Penfed Auto Loan Review

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

When the time comes to buy a new or used car, getting an auto loan is an essential part of the process for most car buyers. Credit unions like PenFed often offer lower interest rates on auto loans than banks, but you must be a member in order to qualify. PenFed membership is easy and rates are competitive, especially if youre buying a late model car. However, if youre looking to buy a motorcycle or RV, youll need to look elsewhere PenFed recently discontinued these types of loans. Keep reading to determine if a PenFed auto loan is a good choice for you.

Is Penfed Credit Union A Legit Company

PenFed Credit Union was founded in 1935, it is a well-established company that has been in business for 87 years.

Unfortunately, we don’t have sufficient community reviews to provide a reliable rating of their user experience and customer service.

SuperMoney DisclosureEditorial Disclaimer

Is A Penfed Auto Loan The Best Choice For You

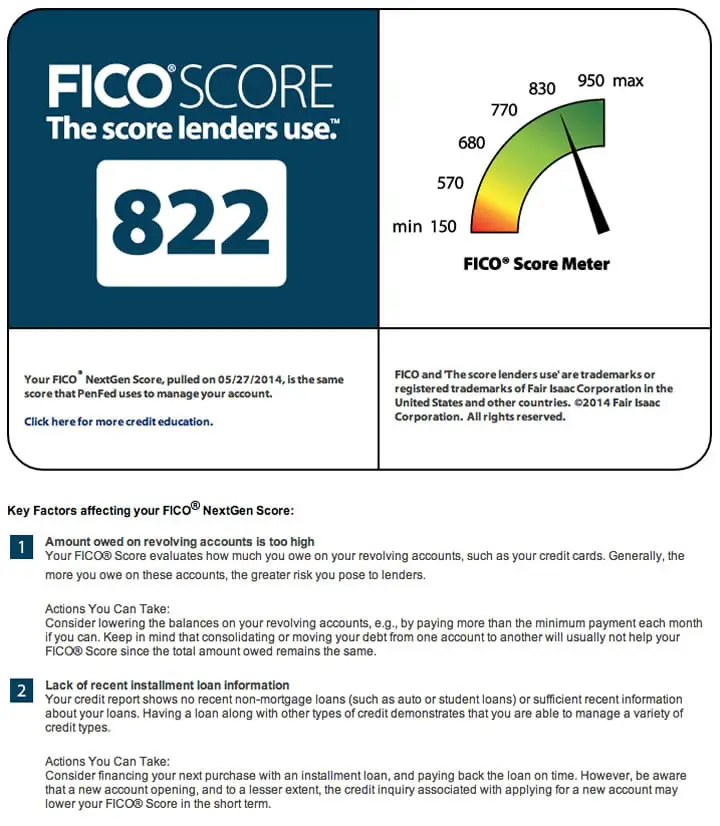

Because PenFed targets consumers with of 700 or above, it can be challenging to get approved if your credit score is below that, even if youre a member.

They also dont have very many branch locations and can be hard to contact with questions if youre not already a member.

However, if you qualify for membership, PenFed has some excellent financing options at competitive rates. The whole process can be done online, and you get the many perks that come with membership to a credit union.

PenFed Auto Loan

Don’t Miss: What Credit Score Is Needed For Sba Loan

Pentagon Fcu Closes Inaugural Prime Auto Loan Securitization

Pentagon FCU, or PenFed Credit Union, closed its inaugural prime auto loan securitization, PenFed Auto Receivables Owner Trust 2022-A.

Under the transaction, $460.3 million of fixed-rate, amortizing notes backed by prime auto loans were issued. The notes were offered in four senior and three subordinate tranches of notes. Like other types of loans, including student loans and credit card receivables, auto loans can be packaged into securities and sold to investors. These asset-backed securities, or ABS, provide the lender with the cash to make more loans.

Who Is A Penfed Auto Loan Best For

Since membership is required to get an auto loan from PenFed, this lender is a strong option if you are already a member or meet the requirements for membership and are willing to take that extra step, preferably well in advance of when you plan to buy a car. PenFed is a better option if you are interested in its car-buying service, which is offered in partnership with TrueCar, and offers a starting APR of 1.79%, one of the best rates according to other listings on our site.

Read Also: Types Of Home Loans For First Time Buyers

Additional Penfed Auto Products

PenFed offer several services in conjunction with its auto loans, including:

- GAP protection covers the difference between the amount owed on the loan and the value of the car itself in the event of a major collision or a total loss not covered by your traditional car insurance. The cost is $449 and includes up to a $500 reimbursement for your insurance deductible. You could read more about GAP insurance here.

- An extended warranty from PenFed covers covers towing, rental reimbursement and roadside assistance and certain types of repairs after the manufacturers warranty ends. Multiple options are available ranging from $995 to $2,995. Read up on how to find the best extended warranty.

- Debt protection is available to cover unexpected events including death, disability and involuntary unemployment. PenFed offers several options ranging from $0.88 to $2.10 per $1,000 of your monthly loan balance.

These services are all optional and are not necessary for many borrowers. They can be purchased elsewhere, so you may want to shop around before adding any of these products to your PenFed car loan.

How The Application Works

If youre already a PenFed member, you can log in to your account and apply online. If you arent a PenFed member, you can still apply online. Just go to its auto loans page and click Apply now under the type of loan youre interested in.

From here, you can fill out its application. The process should take around 10 minutes to complete. Loan decisions may be available within a few business days.

However, applicants must be members for 90 days or more to apply for preapproval. New members may still qualify, but it means a hard credit check once you submit an application. In this case, you may want to make PenFed a last stop when comparing car loans to avoid impacting your credit.

Read Also: How Much Loan I Can Get For Business

How To Apply For An Auto Loan At Penfed

One of the best ways to apply for an auto loan, not just one from PenFed, is to get preapproved. That way, you can walk into the dealership with an idea of the rate and amount for which you qualify. If the dealer can beat it, thats great youre probably getting a good deal.

PenFed offers preapprovals for loans as long as you have been a PenFed member for more than 90 days. If not, youll need to know the exact car you want to buy before applying for a loan. In either case, here are the steps you must follow:

Penfed Credit Union Announces Inaugural Auto Loan Securitization

Securitization leveraged to further strengthen credit union through reduced interest rate risk to balance sheet, increased liquidity and net worth

TYSONS, Va., Aug. 29, 2022 /PRNewswire/ — PenFed Credit Union, the nation’s second-largest federal credit union, today announced the closing of their inaugural prime auto loan securitization offering PenFed Auto Receivables Owner Trust 2022-A . The transaction issued $460,292,000 of fixed-rate, amortizing asset-backed notes backed by prime auto loans.

“PenFed is proud to announce our first auto loan securitization,” said PenFed Credit Union President/CEO and PenFed Foundation CEO James Schenck. “Entering the securitization market will reduce interest rate risk, increase liquidity and strengthen net worth.”

The securitization is a private placement offering, which in the United States is offered only to qualified institutional buyers under Rule 144A. The asset-backed notes were offered in four senior and three subordinate tranches of notes and rated by S& P and Fitch.

“PenFed is pleased that the auto loan securitization offering was very well received by the market,” PenFed Credit Union CFO and EVP, Jill Streit. “We plan to leverage securitization as a tool to further diversify liquidity and funding options, adding additional protections for PenFed members.”

J.P. Morgan Securities LLC acted as the structuring lead manager of the transaction and Wells Fargo Securities, LLC, acted as joint lead manager.

You May Like: How Much Home Equity Loan Can I Get Calculator

What Do You Need To Qualify For Penfed Credit Union Auto Loans

PenFed Credit Union Auto Loans does not have or does not disclose a minimum annual income eligibility requirement. PenFed Credit Union Auto Loans only considers borrowers who are employed.

The Military Lending Act prohibits lenders from charging service members more than 36% APR on credit extended to covered borrowers. Active duty service members and their covered dependents are eligible to apply for a loan via PenFed Credit Union Auto Loans. Their rates fall within the limits of The Military Lending Act.

U.S. citizens are, of course, eligible for the services offered by PenFed Credit Union Auto Loans. Permanent resident / green card holders are also eligible to apply.

To qualify, applicants may need to provide the following documentation:

- Government issued photo ID

Penfed Auto Loan Rates And Terms: At A Glance

- Loan amounts from $500

- Terms starting at 36 months

- FICO Score of 610 or higher preferred

PenFed offers auto loans on new and used cars, as well as the option to refinance a car loan from another lender. Rates and loan amounts are low, but if youre looking for a shorter term, youre out of luck all PenFed auto loans begin at 36 months. That may best suit new car buyers who are eligible for the starting APR above or even lower rates by using PenFeds car-buying service. Another option is a PenFed Payment Saver loan, but a balloon payment is required at the end of the loans term in exchange for lower monthly payments. Well break down each option, below.

While PenFed previously wrote loans on other vehicle types, such as RVs and motorcycles, it discontinued this option on Nov. 16, 2019 and now only issues loans for new and used autos, including trucks, SUVs, electric cars, sedans and hybrids.

Don’t Miss: How To Use Your Va Loan With Bad Credit

What Sets It Apart

Like other lenders, PenFed offers gap insurance and extended warranties. But there are two ways it stands out from the crowd.

PenFed car buying service

PenFed works with TrueCar to help you find a deal on your next car. You can search by model and ZIP code, and established members of PenFed can qualify for exclusive offers from top manufacturers.

And in addition to special deals, you may also qualify for discounted rates as low as 0.99% on new cars with 60-month terms.

Debt protection

PenFed offers comprehensive debt protection plans on all installment loans including auto loans in the case of death, disability or involuntary unemployment.

While this is an extra cost to your loan, it can help ease the debt burden on your or your family in a worst-case scenario. PenFed has three plans to choose from, and its entirely optional. Plus theres no commitment. If you decide to cancel debt protection, you wont have to continue paying for this service.

Not sold on PenFed or our top alternatives? You can compare current auto loan rates to help find your next loan.

What Apr Does Penfed Auto Loan Offer On Its Car Loans

PenFed auto loan offers a fixed apr car loan productthat ranges from 1.79% APR.

Your APR can vary depending on several factors, such as your credit score. Find out what your credit score is and whether there is any false or inaccurate information in your credit history with these credit monitoring tools.

Read Also: What Fha Loan Can I Afford

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Penfed May Be A Good Fit For Those Who:

-

Find a car to buy through PenFed’s online auto buying service. Purchasing a new or used car through the online service qualifies an applicant for reduced vehicle pricing and a rate discount. PenFed advertises rates as low as 0.99% for borrowers with excellent credit and a 36-month term.

-

Are looking for a lower loan amount minimum. PenFeds minimum loan amount requirement is among the lowest. It provides options for borrowers who may need a smaller loan to buy a used car or buy out their leased car.

-

Want the benefits of credit union membership. Getting an auto loan through PenFed requires opening a savings account there, which opens the door to using other credit union services. Borrowers can manage their loan along with other accounts through online banking and a mobile app.

You May Like: State Of The Union Student Loans

Pros And Cons Of Financing Through Penfed

Similar to many credit unions, PenFeds starting auto loan APRs are competitive, but its important to keep in mind that less-qualified borrowers may wind up with higher rates, as high as 17.99%, according to a company spokesperson. Its also important to remember that all credit unions require membership. Its always a good idea to explore your options for lenders before deciding to jump through that extra hoop of membership. A nice perk from PenFed is the ability to apply for an auto loan before signing up for a membership. Here are some other benefits and drawbacks:

Who Is Penfed Best For

If you prefer handling financial conversations in-person, PenFed can be a great source for you. With branches across the country, you can get a new or used car loan or an auto refinance loan with the help of a lending officer. And the car buying program offered via PenFed can be great for drivers who are unsure which vehicle is right for them and their budget.

But starting APRs that are higher than competing lenders means PenFed may not be ideal for borrowers with excellent credit who could find better deals elsewhere. And those high interest rates coupled with the wide range of repayment terms can be especially problematic. A longer repayment term results in more interest being paid over the life of the loan.

Recommended Reading: Can I Refinance My Car Loan With Wells Fargo

What Is The Maximum Auto Loan Term You Can Get With Penfed Auto Loan

PenFed auto loan has car loans with terms ranging from 36 to 84 months. Having the option of longer terms — terms can range up to144 months — allows borrowers to take on larger auto loan amounts while keeping monthly payments more affordable. However, the longer the term of your auto loan, the more interest you will pay.

Buying A Car Through Penfed

When borrowers use the PenFed Car Buying Service, they can get discounts on their loan rates. Discounts bring the APR to as low as 1.79% for 36 months and 17.99% for 84 months on new cars, while for used cars, rates are as low as 2.99% for 36 months and 17.99% for a 84-month term. PenFed says the service, which is in partnership with TrueCar, gives buyers an average of $3,350 savings off MSRP and offers special cashback offers from select car brands.

You May Like: Can You Get Fha Loan For Mobile Home

How To Bank With Penfed Credit Union

If youd like to bank with PenFed Credit Union, becoming a member is simple. Now that it has opened its charter, membership is available to any American or permanent resident who wishes to open an account nationwide.

You can open an account online or by visiting one of the PenFed Credit Union branches. The online-only savings account can only be opened online.

Membership with PenFed Credit Union used to be limited to people who have close ties to the military and the federal government. Since it opened its charter to allow more people to join, its attractive products and services are now available to every American nationwide. PenFed Credit Union offers competitive rates and fees on its checking, online savings, and money market certificates. It offers a full suite of deposit and lending products and services that are comparable to larger banks. As long as you dont need a physical branch nearby, you can perform all of your banking needs online, through its app, or on its partner network of ATMs.

Securitization Leveraged To Further Strengthen Credit Union Through Reduced Interest Rate Risk To Balance Sheet Increased Liquidity And Net Worth

TYSONS, Va., Aug. 29, 2022 /PRNewswire/ — PenFed Credit Union, the nation’s second-largest federal credit union, today announced the closing of their inaugural prime auto loan securitization offering PenFed Auto Receivables Owner Trust 2022-A . The transaction issued $460,292,000 of fixed-rate, amortizing asset-backed notes backed by prime auto loans.

“PenFed is proud to announce our first auto loan securitization,” said PenFed Credit Union President/CEO and PenFed Foundation CEO James Schenck. “Entering the securitization market will reduce interest rate risk, increase liquidity and strengthen net worth.”

The securitization is a private placement offering, which in the United States is offered only to qualified institutional buyers under Rule 144A. The asset-backed notes were offered in four senior and three subordinate tranches of notes and rated by S& P and Fitch.

“PenFed is pleased that the auto loan securitization offering was very well received by the market,” PenFed Credit Union CFO and EVP, Jill Streit. “We plan to leverage securitization as a tool to further diversify liquidity and funding options, adding additional protections for PenFed members.”

PenFed has the second-largest consumer loan portfolio among all credit unions across auto, personal, student, consumer loans and credit cards. PenFed also possesses one of the largest auto loan portfolios among federal credit unions, with originations across all 50 states and Puerto Rico.

About PenFed Credit Union

Don’t Miss: How To Shop For Home Mortgage Loan