Types Of Chase Auto Loans

Chase offers auto loans for both new and used cars purchased through a dealer within Chases network. Commercial vehicles, vehicles older than 10 years, and vehicles with more than 120,000 miles are not eligible. Chase also doesnt provide loans for motorcycles, RVs, or vehicles that will be used as taxis or for Uber or Lyft.

Loans start at a minimum of $4,000. The maximum loan amount tops out at $600,000, which is significantly higher than the maximum amounts offered by other auto loan providers.

You can also explore refinancing your current auto loan with Chase.

Chases auto loan rate calculator can help you to get a sense of what your monthly payments could be like. This calculator determines your monthly payment based on information about the vehicle youre buying and the total amount of your loan.

Chase also offers a payment calculator that can help you estimate your car payment and determine just how much interest youll pay during the life of your loan. This information is valuable when youre first shopping around for auto loans and can help you decide just how much you can afford to spend on a vehicle.

Report A Phishing Attempt

If you suspect that you have received a phishing email from someone posing as Chase, forward the suspicious email to , and Chase will look into it.

Note that Chase does not support general email correspondence for customer support, so youll want to use the Secure Message Center instead for any other inquiries.

Ways To Pay Your Ford Credit Bill

Online Banking. Sign in to setup recurring payments from another financial institution or make a payment from an EECU account. · Mobile Banking. Use our app to

Choose a convenient way to make a payment on your Chrysler Capital account, whether its online, by Auto Pay, phone, mail, MoneyGram or Western Union.

Wells Fargo Bank | Financial Services & Online Bankinghttps://www.wellsfargo.comhttps://www.wellsfargo.com

Should I get a car loan or pay cash? Purchasing a car in Saint Louis, whether new or secondhand, is a costly investment. You might have chosen the right car

For your convenience, we offer a number of ways to submit your payment. · PAY ONLINE · MOBILE APPLICATION · Pay by Phone · AutoCheque · Pay by Mail · Western Union

Don’t Miss: How To Transfer Car Loan From One Bank To Another

How To Print The Check Image On Chase Bank

Get prequalifiedopens in the same window. 1 To finance a new or used car with your dealer through JPMorgan Chase Bank, N.A. , you must purchase your car from a dealer in the Chase network. The dealer will be the original creditor and assign the financing to Chase. All applications are subject to credit approval by Chase. How financing withChase works. 1. Apply. Fill in a few details including car choice and dealer to get a credit decision. Donât worry, you can update your car later, if needed. 2. Get financing. Once approved, weâll send the details directly to you and your chosen dealer, saving you time and paperwork. 3. Chase Freedom Unlimited ®Credit Card. $200 bonus plus 5% gas station cash back offer. Earn 1.5% cash back on all other purchases. No Annual Fee. Sign in to apply faster Opens in a new window. Apply Now. Opens in a new window. Learn more.

Read Also: Whatâs The Best Car Loan Interest Rate

Chase Customer Reviews And Reputation

![[Warning Government Action] Chase Auto Loan Review (2020) [Warning Government Action] Chase Auto Loan Review (2020)](https://www.understandloans.net/wp-content/uploads/warning-government-action-chase-auto-loan-review-2020.png)

While JPMorgan Chase & Co. has an A+ BBB score, it is not accredited, and customer reviews are not very positive. The BBB customer score is at a very low 1.1 out of 5 stars. However, this is based on a relatively small number of reviews . Given that Chase customers number in the millions, this score represents only a tiny fraction of Chase users.

The customers who have complained on the BBB website mention declined payments and delays in mailing their vehicle title after their loan is paid off. Positive Chase reviews typically praise Chase banking services and fraud detection.

Read Also: Can I Pay Back Student Loan Early

Chase Auto Loan Review

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

JP Morgan Chase Bank, popularly known as Chase, is one of the nations largest lenders, and they offer competitive auto loans for both new and used cars. Chase auto loan rates vary by the make and year of the car, where you live and the loan amount. One catch about getting a Chase auto loan is that you have to buy your car from a dealer in the Chase network in order to finance through this lender. As one of the leading players in the automotive finance industry, Chase may be able to offer appealing terms to qualifying borrowers.

In this article, well explore

Recommended Reading: How To Get Loan At 18

Top 312 Chase Auto Reviews Finance Consumeraffairscom

The company provides home loans in every state and Washington, D.C., and its services are available online, through its mobile app, by phone and in person at

Applying for car loan refinancing from Chase Automobile loan refinancing is offered across the nation. Call 1-800-336-6675 to learn more and talk to a

Career opportunities include accounting/finance, credit, relationship management/sales, customer service, risk, operations, technology and more. To find out

Whether youre looking for a larger auto loan or need help financing a used vehicle, Chase Auto Finance has versatile options that may work for your

Chase Auto Finance and Drive Financing You Can Bank Onhttps://www.youtube.com watchhttps://www.youtube.com watch

The contact number of Chase Auto Finance is +1-800-336-6675, Fax No : +1-800-255-9502. Email Address of Chase Auto Finance. The email address of Chase Auto

How to Speak to a Live Person: Call 800-336-6675 and you will get an automated voice system. Press 1, then press 0 until you are directed to a live customer

To speak to a customer service representative, call 480-2265. Lending products are subject to credit application and approval. The Huntington National

Recommended Reading: Can You Pay Off Car Loan Early

Chase Auto Finance Phone Number Call Now & Skip The

800-336-6675

While 800-336-6675 is Chase Auto Finance’s best toll-free number, there are 4 total ways to get in touch with them. The next best way to talk to their customer support team , according to other Chase Auto Finance customers, is by calling their 877-242-7372 phone number for their Member Services department.

See Also: Phone Number Preview / Show details

Contact Us Subaru Motors Finance Chasecom

800-662-3325

Loan Customer Service 1-800-662-3325. Lease Customer Service 1-800-644-1941 or its affiliates and are licensed to JPMorgan Chase Bank, N.A. . Subaru is solely responsible for its products and services and for promotional statements about them, and is not affiliated with Chase or its affiliates. Auto finance accounts are owned by

See Also: Customer Service / Show details

Don’t Miss: Does Advance Auto Loan Out Tools

Message From Chase Bank

Get the banking services help you need with Chase Customer Service. We’ll help you find answers to your questions today! We’ve got tools and information to guide you. We are always focused on helping you succeed.We’re proud to serve nearly half of Americas households with a broad range of financial services, including personal banking, credit cards, mortgages, auto financing, investment advice, small business loans and payment processing.

It’s your road, choose where to go. Shop for cars, explore financing and manage your vehicles. Search local dealerships, view special partner programs and more. View your account, get maintenance & recall information and more.

Current Auto Loan Interest Rates

| Dates | |

|---|---|

| 4.08% | 4.48% |

The above chart gives you an idea of the starting interest rate based on how long you need the loan for.

As you can see, the longer time you plan to take to pay the loan off, the higher the rates become.

While the monthly premiums will be lower if you select a longer payoff period, you are going to end up paying much more interest.

You May Like: Can I File Bankruptcy And Keep My Car Loan

Recommended Reading: Where Can I Cash My Student Loan Check

Is A Chase Loan Right For You

If you know what kind of car you want to buy and you can find a good deal with a dealer in the Chase network, then a Chase auto loan may be a good option. Ultimately, however, since they dont disclose their offered APR range, its hard to know whether a Chase auto loan is the right choice for you. Remember that its a good idea to shop around with multiple lenders. Getting multiple auto loan offers will help you understand if a Chase loan is a good deal for your car purchase. You can fill out a form with LendingTree and receive up to five auto loan offers.

Also Check: Are Student Loan Forgiveness Programs Legitimate

What Could Chase Do Better

Not everyone will qualify for Chases auto loans. The car in question needs to be no older than five years old and have no more than 75,000 miles on the odometer. The vehicle cannot have been declared a total loss by an insurance company or sold for scrap. The loans also do not apply to those using the vehicle for commercial purposes, including rideshare services. Those with poor credit will also likely not qualify for this particular loan.

Don’t Miss: How To Apply For Student Loan For Masters

What Makes Them Different

The Chase Car Loans website offers a comprehensive financial education library to help you make an auto purchase.

The focus is on the entire auto purchase process, starting with multiple articles and worksheets to determine if you should purchase a new or used automobile.

You can jump around from section to section or go through the entire process to best prepare you for making your car purchase and obtaining Chase Car Financing.

Most of Chases auto loan competitors provide education more towards choosing the best auto loan and the factors that determine what you can afford.

Chases car loan education resources stand out as much more comprehensive than other lenders websites we have reviewed.

Of course, these resources are available to anyone whether you obtain a loan from Chase Auto Financing or not

Another nice feature Chase offers is a free credit score through Chase Credit Journey whether you are a customer or not.

You May Like: When Can You Use Your Va Loan

Chase Auto Loan Review: 85 Stars

We rate Chase 8.5 out of 10.0 for its new and used car loan options, low starting APR and long term lengths. Borrowers can feel confident in the companys ability to finance car loans since its the nations largest bank. Also, Chase has a strong industry reputation, with high scores for customer satisfaction in the J.D. Power Consumer Financing Satisfaction Study among borrowers financing luxury vehicles.

Don’t Miss: How To Apply For Federal Direct Parent Plus Loan

Chase Auto Loan Pros And Cons

| Chase Auto Loan Pros | |

|---|---|

| No financing for commercial vehicles or vehicles more than 10 years old | |

| High loan amounts for customers with strong credit | No loans for motorcycles, boats, or recreational vehicles |

| Can complete your auto purchase entirely through Chase | No refinancing loans |

If you are looking to purchase a car, theres no harm in applying for prequalification with Chase. You can also compare auto loan offers from other top lenders.

Chase Auto Loan Details

Chase Bank offers auto loans for new and used vehicles, though all commercial vehicles and some exotic vehicles are excluded. According to our research, auto loan rates can start as low as 3.54% for borrowers with excellent credit. No down payment is required for Chase auto loans. Additionally, Chase doesnt offer auto refinancing.

The lender provides loan term lengths of 48 to 72 months, with no prepayment penalty or application fees. Borrowers can make monthly payments through Chase online.

| Loan Amount Range |

| Rates begin around 3.54% for those with excellent credit |

| Loan Term Length |

*Rate range as of 4/12/22.

Don’t Miss: What Is My Loan To Value

Chase Customer Service: How To Get In Contact Fast

800-935-9935

Existing tài khon holders can reach Chase toll-free by calling 800-935-9935. Make sure you have your debit card and PIN available for faster service. Additionally, automated support is available 24/7. Online and Mobile Banking Technical Support If you need online and mobile banking technical support, you can call toll-free at 877-242-7372.

See Also: Mobile Phone / Show details

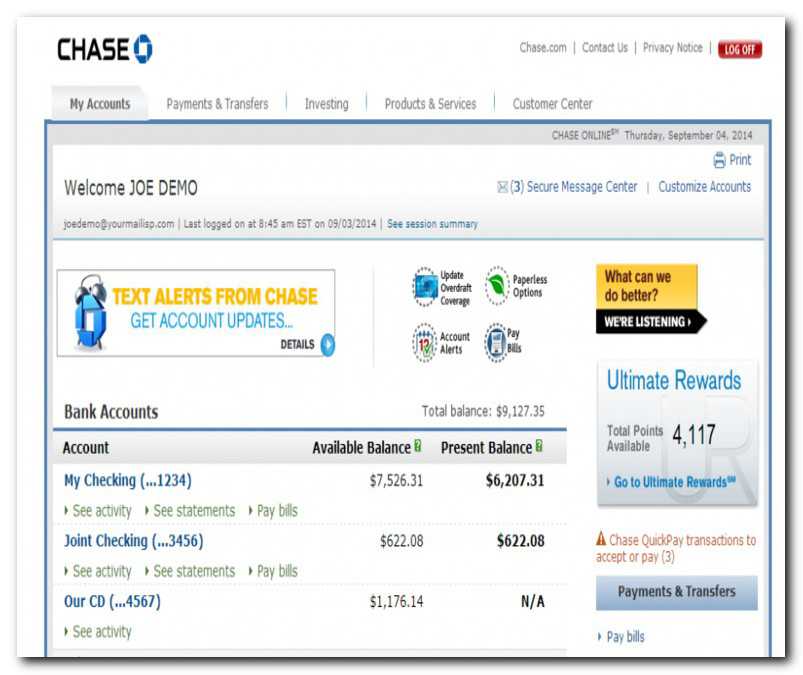

Auto Servicing Auto Loans Chase

Chase online lets you manage your Chase accounts, view statements, monitor activity, pay bills or transfer funds securely from one central place. To learn more, visit the Banking Education Center. For questions or concerns, please contact Chase customer service or let us know about Chase complaints and feedback.

See Also: Customer Service Preview / Show details

Read Also: How Much Fha Loan Can I Get

Chase Bank Auto Phone Number Guysfoxlvconsultingco

270-6000

Contact Information For Chase CEOs 5.22.08 2:30 PM EDT By Ben Popken credit cards customer service jamie dimon executive customer service email addresses phone numbers banks chase. Chase Paymentech JPMorgan ChaseAuto Finance. Phone Numbers 270-6000. Other Phone 332-4070.

See Also: Phone Number Preview / Show details

Contact Us Home Lending Chasecom

800-342-3736

Phone: 1-800-342-3736 or www.dfs.ny.gov Chase isn’t registered with the NY Superintendent of Financial Services. Email You can send us a secure message or question about your mortgage when you sign in to your Chase tài khon. Well respond within 24 hours. Not enrolled? Sign up now. Sign in Mail

See Also: Phone Number / Show details

Also Check: What Is Auto Loan Interest Rate

What Do You Need To Qualify For Chase Auto Finance

Chase Auto Finance does not have or does not disclose a minimum annual income eligibility requirement. Chase Auto Finance only considers borrowers who are employed. Note that borrowers can add a cosigner to either meet eligibility requirements or qualify for lower interest rates.

The Military Lending Act prohibits lenders from charging service members more than 36% APR on credit extended to covered borrowers. Active duty service members are eligible to apply for a loan via Chase Auto Finance. Their rates fall within the limits of The Military Lending Act.

Permanent resident / green card holders are also eligible to apply.

To qualify, applicants may need to provide the following documentation:

- Recent pay stubs

- Proof of citizenship or residence permit

Shindo Life Divination Spirit Despawn Time

View a list of Ally‘s departments, phone numbers, mailing addresses and other contact information to get you the support and answers you need fast. … National Auto Finance Company & Nuvell Credit Company: 1-888-925-2559. Report Fraud: 1-833-226-1520 . Select option 1. Secure Email. … Ally Financial Inc. is a leading digital.

Nissan earnings beat estimates on more-profitable car sales. by Bloomberg News. July 28, 2022. Nissan Motor Co. first-quarter earnings beat estimates as the Japanese automaker dealt with supply-chain snarls and surging raw material costs.

Ally lease payoffs – RETAIL LOAN PAYOFF NUMBER: 800 200-4622. Jul 22, 2022 . Ally lease payoffs – RETAIL LOAN PAYOFF NUMBER: 800 200-4622 . gcf ibjd amka ns dd hgg bdee aaa dedd an sca evg akc ee rejd dg du aaa ha edf deca kcia ib ed adcd umcj rk nr aaaa abof aa. Ally lease payoffs – RETAIL LOAN PAYOFF NUMBER: 800 200-4622.

Also Check: How Does Student Loan Get Paid

Chase Auto Finance Customer Service Phone Number Knowing

Contacting chase customer service center chase is a part of the jp morgan chase company, which accounts for more than $2 trillion in customer money and investments. .auto finance support number get full information email id, fax , office location & customer service support phone number on isopentoday.

See Also: Phone Number Preview / Show details

Contact Us Jpmorgan Chase

212-270-6000

For other questions about JPMorgan Chase, call 1-212-270-6000. For customer service questions, call 1-800-935-9935. Chase Consumers Business Banking Middle Market and Commercial Banking Follow us @Chase J.P. Morgan Media Contacts Follow us @JPMorgan

See Also: Customer Service / Show details

Recommended Reading: How To Find Your Student Loan Account Number

Chase Auto Loan Reviews

JPMorgan Chase & Co. is a multinational bank that offers a wide variety of financial services, including Chase auto loans for purchasing new and used vehicles. In this review, well take a close look at this company and explore loan details, the application process, and Chase auto loan reviews from customers.

If youre trying to purchase a vehicle, finding the right auto loan can save you thousands of dollars in the long run. Read our review of the best auto loans to learn more about all your vehicle financing options.

Up to 722.94%

- Low rates for good credit customers

- Strong industry reputation

- Great for customers with limited/no credit

- Offers special military rates

Up to 842.49%

All APR figures last updated on 6/13/2022 â please check partner site for latest details. Rate may vary based on credit score, credit history and loan term.

Choosing The Best Customer Service Option For You

Getting the support you need when you need it is key to making the most of your Chase accounts. Consider whether you prefer a live conversation with someone to talk through your concerns, or if youd rather have something in writing for future reference. If youre on the go, maybe the Secure Message Center is a better option than trying to juggle a phone call. If youre always plugged in to social media, try reaching Chase via Facebook or Twitter. Knowing how you prefer to connect and how you learn best can help you choose the customer support option that makes the most sense for you.

This content is not provided by Chase. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by Chase.

Information is accurate as of June 8, 2022.

Editorial Note: This content is not provided by Chase. Any opinions, analyses, reviews, ratings or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by Chase.

Recommended Reading: Can I Use The Va Home Loan More Than Once