How Many Va Loans Can You Have In A Lifetime

Technically, you can take out as many VA loans as you would like during your lifetime. However, youll need to keep your entitlement options in mind. Based on your remaining entitlement, you may not be able to tap into another VA loan until you sell the initial property you acquired through a VA loan.

What Are The Stipulations

Acquiring a second VA loan does come with certain conditions.With most lenders, you must have a renter locked into a lease and a security deposit to offset your first VA loan mortgage payment. While having a renter locked in helps your debt-to-income ratio because it offsets your mortgage payment, unfortunately, any additional rental income cant be used towards qualifying for your second loan. For example, say your monthly mortgage payment is $800, but youre going to charge your renters $1,000. That $200 extra cant be used as additional income to qualify for a second VA loan. Income qualification for secondary properties can vary by lender, so be sure to ask about the necessary underwriting guidelines when applying for a second home.Additionally, youll still need to meet the occupancy requirements of a VA loan, meaning that this new home must be your primary residence. Youll need to occupy your new home before a certain time period passes following your closing.VA loans are arguably the best loan program available. So if youre eligible, be sure you know how to take full advantage. If you have questions about keeping your home and buying again, please feel free to contact a mortgage banker.

Can I Get A Second Va Home Loan

Yes, it is possible to get a second VA home loan.

When pursuing a second VA home loan, youll need to have enough entitlement leftover from your first-time use. Or restore your entitlement through one a number of ways. A few options include selling the initial property or proving a net tangible benefit.

Recommended Reading: How To Qualify For Fha Loan In Arizona

What Documents Will You Need

Depending on your military experience, youll need certain documents to meet VA home loan requirements.

VA Loan Required Documents| Active Duty Members |

|

|---|---|

| Active Duty, Veteran, Current or Former National Guard or Reserve Member |

|

| Current Reserve or National Guard Member |

|

| Discharged National Guard Member |

|

| Discharged Reserve |

|

| Surviving Spouse |

|

How Many Va Loans Can I Have At Once

Generally, you cant take out more than two VA home loans at once, as youre supposed to reside or have resided in a home to take out a VA mortgage. This can happen when selling one home to buy another, or if keeping one home and then buying a home when assigned to a different military base. You cant borrow VA loans for investment properties you dont live in, however.

When borrowing money to buy the second home, your VA eligibility is reduced by the amount owed on the first mortgage. For example, in Phoenix the limit is $647,200. So, if your current mortgage is for $400,000, you could potentially borrow up to $247,200 on your second home.

When it comes to a second VA loan, theres still a maximum amount you can borrow in total between the two homes. If you need more than the VA home loan limit, you may want to consider refinancing the mortgage on the first home to a conventional loan and then using the VA loan for the second loan. You can get a seemingly limitless number of VA loans if you pay off one VA loan and sell the home before taking out the next mortgage.

Also Check: Can You Refinance Your Auto Loan

Basic Allowance For Housing

The Basic Allowance for Housing, or BAH, is a military entitlement given to active-duty personnel to provide housing for themselves and their families. The BAH is calculated according to location and pay grade, and the allowance is designed to provide servicemembers housing compensation equitable to local civilian housing markets.

The BAH can be used toward rent or a mortgage, allowing you to build equity in your home, even if you dont have a down payment to get started.

Can I Use A Va Loan When I Buy With Orchard

There are a ton of VA loan benefits, so youâll be glad to know that you can use a VA loan when you buy with Orchard. Here’s why you’d want to work with Orchard: While the process of restoring your entitlement to get another VA loan is relatively straightforward, the timing of it all can get tricky. Youâll need to sell your home and then get your entitlement restored before you can buy your new house with a VA loan. Youâll also be required to occupy the new property within 60 days of closing which could further complicate your timeline.

The good news is that Orchard can help streamline your move. Weâll give you an offer on your current house thatâs valid for up to 6 months, giving you plenty of time to find your new dream home. Weâll also help line up your closing dates, so you can avoid potential entitlement issues and occupy the house on time. Learn more about Orchardâs Move First service here.

Free download: Your guide to buying while you sell

Say goodbye to the days of needing to sell your home before buying a new one. Thereâs an easier way, and our FREE guide breaks down how it can work for you.

Stand out to sellers with a cash offer

A cash offer is 4x more likely to be chosen by a seller. Get qualified today.

Recommended Reading: People Who Got The Ppp Loan

Can I Have Two Va Loans At The Same Time

It’s possible to have more than one VA loan at the same time. To do this, you would need to use your remaining entitlement for the second loan also called second-tier entitlement.

This approach is often used by:

- Service members experiencing a permanent change of station. They may choose to retain their primary residence, often to be rented out. The VA borrower may have enough remaining entitlement to purchase a new home without a down payment at the new duty station.

- Former VA borrowers who lost their homes to foreclosure. Using their second-tier entitlement can allow them to buy a new home and start anew.

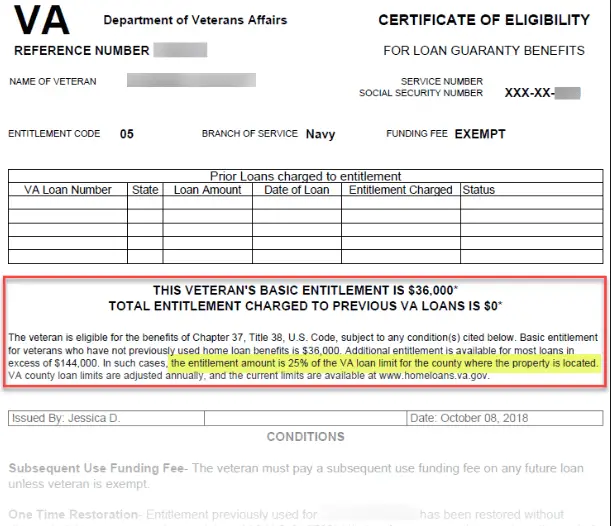

Your Certificate of Eligibility will detail how much of your entitlement remains. This is the amount youd be eligible to have guaranteed by the VA on your second loan.

If theres not enough to cover the loan youre looking for, you may be able to qualify by making a down payment . VA loans also do not require mortgage insurance, another way youll save over other loan options.

How Va Loan Entitlement Works

Since 2020, the Department of Veterans Affairs has not imposed any formal loan limits on VA loans. This means you can borrow as much as you want using a single VA loan, providing you can prove you can comfortably afford the monthly payments, are a responsible borrower , and have whatever assets your private lender requires for the loan amount you want.

Read Also: What Is The Best Type Of Loan For Home Improvements

Can I Use A Va Loan More Than Once

Yes! Theres no limit to how many times you can use your VA loan benefit over your lifetime if you still meet the requirements of the VA and your lender. Your VA entitlement determines how much of your loan the VA will guarantee. Well look at that later.

Most of the time, your VA loan must be for either a purchase or refinance of your primary residence, so, for example, you wouldnt be able to use it to buy a vacation home.

For eligible borrowers who qualify with an approved lender, theres no limit as to how many times you can use your VA loan benefit in your lifetime. In some situations, it may even be possible to have more than one VA loan at a time, as well cover next.

Who Can Get A Va Loan

The VA has very specific criteria that youll need to meet to be eligible for a VA loan. These differ depending on what time period you served and whether you were on active duty, in the reserves, or in the National Guard.

Generally speaking, if you began your service after Aug. 2, 1990, and you were an active-duty service member, your eligibility for a VA loan will require that one of the following circumstances applies to you:

- At least 24 continuous months of service

- At least 90 days during which you were called or ordered to active duty

- Fewer than 90 days if you received a discharge for a service-connected disability

- At least 90 days if you were discharged for a hardship, the convenience of the government, or a reduction in force

Furthermore, to be eligible for a VA loan, you also cannot have received a dishonorable, other-than-honorable, or bad-conduct discharge.

Recommended Reading: What Loan Can I Afford Calculator

When You Might Need A Second Va Loan

There are a few situations where you might need a second VA loan:

- If youre a service member who receives permanent change of station orders and you have to move to a new duty station. This would allow you to have two primary residences.

- If youre a previous VA loan borrowers who lost your home due to foreclosure, you can still use your VA benefit again after waiting a certain amount of time after your foreclosure. This is usually two years. However, if youre in financial hardship, you may qualify for financing sooner. Each lenders guidelines may be different.

- A VA loan assumption can restore your VA loan entitlement to full. An assumption means that someone else takes over your loan, assuming the interest rate, monthly payments and loan balance. This person must meet VA loan requirements themselves and be willing to transfer their own VA loan benefits, so your entitlement is restored.

- You can apply to have your VA loan entitlement restored in full once if you pay off your VA loan, but dont sell your home. This would allow you to purchase another home with a VA loan to be your primary residence, while keeping the other property to serve as a vacation home or rental property.

When A Va Loan Is A Good Ideaand When It Isnt

If youre eligible, a VA home loan is a good idea for the most part. Among other benefits, VA loans dont require a down payment and can have lower interest rates.

But there are times when it might not be the right choice if:

- You have an excellent credit score and can find a loan with a lower interest rate that isnt a VA loan, like a conventional home loan.

- You dont have enough remaining VA loan eligibility for the new home youre buying. You may want to refinance your first VA loan into a conventional loan to restore your eligibility for a new VA home loan.

If you can qualify for a VA loan with a good interest rate, it can be the right choice. But you need to carefully weigh your options before deciding on the best loan for your situation.

Don’t Miss: Suntrust Auto Loan Customer Service

Can I Buy A Second House With My Va Loan

With your VA benefits, you may be able to purchase a second primary house with no money down. To qualify for both properties, you just must have sufficient entitlement and income. Using a VA loan to purchase a home for the goal of converting it to a second home or investment property is permitted, but only after youve lived there for a period of time. Living in one unit and renting out the others can potentially provide rental income.

Va Loan Entitlement: What Is It

What is VA loan entitlement?

VA entitlement is the dollar amount the VA will repay a mortgage lender if the qualified borrower defaults or fails to pay their mortgage, said Sam Atapour, the branch manager for Embrace Home Loans in Ashburn, Virginia.

Typically, the entitlement guaranteed by the VA to cover any losses equates to 25% of the total loan amount. Basic primary entitlement is $36,000, although Atapour said most lenders will permit a loan up to four times that amountâ$144,000. A VA bonus entitlement provides the ability to borrow more than this amount.

You May Like: Hardship Loans For Bad Credit

Things Most Veterans Don’t Know About Va Loans

More than 21 million Veterans and Servicemembers live in the U.S. today, but only about 6 percent of them bought a home using a VA home loan in the past five years. That percentage could be much higher.

Eligible Veterans often bypass the program as a viable option for a number of reasons.

First, they may not know all the advantages. Second, they may think getting a VA loan is an arduous process to be avoided. Last, some lenders dont take the time to teach Veterans about the program, or dont know much about it themselves. The VA home loan is a program non-military home buyers wish they had access to.

My advice: take a few minutes to learn these 10 facts about the program, and youll all but forget about any other home buying or refinance option.

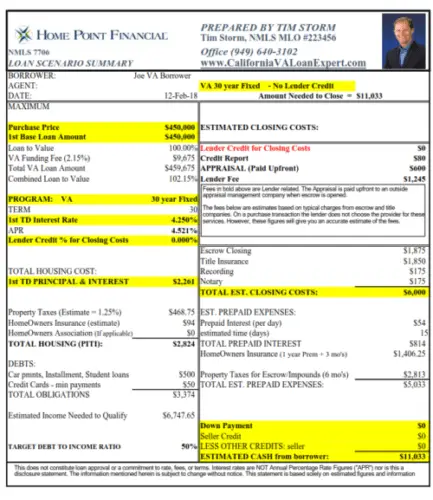

1. No down payment, no mortgage insurance

These are perhaps the biggest advantages to a VA loan. You dont need a down payment. None whatsoever. Most mortgage programs, such as FHA and conventional loans, require at least 3.5 percent to five percent down.Thats up to $12,500 on a $250,000 home purchase.

With a VA loan, you can buy immediately, rather than years of saving for a down payment. With a VA loan, you also avoid steep mortgage insurance fees. At 5 percent down, private mortgage insurance costs $150 per month on a $250,000 home, according to PMI provider MGIC.

2. Use your benefit again and again

Your VA home loan benefit is not one-and-done. You can use it as many times as you want. Heres how.

3. Your benefit never expires

Buying Vs Renting Using Entitlement

What about renting your home while youre trying to buy another one with a VA loan?

This might occur if, for example, you are stationed at a different location but dont want to sell your existing home. In this case, you decide to rent out your existing property and buy another one, says David Reischer, an attorney in New York City.

Theres a catch: You cant convert your primary residence into a rental and buy a similar-sized home in the same location. The second home would have to be a larger residence for a growing family, or would have to be in a different area.

You would not be able to use any of that rental income to reduce your debt-to-income ratio when applying for the second VA loan, says Yvette Clermont, mortgage consultant with Pewaukee, Wisconsin-based Inlanta Mortgage. But that rental income may help offset your mortgage payment, helping you qualify for the second VA loan.

Read Also: Interest Rate For Mortgage Loans

Restoration When You Sell Your Current Home

If youve paid off the previous mortgage and you no longer own that property, you can have your entitlement restored as many times as you want. In other words, you can keep changing homes, as long as you are selling and paying off the former VA loans in full each time.

Again, getting your entitlement restored doesnt happen automatically. Youll need to complete VA Form 26-1880. Check with the nearest VA office to obtain this form and to learn when, how and what you can buy using any remaining entitlement.

Using Your Full Entitlement

If youve got your full entitlement to use, great! This indicates that either youre a first-time VA loan user, or youve fully paid off a previous VA loan. This means you have that full $36,000 entitlement amount. Because theres no limit on how many times you can use your VA loan benefit, each time you pay off a VA loan, that $36,000 is restored.

Read Also: How Much Home Loan Can I Get On 90000 Salary

Wondering How To Qualify For A Va Home Loan

To qualify for a VA loan, the most important document youll need is your VA COE. However, you must remember that your COE is just one part of your eligibility. Ultimately, who qualifies for a VA loan depends on a number of additional factors as well.

You must also satisfy your lenders financial requirements and make sure the property meets all the MPRs.

Check out our Best Rated VA home loan lenders.

What If I Need More Than My Basic Entitlement

Say youve got your eye on a home that exceeds the $144,000 amount covered by your lender. Thats where bonus entitlement comes in. Bonus entitlement increases the amount you can borrow, freeing you up to find your dream home in more expensive housing markets.

A bonus entitlement can even exceed the conforming loan limit giving you an edge over other buyers. This is called a jumbo loan. Keep in mind that to qualify for a jumbo loan with a bonus entitlement, youll need to pay off your current VA loan in full to restore your entitlement.

Youve probably already used some of your entitlement on your current home loan, but there are a few ways you can restore it and increase your borrowing eligibility. This allows you to keep taking out VA loans as many times as you need to, forever.*

*When you reuse your entitlement, your VA funding fee may increase. Your funding fee varies based on your military status, down payment, and the number of times youve used your entitlement.

Don’t Miss: How To Compare Student Loan Rates