How Do Taxes Affect The Auto Loan Interest I Pay

While taxes are generally a complicated issue and need to be worked out on an individual basis, the concept of how taxes affect your car loan is straightforward. When buying a car, you are charged taxes on the price of the car you are purchasing, meaning the amount of tax you owe is added directly to your loan amount. So, if you wish to buy a car for $20,000 and you owe taxes on it of 8%, then you will owe $1,600 in taxes and thus will need a car loan for $21,600.

Notice that your tax rate will not change the interest rate you will owe on your loan. However, the amount you must borrow to pay for your taxes will be included in the amount you borrow from the lender, and you have to pay interest on the full amount you borrow. Your taxes do not increase your interest rate, but they do increase the loan balance on which your interest charges are based.

Unfortunately, taxes are a part of life and are unavoidable. Still, it is important that you understand how your tax rate will influence your auto loan.

Three Big Factors About Car Loans

The average price of a new car is $46,085 as of February 2022, up 11.4% from a year ago. So, its no surprise that consumers increasingly finance their purchases with longer-term loans. The average auto loan term is about 70 months while the most common is 72 months.

Here are the three big factors to consider before taking out your own auto loan:

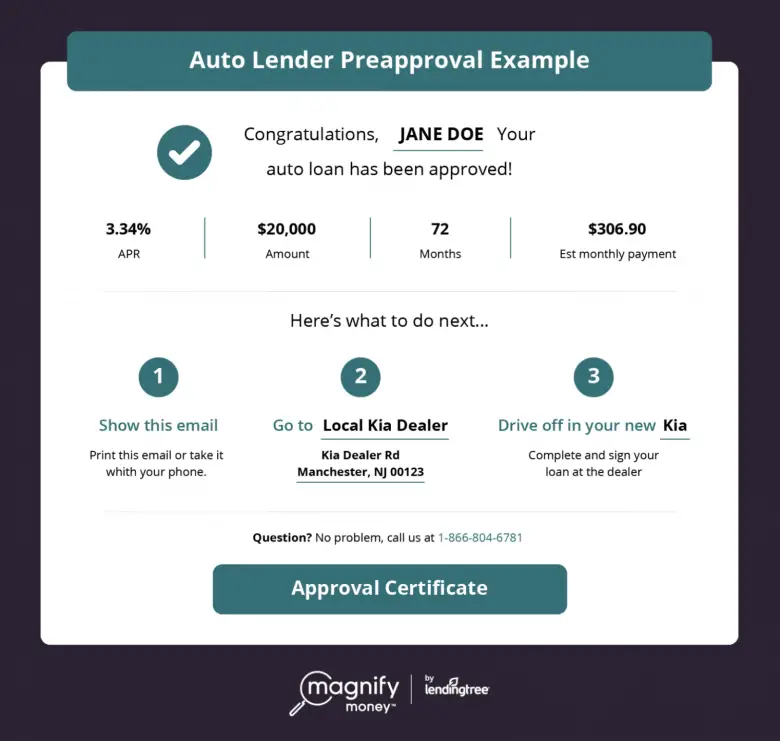

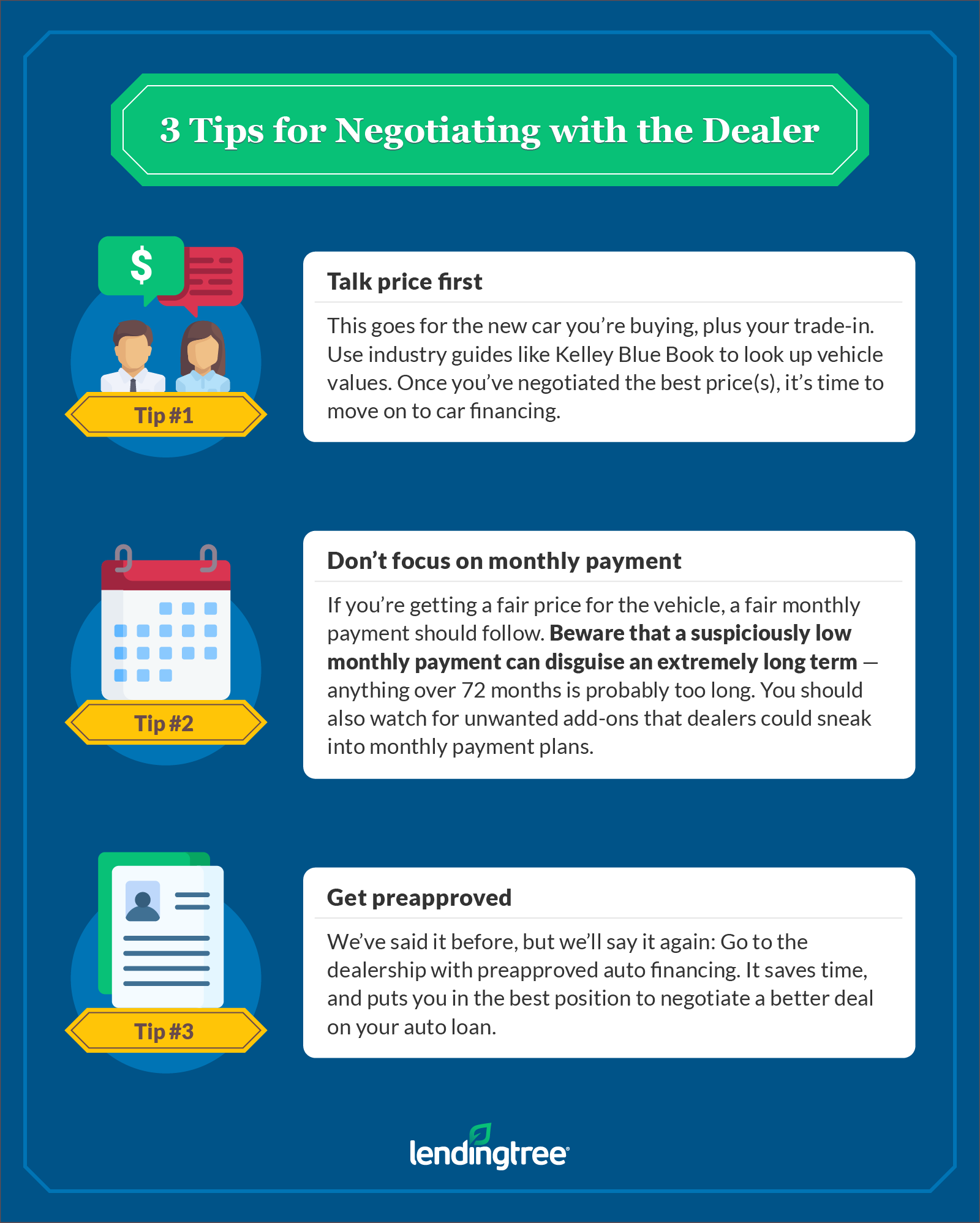

- Auto loan interest rates change daily and vary widely. Before you enter a showroom, check the current auto loan rates. You might consider getting pre-approval from a bank or credit union before shopping for a car. Consumer advocates say that an auto salesman might give you either a good price on the car or a good deal on the financing, but not both. In any case, you want to be informed about the best possible deal on a loan.

- Auto loans include simple interest costsnot compound interest. This is good. The borrower agrees to pay the money back, plus a flat percentage of the amount borrowed. With compound interest, the interest earns interest over time, so the total amount paid snowballs.

- Auto loans are amortized. Just like a mortgage, the interest owed is front-loaded in the early payments. During the housing price collapse, homeowners who owed more than their homes were worth for resale were said to be underwater. Car buyers can also be driving underwater for a long time unless they make a hefty down payment or offer a late-model trade-in. That’s because a car depreciates steeply in value as soon as you drive it off the lot.

How Interest Rates Work On Car Loans

Next to a home, your car may probably be one of the most expensive purchases you’ll make in your lifetime. And if you’re like most people, you’ll change vehicles a few times in your lifetime. But let’s face it, most of us don’t have the money to pay for a car or truck outright, which is why we rely on financing to purchase them. Some people may take advantage of financing deals from the automaker while others go to outside lenders. Whichever option you choose, you will have to pay interest on the loan.

But before you sign anything, it’s important to know how interest rates work on these loans. Getting an auto loan for a longer term with lower interest rates may keep the monthly bill below a budget-busting level, but is it a good deal for you? To answer that question, you need to understand how interest rates on car loans work.

Read Also: Guaranteed Tribal Loans No Credit Check

Make Loan Payments On Time

Credit scoring models take into account how reliably you pay all your bills, including auto loans. In fact, payment history is the most important factor in determining credit scores. By paying your car loan on time every month, you can help build positive credit history.

What’s more, when you finish repaying the loan, the lender will report the account as closed and paid in full to credit bureaus, and that will remain on your credit report and benefit your credit for 10 years from the closed date. That paid-up loan tells future lenders you know how to manage credit and repay your debts.

However, paying late or missing payments altogether can hurt your credit scores and make it harder to get credit in the future. Late or missed payments appear as negative information on credit reports, and remain for seven years. On the positive side, as the late payment ages over time, the less impact it will have on your credit score.

Missing too many payments may cause the lender to turn your debt over to collections or even repossess your vehicle. Both collections and repossessions remain on credit reports for seven years from the initial date of delinquency, and can negatively affect credit scores throughout that time.

How To Get A Car Loan With Bad Credit

If your credit report contains some negative information, or your credit score is not as high as you would like, consider taking steps to improve your credit before applying for an auto loan. Improving your credit can boost your chances of qualifying for an auto loan at a good rate and terms. Steps you can take to improve your credit include:

- Bringing any late payments or collection accounts current.

- Paying all your bills on time every month.

- Paying down existing debt to improve your , which compares the total amount of credit you have available with how much of it you’re actually using.

If your credit reports and scores are poor, and you can’t afford to wait to get a car, it may still be possible to get a car loan. However, be aware your loan will likely have a higher interest rate than what’s offered to people with good credit scores.

You can offset the impact of poor credit by saving up for a bigger down payment. The down payment will reduce the amount you have to borrowand the amount of interest you’ll pay over the life of the loan. Plus, lenders may view your down payment as evidence you know how to manage money and will likely repay their loan.

You can also ask someone with good credit to cosign for a car loan. When you have a cosigner, that person’s good credit will influence the interest rate and terms the lender offers. However, your cosigner will share responsibility for repaying the loan, so it’s important to ensure you make all payments in a timely manner.

Also Check: How To Calculate Home Loan Approval

Car Loan Apr Versus Interest Rate

When reviewing financing details and picking a lender, its important to compare APRs. According to the Consumer Financial Protection Bureau , an auto loans interest rate is the cost you pay each year to borrow money expressed as a percentage. The interest rate does not reflect fees charged for the loan. The APR is the cost you pay each year to borrow money, including certain fees, such as origination fees, expressed as an annual rate.

Getting The Annual Percentage Rate

Individuals or businesses are not always on the paying end of the APR. When an individual or business maintains a deposit account at a financial institution, they can earn interest on their deposits. The bank or other financial institution pays the account holder interest because the bank is essentially borrowing the account holders money. In this scenario, the account holder will receive the quoted APR for the deposit account.

Note that lending institutions always offer an APR on deposit accounts that is significantly lower than the APR they charge for loans. This is how banks make money. They borrow deposit account money at a low interest rate, and then loan the money out at a higher interest rate.

Read Also: Can You Get More Than 1 Va Loan

What Does Typical Or Representative Apr Mean

When you compare credit cards, the APR is advertised as either a ‘typical’ or ‘representative APR’.

Representative or typical APR refers to the rate that at least 51% of those accepted for that product will get.

Up to 49% of the remaining applicants may be charged a higher APR. This can understandably be a bit confusing, given you do not know if this is the APR you will actually receive. It means most people will receive this, but not all.

The typical APR is a guide to the amount of interest most people are likely to be charged. However, it may be higher depending on your personal financial circumstances and your credit rating.

Find out more about how your personal credit rating or credit score affects the interest rate you will be charged with our guide to credit scoring.

What Does Apr Mean On An Auto Loan

While shopping for car loans, credit cards, and other financial services, you have probably come across the term APR. APR stands for Annual Percentage Rate. It is the annual rate of finance charge you pay for your loan or credit line. For car loans, APR is the rate you pay that accounts for your interest charges plus all other fees you have to pay to get your loan.

To clarify how much you will pay in interest charges versus how much you will pay in interest charges plus fees, your car loan paperwork will likely come with two rates. Each rate gives you different information about your loan, yet mathematically they are the same in that they both give you the same payment and both require you to pay the same amount for you car over the course of you loan.

The lower of the two rates is your interest rate or note rate. This rate describes how much in interest charges you will pay on the balance of your loan over a year period.

You can think of your two rates as follows.

Please note, while these equations are helpful for understanding these two rates, they do not necessarily reflect how you would calculate the two rates. However, you can read much more about how APR works here, including how to use the above equations to correctly estimate your note rate or APR.

Also Check: How To Find Mortgage Loan Number

How Can You Calculate Apr On A Car Loan Quickly

If you dont have the time to sit and crunch the numbers manually, skip the hard work and use an Online Auto Loan Calculator to adjust the key parameters easily. By entering the loan term and monthly payment youre comfortable with, you can find what APR will give you the best value in just a few minutes.

What Is An Apr

Every auto loan has an APR, which is the annual cost youâre charged by the lender for borrowing money. Itâs slightly higher than the base interest rate the loan carries because it includes fees for servicing the loanâlike documentation of the title and taxes, dealer prep and other fees associated with the transaction.

The higher the APR, the more you will pay back to the lender over the life of the loan. This is why itâs important to shop around for the loan.

Don’t Miss: How To Apply For Usda Direct Loan

Calculate Your Monthly Estimated Payment

If you already know your estimated monthly loan payment, you can skip this step. If you dont, you can easily estimate your monthly car payment on a spreadsheet by typing the formula below into a cell.

=PMT

The result is your estimated monthly payment. It will be a negative number, but dont worry. You didnt make a mistake. Keep this number handy for calculating your APR.

Lets say you want to finance $13,000 with a loan term of 60 months and an interest rate of 4%. Heres what your formula would look like with those numbers plugged in.

=PMT

Using this example, your spreadsheet would calculate your monthly payment to be $239.41.

Car Loans For International Students

Getting an auto loan if you are an international student can be hard. You might not be able to provide a Social Security Number , U.S credit history or credit score as an international student, which means that you wont be able to get a loan from many of the traditional lenders. Some traditional lenders might offer you a car loan as an international student, but the interest rate charged for the risk they take could be extreme.

There are many non-traditional lenders that will offer international students in the U.S car loans. Some lenders will provide you with a personal loan to buy your car, or will offer you an actual auto loan.

These lenders consider factors like your educational or financial history in your home country into account and might even consider your foreign credit score. They will also look at your earning potential in the U.S or allow a cosigner as extra security to them. All of these factors mean that you will not only be able to get a loan to get a car in the U.S but you might even get a relatively competitive interest rate.

Also Check: How To Get Rid Of Private Student Loan Debt Legally

What Affects Your Monthly Payment

The size of your monthly payment is affected by a variety of factors, including the borrowed amount, interest rate and loan term. While current rates and the amount you need to borrow may be outside your control, you may have flexibility in choosing your loan term. Shorter loan terms typically mean higher monthly payments and less interest expense, while longer loan terms typically mean lower monthly payments, though they tend to accrue more interest over time.

Learn How Car Loan Interest Affects How Much Your Car Costs

When you take on a car loan to buy a car, your lender purchases the car for you and allows you to pay it back over a period of years. Essentially, the lender gives you the service of using its money, and in exchange, you compensate the lender for its services by paying interest.

Most car loans use simple interest, a type of interest of which the interest charge is calculated only on the principal . Simple interest does not compound on interest, which generally saves a borrower money.

However, simple interest does not mean that every time you make a payment on your loan that you pay equal amounts of interest and principal. Instead, car loans are paid down via amortization, meaning you pay more interest at the beginning of your car loan than at the end.

Don’t Miss: Same Day Personal Loans Bad Credit

% Financing Vs Bonus Cash

Automakers want you to purchase your next vehicle from their company, not a competitor. This is a key reason 0 percent financing offers exist in the first place. In the same interest of attracting new customers, auto manufacturers often offer bonus cash rebates to buyers.

Sadly, an auto manufacturer might not let you take advantage of both 0 percent financing and bonus cash. If youre faced with this dilemma, youll have to decide which savings opportunity is the better deal.

Bankrate tip: Using an auto finance calculator can help you compare apples to oranges when it comes to 0 percent financing versus bonus cash incentives. Sometimes taking the cash rebate an auto dealer offers along with a higher loan APR will make the most sense as far as overall savings. In other instances, 0 percent financing might be the clear winner.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: How Much Home Equity Loan Can I Get

What Is A Good Apr

You hear a lot of commercials and ads that present buyers with a zero percent financing options, but these are pretty rare and only account for under 10 percent of most loans issued, so don’t start sweating when you see that you’re not getting zero percent.

Your average APR can register anywhere from 3-10%, but obviously you’ll want to aim for the lower numbers. Plus, 3% is a very good annual percentage rate and is your reward for keeping good credit over the years. Anywhere between 4-6% is considered to be a good APR and is usually around the average for people with mid-range credit. Should your credit be less than perfect, you’ll usually pay a higher APR than those with excellent credit, but a car loan is a great step in the right direction for improving your credit.

Related Post: How to Lower APR on a Car Loan

Why The Apr On Your Car Loan Is Important

The APR on your car loan is important because it affects how much your loan costs per month. When you have a car loan, you must pay back the principal amount, which is the amount the car cost at the dealership, and the interest the financial institution charged the borrower for borrowing the banks money. The higher the interest rate is, the more expensive it is to borrow the banks money.

Consider the following table:

| $669 | $710 |

As shown above, a $35,000 loan with an interest rate of 8% will cost you $41 more per month when compared to a $35,000 loan with an interest rate of 5.5%.

Don’t Miss: 7 Year Equipment Loan Calculator