Buying A Home Or Refinancing Here’s How To Find The Right Home Loan

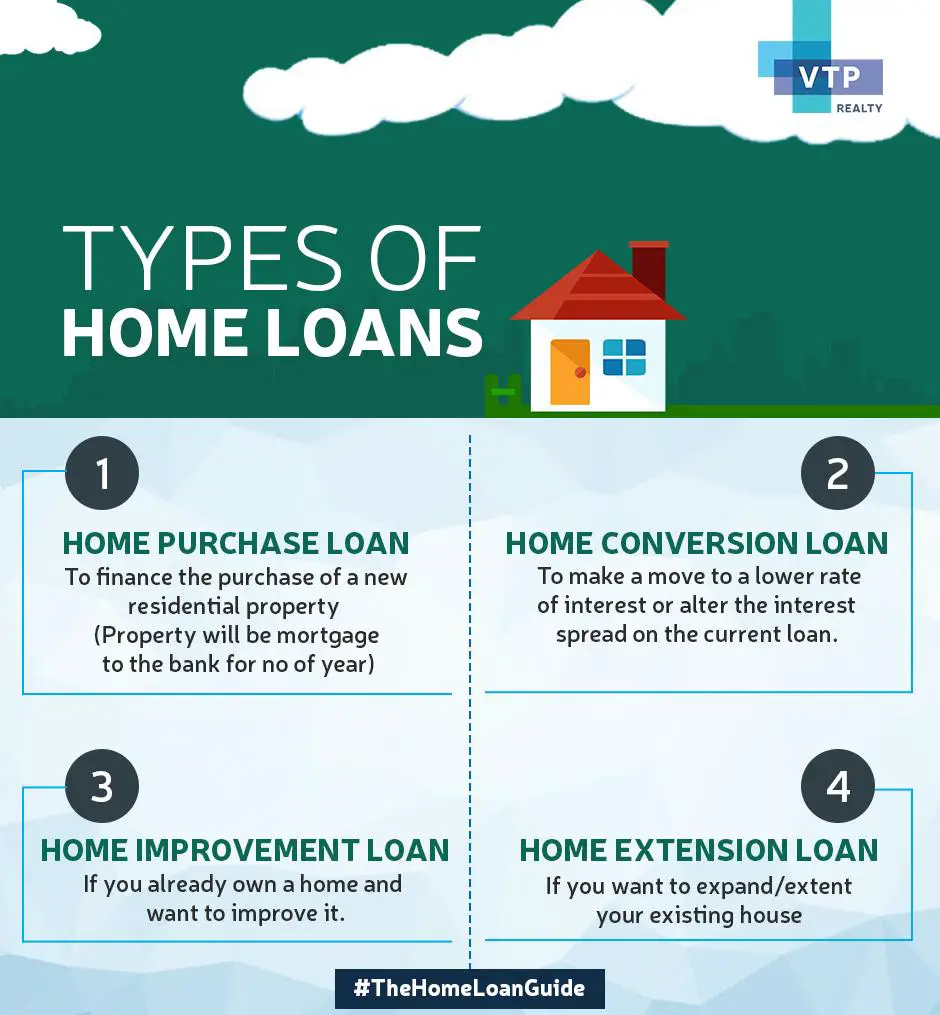

Whether you’re actively looking, just browsing or considering refinancing, understanding the different types of home loans is a crucial first step.

Dori Zinn

Contributing Writer

Dori Zinn loves helping people learn and understand money. She’s been covering personal finance for a decade and her writing has appeared in Wirecutter, Credit Karma, Huffington Post and more.

Navigating the world of home-buying could be an Olympic sport. There are so many different regulations, guidelines and fees to keep track of — and by the time you master one part, there are new rules to learn. And, with mortgage rates predicted to continue rising, particularly as the Fed looks to increase rates as early as March, locking in a rate sooner rather than later may save you tens of thousands in interest.

When searching for the right home loan, you’re bound to come across many options. But not every mortgage is right for every person — you’ll want to learn more about the different types of home loans to decide which one is right for you. This guide will help break down several of the most common home loan types, while explaining what’s required for approval and who each type is best for.

Read more: Mortgages, Credit Scores and Down Payments: 5 Things to Know Before Buying a Home

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Top 10 Different Types Of Mortgage Loans

Are you thinking about purchasing a home? If so, its important to know about all of the different types of mortgage loans that are available to you. Well share the top 10 different types of mortgage loans, and discuss the pros and cons of each one so you can make the best decision for your family and your future. With so many choices, it can be difficult to know which one is the best fit for your needs. Does one provide better value than the others? What about loan terms, interest rates, and other points of comparison? In todays post, were going to break down all the details you need to know.

Recommended Reading: Can You Pay Off Your Car Loan Early

Principal And Interest Repayments

Principal and interest repayments are the favoured option for most people. Each payment reduces your principal as well as the interest charges. Over time you start paying off more and more of the principal. The best aspect of this loan is that your home is building equity, so you could use that equity to invest.

Refinancing An Fha Arm

Many borrowers refinance before the first ARM rate reset. You might want to refinance out of an ARM loan if rates have dropped since you first obtained the loan and you want the stability of a fixed rate. You can also refinance to another ARM.

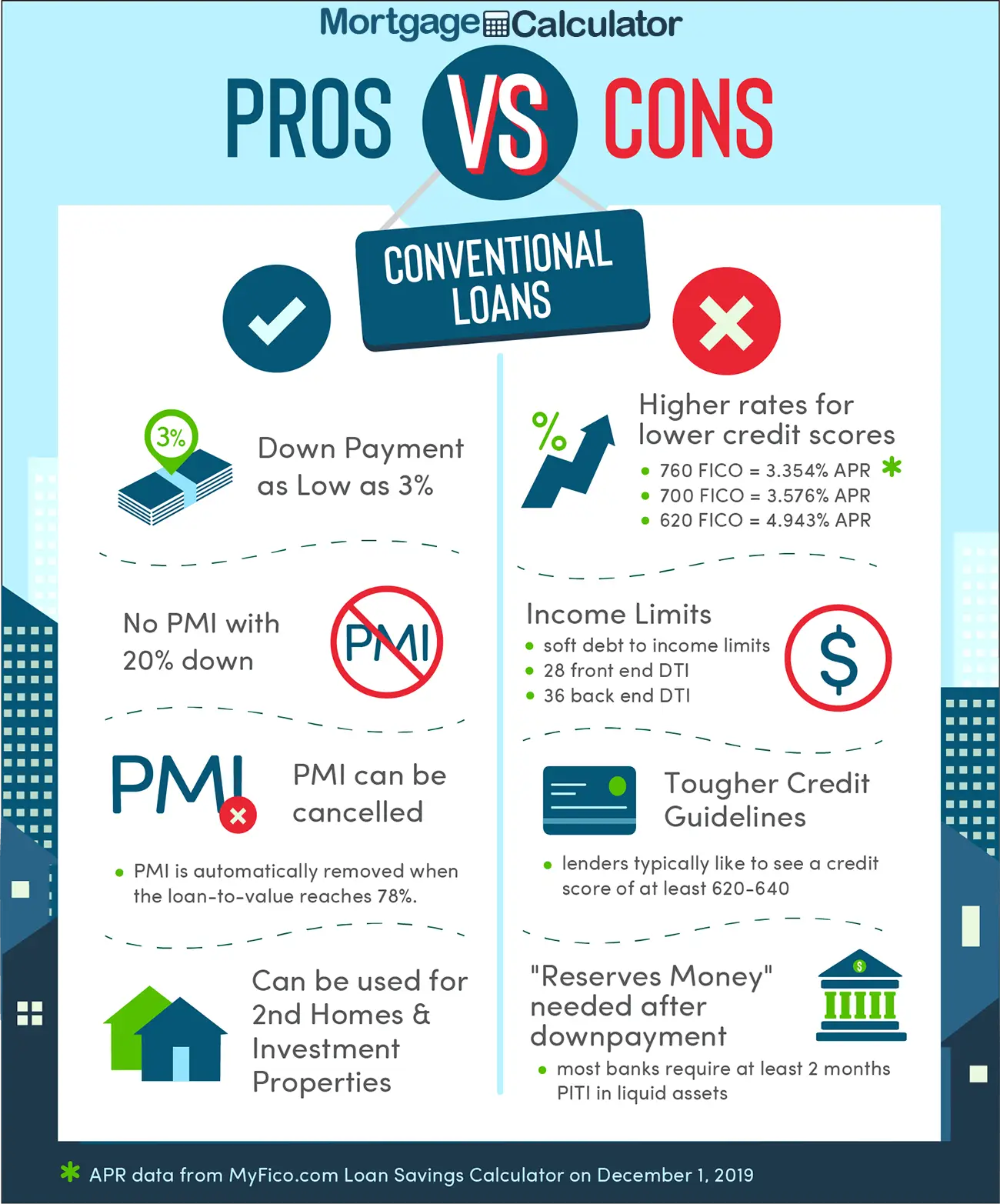

If you qualify, you might want to refinance from an FHA mortgage to a conventional loan, too. This allows you to eliminate mortgage insurance premiums, as conventional loans only require insurance if you have less than 20 percent equity in your home. In contrast, most FHA loans require you to pay insurance for the entire loan term, regardless of how much youve paid down on the mortgage.

Keep in mind, refinancing is typically only worthwhile if you can get a lower rate and pay the closing costs. If you wont be in the home long enough to recoup those costs and realize the savings, it might not make financial sense to refinance.

Read Also: Home Equity Loan Closing Costs

Different Types Of Construction Loans

When you finally make the decision to build a new home, finding the right construction loan to meet your funding needs can be difficult. After-all, there are many different types of construction loans available today. And, these can change depending on the lender you go with. In this article we are going to explore the different types of construction loans and help you decide which is best for you.

What Else Should I Think About Before I Take Out A Mortgage

Youll need to consider more than just your loan type when youre shopping for a mortgage.

Your loan term is an important factor as well. Loans typically range from 15- to 20- and 30-year terms but other lengths may be available depending on your lender.

Keep in mind that shorter-term loans tend to have higher monthly payments , but you can save thousands in interest over the life of the loan. Another consideration is that interest rates on shorter-term loans may be lower.

Depending on your situation, you may also consider a specialty loan like a construction loan or home renovation loan. Construction loansare generally short-term loans used to finance the building of a new house, or renovating an existing one, then convert to a traditional mortgage once the build phase is complete. A home renovation loan, like Fannie Maes HomeStyle® Renovation Mortgage, allows you to borrow enough money to buy a home and fix it up before you move in.

Read Also: How To Settle Defaulted Student Loan

The Bottom Line: The Best Type Of Home Loan For You Is The One You Can Afford

As you can see, there are many different varieties of home loans to pick from. Different mortgage types work best for different types of home buyers. Understanding which makes the most sense for your or your family will largely be a function of your individual financial situation, working scenario, and personal real estate goals.

Interested in shopping for a new home? Youll want to apply now with Rocket Mortgage® and start exploring your options today! Home mortgage specialists are standing by to help you determine the best choice of home loan option for your needs.

Get approved to buy a home.

Types Of Mortgage Loans For Buyers And Refinancers

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Many types of mortgage loans exist, and they are designed to appeal to a wide range of borrowers’ needs.

For each type of mortgage listed below, youll see its advantages and the kind of borrower it’s best for. This page concludes with a glossary of terms describing different types of mortgage loans.

Read Also: How To Pay Back Perkins Loan

Different Types Of Home Loans: Which One Is Right For You

If youre a first-time home buyer shopping for a home, odds are you should be shopping for mortgage loans as welland these days, its by no means a one-mortgage-fits-all model. Youll want to get and understanding of all the basics, with mortgage 101.

Where you live, how long you plan to stay put, and other variables can make certain mortgage loans better suited to a home buyers circumstances and loan amount. Choosing wisely between them could save you a bundle on your down payment, fees, and interest.

Many types of house loans exist: conventional loans, FHA loans, VA loans, fixed-rate loans, adjustable-rate mortgages, jumbo loans, and more. Each mortgage loan may require certain down payments or specify standards for loan amount, mortgage insurance, and interest.

Different Types Of Home Loans To Consider When Buying Your First Home

While many people start the homebuying process with the exciting home search, taking a look at mortgage loan options first can help you zero in on the right home faster.

To help you determine your financing options, we have pulled together the most common loan types borrowers use to purchase their first home.

What’s in this article?

Lets take a look at the different types of home loans, from conventional and VA loans to term lengths, rate options, and requirements.

Recommended Reading: Second Chance Personal Loans With Bad Credit

One Year Traditional Arms

A mortgage loan in which the interest rate changes based on a specific schedule after a fixed period at the beginning of the loan, is called an adjustable rate mortgage or ARM. This type of loan is considered to be riskier because the payment can change significantly. In exchange for the risk associated with an ARM, the homeowner is rewarded with an interest rate lower than that of a 30 year fixed rate. When the homeowner acquires a one year adjustable rate mortgage, what they have is a 30 year loan in which the rates change every year on the anniversary of the loan.

However, obtaining a one-year adjustable rate mortgage can allow the customer to qualify for a loan amount that is higher and therefore acquire a more valuable home. Many homeowners with extremely large mortgages can get the one year adjustable rate mortgages and refinance them each year. The low rate lets them buy a more expensive home, and they pay a lower mortgage payment so long as interest rates do not rise.

Can You Handle Interest Rates Moving Higher?

The traditional ARM loan which resets every year is considered to be rather risky because the payment can change from year to year in significant amounts. Unless the buyer plans to quickly flip the property or has plenty of other assets and is using an interest-only loan as a tax write off, almost anyone taking adjustable rates should try to pay extra in order to build up equity in case the market turns south.

Federal Housing Administration Loans

FHA loans are guaranteed by the Federal Housing Administration and have qualification criteria that open the door for a variety of borrowers. With an FHA loan, your credit score and down payment are linked.

Borrowers with a minimum 580 credit score qualify for the lowest down payment: 3.5% of the purchase price. If your credit score is a bit lower , youll need to bump your down payment up to 10%. Theres a maximum debt-to-income ratio of 43% for all borrowers, and these mortgages must fund a borrowers primary residence. For all borrowers, PMI is required for down payments less than 20%.

Don’t Miss: Can You Get An Fha Loan On New Construction

When Youre Looking To Buy A Home You Have Financing Options

Mortgages come in all shapes and sizes. While the 30-year fixed-rate mortgage might be the most traditional, its far from the only choice you have. Your lenders will ask you questions about your income, credit and the type of home youd like to buy. And theyll use that information to recommend types of loans that would work best for you.

Well go over six of the most common types of mortgage loans on the market and discuss a few other important considerations like what loan term you need and whether a fixed or adjustable interest rate makes more sense for your loan. Lets dive in.

What Is The Difference Between A Mortgage Broker And A Mortgage Lender

A lender is a financial institution that makes loans directly to you. A broker does not lend money. A broker finds a lender. Whether you use a broker or a lender, you should always shop around for the best loan terms and the lowest interest rates and fees.

What mortgage is best for first time buyer?

FHA mortgageAn FHA mortgage is often the best mortgage for a first-time buyer. You may qualify with a lower credit score and higher debt-to-income ratio than with other home loans, making FHA mortgages appealing to people whose finances arent in the best shape yet.

Also Check: What Is Required For Fha Loan

Home Equity Loan Fees

Generally, fees should be disclosed by the lender, under federal law, although there are some fees that are not required to be disclosed. Borrowers certainly have the right to ask what those undisclosed fees are, though. Fees that require disclosure include application fees, points, annual account fees, and transaction fees, to name a few. Lenders are not required to disclose fees for things like photocopying related to the loan, returned check or stop payment fees, and others.

Loans For People In Certain Professions

If you’re a teacher, law enforcement professional, firefighter, or EMT, talk to your loan officer about lending options that may help you save even more money, such as the Good Neighbor Next Door program. There are also special physician loans that can help medical doctors and dentists buy a home even while carrying significant medical school debt.

Read Also: Are Closing Costs Higher On Fha Loan

States That Took Out The Most Home Loans

Homebuyers took out the most mortgages for a primary home residencenot for investment propertiesin Utah, Colorado, Idaho, and South Carolina. The states with the most mortgage activity are also among those that have seen their housing markets superheated by COVID-19-era interstate migration. The least number of home loans were taken out in New York, West Virginia, Mississippi, Pennsylvania, and Vermont last year.

What To Look For In A Home Loan

So, where to begin? There are a few helpful things you can ask yourself when thinking about the different types of home loans to dial in on the one that fits your needs:

The answers to these questions will help you narrow down the type of mortgage you should focus on. For example, if you have good credit and can put down a substantial down payment, a conventional loan may be right for you. Alternately, if your credit score is on the lower end or youre a former service member, you may qualify for assistance.

Recommended Reading: Will Ally Refinance My Auto Loan

Home Equity Loans And Helocs

Home Equity Loans and Home Equity Lines of Credit are both considered second mortgages.

They are different from other types of mortgages because they allow you to borrow against the equity youve been accruing in your home over time. In other words, theyre secured by your current property. In the event of a foreclosure, your first mortgage will be repaid first, followed by your second mortgage.

A home equity loan is a lump-sum loan that includes a fixed interest rate. Youll repay it over a set period of time through fixed installments.

An HELOC is distributed as a revolving credit line. In many ways, its similar to a credit card. The interest rate will vary, though you can use, repay, and reuse the funds as long as you have access to the credit line.

Rate And Term Refinance Loans

Homeowners who have improved their financial situation since initially buying the property may want to refinance their current home loan to a mortgage option that comes with a better interest rate or loan term attached. This type of home refinancing option effectively alters the rate and/or term of your loan and doesnt allow you to access the equity that youve built in your home. On the bright side, rate and term refinances can help you put a great deal of money back in your pocket by helping you save ample money on interest payments over the life of the loan.

Read Also: How To Calculate Student Loan Interest Paid

Why Homebuyers Use This Type Of Loan

- Interest rates are usually lower than for fixed-rate loansat least at the start of the loan.

- Some homebuyers use ARMs to keep their payments lower near the beginning of the loan. This can work in their favor if they plan to resell or refinance the home, especially before the ARM’s first-rate adjustment.

Research The Different Types Of Mortgage Loans

As you can see, there are many different types of mortgage loans available! To figure out which one is right for you, speak to your financial advisor or a trusted real estate agent. There are many factors to consider, including your budget, goals, and plans for the future.

As you browse available options, were here to help you find the Triangle home of your dreams. Take a look at our available properties today and contact us to connect!

Additional Resources:

Also Check: How To Get Approved For First Time Home Buyer Loan

Choosing The Right Loan Type

Each loan type is designed for different situations. Sometimes, only one loan type will fit your situation. If multiple options fit your situation, try out scenarios and ask lenders to provide several quotes so you can see which type offers the best deal overall.

Conventional

- VA: For veterans, servicemembers, or surviving spouses

- USDA: For low- to middle-income borrowers in rural areas

- Local: For low- to middle-income borrowers, first-time homebuyers, or public service employees

Loans are subject to basic government regulation.

Generally, your lender must document and verify your income, employment, assets, debts, and credit history to determine whether you can afford to repay the loan.

Ask lenders if the loan they are offering you meets the governments Qualified Mortgage standard.

Qualified Mortgages are those that are safest for you, the borrower.