What Is A Buydown

A buydown is a way for a borrower to obtain a lower interest rate by paying discount points at closing. Discount points, also referred to as mortgage points or prepaid interest points, are a one-time fee paid upfront. In the case of discount points, the interest rate is lower for the loan term.

In an alternate form of buydown, the points purchased reduce the interest rate for the first few years of the loan. This arrangement is typically paid for through funds escrowed by the seller. Since the interest rate is lower during this time, the borrowers monthly mortgage payments are more affordable.

Why Would Someone Borrow Cryptocurrency

Borrowing cryptocurrency allows people to use cryptocurrency without having to sell what they own. In other words, rather than needing to sell $700 worth of XBTC to buy a new phone, you could simply borrow $700 worth of XUSDC, offering your XBTC as collateral, buy your new phone, then pay back the $700 that you owe and get your XBTC back. In this way, you keep your price exposure to XBTC, keep on HODLing, but still get access to those funds.

But borrowing cryptocurrency goes beyond being able to make real-world purchases without losing your crypto funds. Cryptocurrency borrowing allows you to chase long and shorts in the market while reducing the risk of losing your preferred price exposure. Lets explore a few examples of use cases for crypto borrowing to understand why this is such an exciting option for so many people.

Example 1: Long trading through crypto borrowing

Heres an example of how borrowing crypto helps with longs: lets say you have Token 1, and you dont want to sell Token 1, but youre very interested in Token 2 because you think its price may go up by 30% in the next year. In this scenario, you may decide to borrow 45% worth of your Token 1 in the form of a stablecoin and use that to buy Token 2.

Example 2: Short trading through crypto borrowing

Example 3: Chasing NFTs

Understanding The Different Lender Tier Options

With the newly imposed mortgage regulations taking a toll on Canadian mortgage borrowers, many have started looking towards alternative lenders. Following regulatory changes, mortgage brokers claim as much as a 20% uptick in rejection rates. This has created an opportunity for mortgage investment corporations, private lending options and credit unions to fill the gap that the primary lenders have left wide open.

It is unfortunate that some would be qualified borrowers prior to the regulatory measures have been shunned by the institutional banks. However, the stress test with alternative lenders is more lax and does not come with all the newly imposed stringent qualification procedures looking to cool the housing market.

Institutional lenders including the likes of CIBC, RBC, BMO, TD and Scotiabank are oftentimes referred to as A lenders. These are lenders that offer the lowest interest rates but with the most strings and qualification criteria attached including the newly imposed mortgage stress test.

Lending institutions that fall directly below these A lenders are known as B lenders. The barrier of entry for acquiring a mortgage through this channel is slightly lower. Meaning, the qualification procedure is not as stringent. If you have a lacking credit history for example, this is where a B lender would have some flexibility to accommodate your case.

Also Check: Capital One Auto Loans Rates

How Does Credit Card Interest Work

Unlike auto and home loans, banks and lenders have no collateral to collect in the event that a borrower defaults or stops making payments on their credit card. As a result, credit cards will have a higher interest rate than other loan types to offset overall losses. The average credit card interest rate is in the 14-24% range.

Credit card balances are limited. If you handle them correctly, you can avoid paying significant amounts of interest. Credit cards are a great tool if you know how to manage them, but you dont want to end up with too many credit cards that you cant manage the balances.

How To Reduce Interest Paid

Making extra repayments towards your home loan is one way to reduce the overall cost. The more frequently you make repayments, the less total interest you will pay.

Another way to reduce the interest paid is with our offset sub-account. A loans.com.au offset sub-account is a sub-account within your home loan account where you can deposit your salary, and rental income. . You can then redraw the funds from the loan when you need them if you made extra repayments towards your mortgage.

When calculating your home loan interest, your home loan balance is reduced by the amount you have in your offset sub-account. This means you’ll pay less interest.

As an example, if you have a loan balance of $300,000 and a $20,000 in your offset sub-account, you will be charged interest on only $280,000. This is because $300,000 – $20,000 = $280,000.

Shopping around and comparing loans will help you get the best home loan rate in Australia. You can use our handy home loan calculator to determine how much interest you will need to pay on loans of various sizes, interest rates and lengths.

Compare our home loan interest rates and features to find the best home loan that is right for you.

Tags: home loan interest rates | variable rate home loan

Don’t Miss: Credit Score Usaa

Why Do Interest Rates Change

There are a number of things the RBA will take into account when deciding whether to change the cash rate. Chief among them are domestic conditions, such as employment and inflation, though global financial conditions are also important.

If the economy is booming and high demand is pushing up prices, the RBA might increase the cash rate to make sure inflation doesnât spiral out of control. And if the economy is weak and demand is low, the RBA might decrease the cash rate to encourage spending, borrowing and investment.

Why Do Banks Charge Different Interest Rates

While the cash rate is one of the main things banks will consider when setting commercial interest rates, itâs not the only one. Banks will also be keeping an eye on overhead costs, as well as maintaining a healthy margin between the loan and deposit rates theyâre offering.

Generally speaking, online banks tend to offer cheaper home loan rates and more generous savings account rates than their larger counterparts, as they have fewer overhead costs to worry about. The flipside to this is that larger banks tend to offer more when it comes to physical branches and face-to-face services.

Recommended Reading: Usaa Rv Financing

How Buydowns Are Structured

Since buydowns are negotiated, they can be arranged in a variety of ways. In addition to buydowns over the life of the loan, common structures that lenders use are the 3-2-1 buydown and the 2-1 buydown. However, regardless of the structure, the principles are the same.

The buyer, seller or builder will pay the lender the difference between the standard interest rate and the lowered rate through points at closing. The buyer will benefit from the reduced interest rate until the buydown expires, usually after a few years. Not all buydowns expire. If it does, the buyer will have to pay the standard interest rate for the remainder of the term, which will cause their monthly mortgage payments to increase.

What Is Your Credit Record

Your is a three-digit number ranging from 000 to 999. The higher it is, the better your chances of home loan approval, and the better the interest rate you are offered. Factors such as your debt repayment history, amounts owed, and types of credit applied for, are taken into account when calculating your credit score. Basically, your credit score reflects your financial health.

Scores below 600 are considered poor, and reduce your chances of home loan approval. A score above 670 is considered excellent, and would likely earn you a home loan with favourable interest rates.

You can find out your credit score by using ooba Home Loans free, online tool, the Bond Indicator.

Also Check: Nslds.ed.gov Legit

Are There Limits On Buydowns

If youre interested in a mortgage buydown, you should consult a lender, as some restrictions apply. Buydowns are only eligible when purchasing or refinancing principal residences and second homes. Typically, buyers must qualify for the standard interest rate of the zero-point loan to be able to buy down a mortgage.

Why You Should Apply Through A Bond Originator

A bond originator, also known as a home loan comparison service, such as ooba Home Loans, can be a powerful ally when applying for a home loan. They submit your home loan application to up to nine banks, including your own, and liaise with the banks on your behalf. They provide you with quotes from each bank so you can see which ones are offering the best deal.

This can save you significant resources in the long-term, as you may find that one of the banks is willing to offer you lower interest rates than your own.

ooba Home Loans also offers a range of tools that can make the home buying process easier. Start with their Bond Calculator, then use the ooba Home Loans Bond Indicator to determine what you can afford. Finally, when youre ready, you can apply for a home loan.

Get a free home loan comparison

Multiple quotes from the big banks to compare.

Don’t Miss: Fha Maximum Loan Amount Texas

How Does Your Credit Score Affect Mortgage Interest Rates

Your credit score is an important indicator of how you’ve managed your debts in the past, so it’s a crucial factor in determining whether you qualify for a mortgage and what your interest rate will be.

Most mortgage lenders will have a minimum credit score requirement, which can vary by lender and the type of loan you’re applying for. Just because you have a high credit score, though, doesn’t mean you’re eligible for a low rate. Lenders will also review your credit report, debt-to-income ratio and several other pieces of information to calculate your rate.

Because your credit score is such an important factor in the mortgage process, it’s crucial to take steps to get your credit ready for a mortgage. Ways to do that include:

- Check your credit score to see where you stand and your credit report to determine if you need to address specific areas of your credit history.

- Pay down credit card balances and other debts.

- Avoid applying for credit in the months leading up to applying for a mortgage.

- Make it a priority to pay your bills on time every month.

- Dispute inaccurate information on your credit reports, if applicable.

Getting your credit ready for a mortgage can take time, but again, even a small reduction in your interest rate could save you thousands of dollars.

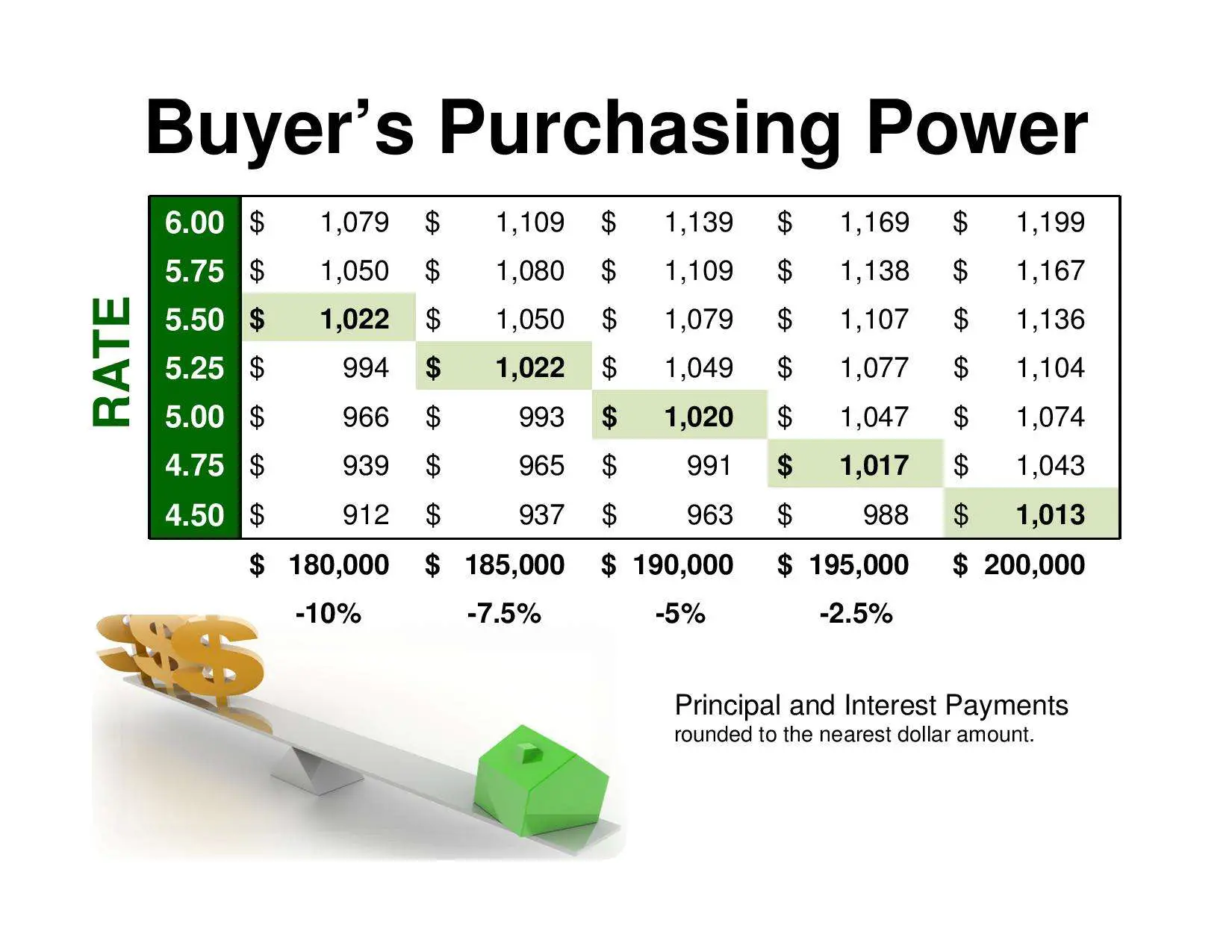

How Much Mortgage Can I Afford

The amount of mortgage you can get will depend on multiple factors such as your down payment, income, and debt load. Since every person has a different situation, lenders typically use two quick calculations to determine how much mortgage you can afford: Gross Debt Service and Total Debt Service .

Your total housing costs cant exceed 32% of your pre-tax income with your GDS ratio. To qualify under the TDS ratio, your housing costs, plus any outstanding debt, cant exceed 40% of your pre-tax income. Note that some lenders may have higher GDS and TDS requirements if you require mortgage loan insurance.

Keep in mind that these ratios are used by financial institutions to quickly figure out how much you can reasonably afford. They dont include your lifestyle costs such as travel, hobbies, raising kids, and retirement savings. They also use pre-tax dollars, which makes no sense since we get paid with after-tax dollars. In other words, you should never stretch out your budget when buying a home, or youll just be house poor.

Recommended Reading: Chfa Loan Colorado

Whats The Difference Between An Interest Rate Vs A Comparison Rate

Interest rates play a big part when deciding which home loan is best for you. People often focus on the advertised rates without knowing how much a mortgage will really cost. But this is when you need to pay a little more attention to the comparison rate.

The Comparison Rate shows you how much interest you are paying on the loan when all fees and charges are added in, providing you the true cost of the loan, versus the interest rate on its own. Here is a simple example:

Hot To Be A Fast Efficient Rate Shopper

Now lets talk about smart rate shopping moves.

Yes, it takes some work to find the best mortgage rate. But the time and effort you put in should pay off nicely.

There could potentially be thousands of dollars worth of savings on the line. So the time you spend searching for a lower mortgage rate could net the best hourly rate youll ever earn.

Read Also: Capital One Pre Approved Car Loan

Why Would Someone Lend Cryptocurrency

Lending cryptocurrency allows you to earn interest on the cryptocurrency that you own, offering a way to put your money to work for you. When combined with yield farming and staking, cryptocurrency lending is simply another way to earn more cryptocurrency while relying on a system of smart contracts to execute the transactions for you. Because the interest rates on Proton Loan are variable, you can loan cryptocurrency depending on the current interest being offered to you allowing you to shop around, time your loans, and make the most profit possible.

Do The Interest Rates Change On Proton Loan

Proton Loan features variable interest rates that respond to market pressures on our platform. The Proton Loan protocol was designed to adjust to supply and demand, meaning that the interest rates will increase as more liquidity is borrowed, and decrease as more liquidity becomes available. In this way, Proton Loans responsive interest rates empowers borrowers and lenders to seek out the interest rates that best suit their investment strategies and risk tolerances.

Heres an example: Imagine there is 1 million XUSDC in the pool and you borrow $100,000 worth. In this example, the interest rate on your loan may be less than 1% APY. However, what if you borrowed much more of that pool like $950,000 worth? In this case, the interest rate may suddenly be closer to 90% APY. When this happens, lenders may see that the interest rate of the XUSDC pool has become quite high, which is attractive to lenders leading them to deposit more XUSDC into this pool. This leads the interest rate to begin to drop in the pool, allowing more borrowers to take out a loan.

The Proton Loan interest rates fluctuate with borrowers and lenders the more borrowers, the higher the rate of return for lenders, and vice versa.

Read Also: Usaa Used Car Refinance Rates

The Bottom Line: Buydowns Can Save Buyers Cash

Generally speaking, mortgage buydowns enable buyers to lower their monthly mortgage payments either permanently or in the first few years of their loan. By paying discount points at closing, buyers can reduce their interest rates slightly, which can lead to long-term savings.

However, buydowns are not appropriate for all buyers. If youre interested in buying down your mortgage, you should calculate your breakeven point to ensure the amount of time it takes to recover the money spent on points is worth the upfront investment.

Alternatively, there are plenty of ways to get a better mortgage rate, which may save you even more money over time. If youre ready to move forward, you can apply online!

Is your mortgage rate still over 3%?

Refinancing now could save you thousands over the life of your loan. Get started below to see how Rocket Mortgage can help.

How Does Mortgage Interest Work

Taking out a mortgage loan is the largest loan most consumers will ever have, so its important to consider all the aspects of buying a home. The interest that mortgage lenders charge on the amount they lend to home buyersis based on the buyers credit and the overall economic trends in the country.

Over the past 40 years, the average mortgage rate, or interest rate on a mortgage loan has fluctuated between 3.56% and 16.64%. While purchasing a home is a great example of a financial goal, before you take out a mortgage loan, its important to do your research to determine if now is the time to buy.

If you want to find the best loan, take a look at each lenders quote carefully. Be sure to consider:

- Interest rates

- Administration fees

- Brokerage fees

Some of these costs may be included in the APR. Make sure that you inquire about what is covered before making a side-by-side comparison.

As of 2019, the average mortgage loan interest rate is around 4-5%.

Read Also: Apply For Capital One Auto Loan

Calculating Interest On A Car Personal Or Home Loan

These loans are called amortizing loans. The mathematical whizzes at your bank have worked them out so you pay a set amount each month and at the end of your loan term, youâll have paid off both interest and principal.

You can use an interest calculator to work out how much interest youâre paying all up, or, if youâd rather do it by hand, follow these steps:

1. Divide your interest rate by the number of payments youâll make in the year . So, for example, if youâre making monthly payments, divide by 12.

2. Multiply it by the balance of your loan, which for the first payment, will be your whole principal amount.

This gives you the amount of interest you pay the first month.

So for example, on a personal loan of $30,000 over a period of 6 years at 8.40% p.a. and making monthly repayments:

Because youâve now begun to pay off your principal, to work out the interest you pay in the following months, you need to first calculate your new balance. So:

1. Minus the interest you just calculated from the amount you repaid. This gives you the amount that you have paid off the loan principal.

2. Take this amount away from the original principal to find the new balance of your loan.

To work out ongoing interest payments, the easiest way is to break it up into a table. So using the above example, your calculations might look like this: