About International Student Loans

Typically students can borrow up to their school’s total cost of attendance, as determined by the school, minus any other aid received. Total cost of attendance includes tuition, room and board, books and supplies, personal expenses, and transportation.

International student loans typically also offer:

- No collateral required

Start your application today

More Shocking Student Loan Debt Statistics

If those numbers werent stunning enough, heres a closer look at how students accumulate debt based on the type of school they attend:

- 55% of bachelors degree recipients graduating from four-year public and private nonprofit colleges in 2020 had student loan debt.

- The average debt at graduation from four-year public and private nonprofit colleges was $28,400 in 2020, a $400 decrease from 2019.

- 66% of graduates from public colleges had loans , according to 2016 data from an April 2019 report the latest available.

- 68% of graduates from private, nonprofit colleges had loans in 2016 .

- 83% of graduates from for-profit colleges had loans in 2016 .

- Students and parents borrowed an estimated $95.9 billion in the 2020-2021 academic year, and 13% of that were private and other nonfederal loans.

- 48% of borrowers who attended for-profit colleges default within 12 years, compared with 12% of public college attendees and 14% of nonprofit college attendees.

The Pause In Payments Will Lift No Matter What

The Administration has already stated that the moratorium on federal student loan payments will resume 60 days after litigation concludes or debt relief has been implemented, said Laurel Taylor, CEO and founder of Candidly. That means that if the Supreme Court rules against the administration, we can expect the payment freeze to end shortly thereafter without borrowers receiving the forgiveness that had been previously offered in the presidents plan. This could have devastating consequences for the morale of student loan borrowers, many of whom havent made a payment in three years and have reallocated the average monthly student loan payment of $393 to other life expenses and are counting on $10k-$20k of forgiveness to eliminate or lower their monthly payment due to re-amortization of the remaining balance.

You May Like: Direct Deposit Loans In Minutes No Credit Check

How Are Student Loans Repaid

Slowly or in many cases, not at all. A sizable chunk of student loans are in limbo or totally abandoned.

- 2.9 million borrowers are currently deferring their federal student loans. In this instance, deferment means that interest doesnt accrue.

- 24.8 million borrowers currently have federal student loans in forbearance. Interest is still piling up for them.

- An astounding 5 million borrowers have their federal student loans in default. That means that 10% of all people with student loans havent made student loan payments on their debt in more than 9 months.

- Students that left college before completing their degree are more than twice as likely to eventually default on their loans compared to students that graduated.

- More than half of all defaulted debts are on loans that amount to less than $10,000.

Unable To Repay Student Loans

If you cant pay the full amount due on time or have to miss a student loan payment, your loan may be considered delinquent and you may be charged late fees. Contact your loan servicer immediately for help, and ask them about your options.

Learn the latest about the Student Debt Relief Plan, which courts have blocked. The plan would cancel up to $20,000 of student loan debt for Pell Grant recipients and up to $10,000 for other borrowers.

Learn about the new extension to the COVID-19 emergency relief pause in federal student loan repayments. Payments will restart sometime in 2023. The exact date depends on other events.

Don’t Miss: Best Low Interest Personal Loans

Which Schools Make The Eligible List

We use a proprietary algorithm to continuously evaluate all accredited colleges and universities in the U.S. and Canada on factors like graduation rate, employment rate, and alumni earnings.

If you dont see a specific school, you can compare your eligibility for other student loans for international students here.

Summary Of Student Loans In The United States: Facts And Rulings

Date: December 22, 2015 | Category: AMJA Bridge

This is an important issue to discuss because the cost of a college education is increasing and the need for a college education is something agreed upon by all intelligent people. Therefore, one must ask: What is the default ruling concerning student loans? What is the ruling if there is no viable alternative to a student loan for a persons education? If it is permissible, is it permissible in order to obtain a higher degree or one must one discontinue such loans after completing the degree that one absolutely needs?

General Statistics

Muslims number about 6 to 7 million in the United States. By 2014, the number will increase to 16 million. 65% of those Muslims are under the age of 40, with 1.5 million being at least eighteen years old. These statistics show that the question of student loans is relevant to at least one million Muslims. This number increases to over 4 million if we include all under the age of forty. This makes it clear that this issue touches or will touch a large number of Muslims this it is not a rare occurrence or an individual problem that requires a ruling for an individual alone.

The Demand for Loans

The Costs of Education

Read Also: How To Find My Sba Ppp Loan Number

Compare Loans And Lenders

All loans are not created equal so we developed an easy to use comparison tool to help users find the option that works best for their situation. After you select your citizenship and school, the tool returns a list of lenders that will work for you. Compare the different terms and conditions, choose the lender that works best for you, and apply online.

Perkins Loan Cancellation For Teachers

The Perkins Loan Cancellation for Teachers program forgives up to 100% of the federal Perkins loan. However, you need to be a full-time teacher at a school considered low-income, or you need to teach specific subjects.

Heres what you need to know about the Perkins Loan Cancellation for Teachers program:

- Suppose you have Perkins loans, then this program is designed to forgive your Federal Perkins loans.

- Up to a hundred percent of the loan could be canceled for service as a teacher in the following increments:

- Please note that every amount canceled annually is inclusive of the interest accrued for that specific year.

- Check the studentaid.gov database online for the number of years youve been working as a teacher to find out if the school is classified as a low-income school.

- You may qualify if you teach science, mathematics, foreign languages, special education, and bilingual education, even if you dont teach at a school considered low-income. If you teach a different subject decided by the relevant state education agency or have a shortage of qualified teachers in the relevant state, you may also qualify.

- If the school is a private school and has confirmed its non-profit status with the IRS, then private school teachers may also qualify for this program. Additionally, you may also be eligible if the school is offering secondary or elementary education as per state law.

Recommended Reading: How Do Auto Loan Inquiries Affect Credit Score

Would A Similar Package Work In The Uk

Our analysis suggests that if a similar reform were to be implemented in the UK, it would be less well targeted at lower-income students. This may be a disappointing conclusion to many younger graduates with large outstanding student debts, who would be relieved to see a reduction in their loan balance, especially in the middle of the biggest cost of living crisis in a generation.

But the student funding landscape and the demographic profile of those in educational debt is very different in the UK compared with the United States. This means that a similar policy would be a very different social and economic proposition. Here, we highlight four key differences.

It is much more common for US parents to pay for their childs university education

Nearly all new students in the UK take up government loans. In contrast, 30% of US undergraduates do not use federal loans, with 85% of families using parent income or savings to pay for some proportion of college costs.

In the United States, students from more affluent backgrounds are more likely to leave with no debt. So, in the United States, helping those with debt is a progressive policy, at least within the university-attending population.

In contrast, helping debtors in the UK would mean offering support to all undergraduates equally, rich and poor alike. Consequently, it would not be a progressive policy within the university-attending population.

The dropout rate is very low in the UK

Student Loans In The United States

| This article uses bare URLs, which are uninformative and vulnerable to link rot. Please consider converting them to full citations to ensure the article remains verifiable and maintains a consistent citation style. Several templates and tools are available to assist in formatting, such as Reflinks , reFill and Citation bot . ( |

|

|

Student loans in the United States are a form of financial aid intended to help students access higher education. In 2018, 70 percent of higher education graduates had used loans to cover some or all of their expenses. With notable exceptions, student loans must be repaid, in contrast to other forms of financial aid such as scholarships, which are not repaid, and grants, which rarely have to be repaid. Student loans may be discharged through bankruptcy, but this is difficult.

Student loan debt has proliferated since 2006, totaling $1.73 trillion by July 2021. In 2019, students who borrowed to complete a bachelor’s degree had about $30,000 of debt upon graduation.:1 Almost half of all loans are for graduate school, typically in much higher amounts.:1 Loan amounts vary widely based on race, social class, age, institution type, and degree sought. As of 2017, student debt constituted the largest non-mortgage liability for US households. Research indicates that increasing borrowing limits drives tuition increases.

Don’t Miss: Itt Tech Loan Forgiveness 2021 Application

Finding Your Student Loan

As long as you or your co-signer have decent credit, getting student loans isnt all that difficult. After all, there are literally dozens of companies offering student loans in the USA. However, unless you want to try your luck applying for student loans from literally every lender, then it pays to do a bit of research first. On this website, youll find lender reviews and information to help you find student loans with low interest rates and favorable terms. Compare the student loans organizations on key factors like APR, loan type, and repayment term to find which makes most sense for you.

Student Loan Borrowers By Debt Size

- In 2022, 9.7 million borrowers held between $20,000-$40,000 in student loan debt, the largest group of borrowers by debt size.Note Reference

- About 19 million borrowers had student debt between $10,000-$40,000 in 2022. This group made up about 44% of all student loan borrowers.Note Reference

- Only 1 million borrowers had debt over $200,000 in 2022.Note Reference

- In the last five years, the number of borrowers with debts under $20,000 decreased by about 1.5 million borrowers. And the number of borrowers with debt larger than $20,000 increased by about 2.4 million borrowers.Note Reference

Recommended Reading: Does The Cleo App Loan Money

Types Of Student Loans

Student loans are from the federal government or from private sources, such as a bank, credit union, state agency, or school. Learn the differences between federal and private loans before considering a loan.

Federal Student Loans

If you need to borrow money to pay for college or career school, start with federal student loans. Theyre more affordable than private loans.

Types of Federal Student Loan Programs – The William D. Ford Federal Direct Loan Program offers four types of Direct Loans:

- Direct Subsidized Loans are made to eligible undergraduate students based on financial need.

- Direct Unsubsidized Loans are made to eligible undergraduate, graduate, and professional students, and are not based on financial need.

- Direct PLUS Loans are made to graduate or professional students and parents of dependent undergraduate students.

- Direct Consolidation Loans allow you to combine all of your eligible federal student loans into a single loan with a single loan servicer.

Eligibility – You must be enrolled at a school that participates in the school loan program, and meet the general eligibility requirements.

How to apply – Complete the Free Application for Federal Student Aid or FAFSA.

Private Student Loans

Before taking a private loan, make sure you need it. These loans generally are not as affordable as federal student loans and offer little repayment flexibility. Read these tips before getting a private loan.

Why Student Debt Has Rapidly Increased

Lets illuminate the reasons behind the increase in the student loan debt:

1. Financial difficulty- There are several challenges that student borrowers experience while paying down their loans, as most of them come from a low or middle-income family. So, financial instability becomes a barrier for student loan repayment.

2. Higher education has become costly-The tuition fees of colleges has inflated at a faster rate. If the annual fee of private and public colleges in 2008-2009 were $38,720 & $16,460, then it raised to $48,510 & $21,370 respectively in 2019. With a rise in college fee, there has been an equivalent rise in the student loan crisis. Some of the prominent factors that made colleges so expensive are:

- The sudden surge in demand for college degrees

- A higher number of enrollments contribute to the expansion of financial aid

- Colleges need more funds to pay experienced faculty

- Lack of financial support from the government.

3. Not getting employment opportunities- Even after spending tons of money on pursuing a degree, new graduates cannot find a job due to their lack of real-time experience and required skills. Thus, they fail to make loan repayments and get overburned with thousands of student debts.

Recommended Reading: Fha Loan Mobile Home Requirements

How Do You Get Your Student Loans Forgiven

The U.S. government will currently forgive, cancel, or discharge some or all of an individual’s student loan debt only under a fewl specific circumstances. Teachers in low-income schools and public service employees may be eligible for forgiveness of a portion of their debt. People who are disabled may be eligible for discharge of the debt. Those who think they may qualify for loan forgiveness should contact the student loan servicer of their loans.

Who Has Student Loan Debt

Forty-five million Americans have student loan debt that’s about one in 7 Americans , according to an analysis of January 2022 census data.

Those ages 25-to-34 are the most likely to hold student loan debt, but the greatest amount is owed by those 35 to 49 more than $600 billion, federal data show.

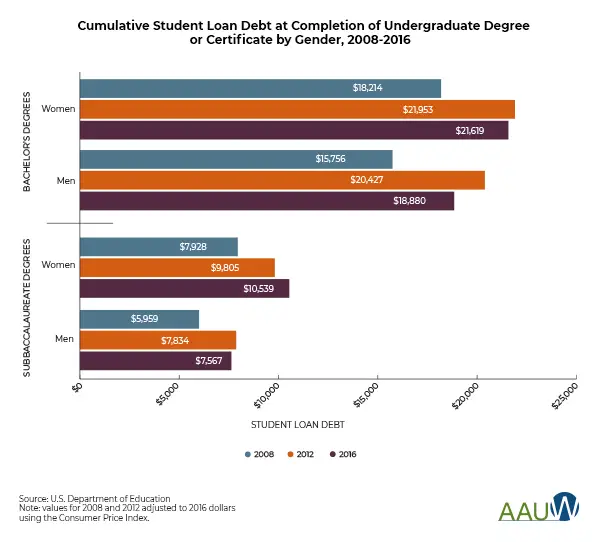

Among all borrowers, women typically borrow more for college compared with men , according to 2020 data by the American Association of University Women. And Black students borrow more often and greater amounts compared with all other races and ethnicities, according to federal data.

Learn more about the characteristics of student loan borrowers here.

You May Like: What Is Personal Loan Used For

Black People Are Increasingly Carrying A Larger Student Debt Load

2020

As student debt has grown in recent years, peoples ability to repay it has declined.

When the pandemic brought the global economy to a standstill in 2020, President Trump issued a moratorium on student debt payments and forced interest rates down to zero. Mr. Biden adopted similar policies. The moves helped millions of people lower their loan balances and prevented borrowers unable to pay their loans from defaulting on them.

Nonetheless, there has been a sharp increase in the number of people whose loan balances have stayed the same or have grown since the start of the pandemic.

Overall Average Student Debt

How big a role do student loans play in today’s colleges and universities? Here is a snapshot of borrowing.

| Student Loans Snapshot | |

|---|---|

| Amount of student loan debt outstanding in the U.S. | |

| 45 million | Number of borrowers with federal student loan debt. |

The total amount of outstanding student loans was $1.77 trillion in Q3 2022 compared to $1.74 trillion one year prior.

Recommended Reading: What Is The Maximum Va Loan Entitlement

Demographics Of Loan Holders

Surprisingly, its not only those in younger age groups that struggle with debt.

- Only 37.5% of people with student debt are below the age of 30. The other 62.5% are older than 30.

Unsurprisingly, minorities are affected significantly by student debt.

- 77% of African American students took out a federal loan to pay for higher education compared to the 60% national average for all students.

- The average debt upon graduation is also higher for African American students. For example, In 2012, their average debt was $29,344 compared to the national median of $25,640.

- Troubles dont end after successfully securing a job after graduation: of the total number of workers with a bachelors degree, African American households earn an income of 23% less than the median for the overall population.

- Examining students that began college in 2003: 50% of black students have ceased student loan repayment and gone into student loan default on their loans within 12 years due to financial insecurity .

The problem of debt is especially acute for women.

- While women account for 66% of undergraduates nationwide, they are saddled with almost two-thirds of all student debt.

- Not only are women more likely to take on debt, but their median debt is also 9.6% more than men.

- Females do also take a longer period to repay their debt, resulting in more overall interest. This is partially due to the gender pay gap women earn 83 cents for every $1 that men earn as of 2021.