What Are The Alternatives To Multiple Fha Loans

Applying for conventional financing would be one way to avoid having more than one FHA loan at a time.

The problem with conventional mortgage loans is that its more difficult to get approved for them since a higher credit score is required, plus the required down-payment can range between 5-20%.

However, its entirely possible to have multiple FHA loans at the same time, provided that you fit into one of the circumstances that qualify as an exception to the rule of a single FHA loan at a time, you have enough equity, you can use rental income and your DTI is low.

In any event, every borrower situation is determined, and approval is granted by the lender on a case-by-case basis.

Fha Loans Dont Have Income Or Geographic Limits

Other low-down-payment mortgage programs may have special eligibility requirements. Many are limited to those with low, very low, or moderate income. Or they are available to only certain groups.

The VA loan, for example, allows 100% financing. But you must be an eligible military borrower to use it.

The USDA Rural Development loan also allows 100% financing, but the program requires you to buy in a designated rural area and imposes income limits, too.

For most buyers, FHA mortgages require a 3.5% down payment. This makes the FHA mortgage one of the most lenient mortgage types available nationwide.

Your down payment money could be a gift from a family member, employer, charitable organization, or government homebuyer program.

Can You Have Multiple Fha Loans At The Same Time

The FHA has flexible guidelines except when it comes to how many loans you can have. In general, you can only carry one FHA loan at a time. It makes sense since the FHA loan is only for owner-occupied properties. After all, you cant live in more than one property at a time.

Just like most rules, though, there are exceptions. You may find that you can have more than one FHA loan at a time. Keep reading to learn if its possible for you.

Also Check: What Is The Average Motorcycle Loan Interest Rate

Ways You Can Get An Fha Loan For A Second Home

First, know that the FHA forbids having two mortgages with active FHA mortgage insurance at the same time except under certain circumstances.

Job Relocation

You may be able to finance a second home with an FHA loan if you relocate of find a new job that is at an inconvenient distance for commuting purposes. The FHA guidelines use 100 miles at the minimum distance but if your commute is shorter than that but other factors such as intense traffic make it difficult, you may get approved.

If you can get an exception to have a second FHA approved while maintaining your current home, you may rent out the existing home. There is also no expectation that you must return to the first home at any time. Even if you relocate back to the area where your first home is, you can still buy another home but quite possibly not with an FHA loan.

Family is Growing and You Need a Larger Home

If you have out-grown your current residence and need something larger, then you can get approval for a second FHA insured loan. You may need to document the additional family members and detail how the size of your current home is not sufficient.

If you can get approved for this FHA family size exception, they will require that your current FHA mortgage be paid down to 75% of the home value before approving your new loan.

Borrower Vacating a Jointly Owned Property

There are a couple of scenarios where this may occur:

Non-Occupying co-Signer for an FHA Home

Meet Fha Loan Qualifications

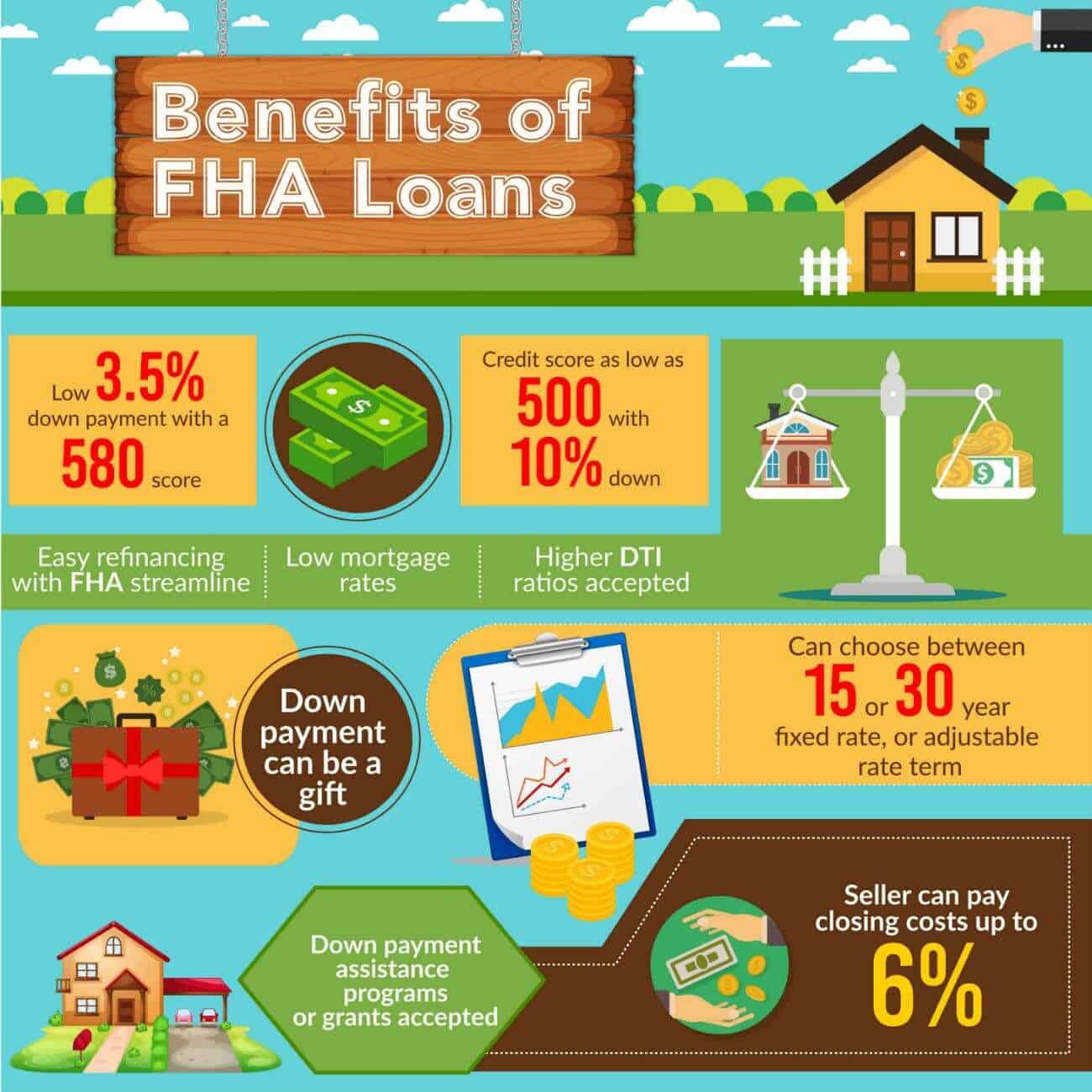

- Youll need a of at least 580 and a down payment of 3.5% of your homes final purchase price to qualify for an FHA loan. While you can qualify for an FHA loan with a credit score as low as 500, your down payment would then need to be 10% of the purchase price. To qualify for an FHA loan through Rocket Mortgage®, youll need a minimum credit score of 580.

- Debt-to-income ratio: While requirements may vary by lender, youll generally need a debt-to-income ratio of 43% or lower to qualify for an FHA loan.

- Satisfy any additional requirements: Your lender may require you to have enough money in your savings account to cover closing costs in addition to a down payment and two monthly mortgage payments.

Also Check: Is Max Loan 365 Legit

Why Is Water Escaping From My Central Heating System

The answer to this question is very simple: water is escaping from the central heating system. To put it simply, you have a leak. If there is apparently no leak in the home but the boiler pressure still keeps dropping, the culprit may be one of the boilerÕs internal components.

How Many Times Can I Get An Fha Loan

An FHA loan is a type of mortgage that is backed by the federal government. It can help buyers with limited cash reserves and lower credit scores achieve the dream of homeownership.

If you have an existing FHA loan, you may wonder if you can get a second FHA loan to buy a new home. There is no limit to how many times a borrower can get an FHA loan. But there’s a catch: You can only have one at a time unless you meet specific criteria.

Don’t Miss: How To Find Out Student Loan Account Number

Can You Get An Fha Loan Twice

You can take out more than one FHA loan during your life. You just cant take out more than one at a timein most instances. The reason for this? Youre supposed to use FHA loans to buy a primary residence. The Federal Housing Administration doesnt want borrowers taking out multiple FHA loans and benefitting from less stringent requirements to purchase investment properties instead of fulltime homes.

Exceptions To The Fha Owner Occupancy Requirement

Some exceptions to the FHA Owner Occupancy Requirement do apply.

One has already been mentioned: if the owner purchases a duplex, tri-plex, or four-plex and lives in one of the units as their primary residence, they can earn the income from the other properties

Second, if your job relocates you to another area that is beyond reasonable commuting distance or where affordable rental housing is not available, you may be able to rent out the first home if you lived in it as your primary residence for over a year.

Third, if your home has become too small for your growing family, and youve passed the one-year residency requirement, you can rent it out while living in a second home.

Fourth, if you become disabled or otherwise incapacitated, you may be able to make up your lost wages by renting out rooms in your home to boarders

Don’t Miss: How Do You Get An Fha Loan

Is It Normal For Boiler Pressure To Fluctuate

DonÕt get straight on the phone to your engineer if you see your pressure changing temporarily as this is completely normal. Combi boiler pressure increases when the heating is on as your boiler uses fuel to heat the water Ð this increase in pressure is natural.

Fha Loan Down Payments

Your down payment is a percentage of the purchase price of a home, and is the upfront amount you put down for that home. The minimum down payment youre able to make on an FHA loan is directly linked to your credit score. Your credit score is a number ranging from 300 to 850 thats used to indicate your creditworthiness.

An FHA loan requires a minimum 3.5% down payment for credit scores of 580 and higher. If you can make a 10% down payment, your credit score can be in the 500 579 range. Rocket Mortgage® requires a minimum credit score of 580 for FHA loans. A mortgage calculator can help you estimate your monthly payments, and you can see how your down payment amount affects them.

Note that cash down payments can be made with gift assistance for an FHA loan, but they must be well-documented to ensure that the gift assistance is in fact a gift and not a loan in disguise.

You May Like: How Do I Know If I Have An Fha Loan

Lenders Can Set Their Own Fha Loan Requirements

All FHA loans are not the same. There are many types of FHA loans, and mortgage rates vary by lender.

The FHA sets minimum eligibility requirements for all the loans it insures. But each FHA lender can enforce its own rules. The FHA calls these lender-specific rules overlays.

For example, a lender could have higher credit score requirements than the FHAs. Or, a lender could enforce stricter rules about previous foreclosures in your credit report.

It works the other way around, too.

For instance, one FHA lender could allow a higher DTI than another one. Or, one lender could let you use tax returns to show your income while another may insist on pay stubs to prove your employment history.

Because of these variations, when youve been turned down for an FHA mortgage by one lender, you should always try to apply with another which may approve your FHA loan request. Plus, mortgage rates can be very different from bank to bank.

In addition, the FHA offers special refinance loans, cash-out refinance loans, home construction loans, and other benefits to its applicants.

If youve been turned down for an FHA loan with your lender, consider applying somewhere else. Your loan may be approved once you re-apply.

Can You Have 2 Fha Loans At One Time

Can I really buy a second home with the FHA?

FHA loans are intended for principal residence financing, although you may be eligible for 2 FHA loans in certain circumstances.

Generally speaking, a borrower may have just one FHA mortgage loan at any one time. If they want to acquire a second FHA loan in the future, they must pay off the first one before applying for a second. Exceptions exist, however, according to the Department of Housing and Urban Development . They will enable a borrower to have two FHA loans, but only under specified conditions, such as having a larger family or relocating for work.

Don’t Miss: Online Loans That Are Legit

Can You Have More Than One Fha Loan At The Same Time

While you can qualify for FHA loans more than once, you generally cant have more than one FHA mortgage at a time. However, there are some circumstances where you might qualify for a second FHA loan without paying off the debt on your current one. The possible scenarios might be that youre:

- Making a job-related relocation to an area beyond reasonable commuting distance to your current home and where affordable rental housing isnt available.

- Buying a home due to departure from a jointly owned property where the co-owner plans to continue to reside. This might happen following a divorce settlement, for example.

- Purchasing your own home while serving as a cosigner on an existing FHA loan.

- Growing your family that prevents your current home from being sufficient to accommodate your needs.

Fha Owner Occupancy Requirement

The FHA requires that the owner must live in the property being financed for the majority of the year. That property must be the owners principal place of residence for at least one year. If there is more than one person on the loan, at least one of those must live in that home to be eligible for the loan.

This means that summer cabins, properties purchased solely for rental, AirBnB rental, or traditional investment properties would not qualify for FHA financing.

You May Like: How To Apply For Chase Auto Loan

Can You Purchase A Multiple Home Property With An Fha Or A Homepossible Loan

Owning the perfect home in the perfect city, in the perfect neighborhood is a dream for most. While buying a home is one of the most exciting times in your life, it is a huge undertaking. In fact, a home is one of the largest investments you will make in your life. For many, this can seem like an overwhelming process. This is especially true for those who are financially strapped and have either been declined a conventional loan or believe they will not be eligible for a conventional loan. What most are not aware of is that there are loans available for those who do not have as much cash to put down up front. FHA loans and the Home Possible loan are two types of loans which are alternatives to the conventional loan.

Fha Loan Limits In 2022

Each year, the FHA updates its loan limits based on home price movement. For 2022, the floor limit for single-family FHA loans in most of the country is $420,680, up from $356,362 in 2021. For high-cost areas, the ceiling is $970,800, up from $822,375 a year ago.

FHA is required by law to adjust its amounts based on the loan limits set by the Federal Housing Finance Agency, or FHFA, for conventional mortgages guaranteed or owned by Fannie Mae and Freddie Mac. Ceiling and floor limits vary according to the cost of living in a certain area, and can be different from one county to the next. Areas with a higher cost of living will have higher limits, and vice versa. Special exceptions are made for housing in Alaska, Hawaii, Guam and the Virgin Islands, where home construction is generally more expensive.

Also Check: Who Has The Best Home Loan Rates

No Is The General Rule

HUD’s general rule is that a borrower can have only one FHA loan at a time. If the borrower wants a new FHA loan, then he usually must pay off the first FHA loan before applying for the next FHA loan. Despite the general rule, HUD does allow one person to have multiple FHA loans in certain circumstances. Simply stated, HUD will allow multiple FHA loans when the borrower’s circumstances have changed significantly since the closing on the first FHA loan.

Military Relocation With An Fha Loan

Furthermore, military service members receive an occupancy exception. In order to document the exception, the service member must provide the military orders. It proves the active duty status plus if the duty station is over 100 miles from the new property.

Online FHA Applications Made Easy

Did you know you can apply for an FHA Loan online in as little as 15 minutes? Learn about OVMs QuickStart process.

Recommended Reading: Is An Auto Loan Secured Or Unsecured

What Can An Fha Loan Be Used For

FHA loans are strictly for owner-occupied homes, meaning you will live in the home you will buying. No second homes or rentals are allowed.

You can buy a single-family home, as well as a duplex, triplex or four-plex as long as you live in one of the units .

You can also use an FHA loan to buy a manufactured home, condo, or to rehab a home that is in need of repairs. FHA loans are truly one of the most versatile loans available.

Exceptions To Have More Than One Fha Loan

If a borrower finds themselves needing to relocate to a different area, they may be able to obtain another FHA loan if relocating would result in an unreasonable commute to their existing home. One example of needing to relocate would be for a new job. HUD has not determined what an unreasonable commute would be so it makes it a bit tricky and on a case by case situation. Most lenders say anything over an hour commute would be deemed reasonable.

Another reason a borrower may be allowed to obtain a second FHA loan is if their family size has grown significantly since their first home purchase. The borrower first needs to prove that their existing living conditions no longer can meet the needs of their growing family. Such as if they currently have a two-bedroom home but the family triples in size, then they will probably qualify for another FHA loan.

Recommended Reading: Low Interest Home Equity Loans

How To Qualify For An Fha Loan For A Second Home

Now that you understand how you can be approved to purchase a second home with an FHA loan, you still need to qualify. The qualification process is exactly the same as it was when you were purchasing your first home with two exceptions:

How Many Fha Loans Can You Have If Youre Refinancing Your Home

You can refinance more than one home with FHA financing, but at least one of the homes must be your primary residence. Any other homes with FHA loans must be refinanced as investment properties. You may be able to get a new FHA loan on an FHA-financed home youve since converted to an investment property, with the following restrictions:

- The other home must be refinanced through the FHA streamline program, which doesnt require a home appraisal or income verification.

- The other home must be refinanced as an investment property.

- The new mortgage cant be an adjustable-rate mortgage or a cash-out refinance.

THINGS YOU SHOULD KNOW

If your credit scores have improved since you first borrowed an FHA loan on any FHA-financed home, you may want to check out conventional refinance options. An added bonus: Conventional lenders can offer investment property loans to eligible borrowers.

Read Also: Can I Loan Audible Books