Unique Selling Proposition Of Dave

Side Hustle concept of Dave is a unique selling proposition for the company as it is not offered by the competitors and alternative platforms. The app makes sure that you are not only spending but earning the money as well. With the concept of Side Hustle, the app provides gig jobs to users willing to monetize their spare or full time. The service offered by the firm is entirely free of cost for the users. Dave provides the gig jobs to the users with the partners such as Airbnb, Inbox Dollars, DoorDash, TranscribeMe, Instacart, and several others.

What About Earned Wage Access Apps

Earned wage access apps allow you to access some of your pay as soon as youve earned it. With these, you dont have to wait until the end of the pay period to collect your money. These include Branch, DailyPay, Even, PayActiv and TapCheck. However, weve excluded these from the list because theyre employer-sponsored programs, so they arent open to everyone. You can only use them if your employer offers them as a company benefit.

Apps Like Dave For Small Cash Advances

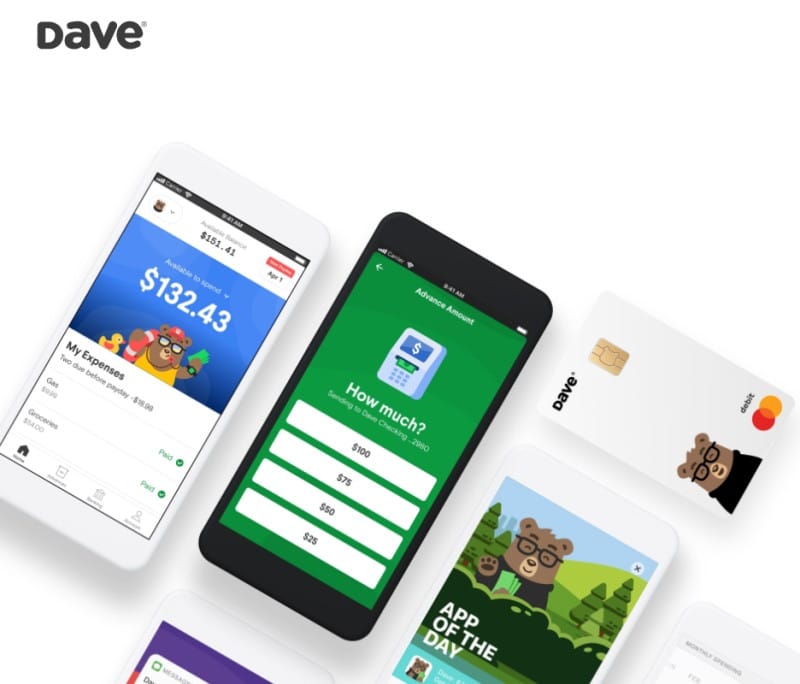

Dave is one of the most popular financial apps. It made a name for itself by eliminating overdraft fees for its customers. Famously receiving an investment from Shark Tanks in its early stages, Dave is well-known as one of the best fee-free cash advance apps.

A cash advance, simply put, is a short-term loan issued by an institution, usually for a relatively small sum. Dave isnt alone in offering this service. So, consumers should weigh their options and choose the one that is best for them.

You May Like: How Much Student Loan Debt Is There

Ingo Get Your Money In Minutes

The Ingo app is much handier than other apps like branch available in the market. As people dont like to pay the fees charged by most check cashing places. With the help of the Ingo app, you can take a photo of the check, and then you can deposit the checks amount whenever you feel like it. You can deposit into your bank account, PayPal, a prepaid card, etc.

The deposit is free if you can wait for 10 days. It will charge you a fee if you immediately want the money. The charges are somewhere between $5 and 5% of the check. The amount you will be entirely based on the type of check you are cashing and the amount.

Which Is The Best App To Get An Instant Loan

This depends on how much money you need to borrow. A money lending app will limit your loan amount to between $50 and $500 and will require immediate repayment when your next paycheck arrives.

If you need a slightly larger personal loan that gives you time to repay your loan through monthly payments, MoneyMutual provides short term loans of up to $2,500 with forgiving approval standards, a competitive interest rate, and terms that are on par with a bank loan.

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- Not available in NY or CT

| Varies |

See representative example |

You can find even larger loan amounts through an online lending network such as CashUSA.com. The lenders that partner with this network provide loans of up to $10,000 with very quick approval times and payouts within one business day.

The unsecured loans offered from MoneyMutual and CashUSA dont require collateral or upfront costs for approval. In many cases, you can repay your loan over several years.

A money lending app will provide you with a cash advance, which is meant to act as a bridge to your next payday and will require repayment in one lump sum. This loan type is useful if you only need a small amount of money to cover your expenses until payday.

For a larger emergency loan, consider an online lending network for a personal loan.

Don’t Miss: What Is Bank Loan In Accounting

Borrow Responsibly When Using Payday Loan Apps Like Dave

If youre like most people, any new financial need or demand makes you irritated and tense. The best money borrowing app can help you meet your immediate demands without delay or having to seek secured personal loans. Since youre likely unready for financial emergencies and each additional financial obligation can put you on edge.

There are several advantages of borrowing money via an app rather than going to a local bank or pawnshop to try and get quick cash. Even though there are many lending institutions in each city today, you may not be aware of all the nuances, interest rates and fees among them.

Every potential borrower must understand that he or she is fully responsible for any loan or cash advance obtained. This money should not be taken for granted, since it will only be used for a brief period of time.

Finally, such small amounts of loaned money cant accommodate long-term financial objectives. Consider alternative ways to finance your long-term goals and needs, or try to increase your income potential with side hustles.

With that said, good luck with borrowing money with these cash advance apps like Dave!

- Get a no-fee and interest-free cash advance of up to $250

- Pay a small fee to get your money instantly or get cash within 23 days for free

- Costs $4 per month after a 30 day free-trial

Online Services That Loan You Money

Online lending networks are the ultimate loan application source because they allow you to submit a loan request to several lenders at once without incurring any damage to your credit score.

Lenders will then compete for your business, and you may receive multiple loan offers to choose from. Once you complete the loan paperwork and are approved which typically takes an hour or less you can receive your loan proceeds as soon as the next business day.

| Varies |

See representative example |

MoneyMutual has cornered the market on finding short-term cash loan options for consumers who have bad credit. With one of the largest networks of lenders on the internet, there are options for many credit types each with a competitive interest rate, loan term, and monthly payment.

And when you go with the network that partners with the most lenders, youll increase the competition among the lenders which means youll receive only the best possible offers to meet your financial needs. A large network also improves your chances of finding a lender that is willing to work with your bad credit score.

| Varies |

See representative example |

A cash advance also known as a payday loan is a super-short term loan that you should only consider as a last resort. The loans from CashAdvance.com require full repayment within 15 to 30 days and come with a very high interest rate that makes them the most expensive option on this list.

Recommended Reading: When To Refinance Home Loan

Moneylion: Best For Multiple Financial Products

The MoneyLion app offers mobile bank and investment accounts, financial tracking, a credit-builder loan and cash advances up to $250. The Instacash advance is available to anyone with a qualifying checking account. However, youll have to pay a fee if you need your funds quickly. MoneyLion says it charges no interest or fees with the cash advance, but you’re asked to provide an optional tip if you get an advance.

Amount: $25 to $250, but only MoneyLion checking account customers get access to the largest amounts.

Fees: MoneyLion has an optional tip, plus a fee for instant delivery that varies by amount borrowed:

-

MoneyLion checking account users: $0.99 to 5.99 for instant delivery.

-

Users with non-MoneyLion checking accounts: $1.99 to $7.99 for instant delivery.

Speed: If you dont pay the instant delivery fee, it takes 12 to 48 hours for MoneyLion checking account users, and three to five business days for non-MoneyLion checking account users.

Repayment: The funds are automatically withdrawn from your account on the day youre expected to receive your next deposit typically your next payday. If your account doesnt have enough money, the app will repeatedly try to withdraw the funds.

Borrow Responsibly When Using Payday Loan Apps Like Earnin

If youre like most people, any new financial need or demand makes you irritated and tense. The best money borrowing app can help you meet your immediate demands without delay or having to seek unsecured personal loans or secured personal loans. Since youre likely unready for financial emergencies and each additional financial obligation can put you on edge.

There are several advantages of borrowing money via an app rather than going to a local bank or pawnshop to try and get quick cash. Even though there are many lending institutions in each city today, you may not be aware of all the nuances, interest rates and fees among them.

Every potential borrower must understand that he or she is fully responsible for any loan or cash advance obtained. This money should not be taken for granted, since it will only be used for a brief period of time.

Finally, such small amounts of loaned money cant accommodate long-term financial objectives. Consider alternative ways to finance your long-term goals and needs, or try to increase your income potential with side hustles.

With that said, good luck with borrowing money with these cash advance apps!

- Get a no-fee and interest-free cash advance of up to $250

- Pay a small fee to get your money instantly or get cash within 23 days for free

- Costs $4 per month after a 30 day free-trial

Recommended Reading: Is Refinancing Car Loan Worth It

What Credit Score Do I Need To Get A Loan

There are no minimum credit score requirements for a money lending app or online lending network. With that said, every lender has a unique algorithm that it uses to assess creditworthiness. While one lender may accept your application, another may reject it.

If youre concerned about your credit score affecting your chances of getting a loan, you should consider submitting a loan request to an online lending network such as those listed at the top of this page.

Whichever network you choose to work with will forward your loan request to each of its partner lenders, which means youll apply to several lenders at once. And since most of these lenders specialize in bad credit loans, you wont have to worry about your credit score locking you out of the loan you need.

Within minutes after you submit your loan request, you could receive multiple loan offers to choose from. Each loan offer will have a unique loan term, monthly payment, and interest rate, so study each offer carefully before choosing the one for you.

Submitting a loan request to an online lending network will not place a hard inquiry on your credit report and wont impact your credit score which gives you the peace of mind you need when looking for an emergency loan.

Rainy Day Lending App Similar To Dave

Rainy day is not a lender, and it does not offer wage advances, but the app for cash loans offers you the chance to have a personal loan quickly based on certain conditions.

Here, all the credit types are accepted, and you can have the money deposited directly into the account immediately on the next business day. It will vary based on the loan that you are matching up. However, there are certain considerations when there are insufficient fees, overdraft charges, and loans you can have with a certain rate of interest.

Also Check: Small Loans For Bad Credit Online

Best Cash Advance Apps Like Dave You Cant Ignore

Dave is the one-stop solution for our financial ability. Dave ticks all the boxes, whether its budgeting tools, savings, overdrafts protection, interest-free advance, or security.

One of its most standout features is Side Gigs which hooks you up with a side hustle.

Despite offering a top-notch experience, it is not a perfect budgeting app that hits every ball. Dave requires a steady flow of income into your direct deposit that you set up with your bank account.

Also, the low withdrawal limit and Membership fee prompt users to switch to other cash advance apps like Dave that could offer more suitable finance options. We have compiled a list of the best Dave alternatives to help you with money management.

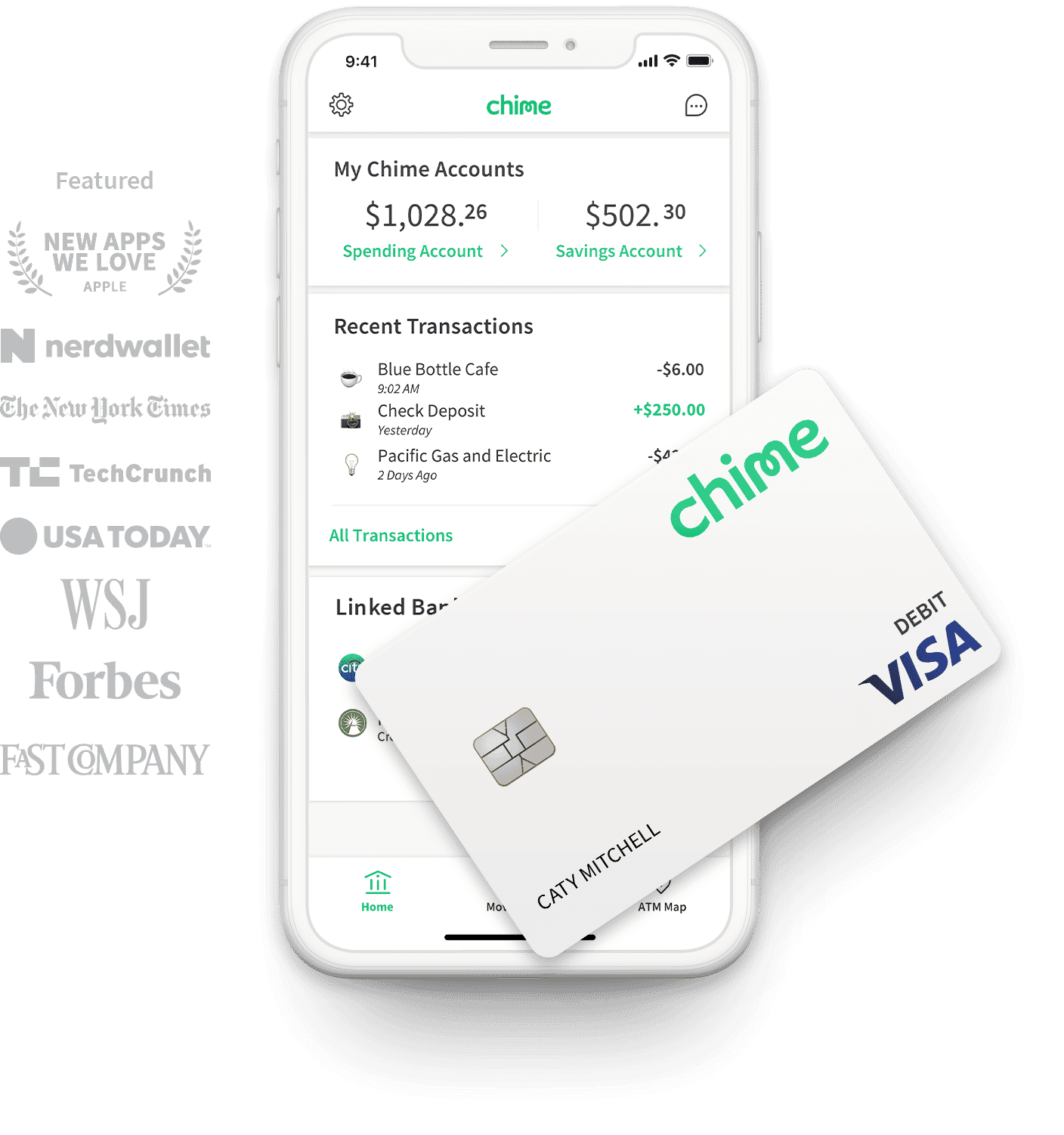

What Is Chime Spotme

If youre looking at cash advance apps that work with Chime, the simplest place to start is SpotMe, Chimes own advance program. SpotMe is a no-fee overdraft service.

If you have a Chime bank account and you have received $500 in direct deposits in the last 31 days you are eligible for SpotMe. You will have to continue to receive at least $500 every 31 days to stay eligible.

When you register, you will get a SpotMe limit, usually starting at $20. You may be eligible for a limit up to $200, depending on your deposit history.

SpotMe will cover all or part of debit card purchases up to your limit. Theres no limit on the number of transactions. Your overdraft will be deducted from your next direct deposit, with no additional fees. You cannot withdraw cash or use SpotMe to fund a transfer.

Interested in Chimes Spot Me program? Watch this to learn more:

Recommended Reading: Sofi Student Loan Refinance Rates

Apps Like Dave: Here Are 12 More Cash Advance Options

Disclaimer: Some or all of the products featured in this article are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. All opinions are our own.

Dave is one of the most popular cash advance apps, but other popular alternatives have different benefits. Follow along for 12 other online banking options that will give you the cash you need to get to payday.

If you already know the pros and cons of using Dave and are looking for the best apps, .

What Are Cash Advance Apps And How Do They Work

Also known as Payday Advance Apps, Cash Advance apps offer users the option to get paid early for the work they have already done. They typically allow you to borrow $100 $200 from your next paycheck for use during emergencies. For example, you can use the app to borrow $100 a few days before your payday. The app will then deduct it directly from your paycheck once it arrives a few days later.

While some apps also offer personal loans, payday advances are not loans per se. Thats because you are accessing your own hard-earned money, even though your employer is yet to transfer the earnings to your bank account. Since you are using your own money, the apps do not charge interest. However, most of them typically have membership fees between $1-$10 per month to use their services.

One of the leaders in the segment is Dave, which charges $1 per month for small cash advances of up to $100 per pay cycle. It also offers a whole host of other features, including overdraft warnings and budgeting tools. Dave is considered the industry leader with the best rates and the most dedicated userbase. But it is far from the only cash advance service in the segment. So, here are the best apps like Dave you can use to borrow cash right now:

Also Check: How Much Interest Will I Pay On My Car Loan

Best For Larger Advances: Branch

Like PayActiv, the Branch app allows you to get up to 50% of your paycheck as an advance. But keep in mind that your advance limit may depend on your payment history and other factors.

You can get your advances in three days, or you can opt for Instant Pay and get the money immediately with no fee if youre transferring to a Branch debit card. Theres no interest involved and no membership costs, so you dont have to worry about high costs to use the app.

Branch users also get access to no-fee checking with a debit card, plus access to more than 40,000 ATMs that wont charge a transaction fee.

Apps Like Dave For Getting Cash Advances Easily

Your phone bill for the month has arrived unexpectedly earlier than usual, but payday is not until the next two weeks. Things like this can be a headache, especially if you are living paycheck to paycheck. Thankfully, there are now financial apps that will help you get by without trapping you into the pit of debt. Dave, a cash advance app, has been helping people get the money theyve already earned prior to payday while avoiding bank overdraft fees. Its not just Dave now, though. Apps like Dave have started to emerge, giving you more and potentially better alternatives.

Don’t Miss: Lowest Interest Personal Loan Rates

Apps Like Moneylion: 13 Emergency Alternatives

We all dream of having a neat emergency stash saved up somewhere to cater for unplanned expenses and emergencies as they crop up. While these intentions are great, saving isnt always possible.

From time to time, youll need to come up with some cash. Without savings, most people turn to credit facilities.

However, we all know banks can tie you up in lengthy processes that arent really useful when you need to borrow money quickly. The best option when in a pinch are loan apps like Moneylion.

Here are 13 alternatives to Moneylion that you can consider when you need to borrow money.