Do More With The Mobile Banking App

- Set customizable alerts

- Snap a photo to deposit a check, and get instant confirmation

- Use your fingerprint or Face ID for quicker access on the go

Get the Mobile Banking app

Get it on the App Store

Before you leave our site, we want you to know your app store has its own privacy practices and level of security which may be different from ours, so please review their policies.

Or we can text a download link directly to your phone

Apple, the Apple logo, iPhone, iPad, Apple Watch and Touch ID are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

Get it on the App Store

Before you leave our site, we want you to know your app store has its own privacy practices and level of security which may be different from ours, so please review their policies.

Or we can send you a link by email

Apple, the Apple logo, iPhone, iPad, Apple Watch and Touch ID are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

Get it on Google Play

Before you leave our site, we want you to know your app store has its own privacy practices and level of security which may be different from ours, so please review their policies.

Or we can text a download link directly to your phone

Android is a trademark of Google Inc. Samsung is a registered trademark of Samsung Electronics Co., Ltd.

Our mobile app isn’t available for all devices

American Express Vs Bank Of America

Bank of America is another great choice for in-person banking, falling just behind Chase Bank in terms of size and the number of branch locations available around the country. It offers an even wider selection of small business financing products, and for an even better rate than American Express term loans. However, Bank of America small business loans are better suited for slightly larger operations: It requires a minimum annual income of at least $100,000, and the minimum amount you can borrow for a term loan is $10,000.

Pros And Cons Of American Express

| Pros | |

|---|---|

|

No application or origination fees No prepayment penalties Can easily see how much you’re preapproved for Applying doesn’t impact credit score Can use loan for business expenses or business credit card consolidation |

Must complete application online Only available if you’ve had an Amex small business credit card for at least a year Can only consolidate certain types of credit card debt |

You May Like: How Much Interest Rate For Commercial Loan

How We Rate American Express Personal Loans

NerdWallet writers rate lenders against a rubric that changes each year based on how personal loan products evolve. Heres what we prioritized this year:

|

Category |

|---|

Affordability

An affordable loan has low rates and fees compared with other similar loans and may offer rate discounts.

Transparency

A transparent lender makes information about the loan easy to find on its website, including rates, terms and loan amounts. Transparency also means allowing users to pre-qualify online to preview potential loan offers and reporting payment information to the major credit bureaus.

Loan flexibility

A flexible loan is one that lets users customize terms and payments. That means offering a wide range of repayment term options, allowing the borrower to change their payment date, offering loans in most states and funding it quickly.

Customer experience

A good customer experience can include a fully online application process, financial education on the lenders website and a customer service team thats available most of the time and can be reached in multiple ways.

Ready to apply? Select “See my rates” below to compare rates for different lenders on NerdWallet.

How To Contact American Express

If you are an American Express card member and have any questions about the personal loan process, you can contact the American Express support and help center over the phone, online chat or through the mobile app.

The American Express mobile app is available for both Android and iOS users. You can call the personal loan customer service direct line at 844-273-1384 Monday through Friday from 9 a.m. to 8 p.m. ET.

Read Also: Monthly Payment On Loan Calculator

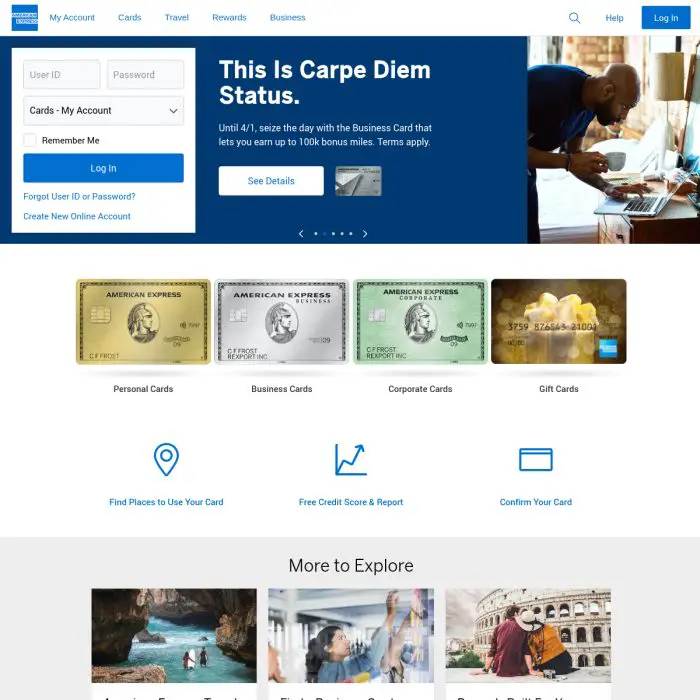

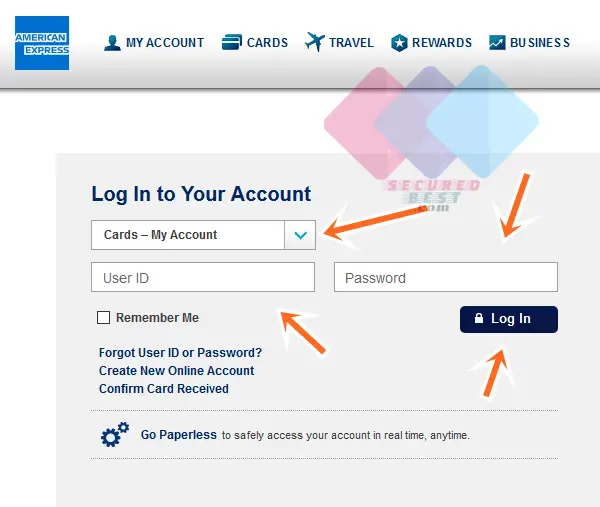

How To Log In To Your American Express Account From A Computer

When you get to the American Express homepage, youll see a place to sign in to your account on the top right of that page. Simply type your username and password into their respective slots. With American Express youll also have to select what you want to log in to based on what type of account you have. The choices are as follows:

- Cards and Banking

More From Your Money: Choose a high-interest saving, checking, CD, or investing account from our list of top banks to start saving today.

You can click the Remember Me checkbox, but before you do, consider whether or not someone could find and steal your personal information. If youre using a shared computer or public WiFi, you might want to think twice before hitting that box.

What Is A Line Of Credit

A line of credit is a lending option that allows you to borrow from it as needed, but there is an assigned limit on the amount of funds available. You only pay interest on the money that you borrow, and you can borrow up to the available credit limit. As you pay back the money, the line of credit is replenished. You might be able to qualify for an unsecured personal line of credit, much like an unsecured personal loan which does not require any collateral. If not, you will be required to secure the funds by putting up collateral, like your home or vehicle, for example. With lines of credit, interest rates generally vary. You can pay your minimum payment monthly to revolve on your balance, however you would continue to accrue interest. A Line of Credit can be a flexible option if you have unforeseen expenses and allows you to make the minimum payment where there is no fixed term.

You May Like: How To Pay Off Car Loan

American Express Borrower Requirements

| Minimum credit score | 660 |

Applying for an American Express small business loan is a bit counterintuitive. If you need to borrow money, you typically go out and get quotes from different lenders. But with an Amex small business loan, Amex will come to you itself and let you know if and when you can apply for a loan whether you need one right then or not. Only people who have been Amex small business cardholders for at least a year are eligible to apply, and only if you see it listed as an option when you log into your online account.

In addition to these requirements, there are a few other basic small business loan eligibility requirements to keep in mind. Youll need to be at least 18 years old and a U.S. citizen or resident to apply, and youll need to have an email address. Youll also need fair to excellent credit, although unlike most other lenders American Express doesnt perform a hard credit check after you apply.

How To View Your Bank Statement Information

Because American Express is an online bank, it makes it easy to find and view your bank statement. In fact, up to two years of transaction history can be viewed on your online account.

After youve logged in to your account, you can just click statements. From there you can sort and organize how you want to see your transaction history. You can even download your transaction history as a PDF, CSV or Excel file. Get ready to excel at finance with this tool.

Read Also: How Much Is The Maximum Student Loan

How To Use And Find Your American Express Login

American Express National Bank, Member FDIC, has been around since 1850, and its not going anywhere. Ranked number 85 by Fortune 500, it holds around $180 billion in assets. Chances are, you or someone you know has an American Express account.

If youve been feeling lost in the world of online banking and want to learn how to make the most of your American Express account, look no further.

What We Don’t Like

- You must be an American Express card member to apply. Only existing American Express card members are eligible to apply for a personal loan through the lender. If youre not already a member, it might not make sense for you to open a new revolving credit card account just to meet this eligibility criteria.

- You must be preapproved to apply. American Express personal loans applications are available by invitation only. Even if you open an American Express credit card account to address the first disadvantage, theres no guarantee that youll automatically receive a personal loan offer.

- No option to change your due date. Your loan payment due date is the date your personal loan is approved, and theres no option to change it. This can be problematic if youd like your payment due date to fall after pay day or on a specific date to better align with your monthly budget. Some lenders offer the option to change your due date.

- No autopay interest rate discount. Although American Express gives you the option of setting up autopay when you apply for its personal loan, theres no additional incentive for enrolling in automatic payments. Some lenders give their borrowers a nominal interest rate discount when enrolling their personal loan account in autopay.

Recommended Reading: How To Get Startup Loan For Business

A Bank Account That Does More Means You Will Too

Receive an annual fee waiver on select credit cards by signing up for a Preferred Package or Ultimate Package.

Savings and reward potential in first 12 months based on the following card usage and offers:

$450 in travel rewards when you spend $1,000 within your first 3 months and when you spend $7,500 within your first 12 months

$120 primary card fee waiver for the first year

$33 in foreign transaction fee savings based on average first year annual foreign spend per account

$247 in travel rewards on everyday purchases based on average annual first year spend per account with an average spend of 21% in 5x accelerator and 7% in 3X accelerator categories.

Potential First Year Value = up to $850

Actual savings and rewards earned will depend on individual card usage and eligibility for applicable offers. Conditions apply

Offer Description and Conditions: The 45,000 Bonus Scene+ Points and First Year Annual Fee Waiver Offer applies only to new Scotiabank Gold American Express credit card accounts opened by April 30, 2023 and is subject to the conditions below. We will waive the annual fee for the primary card issued before April 30, 2023 on the Account for the first year only. Offer may be changed, cancelled or extended without notice at any time and cannot be combined with any other offers.

First Year Annual Fee Waiver Offer Description and Conditions: We will waive the annual fee for the primary card issued before April 3, 2023 on the Account for the first year only.

American Express Personal Loans Terms And Conditions

General

American Express Personal Loans are personal loans issued by American Express National Bank. Personal Loans are not Card products. Unlike American Express Cards, they are not eligible for any Card benefits, rewards programs, or insurance. For example, you do not get Membership Rewards® points or Reward Dollars from American Express with your Personal Loan.

Any information American Express collects from you shall be governed by our Privacy Statement .

Eligibility, Use and Verification

Personal Loans may not be used for post-secondary education expenses, real estate, business, securities, vehicle purchases , or any purpose prohibited by law or not otherwise permitted by these terms and conditions or your Loan Agreement.

We reserve the right to verify any information you provide to us or that we have on file for you, including your identity and any bank account information. However, we may also rely on the accuracy, authenticity and completeness of any information that you provide to us. We reserve the right to refuse to make any payment to any of your designated accounts if your request does not meet these terms and conditions or the terms of your Loan Agreement, or violates applicable law.

Patriot Act Notice

Your Pre-Approved Loan Amount and APR

Fund Disbursement

Your Loan Agreement

Consent to Electronic Communications

Notice to California Residents: A married applicant may apply for a separate account.

Don’t Miss: Fha Loan For Multifamily Property

American Express Vs Chase Bank

Chase Banks small business department offers a wider range of products that anyone can apply for at any time unlike American Expresss small business loan, which is only available sometimes to certain people. Unfortunately, though, Chase Bank isnt as upfront about the details of these loans, so itll still be on you to compare your options with other lenders. Still, given Chase Banks ubiquity with brick-and-mortar branches, itd be an especially good option if you prefer to do your small business banking in person.

When Should I Choose A Line Of Credit Vs Personal Loan

When you need more flexibility, a line of credit is probably the way to go. For example, if you have:

- An ongoing remodeling project with costs that are ever-changing

- Ongoing business overhead costs

No matter what method you choose a personal loan or a line of credit be sure to do your homework. There’s an array of lending institutions offering these options, and it may be difficult to choose the right one for you. Be sure to compare things like interest rates, borrowing limits and repayment terms, which can all vary greatly from lender to lender. And, most importantly, read all the fine print related to interest rates and fees so that you’re not caught off guard.

You May Like: Bb& t Home Equity Loan

Time To Receive Funds

It can take three to five business days to receive funds from a personal loan with American Express after you sign your loan agreement. The funds will be electronically deposited to your bank account, typically through an ACH transfer.

If you dont have a bank account on record with American Express or want the funds deposited to a different bank account, youll first need to verify your bank account, which can take a couple of days. After that, it can take three to five days to deposit funds. This timeline is typical for the industry, though certain lenders may disburse funds more quickly.

How To Log In To Your American Express Account From A Mobile Phone Or Tablet

Having your banking information at your fingertips could help you become more proactive in taking charge of your finances. Thankfully thats easy to do if you have an American Express account. You can download the app to both Apple and Android devices easily. You can also text MOBILE to 86509 to receive a link to the app itself, and from there just download it to your phone.

Once youve downloaded and opened the app youll be prompted to log in. Then, enter your username and password like you would on a computer. Once youve logged in, you have your account at your disposal you can deposit checks, set automatic bill pay and view a history of transactions whenever you need it.

One of the most helpful perks of the American Express mobile app is the chat function with the app, you can message customer service and receive support wherever you are.

Recommended Reading: What Is The Loan To Value Ratio For Refinance

American Express Personal Loan Requirements

Category Rating: 70%

- Amex customer: You must have an American Express credit card account to be eligible for personal loan offers.

- Minimum credit score: According to American Express, you will need a credit score of at least 660 to be approved for a personal loan.

- Minimum income: American Express does not disclose minimum income requirements.

- Age: You must be at least 18 years old to receive a personal loan offer.

- Citizenship: You must be a U.S. citizen or permanent resident.

- Identification: You must have a Social Security number. Even though you can get an American Express credit card using an ITIN or passport, Amex requires an SSN to get a personal loan offer.

- Pre-qualification: People with an existing Amex account can check their potential rates online.

- Ways to apply: If you have received a pre-approved offer, you can apply for an Amex personal loan online or by phone.

- Joint loans: American Express only extends individual offers. Therefore, they do not accept co-signers or co-applicants.

- Application status: It usually takes up to 3 business days to get a decision and another 3 to 5 business days to receive your funds after approval, according to Amex representatives. You can check your application status any time by logging into your online account.

How To Apply For A Personal Loan With American Express

Applying for an American Express personal loan is straightforward, as long as youre already an existing card member and have been preapproved. Heres how to apply:

Each of the steps are completed on a single application page, making it easy to navigate the process. In total, the application for an American Express personal loan takes a few minutes to complete.

You May Like: What’s Required For Fha Loan

American Express Personal Loans: 2023 Review

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.