How To Decide If An Fha Loan Is The Right Choice

An FHA loan does offer significant benefits, but it’s not the right choice for every would-be homebuyer. An FHA loan could make sense for you if:

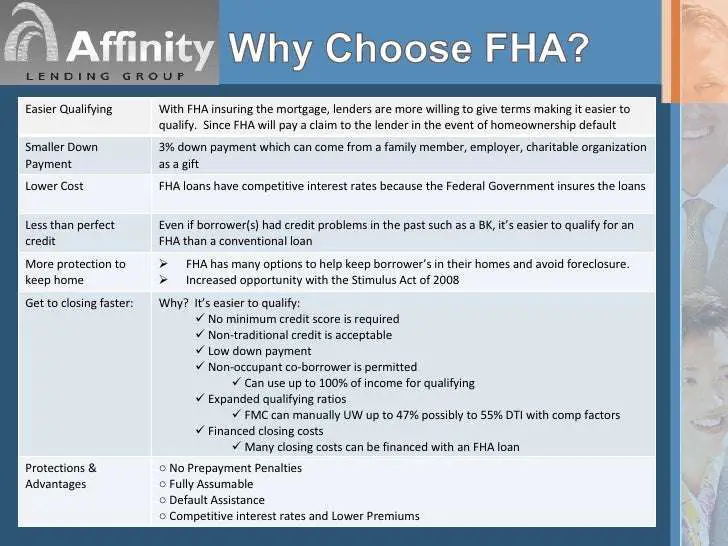

- Your credit needs improvement. Conventional mortgage loans usually require a , while FHA loans allow for lower credit scores. Even if you’ve had more significant credit problems, such as a bankruptcy, you could still qualify for an FHA loan.

- You don’t have much saved for a down payment. Since FHA loans allow you to put down as little as 3.5%, they’re an option for homebuyers who haven’t been able to set aside a significant sum.

- You need help with closing costs. Conventional mortgages require borrowers to pay hefty upfront costs in addition to the down payment, which can easily total in the thousands. To help homebuyers, the FHA allows some closing costs to be rolled into the mortgage and paid over time.

FHA loans have their advantages, but there’s a trade-off in the form of the mortgage insurance. Homebuyers who take out an FHA loan must pay an upfront premium that’s usually 1.75% of the base loan amount. There’s also an ongoing annual mortgage insurance premium that usually costs 0.45% to 1.05% of the loan amount. This annual premium lasts for the life of the loan unless you refinance later on or put down 10% or more, in which case it falls off after 11 years.

Do You Qualify For A Home Loan

Numerous factors determine whether youll qualify for a home loan. Your mortgage lender will look closely at your credit history, your debts, cash on hand, and income to gauge affordability.

Mortgage approval isnt one-size-fits-all, so its also important to get pre-approved for a loan before house hunting. This way, youll know your qualifying amount with your current income. You can then search for properties within this price point.

Other Types Of Income That Count Toward Mortgage Qualifying

Heres what you need to know when using other types of income to qualify for a home loan:

- Dividend income: These are cash payments received for owning stock in a company. This income must be regular, and you must show a two-year history of receiving dividends

- Retirement income: Income must continue for at least three years post-closing

- Social Security income: This income must continue for at least three years post-closing

- Alimony/child support: You must have received regular payments for at least six to 12 months prior to getting the mortgage, and support payments must continue for at least three years post-closing. Youll need to provide a copy of a divorce decree and other court orders

If youre not sure whether your income qualifies, talk to a mortgage lender. Your loan officer can help you understand which types of income are eligible and how much home you can afford based on your monthly cash flow.

Also Check: When Should You Refinance Your Car Loan

Income Documentation Requirements For An Fha Loan

June 7, 2016 By Justin McHood

There are many speculations regarding what an FHA loan requires in terms of income. Some people believe that this loan program is strictly for the lower income borrowers and that those that make too much will not qualify. This is simply not true there is no maximum amount of money you can make that would disqualify you for FHA financing. Just like any other loan, the requirements for FHA financing include having the appropriate credit score, a low-enough debt ratio, and a steady job. When it comes to your income, here are three requirements you must meet.

How Do Fha Interest Rates Compare To Other Types Of Loans

If you’re trying to decide between an FHA or VA loan, you may be surprised to know how competitive FHA rates are. As of this writing, for example, FHA and conventional loan rates are running neck and neck. And the VA loan has a slightly lower interest rate.

Since FHA mortgage rates are competitive compared to other mortgage types, you can decide which mortgage to apply for based on more detailed factors, like your credit score and how much you have for a down payment.

Also Check: Do You Pay Taxes On Home Equity Loan

How To Calculate Your Down Payment

Most lenders require 20 percent down if you want to avoid paying for a product called private mortgage insurance . PMI covers your lender in the event that you stop making your payments.

To be clear: PMI covers the bank’s loss if they foreclose on your home. It has no benefit to you – it only costs you additional money every month. And you can avoid it by putting enough cash down.

If you chose a private mortgage, you would then put down 20 percent of the agreed purchase price. So if you want to buy a $200,000 home, you’ll need a $40,000 down payment.

The down payment is a huge stumbling block, particularly for renters. It’s seemingly impossible to tackle rising rents, student loans, and save $40,000 of your income.

The average American puts down only six percent, but even that can be problematic for someone who lives in an area where rent is high.

That’s where FHA loans come in.

Because an FHA loan comes with a government guarantee, you can put as little as 3.5 percent down.

The FHA 3.5 percent down payment for borrowers with a credit score over 580. If your credit score falls between 500 and 579, you’ll need to put 10 percent down.

Note: if you take out an FHA loan, then you will pay PMI for the life of the loan or until you refinance into a conventional mortgage. This differs from a traditional mortgage when you can remove PMI when you hit 78 percent loan-to-value.

Fha Vs Conventional Loans

A conventional loan is a common alternative to an FHA loan. Though conventional mortgages require a stricter set of financial qualifications, they also typically come along with lower interest rates and mortgage insurance that comes off at 20% equity, which is why borrowers often consider refinancing their FHA loan to a conventional loan. Lets take a closer look at some of the differences between conventional and FHA loans.

Also Check: Why Mortgage Companies Sell Your Loan

Do You Have All The Relevant Paperwork

What kinds of things will you need to document? Your Social Security number, income, current address, employment history, bank balances, federal tax payments, any open loans and the approximate value of your current property. And thats a minimal list. Youll want to talk to a loan officer about the paperwork youll have to submit with your application. Then, start digging it all out and make copies. If youre a veteran, youll need to submit extra paperwork related to your service record.

Keep in mind that individual lenders requirements may be more stringent than the FHA qualifications. When banks decide to offer FHA loans, theyre allowed to impose their own standards beyond those set out by the government. Thats why it pays to shop around for a lender before committing to a mortgage.

How Do You Apply For An Fha Mortgage

Applying for an FHA loan is like any other mortgage application process, meaning get ready for a lot of paperwork. The only difference is the mortgage broker must be authorized to make FHA loans.

Most are, and you can check with FHA Lender finder on the internet to find a list of brokers. Consider getting a mortgage pre-approval before going out home shopping, so your offer carries more weight with sellers.

You May Like: Who To Call About Student Loan Garnishment

What Is An Fha Adjustable

The FHA provides various mortgage loans with less stringent financial stipulations. Specifically, FHA loans usually dont require as high of a credit score or as favorable of a debt-to-income ratio as conventional mortgages. These loans also generally require a small down payment . Additionally, the federal government insures FHA loans.

An FHA adjustable-rate mortgage consists of four components: initial interest rate period, index, margin, and interest rate cap. Investors gives borrowers an initially low interest rate on the mortgage for a fixed number of years. Then, once the introductory period expires, the mortgage interest rate fluctuates based on an index preset in the loan conditions. For FHA loans, its typically the Constant Maturity Treasury and the U.S. Treasury that determine mortgage rates.

The interest rate cap sets an upper limit for your loans interest rate. For example, an ARM with an introductory period of 10 years could have a 1/1/5 limit structure. This cap structure means that after the fixed-rate period, the interest rate would not deviate more than 1% from the initial rate. Afterward, while the interest rate might change every year, your interest rate will never rise beyond 1% from the calculated rate. The final figure in the structure means that the maximum the interest rate can grow in total over the life of the loan is by 5%.

Fha Foreclosure Waiting Period

If you have previously lost a home to foreclosure, you’ll have to wait three years before applying for an FHA loan. There are some exceptions, however, for circumstances like a serious illness.

Those who have experienced bankruptcy can also qualify for an FHA loan, though you’ll have to demonstrate that you’re now on better financial footing. Some allowances may be made on an individual basis, but in general, you’ll need to wait two years after a Chapter 7 bankruptcy and at least a year after a Chapter 13 bankruptcy to apply for an FHA mortgage.

Recommended Reading: How Do I Figure Out My Loan Payoff Amount

What Are The Advantages Of Fha Loans

Unlike other conventional loans, if you have a lower credit score, this type of loan could be ideal for you. With an FHA loan, you can purchase a home with as little as 3.5% down. Also, the down payment can be gifted from an acceptable gift/donor.

You can qualify for an FHA loan with a credit score as low as 500 with a 10% down payment. To be eligible for the maximum financing of 96.5%, you need a credit score of 580 or higher and a 3.5% down payment. .

What Is An Fha Loan And How Does It Work

An FHA loan is insured by the Federal Housing Administration , a division of the U.S. Department of Housing and Urban Development . This government-backed mortgage product is designed for low- to moderate-income borrowers, and comes with lower minimum credit score and down payment requirements.

Compared to conventional loans, FHA loans also have more relaxed underwriting standards, including a higher allowable debt-to-income ratio and increased flexibility if youve had financial difficulties like a bankruptcy in the past.

There are different types of FHA loans, including:

- Purchase loans: For buying a home

- Streamline refinances: For refinancing an FHA loan to a new one without needing to undergo a credit check or other steps in the underwriting process

- 203 loans: For buying and fixing up a home

- Cash-out refinances: For tapping your home equity

Don’t Miss: How Many Pay Stubs For Home Loan

What Are The Requirements For An Fha Loan

To qualify for an FHA mortgage loan, the FHA guidelines state that applicants must meet the following requirements.

Risks With Being A Co

There are more risks with becoming a non-occupant co-borrower. Rewards to being a non-occupant co-borrower are the reward of helping a family member or relative the chance of becoming a homeowner. Without the non-occupant co-borrower, they would not have qualified for an FHA loan. Chances are that they will still be renting. If the main borrower is late on their monthly mortgage payments, it will really adversely affect non-occupant co-borrowers credit.

Don’t Miss: Are There Student Loan Forgiveness Scams

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Are There Income Limits For A Mortgage

Some mortgage programs have income limits, meaning your income cannot exceed a certain percentage of the areas median income to qualify.

Standard conventional loans, VA loans, and FHA loans dont have income limits.

But household income limits are typical with USDA loans and some specialized programs.

USDA loans, backed by the U.S. Department of Agriculture, are used to purchase homes in eligible rural areas. To qualify, though, your income cannot exceed 115% of the area median income.

Likewise, if you apply for Fannie Maes HomeReady mortgage, your income must remain below 100% of the area median income and your income must remain below 80% of the area median income for Freddie Macs Home Possible mortgage.

Keep in mind, too, many down payment assistance programs have income limits. These limits vary depending on the program. Typically, your income cannot exceed 100% to 115% of the median area income.

Don’t Miss: What Is The Price Limit For Fha Loan

How Do I Apply For An Fha Loan

You apply for an FHA loan directly with the bank or other lender that you choose. Most banks and mortgage lenders are approved for FHA loans.

You can apply for pre-approval of an FHA loan with the lender you choose. The lender will gather enough financial information to issue a pre-approval within a day or so. That will give you an idea of how much you can borrow while not committing yourself to anything.

All of the above is true for any mortgage application. If you want an FHA loan you should say that upfront.

Is An Fha Loan Right For You

If youre still debating the pros and cons of an FHA loan compared to a conventional loan, you should know that a conventional loan is not government-backed. Conventional loans are offered through Fannie Mae or Freddie Mac, which are government-sponsored enterprises that provide mortgage funds to lenders.

They have more stringent requirements, so keep in mind that youll need a higher credit score and a lower DTI to qualify. FHA loans, on the other hand, are nonconforming loans, meaning they dont satisfy Fannie Mae or Freddie Macs requirements for purchase.

Regardless of whether you choose a conventional or FHA loan, there are a few other costs of which youll need to be aware. You’ll have to pay closing costs, which are the fees associated with processing and securing your loan. These can vary depending on the price of the house and the type of mortgage, but you should budget 3% 6% of your homes value.

You should also budget 1% 3% of your purchase price for maintenance. The exact percentage is going to depend on the age of the house. If your house is newer, odds are less things are likely to break right away. Meanwhile, if the house is on the older end, you may need to set aside more. Finally, if you live in an area with homeowners association fees, youll end up paying for those on a monthly or yearly basis.

You May Like: Can Your Business Loan You Money

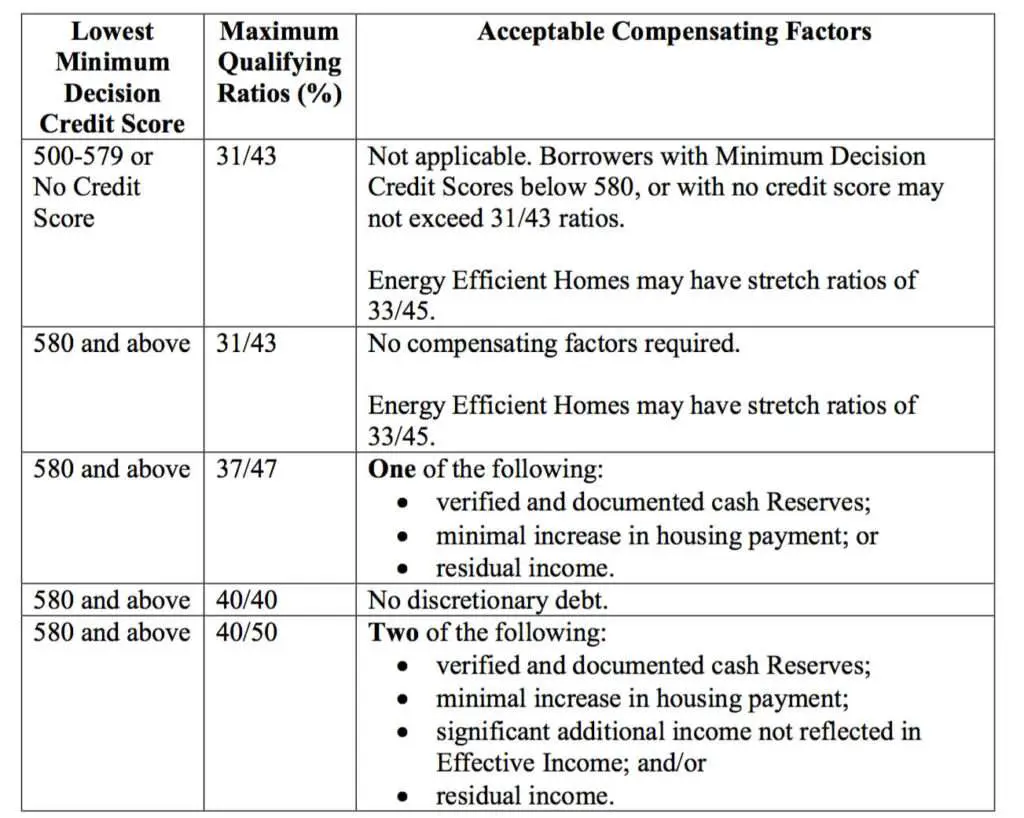

Are There Any Exceptions When It Comes To Dti

If any of these factors are in play, an FHA lender may permit you to carry a DTI of up to 59.6%.

- Residual income: If you have significant funds left over each month after you’ve paid bills, a lender can see there’s a good chance you’ll make your mortgage payments.

- Cash reserves: If you have a substantial emergency fund, a lender is less likely to worry you’ll run into financial trouble and be unable to pay your mortgage down the road.

- Minimal payment shock: If the payments on your new home are close to your previous rent or mortgage payments, it’s easier for an FHA mortgage lender to believe you can swing the monthly payment on the property you hope to buy.

- High credit score: If your credit history is great, an FHA lender has reason to believe you will make your monthly mortgage payment and protect your credit score.

- Steady employment: A history of job and income stability shows you’re less likely to hop from one job to another, jeopardizing your ability to pay the mortgage.