Calculating The Va Entitlement Amount

If you have full entitlement, you dont have a loan limit, so you dont need to worry about calculating how much entitlement you have. You can borrow as much as a lender will give you with no down payment.

If you have reduced entitlement and want to know how much you have left, youll need to figure out how much of it youre currently using.

Remember that the VA guarantees up to 25% of your loan. To find out how much of your entitlement youve used, simply multiply your loan amount by 0.25.

Loan amount × 0.25 = entitlement youve already used

Youll also need to determine your countys conforming loan limit. In 2021, the baseline conforming loan limit is $548,250. In high-cost areas, it may be higher than this.

The maximum entitlement is equal to 25% of the conforming loan limit for your county.

County conforming loan limit × 0.25 = maximum entitlement

However, if you have a reduced entitlement, you likely wont be able to borrow up to the maximum with no down payment. You can determine your remaining entitlement by subtracting the entitlement youve already used from the maximum entitlement amount.

Maximum entitlement entitlement youve already used = remaining entitlement

Your remaining entitlement is the maximum amount the VA will guarantee on your loan. Since the VA guarantees 25% of the loan, you can multiply your remaining entitlement by 4 to see the maximum amount you can borrow without having to make a down payment.

Applying For A Va Loan

Applying for a VA loan is different from applying for a conventional mortgage, and this affects the home-buying process.

The VA recommends working with a real estate agent whos familiar with VA loans and getting prequalified with a lender before making an offer.

There are a number of steps to applying for a VA loan, including

- Obtaining a certificate of eligibility, which verifies to the lender that you meet minimum eligibility requirements.

- Comparing offers from different VA lenders to find the best interest rate and most affordable fees for you.

- Submitting a loan application and providing financial information, including pay stubs and bank statements.

- Obtaining a VA appraisal, which is ordered by the lender.

Your credit information, income and the value of the home will be reviewed, and then the lender will either approve or deny your loan. Make sure your purchase agreement has a clause called a VA option clause, which allows you to avoid financial penalties if the home doesnt appraise high enough.

When your loan is approved, the lender will choose a representative to conduct a closing, during which the money can be released and the property transferred to you.

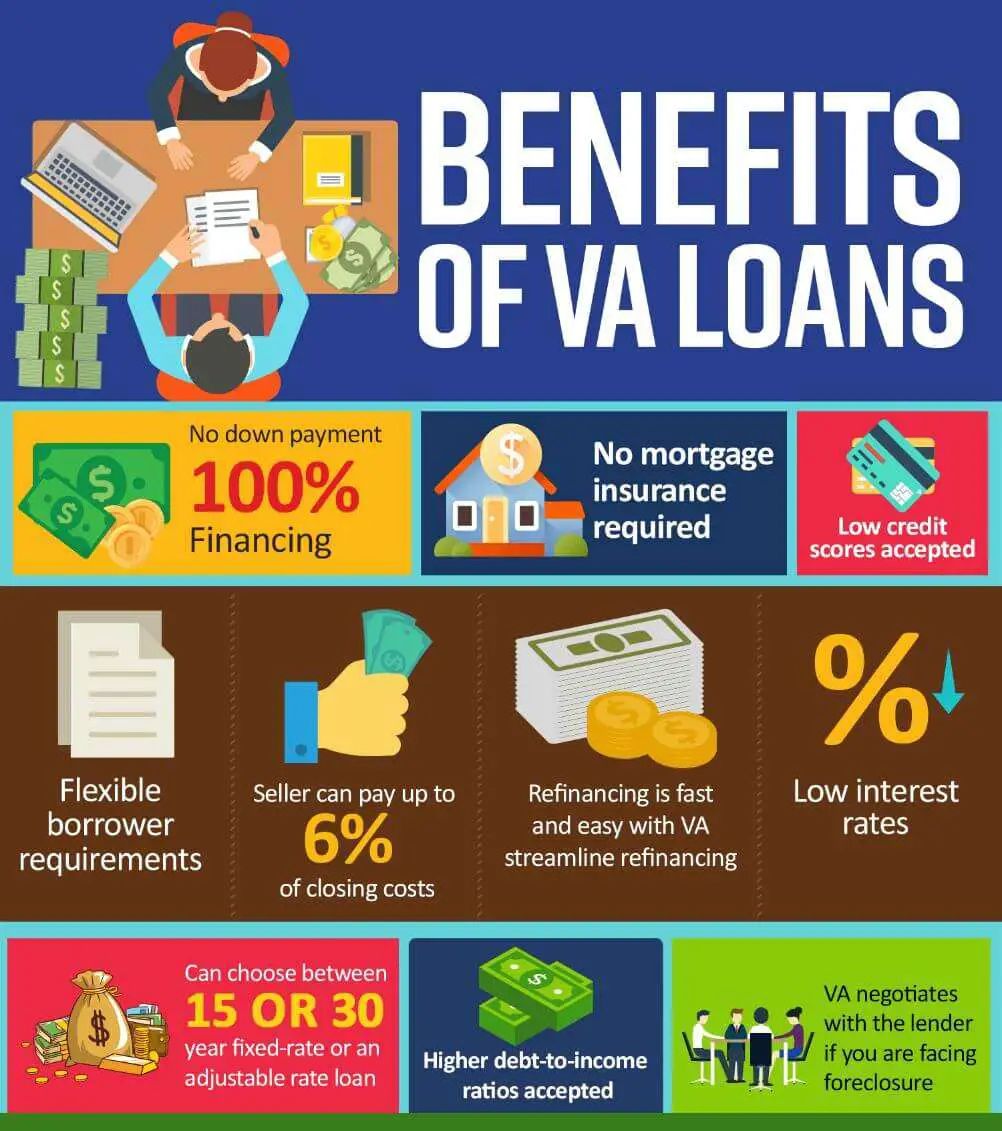

How Does A Va Loan Work

On the surface, a VA loan works like any other home loan program. You fill out a loan application, provide proof you can repay the loan based on your earnings and credit history and verify you have enough money saved up to cover closing costs.

However, there are some big differences between VA loans and conventional or FHA loans, especially when it comes to how costs and fees are charged and paid.

You have to verify your military service history. The VA home loan benefit is only for military borrowers that have served enough time to meet eligibility requirements.

You dont pay any mortgage insurance. Most low- or no-down-payment loan programs require mortgage insurance, which covers lenders in case you default on your payments and they have to foreclose. The VA doesnt require mortgage insurance on any of its loan types.

Youll pay a VA funding fee. One of the downsides to a VA loan is having to pay the VA funding fee cost of 0.5% to 3.6%. The funding fee is charged to offset the cost of the VA loan program to taxpayers and is typically rolled on top of the loan amount, even if you make no down payment.

Your lender cant charge you more than 1% in closing costs. VA lenders are limited to charging 1% of your loan to cover their fee. That saves you money at closing and makes VA closing costs more affordable than other government-backed loan programs.

Don’t Miss: Bayview Loan Servicing Dallas Tx

How To Determine Eligibility For A Va Loan

When you begin your homebuying journey, youre going to deal with some pretty large numbers. For many Veterans, those numbers can be a bit intimidating.

Talking to a VA lender about your home loan affordability is always a smart first step during the homebuying process. However, powerful tools exist that eliminate the fear of purchasing a home you cant afford, and doing so will give you a realistic idea of how much VA home loan you can afford.

To help you qualify for a mortgage that meets your personal and financial needs, input your information to determine how much home you can afford using this simple VA loan affordability calculator.

Eligibility Requirements For Va Home Loan Programs

Learn about VA home loan eligibility requirements for a VA direct or VA-backed loan. Find out how to apply for a Certificate of Eligibility to show your lender that you qualify based on your service history and duty status. Keep in mind that for a VA-backed home loan, youll also need to meet your lenders credit and income loan requirements to receive financing.

You May Like: What Happens If You Default On A Sba Loan

How Long Have Va Loans Been Around

The VA Home Loan Guaranty program was initially part of the Servicemans Readjustment Act of 1944, also known as the GI Bill of Rights. It was part of a national effort to avoid the economic recession historically associated with postwar periods and transition from the wartime economy of World War II to a peacetime economy, according to the Veterans Benefits Administration.

The programs objective is to help not only veterans but surviving spouses, active-duty personnel, and members of the Reserves and National Guard purchase, retain, and adapt homes in recognition of their service. Recipients also can use VA loans to refinance existing home loans and improve a home by installing energy conservation measures such as solar heating.

Next: See How Much You Can Borrow

You’ve estimated your affordability, now get pre-qualified by a lender to find out just how much you can borrow.

-

What will your new home cost? Estimate your monthly mortgage payment with our easy-to-use mortgage calculator.

- Award Ribbon

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Pig Refinance calculator

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

You May Like: Rv Loan Rates Usaa

Va Loan: How Much Can I Afford

VA loans provide eligible borrowers an outstanding mortgage option. With its zero-down nature, the loan program offers an affordable path to homeownership. But, as with any mortgage, borrowers need to measure home prices against their personal financial situation. As such, well use this article to answer the question: with a VA loan, how much can I afford?

Specifically, well discuss the following:

- VA Loan Overview

- Factors Affecting How Much VA Loan You Can Afford

- Additional VA Loan Affordability Considerations

- Final Thoughts

The VA Home Loan offers $0 Down with no PMI. Find out if youre eligible for this powerful home buying benefit. Prequalify today!

How Much Down Payment Should You Save

Before buying a house, be sure to give yourself enough time to save for a down payment. While the amount depends on your budget, the homes price, and the type of loan you have, most financial advisers recommend saving for a 20% down payment. This is a sizeable amount, which is more expensive if your homes value is higher.

In September 2020, the median sales price for new homes sold was $326,800 based on data from the U.S. Census Bureau. If this is the value of your home, you must save a down payment worth $65,360. Paying 20% down lowers risk for lenders. Its a sign that you can consistently save funds and reliably pay back your debts.

Down Payments Vary

Down payment requirements are different per type of loan. However, many conventional mortgage lenders require at least 5% down. For government-backed loans such as an FHA loan, a borrower with a credit score of 580 can make a down payment as low as 3.5% on their loan. Take note: A smaller down payment subjects you to a higher interest rate.

Nonetheless, its still worth making a larger down payment on your mortgage. Heres why paying 20% down is more beneficial for homebuyers.

Read Also: Mortgage Loan Signing Agent

The Bottom Line: Entitlement Helps You Understand How Much You Can Borrow With Zero Down

Your VA loan entitlement amount tells you how much of your loan the VA will guarantee.

If youre a first-time VA borrower or youve paid off a previous VA loan and sold the property you used the loan to purchase, you should have full entitlement, which means that the VA will guarantee up to 25% of your loan, with no loan limit.

If you have entitlement tied up in another loan, your entitlement amount will be limited by your countys loan limit and how much of your entitlement has already been used. If you want to borrow beyond this, youll need to bring a down payment to the closing table.

No matter how much entitlement you have available, youll ultimately only be able to borrow as much as a lender is willing to give you. Plus, you want to ensure youre getting a loan your budget can comfortably handle. Rocket Mortgage® has a few different tools you can use to get an idea of how much you can afford.

Ready to start the home buying process? You can apply online with Rocket Mortgage.

Get approved to refinance.

How Much Entitlement Does The Va Provide

Entitlement can be confusing for even the most experienced mortgage professionals. But it really just involves a bit of math. In most areas of the country, basic entitlement is $36,000. Additionally, secondary entitlement is $70,025. Adding those together gives you a total of $106,024 for eligible veterans. In higher cost areas, it may be even more.Additionally, the VA insures a quarter of the loan amount for loans over $144,000. Therefore, you can multiply that entitlement amount, $106,024, by four for a maximum loan amount of $424,100. Thats the total amount qualified buyers could borrow before having to factor in a down payment.

Don’t Miss: Sss Loan Requirements

Do Lenders Count Military Income

Lenders can count VA disability income and certain military allowances to determine how much you can borrow with a VA loan. Active duty service members receiving Basic Allowance for Housing can use this income to pay for part or even all of their monthly mortgage payment.

Other types of military allowances that can count as effective income include: flight pay, hazard pay, imminent danger pay and more. Lenders can also count National Guard and Reserve income.

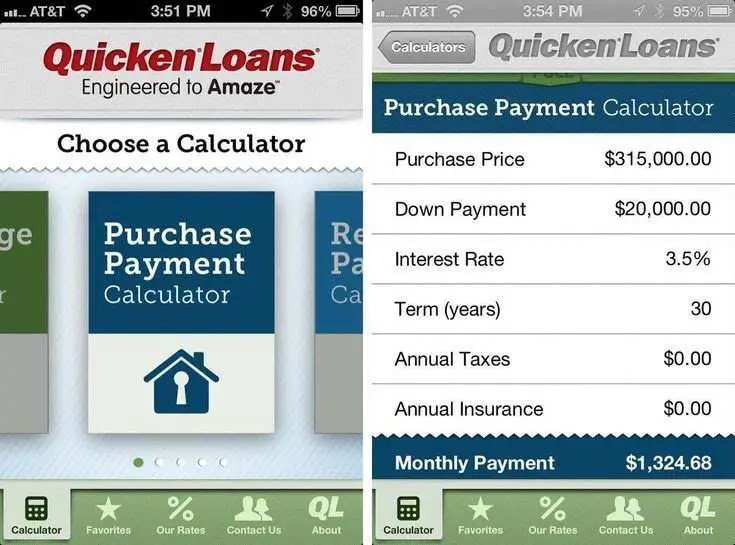

Using The Mortgage Qualifying Calculator

The Mortgage Qualifying Calculator is designed to be easy to use and largely self-explanatory. Just fill in the various fields with the information requested. Start by choosing if you want to base the calculation on your annual income, the purchase price of the home you’re looking at or the monthly payment you can afford. Then work down the page entering your other information and the calculator will figure out the other two values for you and display them in gray.

For example:

- Enter your annual income and the Mortgage Qualifying Calculator will determine the maximum purchase price you can afford and the associated monthly payment.

- Enter the purchase price and the calculator will tell you the income you need and the monthly payment required. Or,

- Enter the monthly payment you’re thinking of and the Mortgage Qualifying Calculator will tell you the income needed to qualify and the home purchase price that will cover.

Then go down the rest of the page entering the information requested. Your answers will be displayed in gray at the top of the page. Click “View report” for a detailed breakdown and an amortization report.

Recommended Reading: Usaa Auto Loan Approval

How Much Mortgage Can I Qualify For

Lenders have apre-qualification processthat takes your finances into account to determine how much they are willing to lend you. Once the lender has completed a preliminary review, they generally provide a pre-qualification letter that states how much mortgage you qualify for. Get pre-qualified by a lender toconfirm your affordability.

Understanding Va Loan Closing Costs

Closing costs to finalize your loan can total thousands of dollars and can be a barrier to home ownership for buyers without significant savings, but VA loans allow sellers to pay up to 4% of the purchase price as a contribution to the buyers closing costs. By contrast, conventional loans allow sellers to pay up to 3% when the buyers down payment is less than 10%, and up to 6% when the buyers down payment is 10% to 25%.

If thats not an option, consider rolling the costs into your loan. Financing your closing costs is more expensive, but doing so can make you a homeowner sooner.

All mortgages have closing costs, including VA mortgages. But youll pay an additional closing cost with a VA home loan that other loans dont charge: the VA funding fee.

Don’t Miss: How Far Back Do Underwriters Look At Bank Statements

How Much House Can I Afford With A Va Loan

Veterans and active military may qualify for a VA loan, if certain criteria is met. While VA loans require a single upfront funding fee as part of the closing costs, the loan program offers attractive and flexibleloan benefits, such as noprivate mortgage insurance premiums and no down payment requirements. VA loan benefits are what make house affordability possible for those who might otherwise not be able to afford a mortgage.

With VA loans, your monthly mortgage payment and recurring monthly debt combined should not exceed 41%. So if you make $3,000 a month , you can afford a house with monthly payments around $1,230 .

Use ourVA home loan calculatorto estimate how expensive of a house you can afford.

What Is The Mortgage Qualifying Calculator +

Our mortgage qualifying calculator was designed to help you determine how much you can borrow, how much income you need to qualify for your desired mortgage, and what your total monthly payment will be for the loan. The calculator uses information such as your mortgage rate, down payment, loan term, closing costs, property taxes, as well as homeowners insurance.

Determining the monthly mortgage payment that you qualify for is similar to determining the maximum mortgage loan you can afford. All you have to do is enter the value of your annual income and the length of your loan on the mortgage qualifying calculator, and it will display the monthly payment you should expect.

Yes, it is absolutely possible for you to get a mortgage on 20k a year. Assuming a loan term of 20 years with an interest rate of 4.5%, you would qualify for a mortgage that is worth $66,396, and a monthly payment of $467. Head on over to our mortgage qualifying calculator to find out what those amounts will be with different interest rates and loan terms.

With a total monthly payment of $500 every month for a loan term of 20 years and an interest rate of 4%, you can get a mortgage worth $72,553. Of course, this value might vary slightly, depending on the percentages of property tax and home insurance.

Recommended Reading: Capital One Auto Loan Private Seller

If You Have To Do A Hard Pull Mix It Up

Having a different mixture of credit will also help you in obtaining a higher credit score.

Loans, credit cards, lines of credit, home loans and auto loans are all seen as different types of credit and having a good mixture will aid in helping your score.

If you are going to have a few hard hits on your credit, make them worth it.

Hopefully these few tips will help you with increasing your score in the immediate future.

Estimate How Much House You Can Afford

To help you get started, you can use our calculator on top to estimate the home price, closing costs, and monthly mortgage payments you can afford based on your annual income. For our example, lets suppose you have an annual income of $68,000. Youre looking to get a 30-year fixed-rate loan at 3.25% APR. For your down payment and closing costs, youve saved $55,000. See the results below.

- Annual income: $68,000

| Total Monthly Mortgage Payment | $1,587 |

Based on the table, if you have an annual income of $68,000, you can purchase a house worth $305,193. You may qualify for a loan amount of $252,720, and your total monthly mortgage payment will be $1,587. Since your cash on hand is $55,000, thats less than 20% of the homes price. This means you have to pay for private mortgage insurance . Take note: This is just a rough estimate. The actual loan amount you may qualify for may be lower or higher, depending on your lenders evaluation.

The following table breaks down your total monthly mortgage payments:

| Monthly Payment Breakdown | |

|---|---|

| Total Monthly Mortgage Payment | $1,587 |

According to the table, your principal and interest payment is $1,099.85. When we add property taxes and home insurance, your total monthly mortgage payment will be $1,481.34. But because you must pay PMI, it adds $105.30 to your monthly payment, which results in a total of $1,587 every month.

Also Check: My Car Loan Is Not On My Credit Report