Why Is My Lender Pushing Me Into An Fha Loan

The loan officer or mortgage broker doesn’t earn more for selling an FHA loan . Chances are, he or she feels that it’s the best loan for your situation or the one most likely to result in approval. However, a lender should be able to explain the reasoning behind a recommendation, and no one should feel pushed into a product.

Ask your loan professional why he or she is positive about the FHA loan and see if that explanation makes sense to you. You should probably speak to more than one lender about your options and compare mortgage quotes from several before committing.

Conventional Mortgage Vs Fha Loan: Whats The Difference

Conventional mortgages and FHA loans function a little differently.

A crucial difference is that the government doesnt usually back conventional loans. Instead, private lenders fund them, using stricter eligibility requirements. So, they can be harder to obtain.

For example, you may qualify for an FHA loan with a score as low as 580. In contrast, a conventional loan requires higher scores, starting around 620. Conventional loan borrowers also are required to make a slightly lower down payment.

However, if you cant pay a 20% down payment on a conventional loan, you must pay private mortgage insurance . PMI can be removed once you hit 20% equity. In contrast, you pay a compulsory MIP on an FHA loan.

Borrowers with lower credit scores, smaller funds and debt may prefer an FHA loan due to competitive interest rates and similar loan limits.

Fha Foreclosure And Bankruptcy Waiting Periods

If you lost a home to foreclosure, youll need to wait three years before you can take out an FHA loan. With a Chapter 7 bankruptcy you can apply for an FHA loan within two years of your discharge date. This waiting period is much shorter than conventional loans, which require a seven-year wait after a foreclosure or four years after a bankruptcy.

You May Like: What Do Loan Officers Do

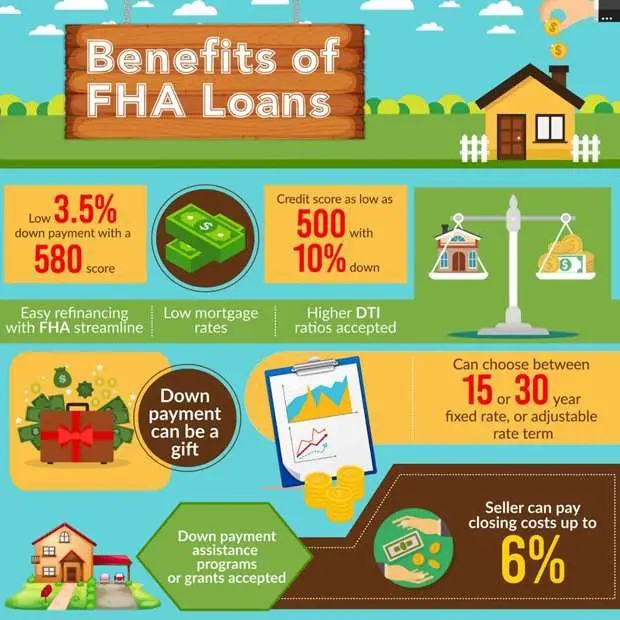

What Are The Pros Of An Fha Loan

FHA loans can be helpful for some home buyers, but it depends on your financial habits, your credit score, and your income. Here are some of the benefits you can enjoy when you secure an FHA loan:

Low credit score requirements. A major benefit of an FHA loan is that its one of the easiest loans to qualify for. If you have above a 580 credit score, youll benefit from paying a lower down payment, but a low credit score doesnt necessarily take you out of FHA loan eligibility.

Low down payment. Your down payment is dependent on your credit score, which can be as low as 3.5% if your credit score is above 580. If you have a credit score below 580, youll pay 10%, which is still lower than the typical 20% from private lenders.

Assumable mortgage. What many people dont know is that an FHA loan is also an assumable mortgage, which is the type of loan where the buyer could take over the sellers mortgage rather than applying for a new loan. This is beneficial to the borrower because even if you have a low credit score, you could still qualify for an FHA loan.

Debt-to-income ratio. What is debt-to-income ratio? This is the percentage that shows how much a persons income is used to cover his or her debts. The minimum debt-to-income ratios required for FHA loans are 31% for housing-related debt and 43% for total debt.

What Are the Cons of an FHA Loan?

Graduated Payment Mortgage/section 245 Program

FHA lenders also offer the Graduated Payment Mortgage program, which offers FHA loans for homebuyers who currently have low to moderate incomes but expect them to increase over five to 10 years. Those with limited incomes can purchase homes with mortgage payments that will grow.

Learn more about the Graduated Payment Mortgage/Section 245 program.

While Morty does not currently offer FHA loans, we can help you get into your dream home. Learn more about hundreds of topics, from refinancing your mortgage to mortgage insurance on our blog.

This post was updated on Feb. 20, 2022 to reflect current FHA loan limits.

Don’t Miss: How To Apply For Joint Loan

New Employees: Get A Mortgage Even With A Low Credit Score

If you have a low credit score, you may have difficulty getting a mortgage. A credit counseling service will assist you in improving your credit score the most effective way possible. Government-backed, subsidized loans, such as FHA loans, allow people to purchase a home and be flexible about their options.

Seller Assist And Other Sources To Help Cover Closing Costs

You have several sources of assistance with covering the closing costs. You may get seller assist, which has the seller pay your closing costs in return for you paying an equivalent amount on the homes price.

If you have friends or family members who will gift you the down payment, you can use that to help with the FHA closing costs. You must have documentation showing the money was a gift without you intending to repay it. Account information from you and the giver also will prove the money came from the giver.

Some lenders also help you cover closing costs by offering higher home loan rates. Depending on how quickly you can pay off the home loan, you may benefit from these. Talk to your lender about your personal situation to see if this option will work for you.

resources

Recommended Reading: Can I Have More Than One Va Home Loan

How Do I Apply For An Fha Loan

You apply for an FHA loan directly with the bank or other lender that you choose. Most banks and mortgage lenders are approved for FHA loans.

You can apply for pre-approval of an FHA loan with the lender you choose. The lender will gather enough financial information to issue a pre-approval within a day or so. That will give you an idea of how much you can borrow while not committing yourself to anything.

All of the above is true for any mortgage application. If you want an FHA loan you should say that upfront.

Down Payment Assistance In 2022

Down payment assistance programs make the mortgage process more affordable for eligible applicants who are interested in purchasing a home but need financial help to do so. Money is usually provided in the form of a non-repayable grant, a forgivable loan, or a low interest loan. Homebuyer education courses may be required.

Typically, a property being purchased must serve as the applicants primary residence and must be located within a specific city, county, or state. It may also need to fall within a program’s maximum purchase price limits. Income limits may apply, and will look something like this :

- 1 person household: $39,050

Read Also: Are Quicken Loan Rates Competitive

Pros Of Community Banks

- Personalized service: Community banks are commonly owned and managed by people who live near the bank. As such, bank employees may have long-standing friendships with customers and be able to provide more personalized service.

- Local investment: A banks focus on giving loans to those in its own community helps local businesses and residents thrive.

- Relationship banking: Community bank officers may take into account discretionary spending and family history when making loans, rather than relying solely on impersonal data like credit scores, according to the Independent Community Bankers of America .

- Community service commitment: Like other local businesses, neighborhood banks often give back to their community through volunteer work and supporting local charitable organizations.

- Lower fees: Some community banks charge lower fees than national banks. For instance, fees for overdrafts and nonsufficient funds are 13-19 percent lower at small banks and credit unions than at large banks, according to a 2021 report from the Consumer Financial Protection Bureau.

The Hybrid Adjustable Rate

FHA administers a number of programs, based on Section 203, that have special features. One of these programs, Section 251, insures adjustable rate mortgages which, particularly during periods when interest rates are low, enable borrowers to obtain mortgage financing that is more affordable by virtue of its lower initial interest rate. This interest rate is adjusted annually, based on market indices approved by FHA, and thus may increase or decrease over the term of the loan. In 2006 FHA received approval to allow hybrid ARMs, in which the interest is fixed for the first 3 or 5 years, and is then adjusted annually according to market conditions and indices.

The FHA Hybrid provides for an initial fixed interest rate for a period of three or five years, and then adjusts annually after the initial fixed period. The 3/1 and 5/1 FHA Hybrid products allow up to a 1% annual interest rate adjustment after the initial fixed interest rate period, and a 5% interest rate cap over the life of the loan. The new payment after an adjustment will be calculated on the current principal balance at the time of the adjustment. This insures that the payment adjustment will be minimal even on a worst case rate change.

Read Also: Why Is Conventional Loan Better Than Fha

How Often Are Fha Loans Denied In Underwriting

According to a Consumer Financial Protection Bureau report, approximately 14.1% of FHA applications for home purchases were denied in 2020 . This is higher, compared to the denial rate of 9.3% for home purchase loans in 2020 overall.

But that doesnt mean you wont qualify for the FHA loan you need. Just make sure you meet the requirements and review your credit report before applying.

Disadvantages Of Fha Loans

Consider a few of the downsides to an FHA loan. You:

- Cannot avoid mortgage insurance. Youll have to pay the upfront mortgage insurance premium and annual mortgage insurance premium. Most FHA loans require MIP for either 11 years or the lifetime of the loan.

- Will have to meet certain property requirements. A home must pass an inspection by meeting minimum safety and security standards.

- Could pay more in the long run. The MIP fee doesnt go toward equity in your home. You may end up paying less in PMI for a conventional loan because your lender will automatically terminate PMI when your mortgage balance reaches 78% of the purchase price

Note: You will need to pay a 20% down payment if you dont want to pay private mortgage insurance for a conventional mortgage. PMI is a type of insurance that protects the lender if you happen to default on your loan.

Don’t Miss: What’s The Best Mortgage Loan To Get

Fha Loan Interest Rates

Below are todays average FHA interest rates. You can also use Zillow to the see FHA interest rates for your particular situation. Just submit a loan request with less than a 20% down payment and you will instantly receive custom FHA quotes from multiple lenders. Use the filter button to filter solely on FHA mortgage rates.

To see what interest rate you would qualify for, enter your specific details such as credit score, income, and monthly debts . Then when youre ready to talk to a lender, you can contact any of the lenders that appear on your search.

| Program | |

|---|---|

| 6.32% | 0% |

A 30-Year Fixed FHA loan of $300,000 at 5.25% APR with a $10,880 down payment will have a monthly payment of $1,656. A 20-Year Fixed FHA loan of $300,000 at 4.58% APR with a $10,880 down payment will have a monthly payment of $1,911. A 15-Year Fixed FHA loan of $300,000 at 5.05% APR with a $10,880 down payment will have a monthly payment of $2,380. A 10-Year Fixed FHA loan of $0 at 0% APR with a $0 down payment will have a monthly payment of $0. A 7/1 ARM FHA loan of $0 at 0% APR with a $0 down payment will have a monthly payment of $0. A 5/1 ARM FHA loan of $300,000 at 4.25% APR with a $10,880 down payment will have a monthly payment of $1,475. All monthly payments displayed assume a maximum Loan to Value of 100% and 680 credit score, and do not include amount for taxes and insurance. The actual monthly payment may be greater.

How Hard Is It To Qualify For An Fha Loan

FHA mortgage underwriting is some of the most forgiving in the business. You need an acceptable credit history, which means no serious derogatory events in the most recent 12 months, a credit score above 579 , verifiable income that is ongoing, sufficient and stable, funds to cover the down payment and closing costs, and a debt-to-income ratio that doesn’t exceed 43%. Higher DTI ratios of up to 56.9% may be allowed on an FHA loan, depending on personal factors.

Those are the basics. Applicants who exceed these minimum qualifications have a better chance at loan approval, and those who barely meet guidelines may have to work harder to get a loan.

Read Also: What Is The Maximum Subsidized Student Loan

What Is The Minimum Income To Qualify For An Fha Loan

FHA required loan money No low or excessive income is due or protects you from obtaining FHA-insured mortgage. Therefore, you must: Have at least two suspended credit accounts. For example, a credit card and a car loan.

Can I get a FHA loan if I dont have 2 years of income?

There is no minimum or maximum amount required for a FHA loan.

What are FHA income requirements?

All eligible financially based on minimum FHA loans and lending rates are welcome to apply for FHA home loan, refinance loan, reverse mortgage, etc. Since the official FHA loan manual, HUD 4000.1, states that no minimum amount is required for a FHA loan, then there will be no over the limit or ceiling of the salary.

How Long Do Borrowers Have To Pay Fha Mortgage Insurance

The duration of your annual MIP will depend on the amortization term and LTV ratio on your loan origination date.

For loans with FHA case numbers assigned on or after June 3, 2013:

Borrowers will have to pay mortgage insurance for the entire loan term if the LTV is greater than 90% at the time the loan was originated. If your LTV was 90% or less, the borrower will pay mortgage insurance for the mortgage term or 11 years, whichever occurs first.

| Term |

|---|

Recommended Reading: Mortgage Calculator For Va Loan

Who Should Consider An Fha Loan

As mentioned before, first-time home buyers are the most popular candidates for an FHA loan given the requirements to qualify. FHA loans also work well for those who are working on building their credit, dont have a large down payment, or those who have high debt.

If youre considering an FHA loan, look at advantages and disadvantages, and compare lenders before making the final decision.

How Long Does It Take To Close On An Fha Home Loan

Well-prepared applicants can usually close quickly if they supply the lender with a complete and accurate application, proof of income and asset documentation, and there are no credit or employment issues.

Most home loans are underwritten with automated underwriting systems , which deliver decisions in seconds. Those with less common circumstances, including no reported credit history, cash down payments or identity theft, must be underwritten manually, which can take longer. On average, home loans close in about 40 days. Experts recommend buyers get pre-approved before shopping for homes to make closing easier.

Don’t Miss: Will Switching Jobs Affect Home Loan

Alternatives To Fha Mortgages

While FHA loans are great options for first-time homebuyers, they arent the only ones. Explore other options to finance your home below.

Conventional Loans With 3% Down

Both Fannie Mae and Freddie Mac offer 97% mortgages to eligible first-time homebuyers. Like FHA mortgages, these loans offer flexible underwriting guidelines. However, they have a few advantages over FHA loans: The down payment is just 3%. There is no upfront mortgage insurance, and the annual premiums are lower. Borrowers can request mortgage insurance cancellation when the loan balance drops to 80% of the original home value.

Seller Financing

Some home sellers are willing to finance their properties. Through this option, the buyer may avoid FHA loan fees and other home-buying costs like title insurance. Sellers may be more willing than mortgage lenders to overlook credit or income issues. However, buyers of owner-financed homes should consider having an appraisal done to avoid overpaying for the property. Inspections and title insurance are still good for the buyer’s protection, and it’s wise to hire a real estate lawyer to review the loan terms. Individual sellers don’t have to play by the same rules as licensed mortgage lenders, meaning borrowers have fewer protections.

USDA and VA Home Loans

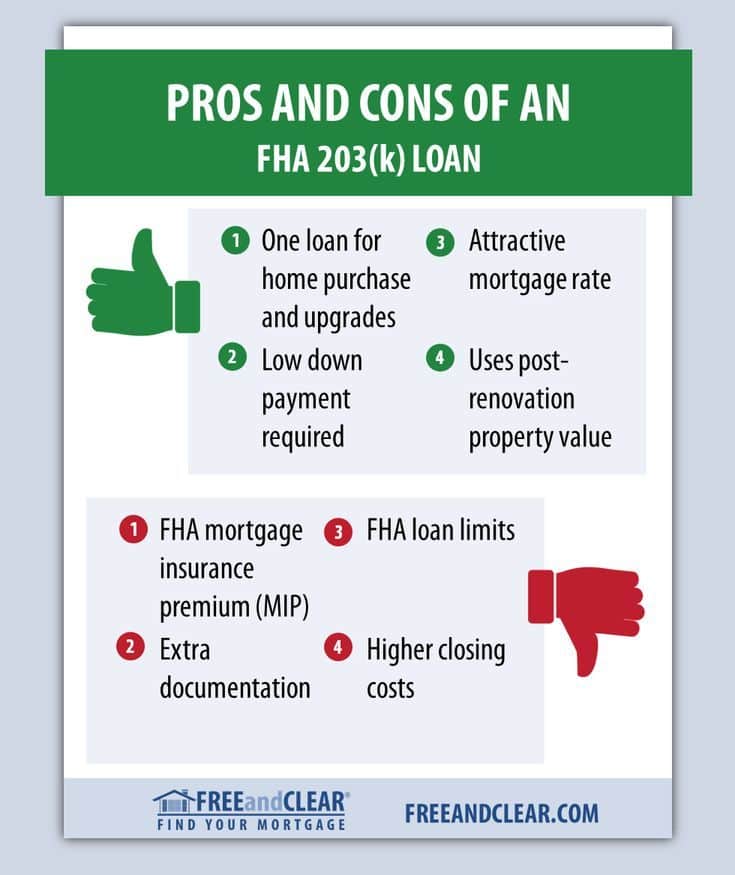

Pros & Cons Of Fha Loans

FHA loans have a lot of benefits, but they may not be the best option for every borrower. Explore the different pros and cons of FHA loans below.

Benefits of FHA Loans

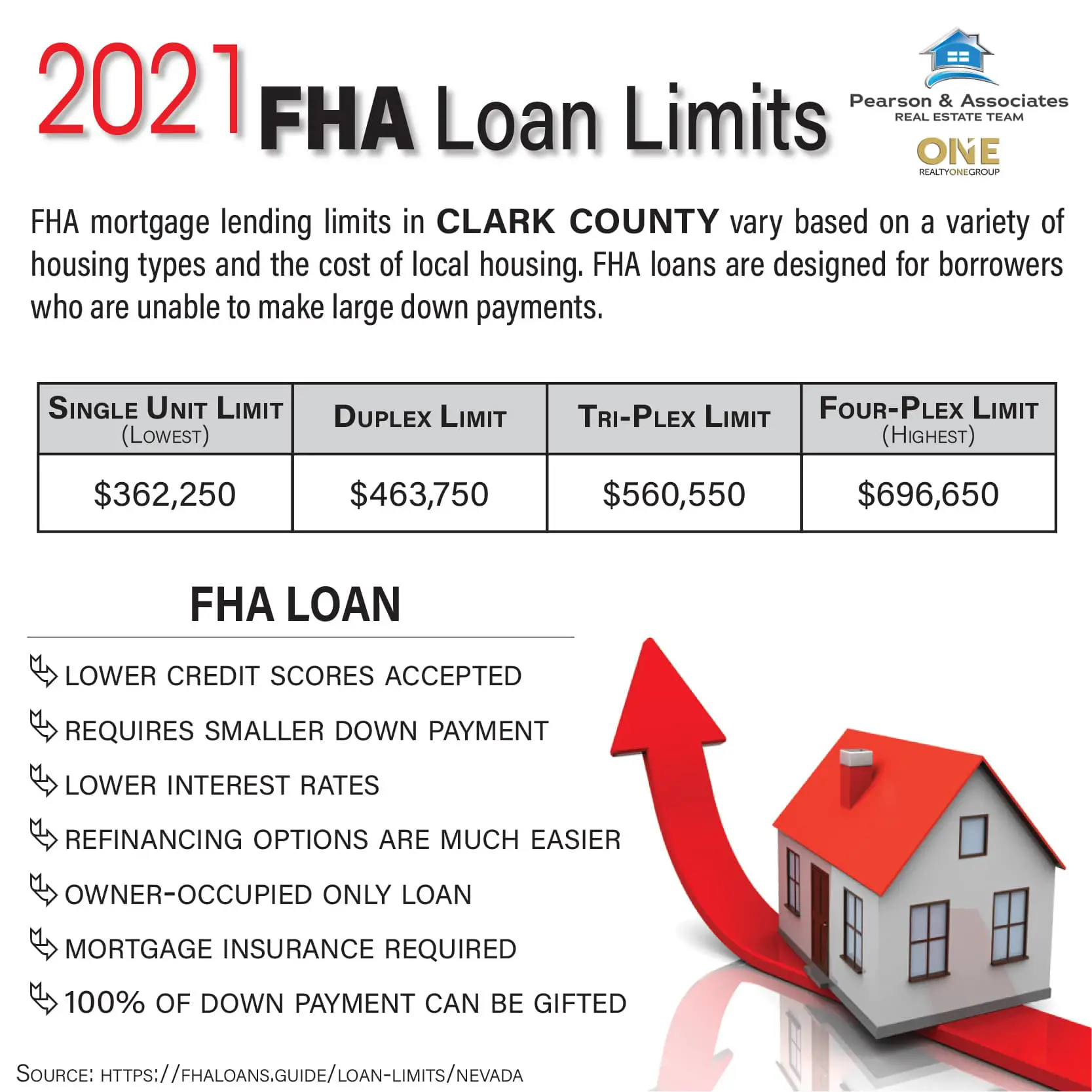

FHA loan limits vary by county. To find out your limits, visit the Department of Housing and Urban Development s website and use their FHA Mortgage Limits tool. This allows you to check what the limits are in each county. Simply input your state, county and county code, select FHA Forward, and leave all other forms blank. Once you hit Send, the details under One-Family show the limits in your county.

Drawbacks of FHA Loans

Regardless of whether you intend to get an FHA loan, its wise to improve your credit score. A high credit score will allow you to get more competitive rates from private lenders, some of which may be better than what an FHA loan offers.

Recommended Reading: How Does Cosigning An Auto Loan Work