How To Choose The Best Auto Loan Lender

Choosing the right lender comes down to financing a vehicle you can afford. It is recommended that you get quotes from at least three lenders outside of a car dealership before deciding which is right for you. Pay special attention to the following factors:

1. Approval requirements. Every lender has different requirements to receive approval. Lenders will consider aspects like your credit history, income and debt-to-income ratio. Your credit serves as the primary determinant of potential rates. Keep in mind that typically, the worse your credit score is, the less competitive your rates will be.

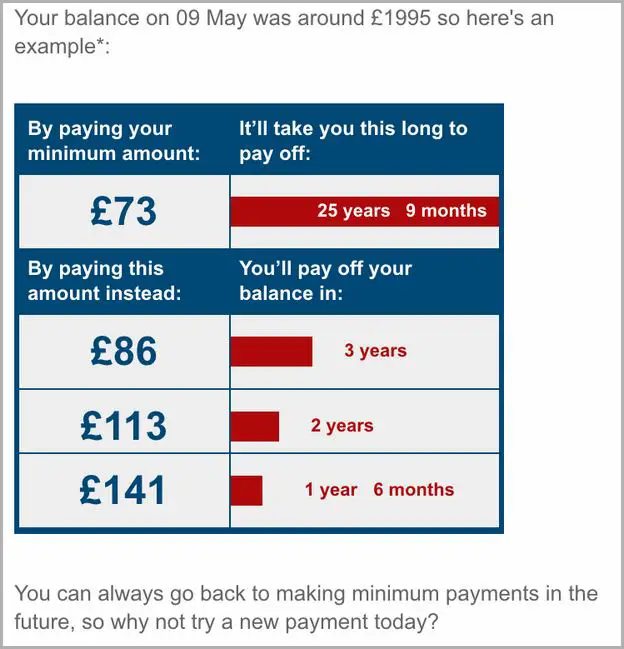

2. Annual percentage rate. The APR represents the amount of interest that you will have to pay during the loan. Pay close attention to this number a higher APR means more interest and thus a larger monthly cost. Also remember to shop the total loan amount, not just the monthly payment.

3. Loan terms. While a lower monthly payment may seem appealing, pay close attention to available terms, and consider how the lifetime of your loan will impact your overall cost. A longer loan term will lower your monthly cost, but you will pay more interest. Conversely, a shorter loan term means a higher monthly cost but a lower cost over the life of the loan.

Auto loans let you borrow the money you need to purchase a car. Since car loans are typically secured they require you to use the automobile you are buying as collateral for the loan.

Best For Shopping Around: Lendingtree

LendingTree

- Minimum loan amount: Varies by lender

- Repayment terms: Varies by lender

LendingTree makes it easy to compare rates from dozens of lenders and offers a variety of helpful financial calculators, placing it in our top spot as the best for comparing rates.

-

Compare auto loans from multiple lenders

-

Search by new, used, refinance, or lease-buyout options

-

Loan-payment and credit-score tools

-

Search process requires personal and financial details

If you are tossing around the idea of getting a new car but are not sure if it will fit in your budget, stop by LendingTree first. Without affecting your credit, you can shop from a variety of lenders. You can use this feature for refinancing, new cars, used cars, or lease buyouts. Just enter your desired loan type, down payment, financial status, and the vehicle you want. Then, LendingTree will match you with lenders.

You can compare the offers to find the best rates and terms for your life. If you decide to apply, the lender will require a full application. LendingTree can also help with a loan-payment calculator, free , and other tools.

Should I Get An Auto Loan Through Capital One

Capital One delivers an intuitive and quick loan experience, but that comfort comes with a few limitations. You will only be able to shop with the dealers that enter into Capital Ones program, so your choices may be limited when it comes to vehicle type or configuration. Youre also limited by the pre-approval options that the bank issues at sign up, so youll need to contact a representative to ask about rate, term, and other changes you need to make.

Also Check: Www Upstart Com Myoffer

Don’t Miss: No Credit Check Student Loans

What Sets It Apart

Capital One is known for its credit card options, but the company also offers tools to help you find and finance your next vehicle. Not only can you filter your search by dealer and car, but loan terms could include the price of the car as well as the tax, title and other relevant fees, lowering your total out-of-pocket cost.

Not all dealerships work with Capital One and if you dont already have an account, you wont be able to apply. You can compare more car loan options to see what other rates you might qualify for.

Types Of Auto Loans Available Through Capital One Auto Finance

Capital One provides auto financing for both new and used vehicles that you can use only at participating dealerships. While choosing from a participating dealer can limit your car-shopping choices, Capital Ones network consists of 12,000 dealerships nationwide. You can find a participating dealership online.

You can easily get pre-qualified for a new or used car loan with Capital Ones Auto Navigator. The process takes just a few minutes, and you dont need to have already identified the vehicle you want to buy.

Instead, you just need to have an idea of how much youll want to borrow. Then, if youre approved, your pre-qualification letter can help you bargain with a dealership. Plus, since theres no hard credit inquiry required upfront, getting pre-qualified with Capital One can be a great option when youre comparison-shopping for the best auto loans.

Don’t Miss: Small Loans For People With Bad Credit

Capital One Auto Finance Reviews

One of the best ways to find a great auto loan lender is by reading third-party reviews. You can discover what actual customers are saying about them before you choose to do business with them. The Better Business Bureau currently gives Capital One Auto Finance an A, and they have very few complaints. You will find plenty of 4- and 5-star reviews of Capital One Auto Finance at several other review sites as well.

Best For Shopping Around For Refinancing: Lendingclub

LendingClub

-

Not available in all states

-

Some vehicle restrictions

Although LendingClub made a name for itself with peer-to-peer personal loans, the online lender now offers auto-loan refinancing. If youre looking for ways to lower your monthly bills, LendingClub can help by showing you your refinancing options.

First, complete the initial application and get instant offers. This step is a soft pull on your credit that wont change your score. Then you can compare the details of each proposal to see which best fits your needs. Whether you need to lower your interest rate, increase the length of your loan, or both, you can find the right lender.

Once you decide on an offer, you can finish the official application. The process is entirely online and easy, and you wont pay an origination fee for your loan. Sit back and enjoy a smaller monthly payment. Rates start at 2.99%. Whether youre sure you want to refinance or just seeing whats out there, LendingClub is a great option.

You May Like: How To Transfer Car Loan From One Bank To Another

Best Bank For Refinancing Your Capitalone Loan

Best Auto Loan Refinance Companies of 2021

- Best for Great Credit: Credit Unions

- Best for Checking Rates Without Impacting Your Credit: Capital One.

- Best Trusted Name: Bank of America, Chase or WellsFargo.

- Best for The Most Options: WithClutch.

- Best for Members of the Military: USAA or Navy Federal CU.

- Best for Peer-to-Peer Loans: LendingClub although not recommendable.

- Digital Credit Union and PenFed.

Auto Refinance Data Methodology

The auto refinance rates published here are based on the results of comparative research done by Way.coms data team. Weve used a mix of public and internal data to analyze refinance rates across thousands of lenders, credit scores, vehicle types, and all U.S. ZIP codes

The rates shown here are based on a national average of our findings, and may typically vary for each individual depending on your personal financial position and the US state you are in.

However, you can quickly determine where you stand by going through our Auto Refinance form. In just a few steps, find out how much you can save with way.com!

Read Also: Can I Use My Va Loan For Investment Property

Is It Ok To Finance A Car For 72 Months

Is a 72-month car loan worth it? Because of the high interest rates and risk of going upside down, most experts agree that a 72-month loan isnt an ideal choice. Experts recommend that borrowers take out a shorter loan. And for an optimal interest rate, a loan term fewer than 60 months is a better way to go.

Capital One Auto Finance Customer Reviews And Ratings

Capital One is accredited and holds an A rating from the Better Business Bureau . It was named one of the best places to work by Fortune magazine in 2017 and is well regarded within the financial services industry.

Despite this, Capital Ones online customer review profile is average. It has a 1.1 out of 5.0-star customer rating on the BBB website and a Trustpilot score of 1.3 out of 5.0 stars. Its important to note a few things about these low ratings. First, many customer reviews mention Capital Ones banking services, not its auto loans. Second, although auto loans are only a small part of Capital Ones business, complaints from banking customers may still speak to the overall quality of the company.

Finally, keep in mind that Capital One is a large company with many products and services, millions of customers, and billions of dollars of revenue. Though there are thousands of complaints online, these represent a small fraction of total Capital One customers.

Also Check: Can Dependents Get Va Loan

How To Get An Auto Loan

Once you find the right auto loan for your situation, follow these steps:

1. Shop around. It is usually best to compare rates and terms from at least three lenders before moving forward with an auto loan.

2. Prequalify. Prequalifying with lenders lets you see your potential rates without a hard credit check.

3. Complete your application. To complete your application, you will likely need details about your car, including the purchase agreement, registration and title. You will also need documentation like proof of income and insurance, proof of residence and a driver’s license.

4. Make payments. Your payment schedule will start as soon as you receive your auto loan. If needed, set up a calendar reminder or automatic payments to keep you on track with your monthly bill and avoid late payments.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: What Is The Maximum Student Loan

Why Consider Capital One For An Auto Loan

Capital One has established itself as one of the most accommodating lenders in the automotive space. The banks apps and online presence are unmatched among its competitors. Buyers can get an easy prequalification and carry that information with them, either to a dealership or to an online retailer. The banks digital tools help buyers make decisions with payment calculators and other information easily accessible.

Capital One Auto Loan Rates

With Capital One, lenders set their own requirements. The companys lowest rates are only available to potential borrowers with good or excellent credit scores. In general, the best rates are available to those with a FICO score of 690 and up. Borrowers with fair or bad credit will not qualify for the lowest auto loan interest rates offered by the company.

Your max loan amount and APR depend on the following factors:

You May Like: How To Shop For Auto Loan Without Hurting Credit

Myautoloan: Best For Shopping For Multiple Loan Offers

Overview: If you want to compare multiple loan offers but you dont want to spend a lot of time doing it, myAutoLoan is a great option. This platform lets you enter your information once and receive multiple loan offers in one place.

Perks: After filling out a single online loan application, youll be given up to four quotes from different lenders. To qualify, you must be at least 18 years old, have an annual income of $21,000, have a FICO score of 575 or greater and be purchasing a car with less than 125,000 miles and that is 10 years old or newer. By comparing multiple auto loan offers at once, you can pick the one with the interest rate, loan term and conditions that work for you and your budget without having to shop around.

What to watch out for: If you have poor credit, your interest rate could be on the higher side. Also note that you can use this platform if you live in most states, but not in Alaska or Hawaii.

| Lender |

|---|

Recommended Reading: Texas Fha Loan Limits

Auto Loan Rates By Credit Score

As mentioned, lenders use credit score as the primary determinant of a potential borrower’s ability to pay off a loan. So, the better your credit score is, the more competitive interest rates you will receive. Below are the average APRs for new and used vehicles in the second quarter of 2022 according toExperian.

| 20.43% |

Recommended Reading: Loan Companies That Take Life Insurance As Collateral

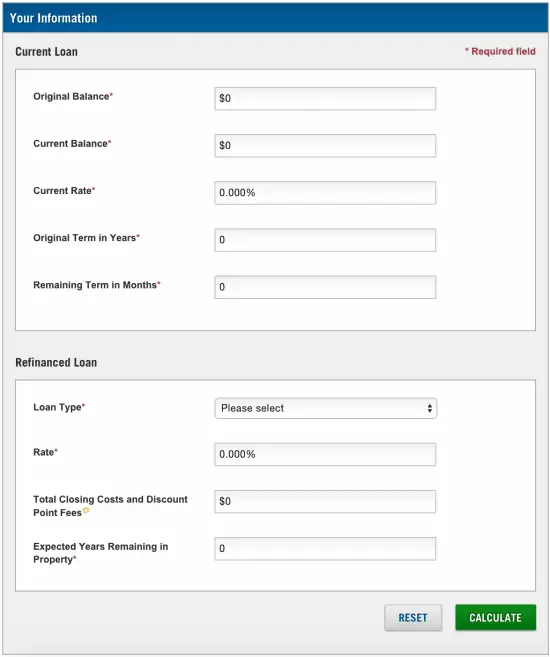

Capital One Auto Loan Rates And Calculators

Capital One auto loan calculatorsare tools that allow customers to estimate how much their auto loans will cost them and make better-informed car purchasing decisions. For more information about Capital Ones car-financing options, users can visit this page. For more specific questions, prospective borrowers can follow this link and scroll down for Capital Ones auto financing FAQ.

New And Used Car Loans

Capital One offers financing for new and used car purchases at over 12,000 participating dealerships. You can prequalify online and know what terms youre eligible for before you start shopping for the perfect ride. Furthermore, the Auto Navigator lets you adjust terms to build a car loan that works for your budget.

Don’t Miss: Huntington Bank Auto Loan Payment

What Happens If I Cant Pay My Car

If you cant resume payments and get caught up, your car can be repossessed. Worse, you could still owe money on your former car after you no longer have it. The repercussions can stick with your credit rating for years, making it hard to borrow money again, and increasing the interest on any loan you do get.

How The Application Works

Capital One allows you to apply as an individual or with a coapplicant. To get prequalified, youll need to submit some information about yourself and your finances, including your income and Social Security number.

If youre prequalified, you can use your finances to shop at participating dealerships for up to 30 days. The dealership will present you with a final loan contract.

Also Check: What Kind Of Auto Loan Can I Get

Capital One Not Alone In Decision To Dial Back On Lending

Capitol One Financials adjustment to its auto lending business strategy comes amid similar decisions from other financial institutions.

Citizens Financial Group also announced plans to taper its consumer lending, citing concerns over how a recession will impact business. The bank’s CEO, Bruce Van Saun, said during its second-quarter earnings call that the bank aimed to put mortgage and auto lending on a stable path and start to reduce auto originations. Van Saun described the move as a “return on capital cost.”

Similarly, , a subprime auto lender, sounded the alarm over the impact the economy had on loan performance in the second quarter of 2022. In its latest quarterly earnings report, the lender reported a decrease in forecasted collection rates for consumer loans assigned in 2020 through 2022.

“It’s likely due to a few factors,” Jay Martin, senior vice president of finance and accounting, said. “Obviously, the end of stimulus and supplemental unemployment benefits, and perhaps it took a little while for consumers to work through the savings they had accumulated during those programs. And then I think the other thing that’s impacting the consumer out there is just the inflationary environment.”

Can I Get An Auto Loan With Bad Credit

It is possible to get a car loan with bad credit, although having bad credit will raise the rates you’re offered. If you are having trouble getting approved or finding acceptable rates, try taking these steps:

- Make a large down payment: Making a larger down payment will lower your monthly payment, but it could also help you qualify for better rates.

- Consider a co-signer: A co-signer with good credit will take on some responsibility for your loan if you default, but they can also help you qualify.

- Reduce existing debt: Before applying for an auto loan, pay down as much debt as you can and avoid opening new accounts, like credit cards.

You May Like: Does Advance Auto Loan Out Tools

How Will Your Credit Score Affect Your Car Loan

The higher your credit score, the better rate youll receive on an auto loan. Borrowers with good credit can expect to receive an APR around 5.59% or lower for used car loans and 3.69% or lower for new cars. Its possible to get 0% financing from auto manufacturers, but 0% APRs are typically reserved for those with excellent credit and may only be available on certain makes and models.

Carvana: Best Fully Online Experience

Overview: Carvana lets you shop for a car online and pick up your purchase from a giant car vending machine. Its process lets you enjoy a unique experience, yet Carvana also offers competitive car loan rates and terms.

Perks: Carvana is a great option for those who want to shop for their new car from home, as well as those with poor credit. Carvanas only requirements are that you are at least 18 years old, make $4,000 in yearly income and have no active bankruptcies. When you prequalify, Carvana does not make a hard inquiry on your credit, so your credit score wont be impacted a hard inquiry is made only once you place an order.

What to watch out for: After you are prequalified, you have 45 days to make a purchase from Carvana inventory and either pick up the car, have it delivered to you or fly to the car and then drive it back.

| Lender |

|---|

| Varies |

Recommended Reading: Why Should I Refinance My Car Loan