How Does The Student Loan Payment Pause Affect My Pslf Eligibility

Federal student loan payments have been on pause for over two years, and were just extended to resume after . Under the PSLF, each of those paused payments counts as a qualifying loan payment during this time. So, if your payments were paused for 26 months, that counts as 26 on-time payments, bringing you closer to your goal of 120.

Am I Eligible For Biden’s Loan Forgiveness And Pslf Forgiveness

Anyone with qualifying federal student loans from the Department of Education who earned less than $125,000 in 2020 or 2021 is eligible for up to $10,000 in loan forgiveness. If you received a Pell Grant, you’re eligible for up to $20,000 in loan forgiveness. This includes anyone eligible for Public Service Loan Forgiveness.

Since PSLF borrowers are on income-driven repayment plans, Biden’s loan forgiveness may be applied automatically, according to Federal Student Aid. This is separate from applying for the expanded PSLF waiver, which offers full loan forgiveness for more public service borrowers.

Student Loan Integration Disadvantages

- The latest interest rate is good adjusted average of the money getting consolidated, circular as much as brand new nearby one-8th off a share part. Thus, youll be able to find yourself expenses a slightly high rate. Remember that private loan providers set their unique rates of interest.

- In the event that your Stafford money had been removed once , you already have repaired-rates funds. Therefore, there would be need not protect against upcoming interest rate grows.

- When specific finance is consolidated, its also possible to eradicate qualifications for most of forgiveness software. For example, government Perkins loans give mortgage termination for certain exercises positions. In the event the a qualified loan are paid as a consequence of a consolidation, eligibility can be lost. You actually have the option of leaving specific money out of new combination.

- If you have a grandfather And financing, also they on combination makes the funds ineligible getting Money-Depending Installment.

Don’t Miss: How Many Type Of Mortgage Loan

Cons Of Student Loan Consolidation

- You could pay more. If you extend your repayment term, youll likely pay more in interest over the life of the loan.

- Your principle could increase. When you consolidate, any unpaid interest on your individual loans becomes part of the principal of the new, consolidated loan. That leaves you with a bigger balance to pay interest on.

- You could lose emergency protections. Federal loans come with generous deference and forbearance options, and a post-graduation grace period. By choosing to consolidate under a private loan servicer, you forfeit those failsafes.

- You give up other benefits. Federal loans come with perkslike Public Service Loan Forgiveness , Perkins Loan forgiveness, or income-driven repayment optionsthat you could lose after consolidation.

- You might lose credit toward forgiveness. Consolidating could reset any progress youve made toward loan forgiveness plans like PSL.

How Does Student Loan Consolidation Affect Credit

If you use the federal loan consolidation program, there’s no credit check, so you won’t get a hard inquiry on your credit reports. Additionally, because you’re just consolidating existing debt instead of taking on new debt, your amount owed won’t be affected either.

However, the new loan account will impact your length of credit history, including the average age of your accounts, which can affect your FICO® Score.

If you’re applying for private loan consolidation, the application process for private consolidation may initially have a negative impact on your credit score because of the hard inquiry. According to FICO, though, one additional hard inquiry typically knocks fewer than five points off your score.

And as with federal consolidation, the new loan account will also impact your length of credit history. That said, none of these potential negative impacts are as important as your payment history, so as long as you continue to make your payments on time, you shouldn’t see any major issues.

Read Also: How Much Va Loan Can I Get

Drawbacks Of Consolidating Student Loans With Your Spouse

Like any major financial decision, consolidating student loans with your spouse has some drawbacks as well:

- You may lose benefits. If you have federal loans, youll lose any special repayment plans or loan forgiveness benefits by refinancing into a private loan.

- Your interest rate may not be lower. If your spouses credit isnt as good as yours, you may not qualify for as low of an interest rate as you would on your own. If market conditions change, your interest rate may also be higher than youre currently paying.

- Your credit score may drop. Adding a significant amount of debt can negatively affect your score.

Increases Your Loan Term

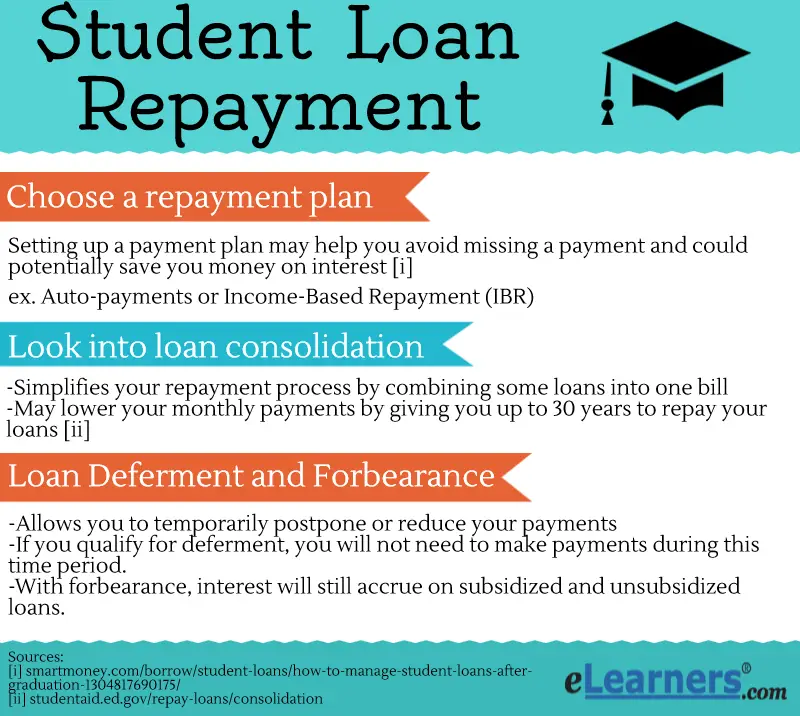

Consolidation usually increases the period of time it will take you to repay your loans or reduces your required monthly payment. You might make more payments and pay more in interest than if you opted not to consolidate.

Remember this rule of thumb: If your balance is less than your annual income, prioritize paying that debt off more quickly to reduce your interest cost over time. Lengthening your payoff timeline without leveraging federal loan forgiveness opportunities is likely not an efficient way to pay off your student loan debt.

Read Also: Can I Pay Off My One Main Financial Loan Early

You Want To Lower Your Monthly Payment

When you graduate, youre automatically enrolled in a 10-year Standard Repayment Plan. If you cant afford your payments, consolidating can help. When you take out a Direct Consolidation Loan, you can extend your repayment term to up to 30 years, significantly reducing your payment.

Youll pay more in interest over the length of your loan with the longer repayment term, but the trade-off is that youll have more breathing room in your budget in the early stages of your career.

Should I Consolidate My Student Loans

The answer to this question depends on several factors, including whether you want to simplify your payments with the federal government or save money by refinancing with a bank, credit union or online lender.

Remember that while refinancing your old private student loans might be a no-brainer, stripping your federal loans of their government-exclusive protections is a more complicated question and only you can answer it.

Weigh the pros and cons of consolidating student loans or refinancing them to choose a secure path for you and your finances.

If youre ready to refinance, check out our student loan refinancing marketplace.

Andrew Pentis contributed to this report.

Recommended Reading: How Much Interest Will I Pay Student Loan

Where To Go To Start Consolidating Your Student Loans

Consolidation can make sense for someone given the right circumstances. These tips of what you need to consider before consolidating your student loans should help guide you before you pull the trigger. If consolidating your student loans makes sense for you, you can complete your free online student loan consolidation application at www.studentloans.gov.

What Are The Advantages Of Student Loan Consolidation

There are different advantages of student loan consolidation, depending on whether you consolidate federal student loans or refinance with a private lender. As mentioned earlier, a federal Direct Consolidation Loan can simplify payments, give you a fixed interest rate, and help you qualify for certain federal programs. You can also lower payments if you lengthen your repayment term, but you will end up paying more interest over time. Refinancing federal or private loans with a private lender can save you money if you qualify for a lower interest rate or shorten your repayment term, but youll lose access to federal benefits and protections.

- Mon-Thu 5:00 AM – 7:00 PM PT

- Fri-Sun 5:00 AM – 5:00 PM PT

Home Loans General Support:

- Mon-Fri 6:00 AM 6:00 PM PT

- Closed Saturday & Sunday

- Mon-Thu 8:00 AM 8:00 PM EST

- Fri 8:00 AM – 7:00 PM EST

- Closed Saturday & Sunday

- Mon-Thu 5:00 AM – 7:00 PM PT

- Fri-Sun 5:00 AM – 5:00 PM PT

Recommended Reading: Which Loan Should I Pay Off First

Gather The Necessary Documents

Before beginning the consolidation process, compile the documents necessary to complete the application and promissory note, including your education loan records and personal income information. If youre completing the application online, youll have access to all of your federal loan details. You also should locate contact information for two references who have known you for at least three years, including one parent or legal guardian.

Can I Consolidate My Student Loans More Than Once

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Find the latest

-

Keep your guard up: How to spot a student loan scam

You may be able to consolidate your student loans even if youve already done so.

If you have federal loans, student loan consolidation allows you to combine multiple federal student loans into one and keep the borrower protections and payment options that federal loans enjoy. It wont reduce your interest rate but can change your term and loan servicer.

If you have private student loans, the consolidation process is called student loan refinance. Unlike federal consolidation, private student loan refinancing can reduce your interest rate, in addition to changing your loan term and loan company. Student loan refinancing is always with a private company and allows you to combine federal and private loans.

Recommended Reading: Did Student Loans Get Deferred Again

You Could Lose A Federal Loan’s Advantages

If you consolidate a federal student loan with a private lender, you’ll lose the option to sign up for an income-based repayment plan. You’ll also no longer be eligible for federal loan forgiveness and cancellation programs. These are major reasons to consolidate your federal loans only through the federal program.

How Does Student Loan Consolidation Work

There are two basic ways to consolidate your student loans. You can do so through a private lender or the federal government. Only federal loans are eligible for federal consolidation.

In the case of a private student loan consolidation , a private lender, such as a bank, pays off your private or federal student loans. It then issues you a new loan at a new rate and with a new repayment schedule. Refinancing makes the most sense if you have high-interest private loans and can obtain a significantly lower rate or better terms with the new loan.

However, with federal student loans, you have another option, which is to combine them into a new direct consolidation loan, through the Federal Direct Loan Program. Your new interest rate will be the weighted average of your previous loans, and you will remain eligible for some of the special features of federal loans, as we’ll explain later.

While you can’t consolidate private loans into a federal loan, if you have both private and federal loans, you can consolidate the private ones with a private lender and the federal ones through the government program.

If your student loan is still within its grace period, wait until that ends before you refinance it.

Recommended Reading: How Much Home Loan Can I Get On 90000 Salary

How To Consolidate Your Defaulted Loans

To consolidate your loans in default you have to meet one of two qualifications:

-

Make three full, on-time consecutive monthly payments on the defaulted loan. The amount you pay is determined by the loan holder, but it cant be more than what is affordable for your financial circumstances.

-

Agree to enroll in an income-driven repayment plan.

If the loan in default was already consolidated as a direct loan you can still reconsolidate, but you must also include at least one other eligible loan in the consolidation. Without an additional eligible loan, the only way to get out of default is to pay in full or through loan rehabilitation.

» MORE:Is there a statute of limitations on student loans?

Borrowers with a defaulted FFEL Consolidation Loan can be reconsolidated, but only if you agree to repay under an income-driven plan.

For those whose defaulted loans are subject to wage garnishment or other collections, you can consolidate only if the wage garnishment order has been lifted or the judgment is vacated.

» MORE:What happens if you don’t pay student loans?

Can You Consolidate Student Loans When You Have Private Loans

With federal student loan consolidation, you can only consolidate federal student loans. No private student loans can be consolidated into a Direct Consolidation Loan.

If you have private student loans, you can consolidate those student loans through refinancing. Both federal and private student loans can be refinanced into one new loan.

When you refinance, a private lender gives you a new loan , and then you have to pay back that one loan.

In addition to combining multiple student loans into a single loan, you may also qualify for a lower interest rate depending on many personal financial factors, including your credit score. Refinancing at a lower interest rate may reduce the money you spend in interest over the life of your loan.

Recommended: How Do Student Loans Affect Your Credit Score?

Recommended Reading: Variable Vs Fixed Rate Student Loans

Miss Out On Borrower Perks

Consolidation may also cause you to miss out on certain borrower perks. You might lose interest subsidies or some loan cancellation benefits that are associated with your current loans.

A Perkins loan has certain forgiveness opportunities . Consolidating these and changing their loan code eliminates those same opportunities.

Student Loan Integration Benefits

- Combining the student education loans helps make lifestyle convenient. According to when you went along to college and you can what kinds of fund you grabbed aside, you might have to juggle several money each month. Merging means that you just need to bother about that college student loan fee each month. Keep in mind that individual student loans cannot be consolidated which have federal financing.

- Student loan consolidation may help include your credit report. Why dont we imagine you have taken out seven subsidized financing and you can 7 unsubsidized fund-that per session. Before you consolidate, you might still only get one statement and come up with you to payment for the lender. However ,, as much as your credit score is concerned, for every financing are noted just like the another obligations. Therefore, for those who miss one commission, this may in fact let you know on your credit history since 16 missed repayments!

- When you yourself have Stafford fund that were applied for ahead of , your own fund probably have a changeable price. Consolidating the individuals fund carry out protect a fixed interest and protect facing upcoming interest rate expands.

- For those who combine your finance, you may have education loan repayment alternatives that would permit you to help you extend your instalments more than a longer period of time. This might allow you to generate faster repayments.

Recommended Reading: What Is An Asset Based Loan

Benefits Of Consolidating Student Loans With Your Spouse

Consolidating your student loans with your spouses loans can have a number of benefits, including:

- You may lower your interest rate. If your financial situation has improved, you may qualify for a lower interest rate than youre currently paying on your student loans. This will reduce the total amount youll pay over time.

- Youll have one payment. Keeping track of numerous loan amounts, payments, and due dates can be a challenge. Consolidating loans leaves you with one loan payment that’s easier to manage.

- You can adjust the length of your loan. When you refinance, you may have several options for your new repayment term. With a longer repayment term, your monthly payments will likely be lower. Shortening the length of the loan will increase your monthly payment, but youll get out of debt faster and pay less interest over the life of the loan.

If youve decided to consolidate your student loan debt with your spouse, Credible lets you easily compare student loan refinance rates from various lenders.

If You Consolidate Your Loans Will You End Up Paying More In Total Interest

More details coming up on if you consolidate your loans will you end up paying more in total interest, direct consolidation loan and disadvantages of consolidating student loans.

Its true: if you consolidate your loans, you may end up paying more in total interest. However, it depends on how long youre going to be in school and whether or not the amount of time youve already spent in school is worth the lower monthly payment.

If your repayment term is extended, your monthly payment will be lower but youll pay more interest over time. If you consolidate with the federal government, your new interest rate will be the weighted average of your federal loans interest rates, rounded up to the next one-eighth of the percentage point.

Recommended Reading: How To Get Credit Score For Home Loan

Beware Of Consolidation And Refinancing Scams

In recent years, many scams have arisen that prey on borrowers struggling to keep up with their payments. For example, some companies will offer to consolidate your loans for you for a fee.

But consolidating your federal loans is completely free, and theres also no fee to refinance student loans.

When it comes to consolidating or refinancing your loans, avoid companies that try to charge you fees to get started.