Update On Minimum Down Payment And Debt To Income Ratio For Conventional Loan

Fannie Mae and Freddie Mac have brought back the 3% down payment conventional loan home purchase program for first-time homebuyers. Fannie Mae and Freddie Mac offer the 3% down payment conventional home purchase loan program to first-time home buyers. First-time homebuyers are defined as home buyers who had not owned a property in the past three years. Seasoned home buyers who had ownership of a home in the past 3 years require a 5% down payment on conventional loans. Private mortgage insurance is required on all conventional loans with higher than 80% loan to value.

How To Improve Your Dti

We’d like to tell you to just spend less and save more, but you’ve probably heard that before. It might be different, though, if you could see your progress in tangible terms, and your DTI can do just that. If you calculate the ratio yearly , you will hopefully see the percentage drop steadily. If you conscientiously work your total debt downward, your DTI ratio will reflect that, both to you and to potential lenders.

Fha Debt To Income Ratio Requirements Versus Conventional Loans

FHA Debt To Income Ratio Requirements applies for both home purchase, refinance loans, and Cash-Out Refinance Mortgage Loans.

Just because borrowers meet all the HUD Agency Mortgage Guidelineson FHA loans does not mean that all lenders will approve borrowers meeting just the minimum agency mortgage guidelines. Lenders will require all borrowers to meet the minimum HUD agency mortgage guidelines on FHA loans. Most Lenders will have Lender Overlays on debt to income ratios, which we will discuss on this blog. Lender overlays are additional lending requirements that are above and beyond the minimum HUD Agency Guidelines. Lenders are allowed to have tougher lending requirements that are above and beyond the minimum HUD Agency Guidelines. There are lenders like Gustan Cho Associateswith no lender overlays on government and conventional loans. Gustan Cho Associates has no lender overlays on FHA loans. We just go off the automated underwriting system and have zero lender overlays.

In this article

Don’t Miss: Does Loan Modification Stop Foreclosure

Score The Dti You Need For A Mortgage

Your debt-to-income ratio is one number that holds a lot of weight when it comes to buying or refinancing a home. But even though it gives a snapshot of your financial health, it doesnt tell the whole story. As you prepare to become a homeowner, work on lowering your DTI, while also keeping in mind the big picture of your finances. As you raise your credit score and increase your savings, you may just see your DTI improve as well.

Wondering how much house you can really afford?

How Can I Improve My Debt

Improving your debt-to-income ratio means lowering it, and doing so requires some combination of two things: reducing your monthly debt and increasing your income.

On the debt-reduction side of the equation, your options may be limited. Long-term student loan or mortgage payments may not be something you can easily change. If you have credit card debt, however, paying down your balances will reduce your minimum monthly payments and lower your DTI ratio. If you’ve got a personal loan or car loan, waiting until it’s paid off before you seek a mortgage will also let your application reflect a lower DTI ratio.

With respect to income, negotiating a better salary or trading up to a better paying job is easier said than done . If you feel you deserve a raise and can document the reasons why, it can’t hurt to ask. Otherwise, consider pursuing a “side hustle” that earns you some extra income.

Lenders consider debt-to-income ratio an important metric for gauging your ability to handle additional loan payments. Calculating your own DTI ratio can help you understand your eligibility for various loans and can guide your loan-application process accordingly.

You May Like: What Does Usda Loan Mean

Divide That Total By Your Gross Monthly Income

Once you have an idea of what your monthly debt total is, divide it by your gross monthly income to determine your DTI ratio. Your gross monthly income is the amount of money you make each month before taxes. You can usually find your gross income on your paystubs or you can calculate it.

If you are a salaried employee, you can divide your yearly salary by 12 to find your gross monthly income. If you are paid hourly, multiply your hourly rate by the number of hours you work in a week and then multiply that number by 52 to get your yearly income, which you can divide by 12 to get your monthly gross income.

Once you know your monthly gross income, you should be able to use it to find your DTI. If you make $4,000 a month as your gross income and your total debts amount to $1,200, the formula to calculate your DTI would look like this:

= 0.3, or 30%

Having A Good Dti Isnt Too Hard

Your debt-to-income ratio is one of the most important factors in qualifying for a mortgage.

DTI determines whether youre eligible for the type of mortgage you want. It also determines how much house you can afford. So naturally you want your DTI to look good to a lender.

Luckily, thats not too hard. Todays mortgage programs are flexible, and a wide range of debt-to-income ratios fall in or near the good category. So theres a good chance you can get approved as long as your debts are manageable.

In this article

Read Also: Is Car Loan Interest Tax Deductible

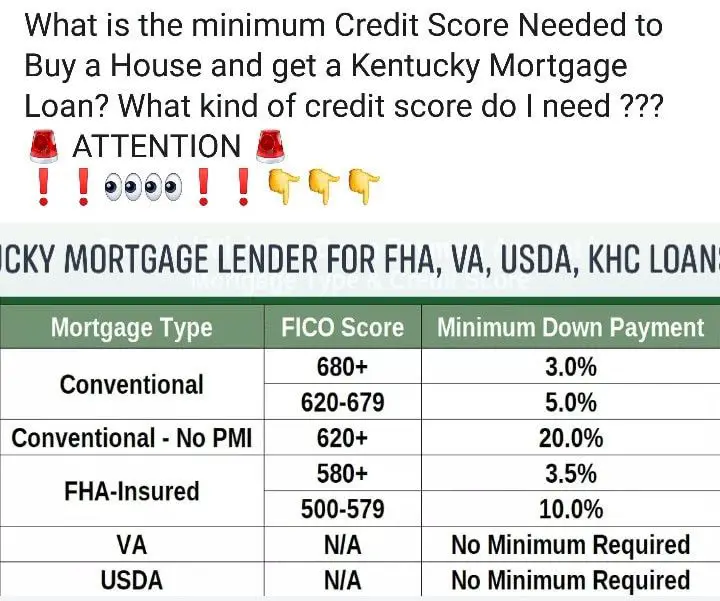

Conventional Loan Credit Scores

In general, conventional loans are best suited for those with a credit score of 680 or higher. If you have a higher credit score, its possible that a conventional loan will offer the lowest mortgage rate. Applicants with lower scores may still qualify, but they can expect to pay higher interest rates.

Buyers with lower credit scores might benefit from a different type of mortgage, perhaps one backed by a government agency. Some other loan programs may cost less overall. For example, Fannie Mae and Freddie Mac impose Loan Level Price Adjustments to lenders who then pass those costs to the consumer. This fee costs more the lower your credit score.

For instance, someone with a 740 score putting 20% down on a home has 0.25% added to their loan fee. But, someone with a 660 score putting the same amount down would have a 2.75% fee added. These fees are not paid upfront but rather, translate to higher interest rates for homeowners.

See the complete matrix of LLPAs.

Why Your Dti Is So Important

First of all, it’s desirable to have as low a DTI figure as possible. After all, the less you owe relative to your income, the more money you have to apply toward other endeavors . It also means that you have some breathing room, and lenders hate to service consumers who are living on a tight budget and struggling to stay afloat.

But your DTI is also a crucial factor in figuring out how much house you can truly afford. When lenders evaluate your situation, they look at both the front ratio and the back ratio.

Read Also: Credit Union Private Party Auto Loan

Qualifying With High Debt To Income Ratio For Conventional Loan

Home Buyers who need to qualify for conventional loans with high debt to income ratios can contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at [email protected]. Gustan Cho Associates is a national mortgage company licensed in multiple states with no lender overlays on government and conventional loans. Not too many conventional lenders will go to the 50% debt to income ratio limit. Gustan Cho Associates has zero overlays on debt to income ratio for conventional loans and we just go off AUS FINDINGS. The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays.

How Lenders Look At Dti

If you want to get a sense of how lenders look at DTI, you can break it out into a front-end and back-end ratio.

The front-end ratio only takes into account housing-related expenses, such as your monthly mortgage principal and interest, real estate taxes, homeowner’s insurance, and any other required add-ons .

The back-end ratio adds your remaining debts, such as minimum credit card and loan payments, on top of your estimated mortgage.

Here’s an example DTI ratio calculation based on $6,000 of gross monthly income:

Recommended Reading: How To Delay Student Loan Payments

How To Calculate Your Debt

To calculate your debt-to-income ratio, add up your recurring monthly debt obligations, such as your minimum credit card payments, student loan payments, car payments, housing payments , child support, alimony and personal loan payments. Divide this number by your monthly pre-tax income. When a lender calculates your debt-to-income ratio, it will look at your present debt and your future debt that includes your potential mortgage debt burden.

The debt-to-income ratio gives lenders an idea of how youre managing your debt. It also allows them to predict whether youll be able to pay your mortgage bills. Typically, no single monthly debt should be greater than 28% of your monthly income. And when all of your debt payments are combined, they should not be greater than 36%. However, as we stated earlier, you could get a mortgage with a higher debt-to-income ratio .

Its important to note that debt-to-income ratios dont include your living expenses. So things like car insurance payments, entertainment expenses and the cost of groceries are not included in the ratio. If your living expenses combined with new mortgage payments exceed your take-home pay, youll need to cut or trim the living costs that arent fixed, e.g., restaurants and vacations.

If Your Dti Is Between 36% And 50%

A DTI between 36% and 50% is still considered OK for the most part you can likely still qualify for a loan fairly easily with a DTI ratio in this range. If your DTI is closer to 50%, however, it may require taking action to reduce debt if you plan on applying for a mortgage soon and hope to get a favorable rate.

If you can afford to do so, you should practice strategies like the snowball method to attempt to pay down some of your debts before applying. While you may have no issues getting a loan, getting rid of some of your debts might help you achieve a lower interest rate going forward.

Read Also: How Does An Auto Loan Affect Your Credit Score

Can A Second Mortgage Eliminate Pmi

A loan option that is rising in popularity is the piggyback mortgage, also called the 80-10-10 or 80-5-15 mortgage.

This loan structure uses a conventional loan as the first mortgage , a simultaneous second mortgage , and a 10% homebuyer down payment. The combination of both loans can help you avoid PMI, because the lender considers the second loan as part of your down payment. A piggyback loan can make homeownership accessible for those who may not yet have saved a down payment.

For an in-depth look at these loans, see our piggyback loan blog post.

Dont Miss: Can You File Bankruptcy Against The Irs

How To Calculate Debt

You can calculate your DTI ratio before you apply for a mortgage, regardless of which kind of loan youre looking to get.

First, there are two types of ratios lenders evaluate:

- Front-end ratio: Also called the housing ratio, this shows what percentage of your income would go toward housing expenses. This includes your monthly mortgage payment, property taxes, homeowners insurance and homeowners association fees, if applicable.

- Back-end ratio: This shows how much of your income would be needed to cover all monthly debt obligations. This includes the mortgage and other housing expenses, plus credit cards, auto loan, child support, student loans and other debts. Living expenses, such as utilities and groceries, are not included in this ratio.

The back-end ratio may be referred to as the debt-to-income ratio, but both ratios are usually factored in when a lender says theyre considering a borrowers DTI.

Read Also: How Much Will My Personal Loan Payment Be

Looking At Your Mortgage To Income Ratio Logically

Above, weve talked about the mortgage to income ratio guidelines according to the lenders. Now its time to talk about the mortgage to income ratio logically. What can you afford? Thats what you need to figure out. Just because you can have a 31% housing ratio for an FHA loan, for example, doesnt mean that you need to borrow that much. If you arent comfortable with a mortgage payment of that size, choose one that you are comfortable with so that you can decrease your chances of foreclosure.

We suggest that you get pre-approved for a loan amount and find out the full payment. Then compare that to your actual budget. Put the numbers in your budget and see how it works. Is it close to the amount you pay now for rent/housing? If its much higher, is it a number that fits within your budget? Do you have enough disposable income after paying the mortgage to cover the cost of everyday living? Consider these factors before deciding on a mortgage.

The 20% Down Payment Myth

Where does the myth about the 20% down payment requirement come from? Probably from shoppers who want to avoid paying private mortgage insurance premiums.

When you put less than 20% down on a conventional loan, your lender will require private mortgage insurance . This coverage helps protect the lender if you default on the loan.

PMI does increase monthly mortgage payments. But thats OK if it allows you to get a conventional loan with a down payment you can afford.

Also note that conventional PMI can be canceled later on, once your home reaches at least 20% equity. So youre not stuck with it forever.

Read Also: What Is The Max Amount For Parent Plus Loan

If Your Dti Is Over 50%

A DTI ratio of over 50% is considered financially unsustainable, and you will likely have trouble qualifying for a conventional loan if the total of your debts consumes more than half of your monthly income.

If you are in this situation, you may want to consider contacting a reputable credit counselor to explore the options available to you. Many small businesses and people who are self-employed live with high debt levels as they build their businesses, so it doesnt necessarily mean you can never qualify for a loan with a DTI this high. Lenders do consider high DTI ratios to be a risk, however, so it may be in your best interest to attempt to pay down what you can before attempting to get a loan.

Create the bathroom you’ve always wanted.

Benefits Of A Conventional Home Loan

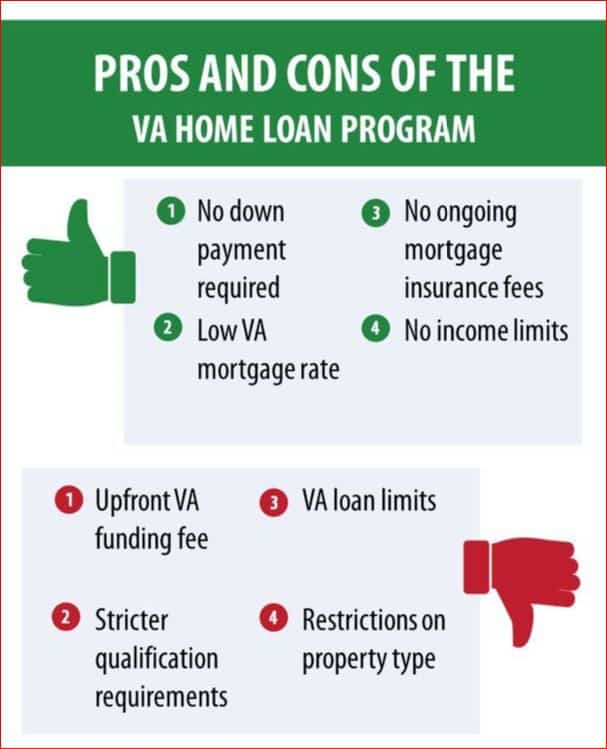

Conventional loans are the most popular type of mortgage. After that come government-backed mortgages, including FHA, VA, and USDA loans.

Government-backed mortgages have some unique benefits, including small down payments and flexible credit guidelines. First-time home buyers often need this kind of leeway.

But conventional loans can outshine government-backed loans in several ways.

Don’t Miss: How To Not Pay Student Loan Debt

How Can I Qualify For The Higher Dti Ratio

There are three major requirements that must be met to take advantage of Fannie Maes maximum DTI ratio, some of which would be particularly difficult for anyone getting their first mortgage.

Some first-time homebuyers may not meet the first two criteria. Regardless of whether youll use Fannie Maes extra wiggle room, consider meeting with a lender early on at least six months before you buy.

Meeting with a lender and knowing your FICO® score early on gives you time to iron out any errors and potentially see meaningful improvement in your credit.

Conventional Dti Calculator For Fannie Mae Dti Guidelines

Fannie Mae DTI Guidelines on Conventional Loans: Borrowers can calculate their debt-to-income ratio using the Conventional Loan DTI Mortgage Calculator powered by Gustan Cho Associates. Conventional loans are the most popular loan program for first-time homebuyers due to the low 3% down payment program. Fannie Mae DTI Guidelines cap the DTI at 50%. However, to get an approve/eligible with lower credit scores, the debt-to-income ratio may be capped at 45%. Fannie Mae DTI Guidelines have a maximum debt to income ratio cap of 50% DTI on conventional loans. Conventional loan debt-to-income ratio guidelines are different than any other mortgage loan program. There is no maximum front-end debt to income ratio on conventional loans. There is only one debt to income ratio on conforming loans which is the back end.

Also Check: Is Personal Loan Installment Or Revolving

What Is The Mortgage To Income Ratio

You can calculate your mortgage to income ratio with the following calculation:

Total mortgage payment/Gross monthly income

You figure your total mortgage payment by adding up your principal, interest, monthly real estate tax payment, monthly homeowners insurance payment, and mortgage insurance amounts. Your gross monthly income is the amount of income you bring home each month before taxes.

How Do You Calculate Debt

Calculating your DTI is a fairly simple process, as long as you know the right numbers. In the simplest terms, you can calculate your DTI by dividing your total debt each month by your total income. But what expenses actually count toward your total debts? Lets break down what you should include when estimating your DTI.

While you can calculate this manually, you can also use the debt-to-income calculator in this article to calculate your DTI ratio quickly.

You May Like: Personal Loans Online Same Day Deposit