loan. Before you sign any paperwork, make sure to read over the terms and conditions.

If you arent able to secure more federal financial aid, dont lose hope. You do have other options to cover tuition bills, as long as youre careful about how much student debt you take on.

Rebecca Safier and Andrew Pentis contributed to this report.

You May Like: Used Car Loan Calculator Usaa

What To Do If You Cant Pay Your Federal Student Loans

If you cant make your federal student loan payments during the COVID-19 outbreak, youre in luck. The federal government has suspended payments and interest on all federal student loans through September 30, 2021. You are not required to make payments during this time.

If you still cant make your payments once the suspension of loan payments has ended, you still have a number of options.

One of the benefits of having federal student loans is that they have plenty of options available to make it easier to pay your loan or pause payments altogether in some situations.

The first thing you might consider is changing your repayment plan.

The federal government allows borrowers to change their repayment plan at any time for free, so you can switch to one that better fits your situation.

The standard repayment plan requires borrowers to pay off their loans in 10 years. But someone with more than $30,000 of debt is eligible for an extended repayment, which gives you an extra 15 years to pay off your loans.

The variety of income-based repayment plans guarantees that your monthly payments dont exceed a certain percentage of your income.

If you cant make your payments at all, a new repayment plan likely isnt going to be enough.

In that case, you might consider either deferment or forbearance of your loan to temporarily suspend payments.

Deferment allows you to postpone loan payments and pauses interest accrual on subsidized student loans.