New And Used Car Financing Or Refinancing

Looking for a new or used car? Get a loan that puts you in the drivers seat.

Or, if youre looking to move your loan from another lender to lower your interest rate, and/or to lower your monthly payment, Tower can help.

We offer:

- Set up convenientautomatic payments.

- RATE DISCOUNTS: Save money when you take advantage of any or all of our rate discounts*:

- when you use the Tower Car Buying Service

- when you make automatic loan payments

Contact us to see how much you could save each month or if you need help deciding if refinancing is right for you. You can also take a look at our Used Car Buyers Guide for knowing what to look for when buying used.

You can also use tools like our Vehicle Loan Calculators to help you understand the difference between payment costs and terms and see how much you could save by choosing to refinance.

Interested in financing a different type of vehicle? We also offer other types of secured loans.

Best Refinance Rates: Openroad Lending

OpenRoad Lending

- Minimum credit score: Not stated

- Loan terms : Up to 72 months

OpenRoad Lending offers auto refinance loans with extremely low rates. While they dont disclose their full range of interest rates online, qualified borrowers can expect to receive quotes for competitive rates.

-

Minimum refinance amount of $7,500 in most states

-

Refinance restrictions on vehicle mileage and age

OpenRoad Lending specializes in auto refinancing, offering traditional and cash-back refinancing options and a wide range of loan terms. Borrowers with excellent credit can refinance into some of the lowest rates available. In addition, it provides financing options for individuals across the credit spectrum.

Can You Refinance Your Auto Loan With Your Existing Lender

The rules for refinancing an existing loan with the same lender vary by financial institution. PenFed Credit Union, for example, does not allow refinancing for cars already financed with the credit union. Other lenders do allow borrowers to refinance an existing loan.

Keep in mind that it may not always be beneficial to refinance with the same lender. You might find a better deal by refinancing with another institution.

Don’t Miss: How To Determine Home Value For Home Equity Loan

Servicemembers Civil Relief Act

The SCRA provides financial relief and protections to eligible servicemembers and their dependents. PNC is grateful for your service and we would like to help you understand your benefits and protections under SCRA as well as other similar benefits that PNC may be able to provide to you.

To find out more, please contact us at:

Used Auto Prices Have Soared Here’s How To Learn What Yours Is Really Worth

The sharp rise in the value of used cars during the past year or two has made it more likely that people’s vehicles are worth more than they owe. And lots of people with lower-paying jobs have seen large wage increases.

Together, more equity and more income make the prospects for refinancing at a good rate more likely.

The Carolinas Credit Union League recently sent me a list of examples of customers who refinanced vehicle and boat loans, trading double-digit interest rates for much lower ones. Credit unions, for those not familiar, are essentially not-for-profit banks.

The examples were a good reminder that lots of people are paying very high interest on auto loans interest rates in the teens, and in one case more than 27 percent and many of those folks have better options.

Also Check: Is Bank Loan An Asset

By Step: How To Refinance Your Car

Similar to a mortgage refi, refinancing your car basically means you are replacing your original financing package with financing that may have more favorable terms. If youre interested in refinancing, its typically a simple process.

To begin, you may want to start by requesting pre-qualification. This initial evaluation gives you an idea of how much a financial institution is willing to lend you. Pre-qualification only requires a soft inquiry, meaning your credit score will not be affected, so it can be a good idea to obtain pre-qualification from multiple lenders.

Next, as you move forward with the refinancing process, you will need to gather some documentation to apply for credit. Some of the information youll need will include:

- Information about your existing financing

- The VIN along with the make, model, and year of your car

- Proof of income

- Your drivers license

- Your Social Security number

Depending on the lender, you may be able to complete the majority of the refinancing process digitally. With Ally Clearlane, you could easily be pre-qualified in minutes and submit an application for approval online.

Best Auto Refinance Rates

- Customers save an average total of $2,225

- 90-second secure application process

Up to 722.94%

- Low rates for good credit customers

- Strong industry reputation

- A leading provider in refinance loans

- Average monthly savings of $150

- Work with a personal loan concierge to compare options

- Average monthly savings of $145

- Online Application

- No SSN required to see pre-qualified rates

- Offers auto refinancing and lease buyouts

Up to 842.49%

- Average annual savings over $1,200

- Lending platform that partners with banks

- Approval and loan terms based on many variables, including education and employment

Up to 72Varies

- Great for customers with limited/no credit

- Offers special military rates

All APR figures last updated on 4/6/2022 – please check partner site for latest details. Rate may vary based on credit score, credit history and loan term.

If youre paying a high interest rate on your existing car loan, you dont have to be stuck with it. Even as little as half a percentage point can save you hundreds, if not thousands, of dollars over the lifetime of your loan. The best auto refinance rates can help you save significantly.

We at the Home Media reviews team took an in-depth look at the auto loan industrys leading lenders to see which offer the best value to borrowers. After comparing interest rates, industry ratings and customer reviews, our team selected these institutions as the top lenders offering the best auto refinance rates.

Also Check: How To Apply For Fema Loan

Auto Refinance In Todays Economy

Its not surprising that people are struggling with finances. Recent Census Bureau shows that about 40% of adults are experiencing difficulty keeping up with basic household expenses.

One avenue for potential savings? Auto loan refinance. Many auto refinance companies currently tout a monthly payment drop of about $100, and a few others claim their average customer saves closer to $150.

Monthly new car payments have been affected as well: about 13% pay more than $1,000 per month, almost twice as many people as last year.

Used car prices have gone up too, sometimes surpassing the cost of a newer version of the same make and model.

However, auto refinance remains a viable option. A lot of companies will even work with borrowers with car loans originated as recently as one month ago.

Can You Sell A Car With A Loan

It is possible to sell a vehicle when you still have a loan, but it adds a few extra steps. There are a few different options in this situation. One option is to pay off the loan in full before selling the vehicle, which involves contacting your lender to determine your payoff amount. After paying off the loan, your lender will release the lien.

You can sell a vehicle that’s financed without paying it off by selling it to a private buyer or trading it in with a dealer.

Also Check: What Is The Best Type Of Student Loan To Get

What Are Refinance Car Loans And How Do They Work

Refinancing a car loan is essentially just taking out a new car loan so the steps for applying are mostly the same. You’ll need your driver’s license, Social Security number and proof of income and insurance, as well as details about your car. If approved, you’ll use the funds from your new loan to pay off your old car loan, then begin making monthly payments with your new interest rate and terms.

Compare Auto Refinance Loans

Before applying for an auto refinance loan, you should be sure to compare quotes from multiple different providers. Some factors to take into consideration include:

- Loan amounts: Most lenders have minimum and maximum loan amount requirements, usually somewhere between $7,000 and $100,000. Make sure that the loan you want to refinance is in between these limits.

- Rates: One of the main goals of refinancing an auto loan is to lock in lower rates. Make sure to compare rates from multiple different providers to ensure youre getting the best possible deal.

- Repayment terms: Whether you want to pay off your loan faster, or need a longer-term length with smaller monthly premiums, look for an auto refinance loan with repayment terms that meet your needs.

- Some lenders have minimum credit score requirements for borrowers. If your credit score isnt where you want it to be, consider holding off on applying until you raise your score.

- Car requirements: Not all lenders will issue auto refinance loans for all cars. Make sure that your car meets the requirements of any lenders that youre interested in.

You May Like: How Does The Veteran Home Loan Work

When Should You Consider Refinancing Your Car

Refinancing a car isn’t for everyone and deciding when to refinance can be challenging. The benefits of refinancing might be limited or non-existent in certain instances. For example, if you have a poor payment history on your current loan or are close to paying it off, it may not be to your advantage to refinance.

However, there are times when refinancing your car can benefit you. Consider refinancing your car if any of the following situations apply to you.

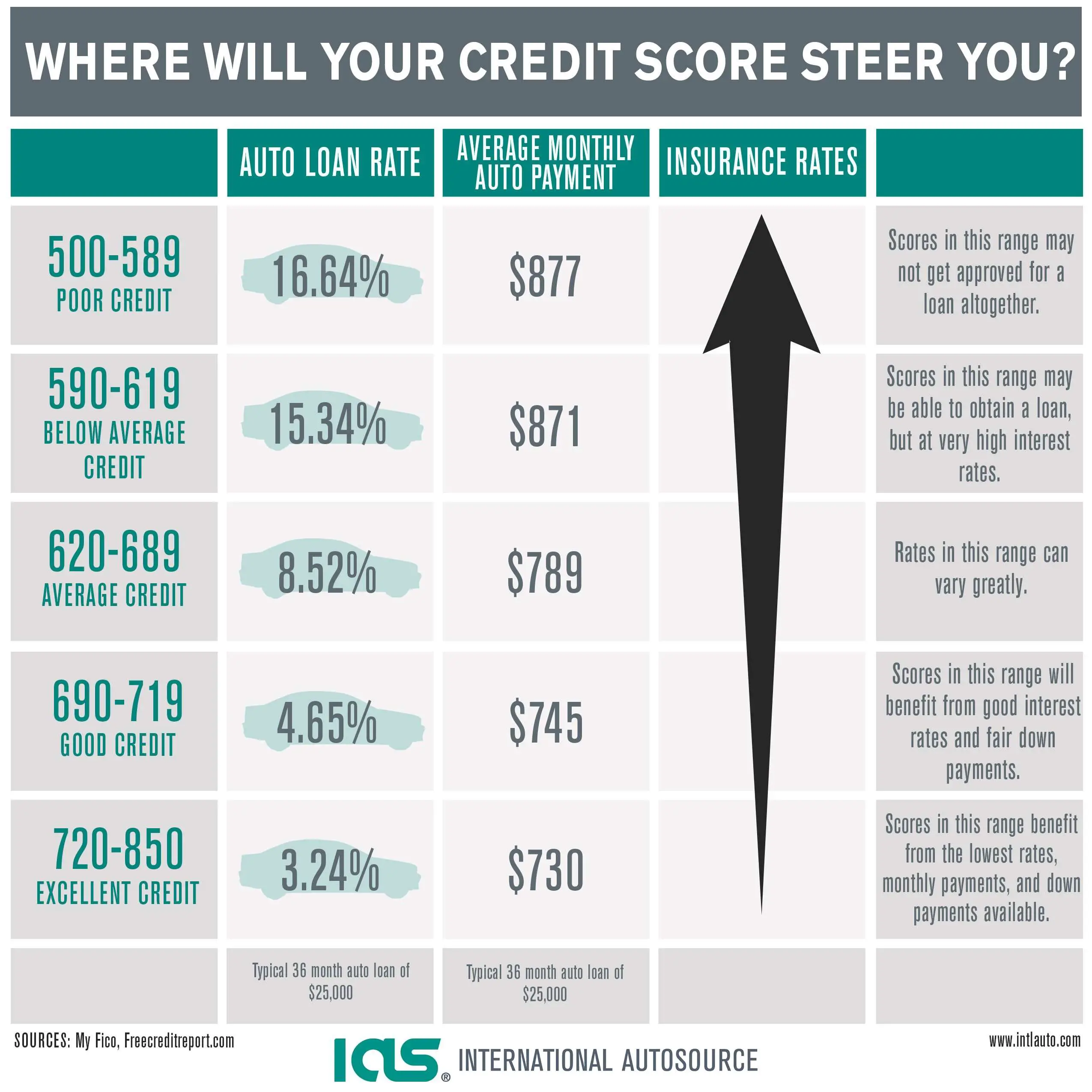

Your credit score increased

Your credit score is one of the main factors a lender considers when determining loan approval and credit terms. If you financed your car with a low credit score, refinancing your car could get you a better interest rate or even reduce your monthly payment.

Interest rates have dropped

If you bought your car when interest rates were high, refinancing your vehicle can save you money, possibly more than you realize. An interest rate decrease of only 2% to 3% could save you hundreds if you do not extend the term of your loan. An auto loan calculator can show you how interest rates affect your monthly payment and the total amount you could pay in interest.

You didnt shop around for rates initially

Your monthly payment is too high

How Do I Refinance My Car Loan

Refinancing a car loan is essentially just taking out a new car loan so the steps for applying are mostly the same. You will need your driver’s license, Social Security number and proof of income, as well as details about your car. If approved, you will use the funds from your new loan to pay off your old car loan, then begin making monthly payments with your new interest rate and terms.

You May Like: What Is Immediate Repayment Student Loan

Auto Express Loan Check

Tower has you covered for everything you need to buy your car with ease. Once you find the car you want, at the price you want, you can get pre-approved for a Tower car loan before you purchase. Then, you can negotiate with the dealer for the exact amount and pay for your purchase on the spot just like a cash buyer. Its that simple.

- Save time. Get easy pre-approval before you go to the dealer.

- Add convenience. Checks are valid for 30 days, so you can take your time finding the right vehicle.

- Protect your credit. Eliminates the need for additional credit inquiries that can lower your credit score. Auto Express Loan Checks can be used at franchise dealers in MD, DC, PA, DE & VA. Certain restrictions apply.

What Is A Good Interest Rate For A Car Loan

Currently, under 6% is considered a good interest rate for borrowers with a credit score in the mid 600s.

Interest depends on your credit score, the amount borrowed, the loan term and your debt-to-income ratio. Borrowers with excellent credit may be eligible for lower interest rates as low as 2 or 3% for a new vehicle. Occasionally dealerships will even offer a 0% interest car loan as a special promotion . For a borrower with fair or poor credit, the rate can exceed 10% or even 15%.

Here is how lenders weigh your credit score:

| Category |

|---|

| $8,370.47 |

This example assumes that you borrow $40,000 for a car purchase . While the monthly payments of loan A are $154.47 more, loan B costs $5,770.58 more! Compare interest rates and limit the length to save serious money.

Recommended Reading: Can I Get Another Car Loan

You May Like: How To Calculate Dti For Loan

Our Top Picks For Best Auto Refinance Companies

- RateGenius – Runner-up for Best Marketplace

- OpenRoad – Best for Low Credit Score

- AutoPay – Runner-up for Best for Low Credit Score

- Caribou – Best for Fair Credit

- myAutoloan – Runner-up for Best for Fair Credit

- Lightstream – Best for Any Kind of Vehicle

- Digital Federal Credit Union – Best for Newcomers to Credit Building

Why we chose it: We chose LendingTree as best auto refinance marketplace because, among its approximately 40 lenders, some will consider borrowers with credit scores in the low 500s.

- Quote request form takes less than five minutes

- Serves a wide range of credit scores

- Minimum loan balance for refinancing is $8,000

- No 24-month loans terms start at 36 months

- No set loan amount range this varies by lender

- Loan Terms

- 36 to 72 months

LendingTree is a marketplace of about 40 lenders where you can compare rates for a wide variety of financial products, including auto refinance loans.

The companys marketplace covers the full spectrum of credit scores. This means that subprime borrowers people with scores between 580 and 619, also referred to as poor credit have a chance at refinancing their auto loan through LendingTrees network.

We particularly liked LendingTrees Auto Refinance Rates comparison tool, which allows you to input your zip code, loan amount and estimated credit score, and then get examples of potential auto refinance options with terms from 36 to 72 months .

- No limit on existing loan balance

- Prequalify with a soft credit inquiry

How Do I Get The Best Auto Loan Rate

The best way to get a low interest rate on an auto loan is by doing your research and preparing ahead of time to set yourself up for success. Here are some general steps to follow:

Don’t Miss: How To Apply For Fha Loan Ohio

What Is Gap Insurance And Do I Need It

GAP insurance is optional auto insurance that helps pay off your loan in the event your vehicle is totaled or stolen and you still owe more than the depreciated value. Regular auto insurance will only cover what the vehicle is worth at the time of the loss. GAP insurance protects you when your auto loan balance exceeds your car’s current book value. DCU offers members GAP Advantage insurance through Allied Solutions. GAP Advantage can be purchased for both new and used vehicles, for a reasonable one-time cost of $300. For more information, visit the GAP Advantage Insurance page.

If you have a GAP Policy and to determine if your current policy terminates upon refinancing, consult your GAP agreement or contact your GAP provider.

Other insurance options that DCU makes available to members include:

- Mechanical Breakdown Insurance An alternative to extended warranties you might purchase from a dealer. Mechanical Breakdown Insurance usually lets you go to your repair shop, whereas dealer warranties limit work to specific dealerships. Visit our Mechanical Breakdown Insurance page for more information.

- Payment Protection Insurance – Helps relieve the financial stress and worry related to making loan payments when your life takes an unexpected turn. Visit our Payment Protection Insurance page for more information about covered events and coverage amounts.

Can You Refinance A Car Loan

Yes, many lenders offer auto loan refinance opportunities, and several promise to make the process quick and easy. It can pay to refinance your loan in several different circumstances. For example, you might be able to improve your rate and monthly payment, shorten the term of your loan repayment, or extend the term if you’re having trouble making payments.

You May Like: Are Home Equity Loan Rates Lower Than Mortgage Rates