You Cannot Qualify For Federal Loan Forgiveness

If you work for a nonprofit organization or government agency and have federal loans, you could qualify for Public Service Loan Forgiveness after making 120 monthly payments and working for a qualifying employer for 10 years.

However, only federal loan borrowers are eligible for PSLF and other forms of federal loan forgiveness. Once you refinance, youll no longer be eligible for loan forgiveness, even if you meet the programs other criteria.

Benefits Of Lowering Your Student Loan Interest Rate

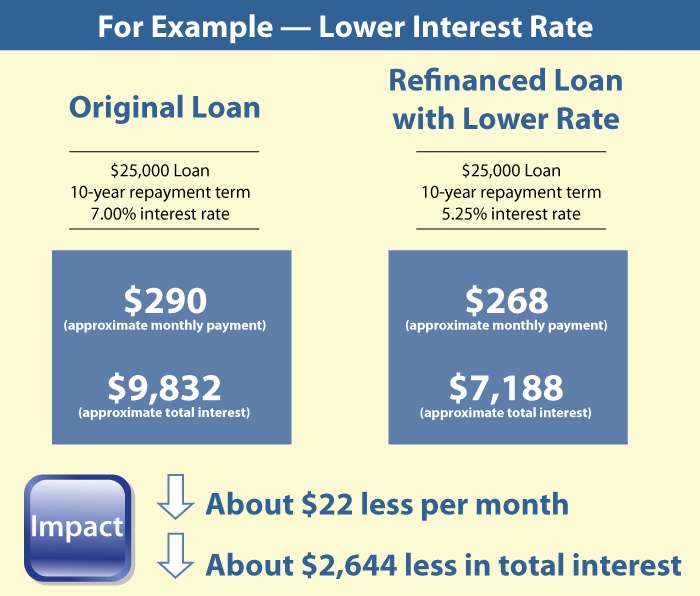

In the examples below, youâll see that refinancing can substantially reduce your monthly student loan payment while potentially saving thousands of dollars on the total principal and interest youâll pay on your student loans. Or, you can save even more on the total amount paid by keeping a similar monthly payment amount and reducing the term of your repayment.

In these examples, youâre a hypothetical law student who needs financing for three years of graduate level schooling. You also have loans covering your undergraduate years. You started college in 2000 and completed law school in 2007. You consolidated $130,000 of student loans into a federal consolidation loan in 2007 just before repayment started on 7/1/2007. Your interest rate is fixed at 6%. Your term is 30 years. In 2021, exactly 14 years after you started making payments, you decide to look at refinancing. You have excellent credit. You consider both fixed and variable interest rate loans. You also consider different loan terms.

In Example-1, you consider a refinanced loan with a term of only 5 years. You choose a variable interest rate since with such a short term, there’s less risk of the interest rate going up. The interest rate is 2%. You choose autopay reducing your interest rate another .25%. You have a five-year loan of 1.75%. Your remaining principal on the original loan is about $96,000.00.

Example-1

| 574.00 | 873.00 |

Example-2

| 619.00 | 916.00 |

Improve Your Credit Score

Its possible to get a student loan with a poor credit score. The federal government doesnt check your credit at all for federal student loans.

And while they do a credit check for PLUS loans, its only to ensure you havent defaulted on any prior loans. Your credit score doesnt affect approval or the interest rate.

But private lenders are very concerned with your credit score. You may still be able to get a loan with an average score, but your interest rate will be much higher.

To score the lowest rates, you must have excellent credit. So if your credit isnt great or you dont have a , you need to work on boosting your credit score. Dont worry. If youre under 18, you can still take steps to build credit.

Start by checking your credit report to see whats negatively impacting it. Once you have an idea, you can address any issues.

For example, if you have any past due payments, get caught up. If you have high balances on your credit cards, work on paying them down. As a general rule, you want to maintain balances of no more than 30% of your credit limit on each of your cards.

If youre a teen just starting to build credit, get a job. It wont directly impact your creditworthiness, but it does make you look good to creditors.

Then, open a teen-friendly checking account and high-yield savings account and start squirreling away a certain percentage of your weekly pay. You can even ask your parent or guardian to put a bill or two in your name.

Don’t Miss: Usaa Car Payment Calculator

How To Qualify For A Student Loan Refinance

Generally, qualifying for a student loan refinance requires a credit score at least above 600. To check your credit score, visit a website that offers them for free, or check if you receive a free monthly score from any financial institutions you do business with. Some banks and lenders provide free credit scores to customers.

Some lenders also have income thresholds. For example, Citizens Bank requires a total income of $24,000 in order to refinance, while CommonBond requires a total income of $65,000.

If you dont qualify for a loan refinance by yourself, you can ask someone to co-sign the loan with you, like a parent. Theyll need to meet the lenders credit score and income requirements in order to co-sign. The loan will stay on their credit report until you pay it off, which could impact their ability to qualify for a loan of their own.

Use A Cosigner When Refinancing

If you have less-than-perfect credit, you might be able to lower your interest rates by refinancing your student loans with a cosigner. A cosigner is typically a friend or relative with good or exceptional credit as well as reliable income who will share responsibility for the loan.

Adding a cosigner reduces the risk to the lender, which could improve your chances of qualifying for a lower interest rate.

Keep in mind:

To qualify for cosigner release, youll typically need to:

- Make consecutive, on-time payments for a specific amount of time

- Meet the lenders eligibility criteria on your own

If youre approved for cosigner release, your interest rate will likely stay the same. Here are Credibles partner refinancing lenders that offer cosigner release:

| Lender |

|---|

|

All APRs reflect autopay and loyalty discounts where available | 1Citizens Disclosures | 2College Ave Disclosures | 5EDvestinU Disclosures | 3 ELFI Disclosures | 4INvestEd Disclosures | 7ISL Education Lending Disclosures |

Also Check: Usaa Rv Loan Rates

Private Student Loan Interest Rates

Private student loans are funded by banks, credit unions and online lenders, so interest rates vary from lender to lender. Many private student loan lenders offer both fixed and variable rates, so your interest rate could fluctuate over the life of the loan if you choose a variable-rate option.

Most student loan lenders set rates based on the Libor or the prime rate. However, while rates are tied to this benchmark, private lenders also typically evaluate your credit score, income and financial history to determine your interest rate. Generally, the better your financial health and credit score, the lower your interest rates will be. In order to access this information, many lenders will run a hard credit inquiry, which can knock your credit score down a few points although you can usually get a preview of your rates and terms with only a soft credit check.

If You Want To Adjust Your Repayment Term

The standard repayment term for federal student loans is 10 years. Extending your repayment term can lower your monthly payments, but you may pay more in interest over the life of the loan. Heres how you can adjust your repayment period:

- Enroll in an income-driven repayment plan. When you enter into an IDR plan, your term will be 20 or 25 years, depending on which plan you choose.

- Consolidate your debt. If you consolidate your loans with a federal direct consolidation loan, your repayment term can be as long as 30 years.

- Opt for extended repayment. Under an extended repayment plan, your repayment term can be as long as 25 years.

Read Also: Usaa Auto Loan Application

Different Loans For Different Folks

Before getting into the different types of available loan programs, lets do a quick refresher on how exactly student loans work. Like any type of loan , student loans cost some small amount to take out and they require interest and principal payments thereafter. Principal payments go toward paying back what youve borrowed, and interest payments consist of some agreed upon percentage of the amount you still owe. Typically, if you miss payments, the interest you would have had to pay is added to your total debt.

In the U.S.A., the federal government helps students pay for college by offering a number of loan programs with more favorable terms than most private loan options. Federal student loans are unique in that, while you are a student, your payments are deferredthat is, put off until later. Some types of Federal loans are subsidized and do not accumulate interest payments during this deferment period.

Download Your Credit Report

If you have private loans educational or otherwise your credit report is the best way to get the full run-down. You can get your credit report free once a year from AnnualCreditReport.com, and you’ll receive the information held by all three major credit bureaus. It will include all of your student loans including federal loans as well as outstanding amounts and lenders. So if you’re not sure if your loans are federal or private , this is great way to find out.

You can see the names of all the federal loan servicers that handle federal student loans for the Department of Education here: Student Loan Servicers: Who They Are & How To Contact Them

You May Like: How Much Car Can I Afford For 300 A Month

Use Auto Pay And Save

Auto Pay automatically withdraws your student loan payment from your checking or savings account on a specific date, and can help you save in a few different ways.

First, you can sign up for Auto Pay while you’re still in school, which will help you get a head start on your payments and save money in the long run.

Once you enter repayment, you can receive an interest rate reduction of 0.25% on your federal Direct loan while you’re making payments using Auto Pay. You may qualify for a benefit from your other lenders as well, so be sure to check with them. This reduces the total amount that you pay over time. Finally, signing up for Auto Pay also means you won’t miss any payments!

Cant Get A Lower Rate Don’t Panic

Refinancing isnt for everyone, and a 0.25% discount goes only so far. But there are other ways to save on interest.

-

Prioritize high-interest student debt. If youre tackling your student loans aggressively, direct your extra payments to those with the highest interest rate. But dont neglect your other loans pay the minimum amount due on all of your debt each month to avoid defaulting.

-

Stick to the standard repayment plan. Youll be done paying your loan and the interest after 10 years if you stick to the standard federal repayment plan. While income-driven plans may sound appealing because they can lower your monthly payment, they also increase the total amount of interest you pay.

-

Pay off your loan faster. This ones easier said than done. But if you rework your budget or get a side hustle, you can pay off your student loans early and save on interest in the process. If you pay more than the minimum payment, ask your lender or federal student loan servicer to apply the extra payments to your current balance instead of your next payment.

Also Check: How Long Do Sba Loans Take To Get Approved

Could 0% Interest Rates Settle The Student Loan Debate

Jason Armesto

The student loan debt has become a topic of conversation nationwide, and for good reason: Since 2003, total student loan debt has grown more than 600% to $1.7 trillion. The weight of that debt has fallen on the shoulders of most college-educated American adults, with 65% of them still paying off student loans.

Many people argue the solution is for the federal government to cancel debt outright. President Joe Biden has listened, at least to an extentâhis administration has forgiven more than $11 billion in student loans since taking office.

Still, some critics say he has not gone far enough, while others think canceling debt is unfair to those who never attended college. While the debate about student debt cancellation rages on, thereâs far less discussion about cancelling interest rates for federal loans. Why not? Thatâs a question Ben Carlson, director of institutional asset management for Ritholtz Wealth Management, addressed in a blog post in August.

âItâs an interesting thought but I havenât seen where thatâs getting any traction,â says Barry Coleman, vice president of counseling and education programs at the National Foundation for Credit Counseling. âI havenât seen any proposals coming out of the federal government other than just forgiveness for those that have already borrowed.â

Could addressing interest rates offer a compromise in the debate about what to do about student loan debt? Hereâs what two experts told Fortune.

Opt For A Shorter Repayment Term

A shorter repayment period always results in less total interest paid over the life of the loan. The standard repayment term is 10 years for Federal Direct Loans, but borrowers may be eligible to choose repayment terms as long as 30 years. The repayment periods for private loans vary and are set at the time the promissory note is signed.

Recommended Reading: Usaa Auto Loan Rates Used Cars

Contact Your Loan Servicer

With private student loans, you can call your loan servicer and ask them to reduce your interest rates. If you have a good credit score, theyâll know you have refinancing options that might give you a better interest rate. If that is the case, the bank may lower your interest rate to keep from losing your business. This is much easier than student loan refinancing.

You Wont Qualify For Future Federal Forgiveness Measures

During President Bidens campaign, one of his proposals was partial student loan forgiveness. In recent months, there has been renewed discussion over loan forgiveness measures.

However, any of Bidens student loan initiatives will likely only apply to federal student loans. If you refinance, your debt will be transferred to a private lender and you wont qualify for any potential loan forgiveness provisions.

You May Like: Usaa Car Loan Refinance

Shop Around And Compare Student Lenders

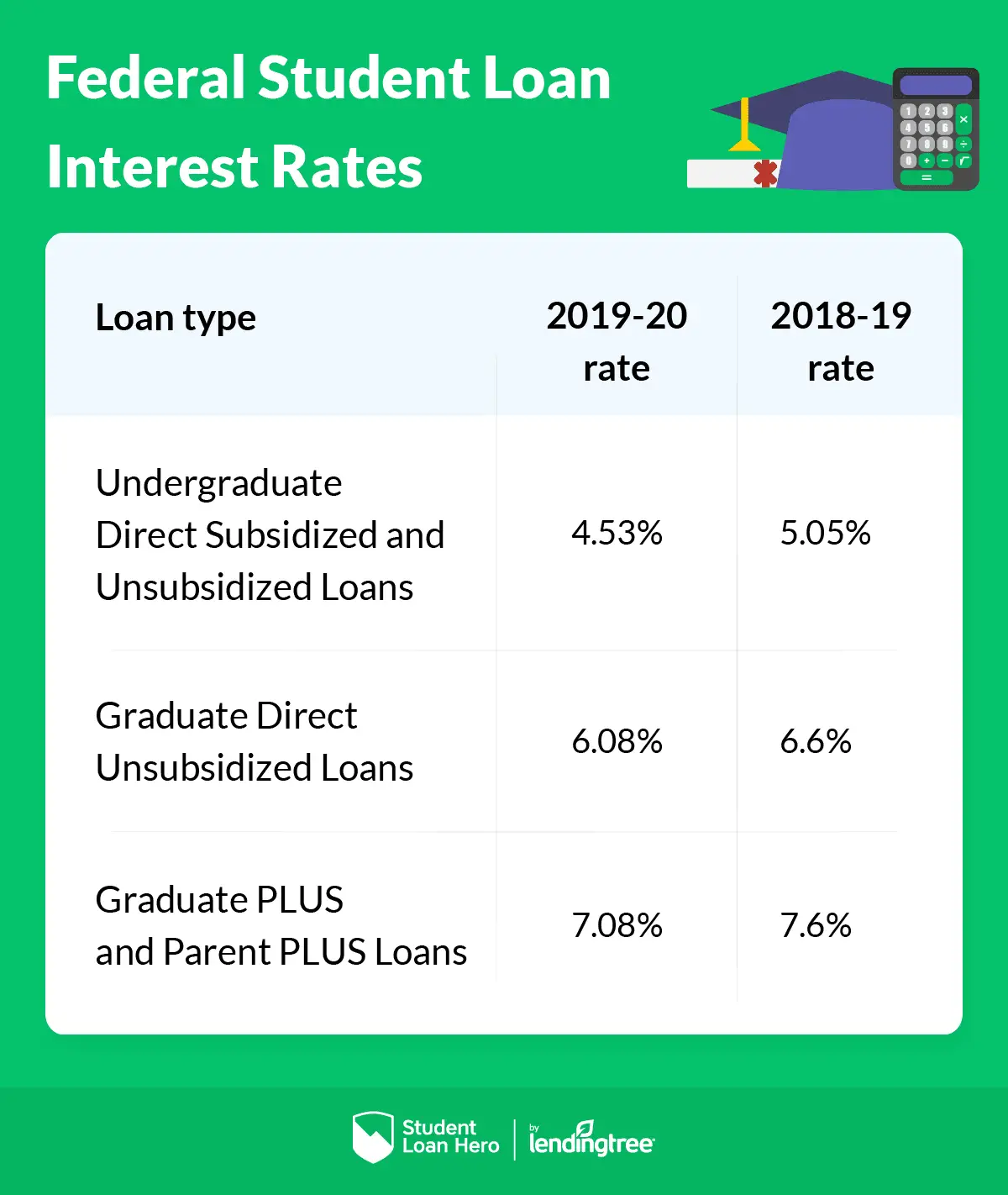

Unlike federal student loan rates, which are the same for all borrowers, rates can vary widely from one private lender to another.

Since your goal of refinancing is to save as much money as possible, youâll want to shop around to find the lender that offers you the best loan terms. You can visit Credible to compare rates from multiple lenders at once to see which offers you the most competitive rate.

STUDENT LOAN REFINANCING RATES ARE DECLINING â HEREâS WHY

Sign Up For Automatic Payments

Many lenders will give you a small interest rate deduction if you sign up for automatic payments. This means that each month, your payment is automatically deducted from your bank account.

If you are confident you would have the funds to cover the monthly payment, this could also help you avoid late payments and any fees that go along with that.

Read Also: Using Va Loan For Investment Property

Refinance Through A Private Lender

Another way to lower your monthly student loan payments is to refinance through a private lender. Refinancing can score you a lower interest rate and lower your monthly payment.

You can refinance both federal and private loans with a private lender. However, bear in mind that if you refinance federal loans, you’ll lose access to perks such as income-driven repayment and Public Service Loan Forgiveness.

Here’s how it can work for you: Let’s say you currently pay $500 a month on a $50,000 loan. If you have a good credit score and refinance at a 5.69% fixed interest rate, you can lower your monthly payment to $349 a month.

Check our Student Loan Refinancing Calculator to find out how much you could save.

Whichever path you end up taking, the first step is reaching out to NelNet. If your account is past due or you can’t make make an upcoming payment, don’t be afraid to call them. As your service provider, they’re here to help. Learn more about the role of a service provider on the blog.

Get Your Credit Ready For Refinancing

If you’re seriously considering refinancing your student loans, either now or in the future, the better your credit profile looks, the lower your interest rate will be. Building credit can take time, but the additional savings can be worth it.

Start by checking your credit score and reviewing your credit report to get an understanding of your overall credit health and what’s impacting your score negatively. Then take steps to address potential issues, such as high credit card balances and past-due accounts.

If you want to refinance sooner but don’t have stellar credit, consider asking a loved one who has excellent credit to cosign your loan application. While this arrangement isn’t ideal, it can be a good option if your credit has some major issues that will take longer to resolve.

Also Check: How Long For Sba Loan Approval

Improve Your Credit Score And Debt Ratio

Student loan refinance loans also differ from federal student loans in that the interest rate you are offered depends on your financial credentials. Borrowers who appear to have a lower risk of default will be offered a loan at a more competitive rate.

Two of the key things lenders look at when assessing the risk of giving you a loan are:

Your credit score is a measure of how responsible you have been for paying bills in the past, while your debt-to-income ratio compares debt payments to income. The higher your credit score and the lower your debt-to-equity ratio, the more confidence lenders have that you will repay your loan. This translates into lower rates.

The good news is that paying down your debt can help improve both your debt-to-equity ratio and your credit score, so you can become a better-qualified borrower and improve your chances of getting a loan at historically high rates. todayâs low. You might also consider asking someone with good credit and a high income relative to their debt to act as a co-signer for you.

If youâre ready to explore your savings opportunities, visit Credible today to get prequalified student loan refinance rates without affecting your credit score.

WHAT ARE THE STUDENT LOAN REFINANCING RATES?