What Are The Downsides Of An Fha Loan

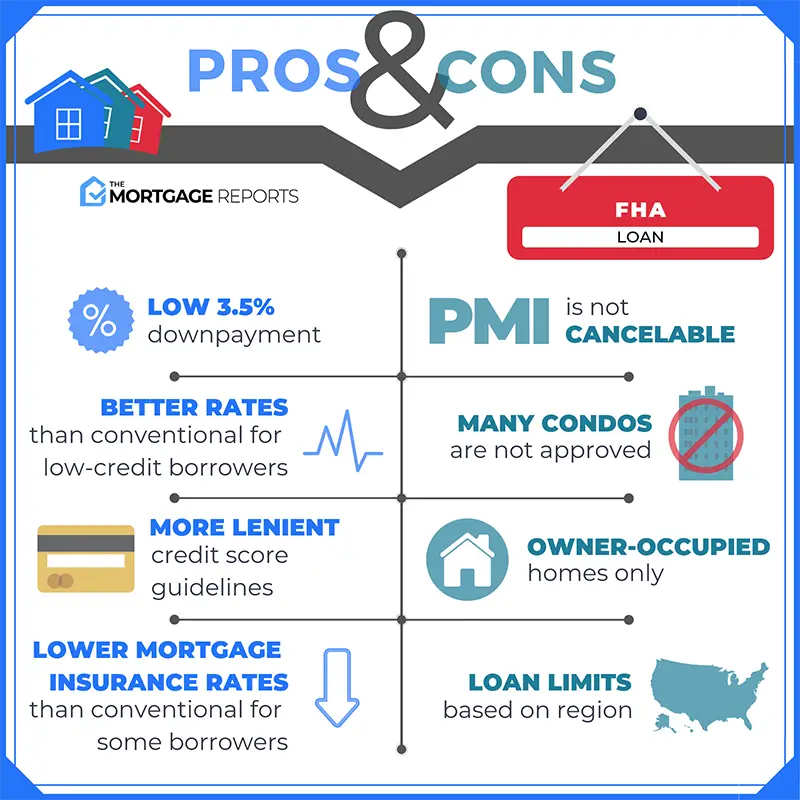

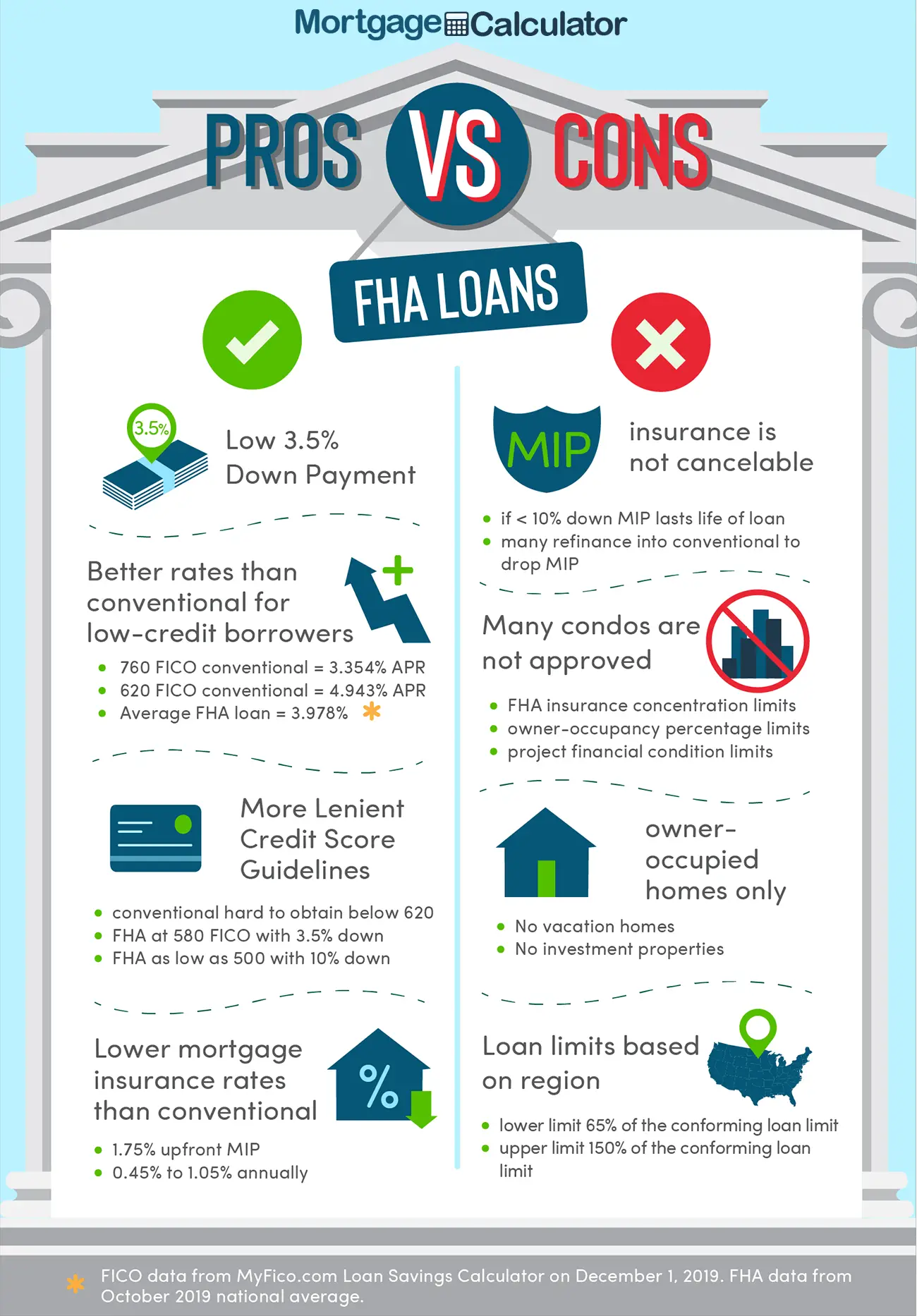

A major drawback of FHA loans is the high cost of FHA mortgage insurance, which must be paid for the life of the loan if you make the minimum 3.5% down payment. FHA county loan limits also curtail your buying power, since theyre set at 35% below conforming conventional loan limits in most counties in the U.S.

Income And Proof Of Employment

You will need to be able to verify your employment history to qualify for an FHA loan. You should be able to provide proof of income through pay stubs, W-2sand tax returns. There are technically no income limits, but you will need enough income to have an acceptable DTI ratio. Having a higher income will not disqualify you from receiving a loan.

You May Have Another Option For Lowering Your Mortgage Payments

The FHA loan streamline refinance process allows you to refinance your FHA loan to take advantage of lower Interest rates. Your mortgage must remain an FHA loan, and you have to be current on your payments.

The good news is that many lenders are currently offering this program with no closing costs.

This program doesnt require income and employment verification, credit checks or appraisals because your loan is staying intact as an FHA loan.

Dropping your interest rate by even half a point through this process can lower your monthly payment and give you peace of mind if you cant get rid of your mortgage insurance anytime soon.

You May Like: Auto Loans For Self Employed

How To Apply For An Fha Loan

Applying for an FHA loan will require personal and financial documents, including but not limited to:

-

A valid Social Security number.

-

Proof of U.S. citizenship, legal permanent residency or eligibility to work in the U.S.

-

Bank statements for, at a minimum, the last 30 days. You’ll also need to provide documentation for any deposits made during that time .

Your lender may be able to automatically retrieve some required documentation, like credit reports, tax returns and employment records. Special circumstances like if you’re a student, or you don’t have a credit score may require additional paperwork.

» MORE: Detailed FHA loan requirements

Why Should I Get Mortgage Insurance

There are two reasons you may want mortgage insurance: First, in some cases, the lender makes mortgage insurance a requirement. Second, FHA loans have lower interest rates than uninsured loans. Lenders require mortgage insurance if the borrower has gone through bankruptcy or foreclosure in the past two years or if the down-payment is less than 20% of the property value.

If you are planning to buy a home and do not have enough cash for a 20% down-payment plus closing costs, then FHA loans may be your best bet. If you are planning to get an FHA loan, the first step is getting pre-approved.

Read Also: Classic Car Loans Usaa

Where Can I Apply For An Fha Loan

The FHA doesnt offer loans directly, so youll need to contact a private lender to apply.

The majority of lenders are FHAapproved, so youre free to choose a local lender, big bank, online mortgage lender, or credit union.

To find a good FHA lender, you can get recommendations from friends or family whove used an FHA loan. You can also check with the Better Business Bureau to review a bank or mortgage lenders rating and read online reviews.

Keep in mind that credit requirements for FHA loans vary from lender to lender. While many lenders allow a credit score as low as 580, some might set their minimum at 600 or even higher. So if your score is on the lower end of qualifying for an FHA loan you might need to shop around a little more.

Regardless of credit score, you should find at least three lenders you like the look of and apply with them.

FHA mortgage rates can vary a lot between lenders, and you wont know which one can offer you the best deal until youve seen personalized quotes.

Fha Loans And Credit Score

There are a lot of factors that determine your , including:

- The type of credit you have

- Whether you pay your bills on time

- The amount you owe on your credit cards

- How much new and recent credit youve taken on

If you have a higher score, you might be able to qualify with a higher debt-to-income ratio, or DTI. DTI refers to the percentage of your monthly gross income that goes toward paying debts. Your DTI is your total monthly debt payments divided by your monthly gross income . This figure is expressed as a percentage.

To determine your own DTI ratio, divide your debts by your monthly gross income. For example, if your debts, which include your student loans and car loan, reach $2,000 per month and your income is $8,000 per month, your DTI is 25%.

The lower your DTI, the better off youll be. If you do happen to have a higher DTI, you could still qualify for an FHA loan if you have a higher credit score.

The FHA states that your monthly mortgage payment should be no more than 31% of your monthly gross income, and that your DTI should not exceed 43% of monthly gross income in certain circumstances if your loan is being manually underwritten. As noted above, if you have a higher credit score, you may be able to qualify with a higher DTI.

Also Check: How To Apply For Sss Loan

Down Payment Assistance In 2021

Down payment assistance programs make the mortgage process more affordable for eligible applicants who are interested in purchasing a home but need financial help to do so. Money is usually provided in the form of a non-repayable grant, a forgivable loan, or a low interest loan. Homebuyer education courses may be required.

Typically, a property being purchased must serve as the applicants primary residence and must be located within a specific city, county, or state. It may also need to fall within a program’s maximum purchase price limits. Income limits may apply, and will look something like this :

- 1 person household: $39,050

The Importance Of Timely Payments After Period Of Bad Credit For Aus Approval

You can qualify for an FHA loan with a prior bankruptcy, foreclosure, deed in lieu of foreclosure, short sale after meeting the waiting period requirements as long as you can get an approve/eligible per automated underwriting system . You can qualify for an FHA loan with credit scores down to 500 FICO. This holds true as long as you can get an approve/eligible per AUS. The key in getting an approve/eligible per automated underwriting system is to be timely on all your payments in the past 12 months. Lenders and the automated underwriting system closely review the borrowers payment history with a strong emphasis on timely payments in the past 12 to 24 months.

You May Like: How Long Does Sba Loan Take

When Are You Eligible For An Fha W2 Only Program

Let me be perfectly clear: W2 Only does NOT mean if you send in your W2s today, youre going to close on your house tomorrow.

Not having to provide tax returns is a huge benefit for many people for multiple reasons.

But to keep it simple not having to provide tax returns keeps things clean and straightforward.

To qualify for this type of mortgage on a home purchase or refinance, here are the main highlights that will be considered:

- Must be a wage earner for a company you do not own

- Minimum credit score is 600

- Must not be employed by family

- If you own rental property, you must be able to qualify for the new mortgage without using rental income

You also need to be sure youre within the FHA county loan limits in your area. Check your county loan limits here.

If you do not meet the requirements listed above, here are more ways to get approved without providing tax returns.

If you do meet the requirements listed for the FHA W2 Only Program, lets break down each of those items further.

Wage Earner

This means you are paid an hourly wage or receive salary pay.

Commission paid employees are also eligible for this program as long as they are W-2 employees, NOT 1099 employees.

Although FHA will allow as low as 500 credit score, most lenders are not doing them below 580 credit score.

If youre below 600 score the lender may have overlays which require tax returns, even if youre a wage earner.

Family as an Employer

For that reason the FHA W2 Only Program would not be an option.

How Much Should I Spend On A House

Anaffordability calculatoris a great first step to determine how much house you can afford, but ultimately you have the final say in what youre comfortable spending on your next home. When deciding how much to spend on a house, take into consideration your monthly spending habits and personal savings goals. You want to have some cash reserved in your savings account after purchasing a home. Typically, a cash reserve should include three months worth of house payments and enough money to cover other monthly debts. Here are some questions you can ask yourself to start planning out your housing budget:

Recommended Reading: Average Apr For Motorcycle

Also Check: Can You Refinance With A Fha Loan

You Might Not Get Approved If You Have Lots Of Debt

FHA loan officers wont approve your loan if theres a good chance you wont be able to afford the mortgage and your other debt, such as car and credit card payments.

A good rule of thumb is that your mortgage payment shouldnt be more than 31% of your income before taxes. Your mortgage payment PLUS your other monthly debt payments usually cannot be more than 41% of your income, though in certain cases you can get approved if your debt obligations total 50%.

Two To Four Unit Multi

Any owner-occupied property up to 4 units is considered residential property. The minimum down payment for a single-family home for a conventional loan is 3% or 5%. However, for any residential property of 2 units or more, the minimum down payment for a conventional loan jumps to 15% or more. HUD requires a 3.5% down payment for two to four-unit multi-family homes. Although the borrower might qualify for a single-family home, they will not qualify for a multi-unit residential property without putting down the required 15% or more down payment. FHA loans are the only option to go in the event if the home buyer is limited with their down payment and cannot put down 15% or more on two to four-unit multi-family homes. With the FHA mortgage loan program, a 3.5% down payment will be sufficient.

Read Also: Can You Put Closing Costs Into Va Loan

Types Of Fha Home Loans

There are several different types of FHA loans. The type of FHA loan you choose limits the type of home you can buy and how you can spend the money you receive. This makes it especially important to be sure that youre getting the right type of loan. If none of the following loan types match your goals, you might want to consider another type of government loan.

Lets look at a few different FHA loan classifications.

Should I Apply For An Fha Loan

FHA loans make homeownership more achievable for many people, especially first-time homebuyers. In fact, 83% of FHA purchase loans were for first-time buyers, according to the FHAs Annual Report for 2020.

A 3.5% down payment is much easier to save for than the traditional 20%, so you can achieve your dream of homeownership that much sooner by going FHA.

Consider that on a $200,000 home, youd have to save a hefty $40,000 to afford a house with the traditional 20% down. But the down payment on an FHA loan for the same home totals just $7,000 $33,000 less.

Many conventional loan programs now allow you to put down as little as 3%. But FHA often has lower interest rates and lower mortgage insurance premium rates than youd find with conventional interest rates and private mortgage insurance .

Its worthwhile to apply for an FHA loan if you have an average credit score or have experienced some bumps with credit in the past. FHA lenders can approve buyers with credit scores of 580 and above. Some will approve a loan with scores between 500 and 579, although they will require a 10% down payment.

Also Check: Refinance Usaa Auto Loan

What Are The Differences Between An Fha Loan And A Conventional Loan

It’s easier to qualify for an FHA loan than for a conventional loan, which is a mortgage that isn’t insured or guaranteed by the federal government.

-

FHA loans allow for lower credit scores than conventional loans and, in some cases, lower monthly mortgage insurance payments.

-

FHA rules are more liberal regarding gifts of down payment money from family, employers or charitable organizations.

-

FHA loans may involve closing costs that aren’t required by conventional loans.

» MORE: Details on FHA vs. conventional loans

Fha Loans In Nc And Sc

Are you looking for an FHA loan in North Carolina or South Carolina? Dash Home Loans offers FHA loans for qualified home buyers throughout the Carolinas.

FHA loans, which are backed by the Federal Housing Administration , may help qualify for a home if you do not meet other requirements. Theyre ideal for individuals and families with low to moderate income and less than perfect credit scores.

Don’t Miss: Usaa Pre Approval For Mortgage

Mortgage Options For Homebuyers With Bad Credit

Here are the types of loan programs:

- FHA loans

- Non-QM Loans

- Bank Statement Loans For Self Employed Borrowers

However, the two most popular mortgage loan programs today are FHA Loans and Conventional Loans. In this article, we will cover and discuss FHA Mortgage Loan Versus Conventional Loan Programs.

The Mortgage Application Process Begins

However, its important to remember that a preapproval letter does not guarantee that you have a loan! Its simply a sign of good faith that youve done the work to qualify when a seller accepts your offer. When you find a home and your offer has been accepted, the actual mortgage process begins.

At this time, borrowers submit the executed contract of sale, proof of required assets and earnest deposit money, the fee for the subject propertys appraisal, and any required credit document updates. The mortgage process can take one to two months, depending on the market, your mortgage company, and the borrowers ability to promptly comply with the requested documentation.

You May Like: 600 Credit Score Auto Loan Rates

Don’t Miss: Used Car Loan Usaa

What Are The Requirements For An Fha Loan

Government backing and mortgage insurance mean FHA loans can have more relaxed borrowing criteria than conventional loans. Here are some of the requirements to keep in mind when preparing to apply for an FHA loan:

If you need assistance determining your eligibility for an FHA loan, find a HUD-approved housing counseling agency in your area. Their counselors can also help you navigate the application process.

How To Get An Approval On Fha Loan With Recent Late Payments

Mortgage borrowers can qualify for FHA Loan With Recent Late Payments, however, the deal needs to make sense. Place yourself as a lender and if a borrower were to come to you with prior bad credit. But has re-established themselves and has proven themselves that they have been paying all of their bills timely since they have recovered. You will most likely feel comfortable giving them a loan. However, if a borrower comes to you for a loan and has been late with their payments in the past twelve months, would you lend them the money?

You May Like: Usaa Used Car Loan Rate

How Do Fha Loans Work

FHA loans can give people with lower incomes or those with lower credit scores the ability to become homeowners. In order to offer a more relaxed credit requirement and a lower down payment, FHA requires you to pay mortgage insurance. If you defaulted on your loan, FHA would be responsible for paying off the remainder of your loan. Mortgage insurance limits the amount of money the lender may lose.

Mortgage insurance is considered a closing cost. Closing costs are the upfront fees required when you close on a home, and they’re separate from your down payment. Lenders and third parties can cover up to 6% of closing costs on FHA loans, including attorney, inspection and appraisal fees.

FHA-backed loans allow for financial gifts from family, employers and charitable organizations to help cover closing costs.

The borrower is responsible for paying two FHA mortgage insurance fees:

Required Documents For Fha Loan Pre

Will there not be any documentation in the meantime? As a matter of fact, there will be because getting a pre-approval for an FHA loan is done legally, which is why you will have a record of everything. Herere the most requested documents by an FHA loan lender that you need to get ready:

- Social Security Number

- Paycheck Stud for the last 2 months

- W-2, Wages and Tax Statements

- Bank statements

- Documents that relate to other assets of yours

- Employment verification letter

You May Like: How Long Does It Take For Sba Loan Approval