Go Autos Car Loan Calculator

Purchasing a vehicle usually requires a significant financial investment. Even a modestly priced vehiclelets say $8,000 to $10,000is more than most people can afford to pay with cash. Which means most people need to take out an auto loan in order to buy a car. But loans come with monthly payments, and it can be hard to figure out how much youre likely to pay once you factor in things like the loan term, the interest rate, the payment frequency, and the trade-in value. To be totally honest, its pretty confusing. But dont worry. Our car loan calculator can do all the hard work for you.

What To Know To Get The Loan You Need

If youre in the market for a new car, its likely the vehicle will come with a loan attached. Chances are you dont want to pay too much for that loan either, so its important to plan ahead. Here are four key things you need to know to accurately calculate a car loan and make sure the vehicle you want fits into your budget.

Why Is The Interest Rate For Used Car Loans Higher Than The Rates For New Car Loans

It is important to note that financing for used cars carries a higher risk for the lender compared to financing new cars. This is because the risk for a breakdown is higher for used cars, which in turn affects its resale value and pay off. Additionally, used cars are typically financed by buyers who have a lower credit score and who are in a relatively riskier financial position.

Recommended Reading: Should I Choose Fixed Or Variable Student Loan

Recommended Reading: Usaa Used Auto Rates

Do All Interest Rates Move In Line With The Cash Rate

Fixed home loan rates and term deposit rates are not tied to the cash rate in the same way that variable rate products are. While they may seem to move in line with the cash rate, theyâre more so a reflection of how the economy is faring.

Itâs more accurate to say that rates like these are influenced by government bonds. By buying up government bonds with the aim of driving down medium term fixed rates, the RBA effectively pushes fixed mortgage and term deposit rates lower.

What Is A Good Interest Rate On A Car Loan

Currently, under 6% is considered a good interest rate for borrowers with a credit score in the mid 600s.

If you have an excellent credit score, you may be eligible for lower interest rates ranging from 2 to 3%. Occasionally dealerships may offer a 0% interest car loan as a special promotion.

The interest rates could exceed 10 or 15% if you have a bad credit score. Interest rates are often lower on new cars than on used ones.

In the market for a new car? Our quick and anonymous car loan comparison tool will help you find a match:

Recommended Reading: Becu Fha Loan

Consider All Aspects Of The Loan

The monthly payment is the best indicator of how the car loan will impact your budget. It can give you a reality check on whether you can afford the vehicle. And though this figure is the easiest to understand, it isn’t the only number to be aware of.

It is also important to be aware of how much the loan will total, how much of a down payment you’re making, and how long the loan will be. The general rule for each of these is as follows:

Your loan payment should be no more than 15% of your take-home pay. The loan term should ideally be less than 72 months, and you should aim for a down payment of at least 10% or consider GAP insurance.

Keep in mind that everyone’s situation will be different, so these recommendations are not set in stone. Furthermore, these figures will differ for those who lease, so take a look at our articles for information specific to that scenario.

When you obtain a monthly payment, be it from a price quote, negotiation or advertised special, make sure you are aware of all the numbers behind it. What good is a low payment if it takes you 84 months to pay off the loan? Is the selling price for the car a good deal? What about the trade-in amount the dealership is offering for your car? Ask for the “out-the-door” figures from your salesperson and review them before making a decision.

Calculate A Payment Estimate

The selling price of the new or used vehicle for monthly loan payment calculation.Estimated sales tax rate for the selected zip code applied to the sales price.Add title and registration here to include them in your estimated monthly payment.Available incentives and rebates included in the monthly payment estimate.The value of your currently owned vehicle credited towards the purchase or lease of the vehicle you are acquiring. If you select a vehicle using the “Value your trade-in” button, the value displayed in the calculator will be the Edmunds.com True Market Value trade-in price for a typically-equipped vehicle, assuming accumulated mileage of 15,000 miles per year.The remaining balance on a loan for your trade-in will be deducted from the trade-in value.The cash down payment will reduce the financed loan amount.Generally available financing interest rate for the estimated loan payment.Your approximate credit score is used to personalize your payment. A good credit score is typically between 700 and 750, and an excellent credit score is typically above 750.

Read Also: Fha Build On Own Land

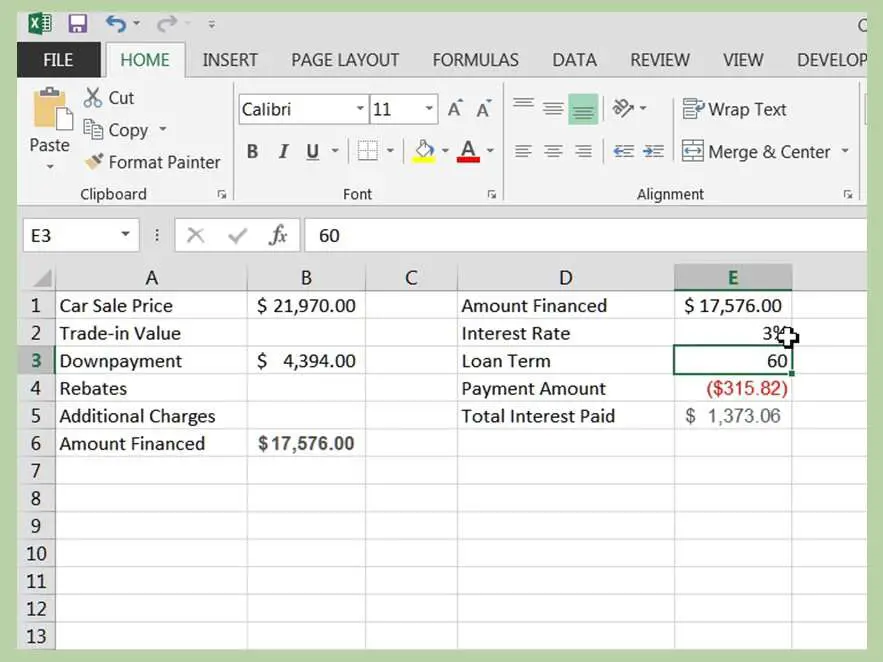

How To Calculate A Car Loan Payment

If youre using financing to buy a new or used vehicle, you should already know that youll have to pay back that loan over several months or years. But just how much will you owe each month, and what costs are included in those payments?

When purchasing a car, it is nice to know how to calculate your car loan payment. Calculating total and monthly costs allows you to budget accordingly and figure out the total price of the carnot just the sticker price.

The math involved can be overwhelming if you do not use math often, but finding a good car loan calculator and having the right information handy can save you a lot of time.

How Do I Calculate The Interest On My Car

Interest is calculated based on the amount outstanding at the end of each period. You can either use the Hardbacon Car Loan Calculator or apply some simple math. If you have a loan with a monthly repayment, you can calculate the monthly interest amount by the following formula:

For example, on a $10,000 loan outstanding with an interest rate of 6%, the formula would be:

Also Check: Upstart Prequalify

Use The Edmunds Auto Loan Calculator To Determine Or Verify Your Payment

You’re gearing up to buy your next car but aren’t sure what the monthly car payment will look like. Getting to a monthly payment usually involves some math, but the good news is that the Edmunds auto loan calculator will do the heavy lifting for you.

Let’s say you have your eye on a compact car or SUV. Choose the make and model you want, or alternatively enter the vehicle’s price into the auto loan calculator. It will ask for a few other details such as the down payment, the loan term, the trade-in value and the interest rate. After that, it will calculate the compound interest, estimate tax and title fees, and display the monthly payment.

This car loan calculator will help you visualize how changes to your interest rate, down payment, trade-in value, and vehicle price affect your loan. Take some time to experiment with different values to find an auto loan setup that works best for your budget.

What Credit Score Is Required For A Car Loan

There are no specific credit score requirements for obtaining a car loan. It is at the discretion of the lender. Most buyers with a score of 660 and sufficient income should have no difficulty getting approved for a car loan from a traditional bank or credit union.

A credit score is a number that reflects how risky your profile is to a lender. It is divided into categories ranging from poor to excellent . Creditors use it to decide if they will offer a loan, the terms and interest rates.

| Category |

|---|

| 760-900 |

When you apply for a car loan, lenders are not only interested in evaluating credit scores, but also details like your employment history, income or the cars value. Below that 660 score threshold, alternative lenders can be an attractive option. They offer more flexible standards, albeit at less favourable rates.

Don’t Miss: Maximum Fha Loan Amount In Texas

Defining Car Loan Terms

Find An Affordable Vehicle

While the thought of a brand new luxury SUV or bright red sports car is wildly tempting, remember to find a vehicle you can actually afford. Stretching too much to buy a car could leave you short on funds for other essentials, so spend within your means.

There are plenty of ways to get a feel for car prices in your area, such as online price guides and local newspaper ads. To give you a better picture of how much you can afford, focus on the sticker price of the vehicle. The car payment calculations can wait until later.

Recommended Reading: Can I Refinance An Fha Loan

Whats The Average Interest Rate On A Car Loan

According to the Federal Reserve, in the first quarter of 2021, the average auto loan rate on a 48-month new-car loan was 5.21%, and the average rate on a 60-month new-car loan was 4.96%.

A range of factors can affect what interest rates you might be offered, including your credit scores, the size of your down payment and the length of your loan term. Your rate may be higher or lower than average depending on your financial situation.

Do Not Forget About Car Insurance

Some people forget about the cost of car insurance while budgeting for a new car. It is essential to work that cost into your monthly budget. All 50 states require drivers to have some kind of auto insurance, so this step isn’t optional.

Insurance costs vary by the car you drive. If you’re considering a new car, get a new insurance quote. This quote will help you more accurately budget for your new car.

You May Like: Usaa Car Refinance Calculator

Why Do Interest Rates Change

There are a number of things the RBA will take into account when deciding whether to change the cash rate. Chief among them are domestic conditions, such as employment and inflation, though global financial conditions are also important.

If the economy is booming and high demand is pushing up prices, the RBA might increase the cash rate to make sure inflation doesnât spiral out of control. And if the economy is weak and demand is low, the RBA might decrease the cash rate to encourage spending, borrowing and investment.

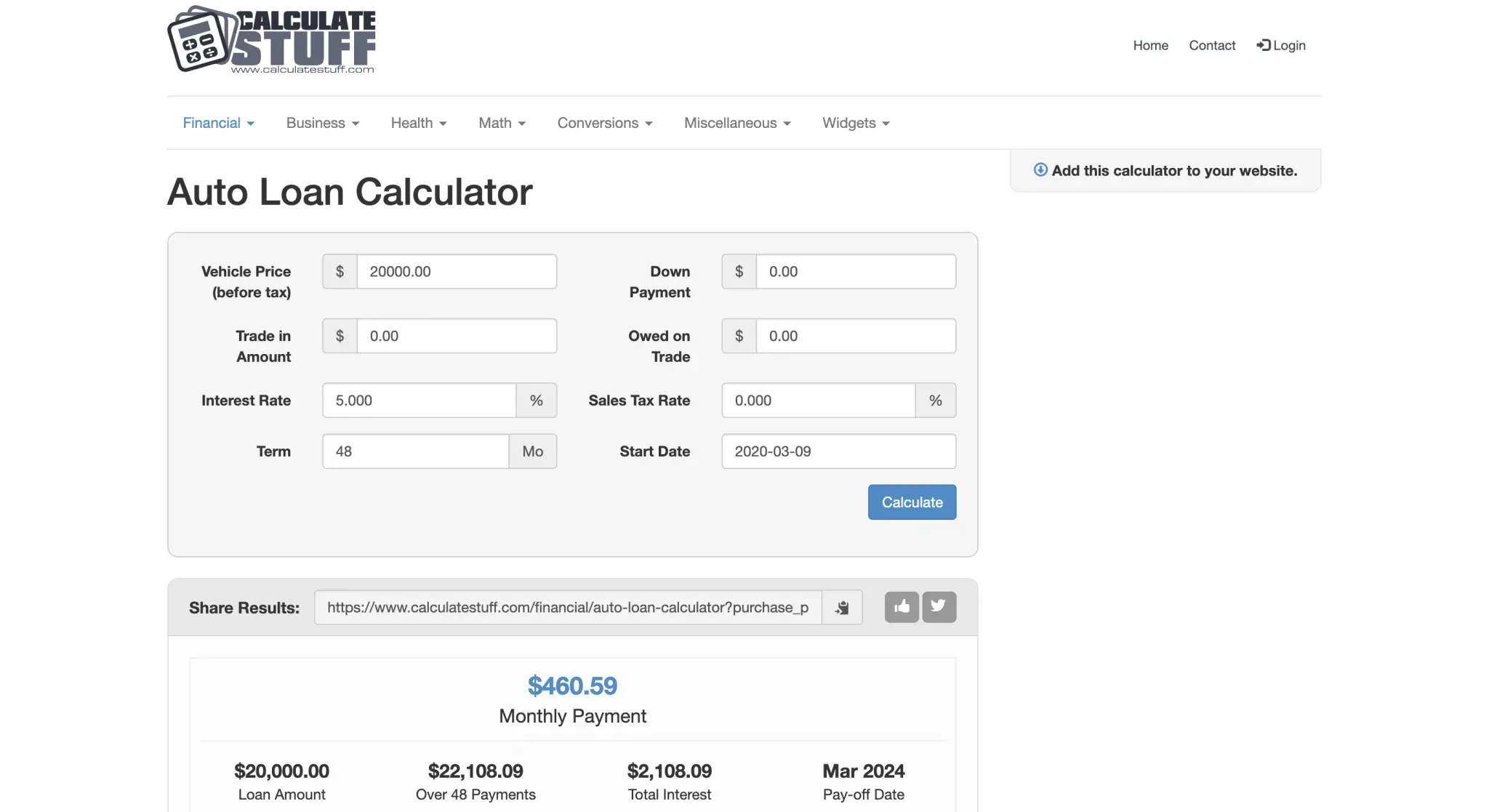

Understanding 0% Financing Vs Factory Rebate

Many times dealerships will offer a choice of 0% financing or a factory rebate. How do you know which is better? Figure out the interest you would pay for the life of the loan if you financed with your bank. If the interest is more than the rebate, then take the 0% financing. For instance, using our loan calculator, if you buy a $20,000 vehicle at 5% APR for 60 months the monthly payment would be $377.42 and you would pay $2,645.48 in interest. If the rebate is $1,000 it would be to your advantage to take the 0% financing because the $1,000 rebate is less than the $2,645.48 you would save in interest. Be aware though, that unless you have a good credit rating, you may not qualify for the 0% financing and this option may only be offered on selected models. People with poor credit are a major source of profits because they can be charged far higher interest rates. Some “buy here, pay here” dealerships specifically focus on subprime borrowers.

You May Like: Usaa Personal Loan With Cosigner

Calculating Auto Loan Payments

The First Necessary Step In The Car Buying Process

Whether you buy new or used, it’s wise to get pre-approved for a loan before you ever step on a car lot. Go to your bank or credit union and ask the agent if you qualify for a loan and how much. The agent will check your FICO credit score and other obligations and provide you with an amount and interest rate. A FICO score can be between 300 and 850. The higher the score the lower the interest rate you will be offered. People with a bad credit history may pay interest rates that are more than double prime rates. You can also shop for auto loans online if you aren’t concerned about where your personal information goes. Armed with a pre-approved loan you are now in control and have a choice to go with dealer financing or stick with your bank, whichever rate is lower.

You May Like: Is Loan Lease Payoff Worth It

Calculate Compound Interest On A Loan Using Fv Function

You can also calculate compound interest on a loan in Excel usingthe FV function.

Introduction to FV Function

Function Objective:

Calculates the future value of an investment based on a constant interest rate. You can use FV with either periodic, constant payments, or a single lump-sum payment.

Syntax:

| The total number of payment periods in an annuity. | ||

| Pmt | Required | The payment that is to be made per period. It is fixed or constant over the life of the loan or mortgage. Typically, pmt contains only the principal and interest but no fees or taxes. If pmt is omitted, you must include the pv argument. |

| Pv | Optional | The present value, or the total amount that a series of future payments is worth now. Also known as the principal. |

| Type | Required | The number 0 or 1. It indicates the time when the payments are due. If the type is omitted, it is assumed to be 0. |

Return Parameter:

Future value.

Step 1:

- First, we will select cell C10 and write down the formula below for compound interest for the first month.

Formula Breakdown:

- C4 = Rate = Annual Interest Rate = 4%

As we are calculating on monthly basis, we have divided it by the number of months in a year, 12.

- C7 = Npr = Total number of payments = 60

We have 5 years to pay back the loan. 5 years have a total of = 60 months

- 0 = Pmt = The payment made each period.

- -C8 = Pv = The present value.

Step 2:

You May Like: What Happens If You Default On An Sba Loan

Auto Loan Payment Calculator Results Explained

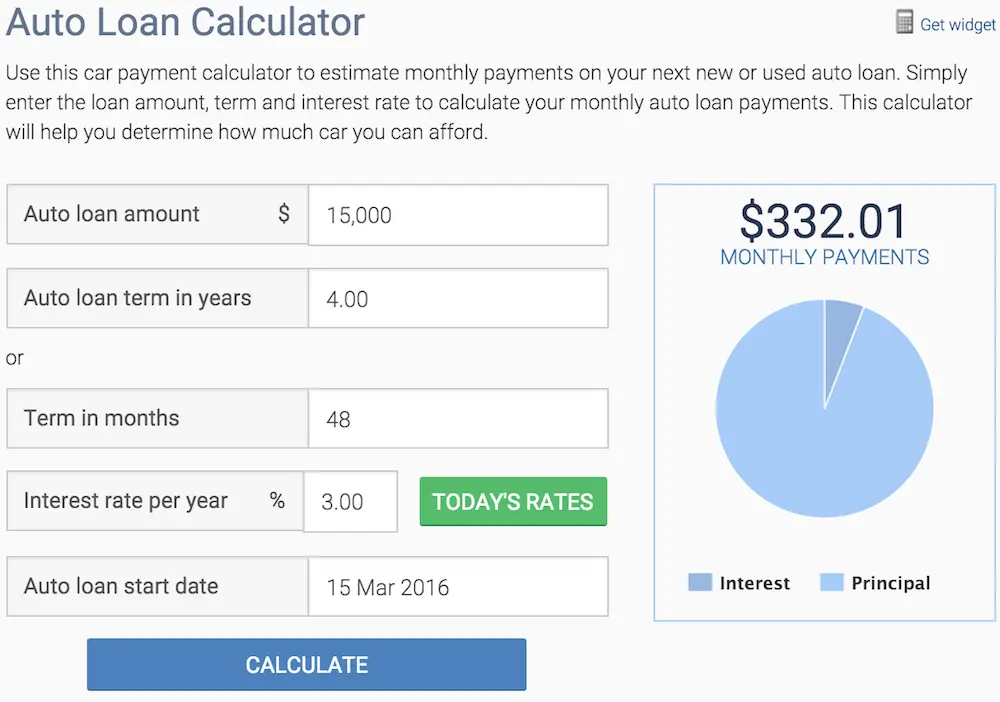

To use the car loan calculator, enter a few details about the loan, including:

- Vehicle cost: The amount you want to borrow to buy the car. If you plan to make a down payment or trade-in, subtract that amount from the car’s price to determine the loan amount.

- Term: The amount of time you have to repay the loan. In general, the longer the term, the lower your monthly payment, but the higher the total interest paid will be. On the other hand, the shorter the term, the higher your monthly payment, and the lower the total interest paid will be.

- New/Used: Whether the car you want to buy is new or used. If you don’t know the interest rate, this can help determine the rate you’ll get .

- Interest rate: The cost to borrow the money, expressed as a percentage of the loan.

After you enter the details, the auto loan payment calculator automatically displays the results, including the dollar amounts for the:

- Total monthly payment: The amount you’ll pay each month for the duration of the loan. Some of each monthly payment goes toward paying down the principal, and part applies to interest.

- Total principal paid: The total amount of money you’ll borrow to buy the car.

- Total interest paid: The total amount of interest you’ll have paid over the life of the loan. In general, the longer you take to repay the loan, the more interest you pay overall. Add together the total principal paid and total interest paid to see the total overall cost of the car.

You May Like: Do Private Student Loans Accrue Interest While In School