If You Need A Bad Credit Auto Loan You Have Alternatives

You have several car financing alternatives even if youve had credit problems. These include private party auto loans for bad credit, but you can also turn to online networks and other funding sources.

Selling cars makes money for manufacturers, financial institutions, and vehicle owners, so you will probably find at least one lender to finance a purchase.

Weve identified two online providers of private party vehicle loans for you to consider. You can also check out your local bank or credit union. Dealers do not have a monopoly on used car sales, but always be cautious when buying from the cars owner its riskier than purchasing a vehicle from a dealers lot.

Sell Your Car To A Used

You can sell your car to some used car dealers without having to make a purchase. You could do this if youâre not ready to buy a new car but you want to get rid of your old car. Before you offer to sell your car to a dealer, look up your carâs value and get it ready for sale by cleaning it and fixing any small maintenance issues. The dealerâs offer will be based on your vehicleâs condition and the auction price of similar vehicles. Like with a trade-in, you probably wonât get as much for the car as you would in a private sale.

Having a loan on the car probably wonât impact the car dealerâs offer, but it will slow down the process since the dealer will have to wait to get the title from your lender. After the dealer gets the title, theyâll write you a check for whateverâs left over after the loan payoff.

Private Seller Pros And Cons

Buying a used car from a private party can have some valuable benefits compared with buying from a dealership. It might be the only way to get the exact car you want, especially if you’re looking for a unique, discontinued or hard-to-find model. Individuals may be less likely to mark up the purchase price than a dealership would often, car owners simply want to get rid of the vehicle. Finally, dealing with an individual can give you more leeway to haggle over the price of the car.

Unlike a dealership, however, a private seller won’t have a finance department on hand to offer you a loan. Since a private seller must get paid in full before you take possession of the car, you’ll need to do some legwork on your own to find financing.

Also Check: Sample Letter To Remove Student Loan From Credit Report

How To Sell A Car With Positive Equity

If you have positive equity in your vehicle, it will be easier to sell than if youâre upside-down on your loan. Again, having positive equity means that your car is worth more than what you owe on the loan. So if your car is valued at $10,000 and you owe $8,000 on the loan, you have $2,000 in positive equity. With positive equity, you have several selling options.

How To Sell A Financed Car

Once youâve decided to sell your financed vehicle, the first and most important step is to contact your loan servicer. If youâre trying to sell your car because you canât afford the car payment anymore, ask the lender if they can adjust the terms of your loan contract to make your payment more affordable. Refinancing may also be an option. When you refinance, you take out a new loan to pay off the old loan. Refinancing may help you lower your interest rate or your monthly payment.

If you donât want to change the loan and you just want to sell the car, youâll still want to contact the loan servicer to ask how to properly transfer ownership. Your loan servicer will tell you exactly how to handle the sale, what the payoff amount is and how to pay it, and whether youâll be charged a prepayment penalty for paying off the loan early.

If your lender is a local bank, you may be able to bring the bill of sale to the bank to sign the transfer paperwork over to the buyer directly in person. An online loan servicer might direct you to one of the bankâs affiliates or another financial institution or it may require you to fully pay off the loan before it releases the title.

Read Also: Quick Loans With Bad Credit

Who Offers Private Party Loan

Bank of America, First Credit Union, and LightStream are just a few of the financial organizations that offer private party auto loans. However, not every lender does. Capital One, Wells Fargo, and Chase only lend to car dealerships.

Check to see if the lender you want to work with provides private party auto loans and if there are any limits. Lenders may impose age and mileage restrictions, as well as a minimum loan amount.

What Does A Private Party Auto Loan Mean

A private party auto loan allows you to finance a vehicle that was sold by the owner rather than a dealer. It is similar to other types of auto loans. You use the loan funds to buy the car, and then make monthly payments to pay off the loan. If you default on the loan, the lender has the right to repossess your car.

This could save you money if you are purchasing a used vehicle from a private party. When compared to official dealerships, private sellers typically provide more affordable costs. In contrast, no non-governmental organizations provide funding. This is when a car loan from a private party comes in handy.

Private-party financing provides the convenience of dealer financing at the cost savings of a private sale. But it has got a catch though. They come with high-interest rates and you cant get one easily if you are purchasing a new vehicle.

Also Check: Can Your Business Loan You Money

Lease Buyout Explained: Should You Buy Your Leased Car

When the end of an auto lease period comes up, it’s not always a given that you need to trade your wheels in for something new. While there are advantages to trading in your car, there may be benefits to buying your leased car.

4 min read

Buying your first car can be intimidating. Our guide can help you understand what financing options are available and how apply for a loan.

9 min read

Apply For And Close Your Loan

When youve found the car you want and youre ready to apply for a loan, come prepared with the information and documentation you may be asked to provide:

- Your full name, date of birth, address and Social Security number

- Employment and income details

- A copy of the vehicle registration

- A copy of the front and back of the vehicle title

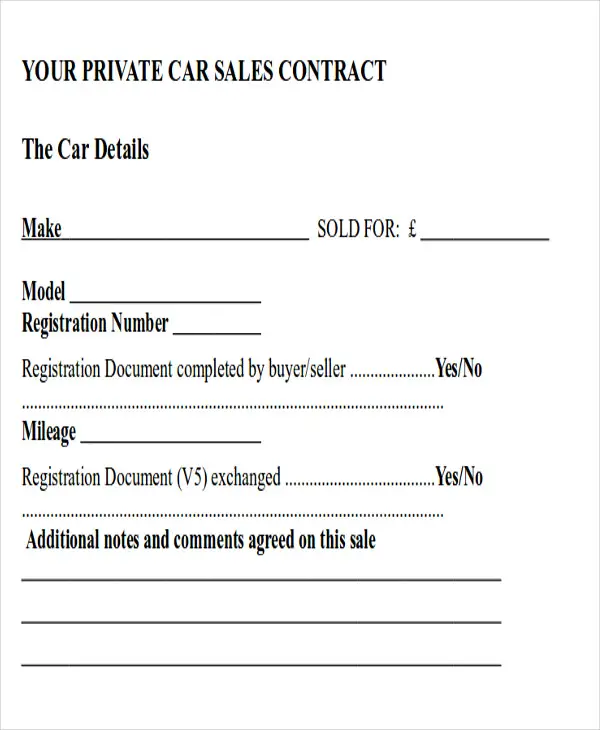

- A bill of sale with details about the agreed-upon purchase

- A written 10-day payoff quote from the sellers lender

If youre approved, youll get the final details on the loan and youll be ready to close. The lender will make out checks to the seller and/or lienholder and you can hand them over. Youll still need to transfer the title and registration into your name and place your lender as lienholder on the title you may want to check with your local Department of Motor Vehicles for the details.

A private party auto loan can give you the flexibility to buy the car you want directly from an owner in a way that best fits your budget.

You may also like

Don’t Miss: Which Student Loan Has No Interest

Can You Sell A Car With An Existing Loan

Itâs possible to sell your car when you still owe money on it, but youâll need to deal with the lenderâs legal claim on the car first. When you have a loan on a car, your lender is a lienholder with a legal interest in your vehicle. They may appear on your carâs title or may even hold your title so you canât sell the vehicle to a buyer without first paying off the loan or addressing the lien. The easiest way to deal with the lenderâs claim is to pay off the auto loan. This will simplify the sale process a lot.

To pay off your auto loan balance, you could get an unsecured personal loan, take a loan from your retirement account, use a tax refund, or borrow money from friends or family. Each of these options has its pros and cons. For example, a personal loan will probably have higher interest than your auto loan, but it may be easy to get if your payoff amount is small.

If you canât find the money to pay off the loan, you still have a few options. You may be able to have the buyer take over the loan or you may be able to roll the amount you still owe on the loan into a new car loan if you trade in at a dealership.

Pay Attention To The Vehicle History Report

Once you’ve found the car you want to buy, you’ll want to take a look at its vehicle history report, also known as a vehicle identification number report. You can get some basic information with a free VIN check:

- Safercar.gov to see if there have been any recalls on the model and whether the specific car has been repaired or upgraded.

- National Insurance Crime Bureau to check if the vehicle was reported stolen and not recovered, or if it has a salvage title.

A paid VIN report will give you more details about the vehicle you’re looking at. You can learn about its service history, ownership history and whether it’s ever been in an accident or stolen. AutoCheck and Carfax are two popular VIN report providers. Compare the report to the seller’s description and look for discrepancies that may be a red flag.

If you’re serious about buying the car, you’ll also want to take a test drive and potentially have a mechanic do a pre-purchase inspection. You’ll likely have to pay for the inspection, which may run around $100 to $200, but it’s often a worthwhile investment as trusted mechanics and technicians can give you the all-clearor warn you about needed repairs or maintenance.

There are mobile inspection services that will come to you, or you can look for a local shop. Working with someone who specializes in the particular type of car could be a good idea, as they can also tell you about common issues that owners experience.

Read Also: Does Student Loan Consolidation Lower Payments

Banks And Credit Unions

Banks dont typically offer bad credit auto financing, although some have more liberal lending policies and offer private party car loan financing. They are not the best places to seek auto loans if you have a bad credit score.

Your best bet may be to try an online bank, as they can sometimes offer a lower interest rate because they dont have the overhead operating expenses that brick-and-mortar banks do.

The typical is friendlier than the average bank, mainly because its customers are also its owners. If you already belong to a credit union, it may provide the best auto loan offer youll find anywhere.

Many credit unions limit membership, but a few national ones are open to anyone. Credit unions are also good places to get life insurance, a credit card, and short- and long-term personal loans.

Bottom Line On Private Party Auto Loans

Private party auto loans arent as easy to find as standard used car loans. But buying a car from a private seller can have advantages that might make the extra effort worth it.

As with any loan, the keys to finding the best rates are having a good understanding of your financial situation and comparing offers from lenders.

Recommended Reading: Bb& t Home Equity Loan

Watch Out For Private Seller Scams

You may be excited to buy a new car while avoiding a dealership, but you also want to watch out for scams. Scams can take different forms, but some common ones to watch out for include:

- Title washing: Even if it can run right now, you may want to avoid a car that has had significant damage that resulted in a salvage title. Sellers may try to “wash” the title by registering it in a new state. A VIN report can help reveal the car’s true history.

- Curbstoning: Curbstoning refers to when a dealership pretends to be a private party selling a car, and it’s illegal in many states. The seller may be offloading vehicles that have liens, bad titles or aren’t safe to drive.

- Fake escrow accounts: A seller might not let you see the vehicle and tell you there’s a lot of demand or they’re in a rush to sell. They’ll then ask you to send the money to a third-party escrow account to “place a hold” on the car or purchase it for delivery. In reality, however, they control the account and simply take your money once the transfer is complete.

- Fake guarantees: Sellers may also try to push a deal forward by telling you that there’s a guarantee from whichever payment platform you use, which might not actually be the case. Some platforms do offer a level of protection, so make sure you understand your rights as a consumer before you agree to anything.

In general, it’s best to avoid:

Buying A Used Car From A Private Party

A lot of people like to buy used cars from private sellers instead of going to a dealership. That’s because there are some opportunities to save money and even save time.

We make the process even easier for our members, by offering private party Used Car Loans at the same rate as New Car Loans*, handling DMV transfer for the member, and mailing the sticker and registration number.

For a list of everything you need to complete a private party transfer,

Things to Know About Buying From a Private Party

There can be some risks involved with private party transactions. Here are some things you should know and do before, during, and after buying a used car.

Ask questions

Don’t be nervous about asking the seller questions. You should try to know everything about the car you’re thinking about buying.

Ask them why they’re selling the car, has it been in an accident, how many owners the car has had, who’s been driving the car, and what it was used for.

If the seller doesn’t want to answer the questions, or can’t answer the questions, this is a red flag, and you might want to look somewhere else.

Take the car for a test drive

First, walk around and check the exterior of the car. Look for wear and tear, indications of repairs. Look at the tires. Is the tread uneven? Do they need to be rotated or replaced?

Get a mechanic you trust to inspect the vehicle

Ask the seller to bring the vehicle to a mechanic that you trust. Do not take it to one they recommend or know personally.

You May Like: How Much Va Loan Can I Get

What Does A Private Party Auto Lender Do

A private party auto lender helps individuals purchase used cars from each other. Not only do they provide financing, but they can also help the transaction go smoothly.

For example, if the seller is still paying off the loan on their vehicle, the buyerâs private party auto lender will ask for the sellerâs lender statement showing the payoff amount and payoff authorization. Your private party auto lender will then send funds directly to the lender to pay off the loan so the carâs title can be transferred. Theyâll also send the seller any proceeds beyond whatâs required to pay off the loan.

Some private party lenders also handle the ownership transfer paperwork with the DMV so you donât have to. But youâll still need to find out the carâs history before you buy it and find the best car insurance as soon as possible.

Find A Car And Compare Offers

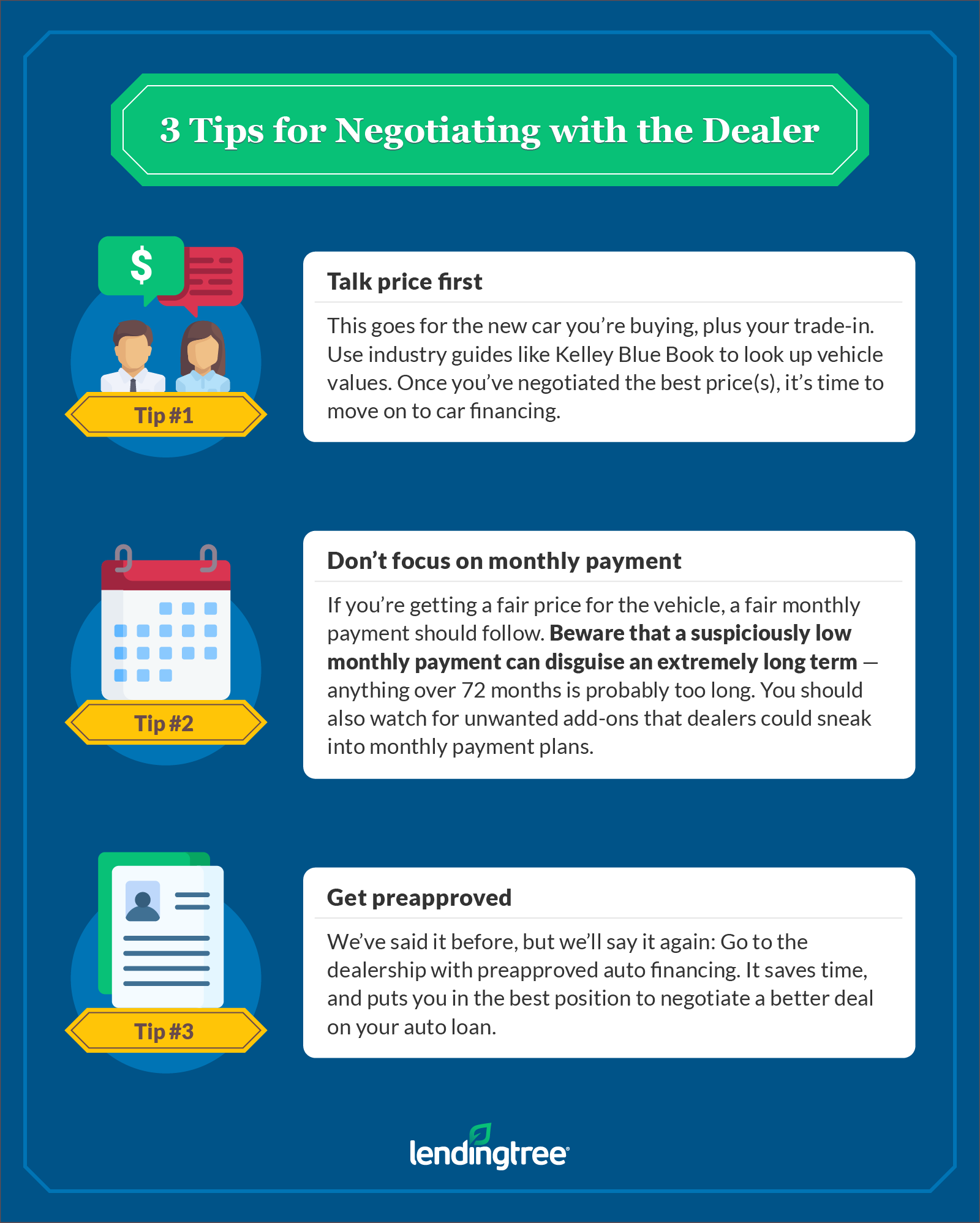

With your budget firmly in place, start the car search. Once you decide on a car and negotiate the price, apply to a few lenders. Youll need the following information:

- The cars vehicle identification number and mileage.

- Your name, address, Social Security number , contact details, employment information and income.

- How long you want the loan to be and how much you want to borrow.

Private party auto loan rates tend to have higher rates than vehicles bought from a dealership because lenders consider it riskier to buy from an individual than a business. Shop around for the best rates, as the three main credit bureaus allow all hard pulls related to the same type of loan to count as one hard pull within a 14-day window.

Also Check: Where Can I Get An Fha Loan

Find Out If You Are Eligible

Lenders often have certain requirements for both the borrowers and the cars that will secure the loan. The criteria may include minimums for your credit score, income and upfront payment. The lender may also set a limit on the age and mileage of the car or require a floor on the price. Usually, you can go online, call lenders or even walk into a financial center to get information about eligibility. Locate a Bank of America financial center near you

Loan Options To Avoid

When considering how to finance your used car purchase, steer clear of the following high-risk loans.

- : Some credit cards let you borrow cash at ATMs and pay it back later. But credit card companies usually charge higher interest rates on cash advances than on purchases, making this a costly way to pay for your new ride.

- Payday loans: These loans may seem appealing because they don’t require credit checks, but generally must be repaid or renewed in a few weeks. With APRs upwards of 400%, payday loans can lead to a cycle of debt that’s difficult to escape.

- Home equity loan or home equity line of credit : Both types of loans use the equity in your home as collateral. If you can’t repay the loan, the lender could foreclose on your house. That’s a big risk to take to get a used car.

Don’t Miss: How To Find Your Student Loan Debt