Benefits Of The Iphone Upgrade Program

- Spreads out your costs Without a trade-in, the latest top-of-the-line iPhone can cost more than $1,000 before taxes and fees. If you dont have that kind of money lying around and still want the latest and greatest, you can spread out your payments over 24 months.

- Allows trade-ins of your old phone You can trade in your previous iPhone to help offset the total cost of the new phone and lower your monthly payments. But if youre signing up for the first time, remember that not all devices are eligible.

- Backed by AppleCare+ AppleCare+ is an insurance policy that covers hardware repairs, software support and two cases of accidental damage to give you some peace of mind.

- Works with major mobile carriers If you have a monthly rate plan with AT& T, Sprint, T-Mobile or Verizon, you can stick with your current plan or switch your plan between carriers and Apple will connect your iPhone for you.

We Got A Technological Breakthrough You Got A Break

Were proud to be one of the first banks in Mississippi to offer live video banking to our busy customers. Our Interactive Teller Machines or ITMs give you access to a Citizens Bank teller through a real-time video connection. Simply touch the ITM | ATM screen to talk to a TCB Live Teller who will help you make deposits of cash and checks, receive cash back, make transfers, loan or credit card payments, and more! Or insert your card and make an ATM withdrawal any time of the day or night.

The new ITMs will be available for personal and business customers weekdays from 7 am to 5:30 pm. We are launching them at our Philadelphia branches and rolling them out to a branch near you soon! Now instead of just punching numbers at the ATM, get the human touch with the bank that stays plugged in.

What To Watch Out For

- You may end up paying interest Even though this Citizens One loan comes with 0% interest, that doesnt necessarily mean you wont pay interest on the loan. Youll make your monthly payments on a credit or debit card tied to your account when you sign up for the iPhone Upgrade Program account, but if you use a on that account if you dont pay off your balance in full each month. So when you sign up, it might be a good idea to link a debit card to your account rather than a credit card.

- Citizens One checks your credit A credit check is required to apply for the Apple Upgrade Program, so if you dont have the best credit, you might not be approved.

- AppleCare+ is required To enroll, you have to buy the AppleCare+ insurance policy. While you may like this extra protection, it could increase the total cost of the phone. Youll also want to double check that you arent double paying for phone insurance through your carrier.

You May Like: How Do I Know If I Qualify For Fha Loan

Turn Your Phone Into The Ultimate Wallet

You already have the perfect wallet. Only you call it your phone. Were always looking to give you more ways to pay, including convenient mobile wallets. With Mobile Pay you can add your Citizens Bank Visa® Debit Cards to your phone, watch or other device, with the security of a lock box. Mobile wallets will change how you pay with contactless payment technology and unique security features built right into the devices you have with you every day.

Frequently Asked Bill Pay Questions

Q: Is the bill payment system a “pay anyone” service?A: Yes. However, payments to tax entities are restricted. International payments are also restricted and not available.

Q: What is the first screen presented to my when I click on the “payments” tab?A: You will always be greeted with the payment “Hub” page. This screen will present you with a multiple payments module, as well as display your pending payments, most recent payments paid, and any bill reminders you have established. It will also notify you of ay new Bill Pay Messages.

Q: What additional features are available with Online Bill Pay?A: Online e-bills from many major billers that notify you via email when the bill arrives, as opposed to receiving them in the mail. The e-bill can be viewed online and printed as needed. Auto payment is available to automatically schedule payments on the due date. Quick bill set up feature requires only a company name and phone number in most cases.

Q: How many days in advance must I schedule a bill payment prior to the due date?A: Most payments must be scheduled four business days in advance, as of 12:00 a.m. CST. If you are scheduling bill payment using Mobile Banking with bill payment it must be scheduled five business days in advance.

Q: What is the time frame I can make edits to a scheduled bill payment?A: You can edit the payment anytime prior to the four business days cutoff time.

Q: Can I pay more than one payment/payee/day?A: Yes.

Don’t Miss: What Credit Score Is Needed For Sba Loan

How To Contact Citizens If You Have Trouble With Your Account

If you need help with your account, you can get in touch with a Citizens Bank customer service representative by calling any of the following numbers:

- General assistance: 800-922-9999

- Mobile banking: 877-670-4100

- Spanish-language support: 888-398-7900

Alternatively, you can visit a branch in person. Search the branch locator to find your nearest branch and its operating hours.

Daria Uhlig contributed to the reporting for this article.

Information is accurate as of Aug. 8, 2022.

Editorial Note: This content is not provided by any entity covered in this article. Any opinions, analyses, reviews, ratings or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by any entity named in this article.

Folks Dont Want To Get Into Debt But They Dont Mind Borrowing

Gaurav Sethi, Citizens Bank

Theres intentional borrowing and theres accidental debt, says Sethi. If I am going to buy a $600 product that Ill have 12 months to pay at $50 a month, thats very intentional borrowing and I can decide if it fits into my budget or not.

Installment payments arent new, but BNPL fits a time when people are becoming more focused on their budgets, according to Sethi.

People are used to thinking in monthly cycles. Look at mortgages, look at auto loans, says Sethi. They are both structured in monthly payments and offer predictability of what consumers must pay. I think that model is going to become more entrenched in U.S. culture.

Citizens is unusual among major U.S. banks in that it has been offering its own take on BNPL since 2015. While the major fintech BNPL companies have focused on a mass-market approach on both sides courting large numbers of consumers and large numbers of merchants with the magic of 0% financing Citizens Pay has been offered on a more select, strategic basis, tailored to individual mass retailers and differing from the fintech players in significant ways.

Don’t Miss: How Much Loan I Can Get For Business

This Is For You Iphone 13 Owners

The iPhone Upgrade Program is supposed to make it easy to get a new Apple device. But the iPhone 13 launch in October was a huge hassle for many in the program because they couldnt buy the device with Apple Card. Until the bug was fixed, the only option was switching to another card.

Apple admitted the error later and gave Apple Card users a credit for the 3% Daily Cash they missed out on because they were forced to use another card to buy the iPhone 13.

But thats not the end. The loan at the heart of the iPhone Upgrade Program will continue to use the same card as the initial payment. In other words, not the Apple Card. Its necessary to manually switch cards.

Rick Bormin Personal Loans Moderator

@rhandoo202008/11/21 This answer was first published on 08/11/21. For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Editorial and user-generated content is not provided, reviewed or endorsed by any company.

Yes, a Citizens One personal loan does affect your credit score, both when you apply and during the entire time that you are paying the loan off. Initially, a Citizens One personal loan will affect your credit score in a negative way, but the long-term impact can be very positive, assuming you repay the loan on schedule.

Read Also: How To Get My First Car Loan

What Is Apples Iphone Upgrade Program

If you become a member of Apples iPhone Upgrade Program, you can apply to finance the full cost of your iPhone and AppleCare+ coverage through a 24-month installment loan from Citizens Bank that comes with a 0% APR. If approved, you can buy your phone directly through Apple, and you wont have to finance it through your mobile carrier, with Citizens One providing the financing for Apple.

Here are some factors to consider before you apply.

Citizens Seeks A Higher

Part of what sets apart Citizens Pay from other BNPL providers is transaction size.

We are atypical in the sense that we are not a small- ticket lender and we are not a one-size-fits-all lender, Sethi explains. The programs sweet spot for purchases lies in the range of $500 to $5,000, with the top end rising as high as $25,000 for certain industry verticals. The key range for payment plans is between three months and 60 months. Some programs are designed like a blend of line of credit and installment loan, enabling consumers to be approved for multiple purchases.

Were not looking to finance purchases for $100 or less, transactions that require only a handful of payments, such as small-dollar financing for apparel, explains Sethi.

Citizens Banks approach differs in multiple ways from that of fintechs because it is a bank, with a traditional deposit funding model.

Thats why Citizens isnt interested in programs that finance numerous small purchases with loans of very short duration. Sethi says such an approach doesnt build a portfolio very quickly.

We are definitely a balance sheet credit provider versus the fintechs, which have to offload their balances, says Sethi. The ability to fund BNPL through deposits gives Citizens critical flexibility that fintech players lack, he explains.

Read More: How Long Will Credit Card Borrowing Defy Economic Gravity?

Don’t Miss: What Do You Need For Va Loan

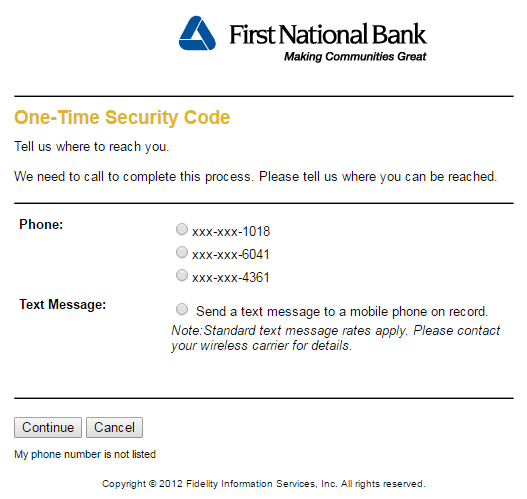

How To Retrieve A Forgotten Username Or Password

No worries if you forget your Citizens Bank online user ID or password. The website lets you request help to regain access to the online features. From the Citizens Bank homepage, click the Log in button, select the Trouble logging in? link and select the option for having forgotten your user ID or password. Follow the prompts to retrieve your missing login information.

How To Get Your Citizen One Loan Number

Read Next

Recommended Reading: Which Bank Offers Lowest Interest Rate On Car Loan

Will A Citizens One Loan Affect My Credit Scores

Possibly. As mentioned earlier, Citizens Bank will check your credit when you apply for the Citizens One iPhone loan. This check known as a hard inquiry is common with personal loan applications and may lower your scores by a few points, or the impact may be negligible. Still, its good to keep in mind that you might see some change to your credit scores, especially if you are applying for multiple loans at the same time.

How To Find And Use Your Citizens Bank Login

Citizens Bank dates back to 1828, but the venerable institution stays current with offerings such as an online-only division launched in mid-2018. Traditionalists who like to balance online services with the ability to walk into a physical branch will appreciate Citizens Banks secure online banking platform, which offers a full suite of services via its website and mobile app.

This guide will explain how to find and use your Citizens Bank login so you can get started managing your accounts online.

Don’t Miss: What Happens If You Consolidate Student Loan Debt

Now Your Account Never Clocks Out

The TCB Mobile App is now available on Apple Watch®. The new Smartwatch App will give you the ultimate convenience of keeping tabs on your moneyright on your wrist. With the quick balance feature, its easy to view your account balances and last 20 transactions. Also, you can see your balances at a glance with just the touch of a finger, without having to enter the app. It couldnt be easier to get balances on the go, view your transactions in real time so any purchase you make will be reflected at your fingertips and get alerts right on your watch. Launching the free app is easysimply download the latest version of our app for iPhone® from The App Store and be sure your iPhone is paired with your Apple Watch. Choose your account view settings and then you can open the app on your Apple Watch anytime.

Life Here Doesnt Stop Neither Does Your Bank

Now you can complete bank transactions at the soccer field, in the carpool line, even in line at the grocery store. While life sometimes keeps you waiting, your bank never will. Life in our communities is faster paced than ever, so being a great community bank means keeping step with the latest and best technology. With The Citizens Bank, you get full service banking by pulling your smart phone out of your pocket, not taking time out of your day.

Read Also: What Are The Current Interest Rates For Home Loans

Pay It Back Pay It Forward Never Get The Side Eye

Forgot your wallet? No cash on hand? You can still split the bill or pay the plumber. C2C People Pay lets Citizens Online Banking and Mobile App users make personal payments anytime, anywhere via the convenience of your computer, smartphone or tablet. When people need money from you, all you need from them is their email address or phone number to transfer funds. They get an email or text giving them the simple steps to deposit the funds into their account. C2C People Pay is the easy solution to lifes sticky payment situations.

Frequently Asked Online Banking Questions

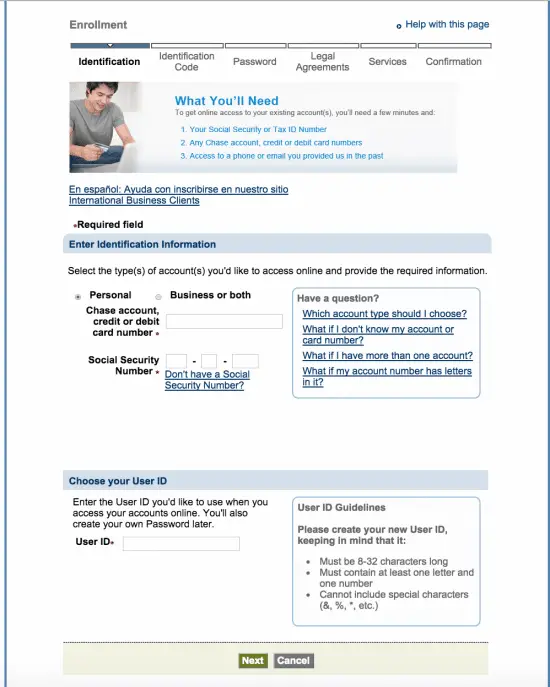

Q: What is Online Banking?A: Online Banking is a tool that allows you to use a personal computer with an Online connection to conduct your banking online.

Q: What can I do with Online Banking? A: You can view account balances and transaction history, transfer money, and download transactions to a personal financial manager and much more. Check out the Online Banking Demo to see all the features of Online Banking and how you can personalize your online banking experience. We also offer free Bill Payment and E-Statements with Online Banking.

Q: What is required to use the Online Banking service? A: All you need to use Online Banking is a secure browser that supports 128 bit encryption, such as Microsoft Internet Explorer®, You can use any computer that has Internet access. It is preferred to use a trusted private computer.

Q: How do I access Online Banking? A: You must first enroll and complete the Online Banking registration form that is located on the Home page of our website. Once your enrollment is received we will process your request. You will need to have your account number available and will be required to create a User ID and passcode to access the service for the first time. You must have an existing checking, savings or loan account before banking online. Generally it takes 24 to 48 hours to see your accounts during the enrollment process.

Q: Can I schedule future transfers? A: Yes Online Banking supports scheduling future and recurring transfers.

Don’t Miss: Is Loan Lease Payoff Worth It

If You Like Having The Latest Iphone But Dont Have The Cash To Cover Its Entire Cost Upfront You May Be Thinking About Financing Your Purchase With The Citizens One Iphone Loan

Apples iPhone Upgrade Program offers members a way to get the new iPhone every year through financing. That means you wont have to finance your phones purchase through your mobile carrier. So if you want to stretch out your payments beyond what your mobile carrier offers, you can apply for this personal installment loan through Citizens One, which is the brand name for Citizens Banks lending business.

But Citizens One will perform a , and youll need a credit or debit card on file which is required when you become a member of Apples iPhone Upgrade Program to make monthly payments.