Best For Flexible Terms

Who’s this for? Similar to some of the other lenders on this list, Alliant offers personal loan amounts for as much as $50,000 . But this lender also has a considerable amount of flexibility when it comes to its personal loan products. For one, the lender can usually deposit the funds into your bank account on the same day . However, if you’d rather receive your funds in the form of a check, Alliant offers to mail you one.

The APR for Alliant personal loans are tiered and depend on the timeline you choose for repaying the loan. According to the Alliant website, you may qualify for a rate close to the lowest APR if you choose a loan term of 12 months. Then the APR starts at 7.24% for a 24-month loan term, 9.24% for a 48-month loan term and 10.24% for a 60-month term. Of course, aside from the term you choose, your interest rate will also depend on your credit score. The higher your , the more likely you’ll be to get approved for interest rates on the lower end of the lender’s ranges.

This lender also doesn’t charge origination fees or a prepayment penalty.

Personal Loan Rates At Banks

Banks may offer competitive rates and rate discounts if youre already a customer but they typically have tougher eligibility requirements and can take longer to fund your loan than online lenders. The average rate charged by banks in August 2022 for a two-year loan was 10.16%, according to the most recent data from the Federal Reserve.

» MORE: Top banks offering personal loans

Other Personal Loan Fees And Charges

Here are other costs, besides the origination fee, to keep in mind when comparing personal loans:

Annual percentage rate: is the sum of the loans interest rate plus all upfront costs, including origination fee. Lenders are required to disclose APR and fees under the Truth in Lending Act. Use APRs to compare the true annual borrowing costs between lenders.

Use our personal loan calculator to see estimated APRs and payments for a personal loan based on your credit score.

Late fee: This common fee is charged when youve missed a payment due date, although some lenders allow a grace period before charging it.

To avoid late fees, consider setting up payment reminders or automatic payments via ACH debit, which authorizes lenders to deduct the loan payment directly from your bank account. Lenders may also be willing to waive a late fee if you request it.

Prepayment fee: While this fee is uncommon on personal loans, some lenders may charge it for paying off the loan early, either with your own money or through a loan refinance.

Insufficient funds fee: Also called an overdraft fee, this may be charged if youve signed up for autopay, but dont have enough cash in your bank account to cover the loan payment. Consider setting up an alert with your bank if your balance falls below the monthly payment amount.

Recommended Reading: Are Loan Origination Fees Tax Deductible

Best For Small Loan Amounts: Penfed Federal Credit Union

Why PenFed stands out: You can borrow as little as $600 using a PenFed personal loan a small amount compared to many other lender minimums. But youll need to become a member of the credit union to apply.

- No origination fees or prepayment penalties.

- Loans capped at $50,000.

Read more about PenFed personal loans.

What Are Rates On Excellent

As with most credit products, the rate you receive on a personal loan depends a lot on your credit score. Borrowers with excellent credit will pay less interest over the life of the loan than borrowers with lower credit scores. The interest rate also affects your total monthly payment, as does the term length a longer term means lower monthly payments, but more interest.

Use our personal loan calculator to see estimated rates, total interest costs and payments for a personal loan.

Here is what interest rates on personal loans look like, on average:

|

How’s your credit? |

» MORE: Compare the best personal loan rates

Recommended Reading: Republic Finance Loan Check In Mail

Counties With The Lowest Debt By Purpose

SmartAssets interactive map highlights the places in the country where people have the lowest overall debt. Zoom between states and the national map to see where people have the lowest credit card, auto and mortgage debt.

| Auto Debt as % of Income | Mortgage Debt as % of Income |

|---|

Methodology Our study aims to find the places where people have the least amount of debt. To find these counties we looked at three kinds of debt: credit card, auto and mortgage.

We calculated debt-to-income ratios for people in each county by comparing each type of debt to the median income. This gave us three per capita debt-to-income ratios. We then indexed the three ratios for each county.

Finally, we averaged those to create the overall Lowest Debt Index.

How We Found The Best Personal Loans

Our methodology to find the best personal loans for our readers included an in-depth evaluation of 40 banks, credit unions, marketplaces and peer-to-peer lenders taking into account the following:

- Loan rates and fees. We chose banks that provided the most affordable loans, that is, those that offered lowest interest rates and fees. We also evaluated which banks offered the most benefits and unique offers.

- Loan term flexibility. We preferred banks that offered customers with multiple term options and ways to pay.

- Customer satisfaction. We evaluated how banks ranked in J.D. Powers Customer Satisfaction surveys and checked any complaints filed with the Better Business Bureau .

- Regulatory compliance. We checked for complaints and reports filed with the Consumer Financial Protection Bureau database and the Federal Trade Commission .

Don’t Miss: What Is The Average Student Loan Interest Rate

How To Compare Personal Loan Lenders

When choosing a lender, its important to understand the terms and the true costs of the loans they offer. Its also important to get acquainted with the many factors they evaluate when processing your application. For example, in addition to your credit score, banks will also take a look at your employment history, credit utilization and your debt-to-income ratios, among other things.

Read on for some additional tips to help you make the right choice.

Check the lenders prequalification and preapproval requirements

When youre getting ready to apply for a personal loan, youll often hear the terms prequalification and preapproval. Both these terms involve an assessment of your current financial situation. Sometimes these terms are used interchangeably however, often there are important differences to be aware of.

- Prequalification involves a soft inquiry of your credit history, meaning it wont leave a mark on your credit report. A prequalification lets you know whether youd be approved for a loan and can give you a rough estimate as to the amount you could borrow. It does not, however, mean youre approved for the loan.

- Preapproval involves a hard credit inquiry, which can slightly impact your score. Because its a more thorough evaluation of your finances, preapproval can give you a better idea of the final amount and APR you will qualify for.

Compare interest rates vs annual percentage rate

Look for any additional fees

Here are some of the most common types:

What If I Need To Borrow More Than They’ll Lend

Once you’ve applied for the loan, it’s already on your credit report. So assuming you applied for the cheapest loan for you, there’s no point in not accepting that cash because it’s not the amount you need. You may be able to apply for another loan elsewhere to fill the gap, though the new lender will take your loan into account when deciding, and may decide that you can’t afford the extra borrowing.

Have a look whether any of the could work for you.

Don’t Miss: Can I Refinance My Mortgage And Home Equity Loan Together

Physician Line Of Credit

Practicing as a physician means dedicationbut it shouldnt always mean sacrifice. With a Truist physician line of credit, interns, residents, and fellows can have easy, low-cost access to cash to help them focus on what matters most.

max line amount for medical residents and fellows

$100,000

max line amount for board-certified physicians, dentists, and podiatrists

Variable rates as low as 11.00% APR8

Excellent credit required for lowest rate

Key benefits

- Competitive, variable interest rates from Prime + 4.00% to Prime + 9.74% APR.8

- Easy access to cash that lets you focus on building a practice.

- Minimal payments mean maximum flexibilitypay only interest during the draw period.7

- Option to eSign for added convenience.

Its best for…

- Managing personal expenses while focusing on your career.

- Covering gaps in your finances during a hectic time.

- Being ready for unplanned expenses.

Personal Loan

How Can I Get A Low Rate On A Personal Loan

Typically, only borrowers with really good credit scores will be offered the lowest interest rates. For some lenders, this amounts to a fraction of people who apply. Youll likely need good-to-excellent credit scores of at least 750 to be eligible for the best rates.

If your credit isnt perfect, lenders may quote you higher interest rates and be more restrictive about the amount you can borrow or you may not get approved. If this happens, applying for loans with no credit check might be an option. Or you could look into a 0% interest credit card. If your credit is in particularly rough shape and youre shopping for a loan, you may want to check into personal loans for bad credit.

Saving up cash or focusing on building your credit before applying for a loan is the ideal way to go if you can take the time you need to set yourself up.

You May Like: How Much House Loan Do I Qualify For

What Is A Good

Having good credit can often mean lower annual percentage rates and more favorable terms on personal loans. These loans are unsecured, meaning you don’t have to put up collateral like your car or savings instead, lenders evaluate applicants’ ability to repay by considering factors like credit, debt and income.

You can get a good-credit personal loan from online lenders, credit unions and some banks.

Factors That Determine Your Interest Rate

Look into these factors before you start the application process there are various factors that play into what interest rate you can get on a personal loan.

- Check your credit score online to get an estimate of the number your lender will see, and your credit score range. This can help you understand the types of rates youre eligible for. If your score is below 670, consider taking steps to improve your credit first.

- Your other debts and income. A lender will ask about your other debts that youre currently paying on, such as car loans, credit cards and other accounts. If you have enough income leftover after accounting for all other debts, you should be set.

- Exact loan amount. Go in knowing how much you need to borrow so you can rule out lenders who dont offer financing in that range. If youre not sure how much youll need, consider more flexible financing options like a credit card or line of credit instead.

- Loan term. Typically, lenders tend to offer lower interest rates to longer loan terms.

- Secured or unsecured. Securing your loan with an asset makes it less risky to the lender and gets you lower rates.

- Loan amount. Often, the lowest available rates are only available on the highest loan amounts.

- Use. How you plan to use a personal loan can affect your rate. For example, if you use a loan for debt consolidation, your lender might offer a lower rate than if you wanted funds to pay for a vacation.

How to prequalify for a personal loan

You May Like: What Do I Need To Apply For Personal Loan

What If I Default On The Debt

If you find you are unable to repay what you owe, the lender could open legal proceedings in an attempt to get its money. It may be possible to create a new repayment schedule that reflects your circumstances.

Explain to the lender any change in your ability to repay the debt at the earliest opportunity. You my be able to arrange a repayment holiday to get you through a difficult patch.

Which Bank Has The Lowest Interest Rate On A Personal Loan

If you have a strong credit score, you can receive the lowest interest rate through LightStream. LightStream has rates as low as 2.49% if you enroll in autopay. Other lenders, like SoFi, PenFed, Wells Fargo, Marcus and U.S. Bank, offer rates as low as 5.99%. Although not as low as LightStream, rates that low still beat out other methods of financing, including credit cards.

You May Like: How Do Car Loans Work With Interest

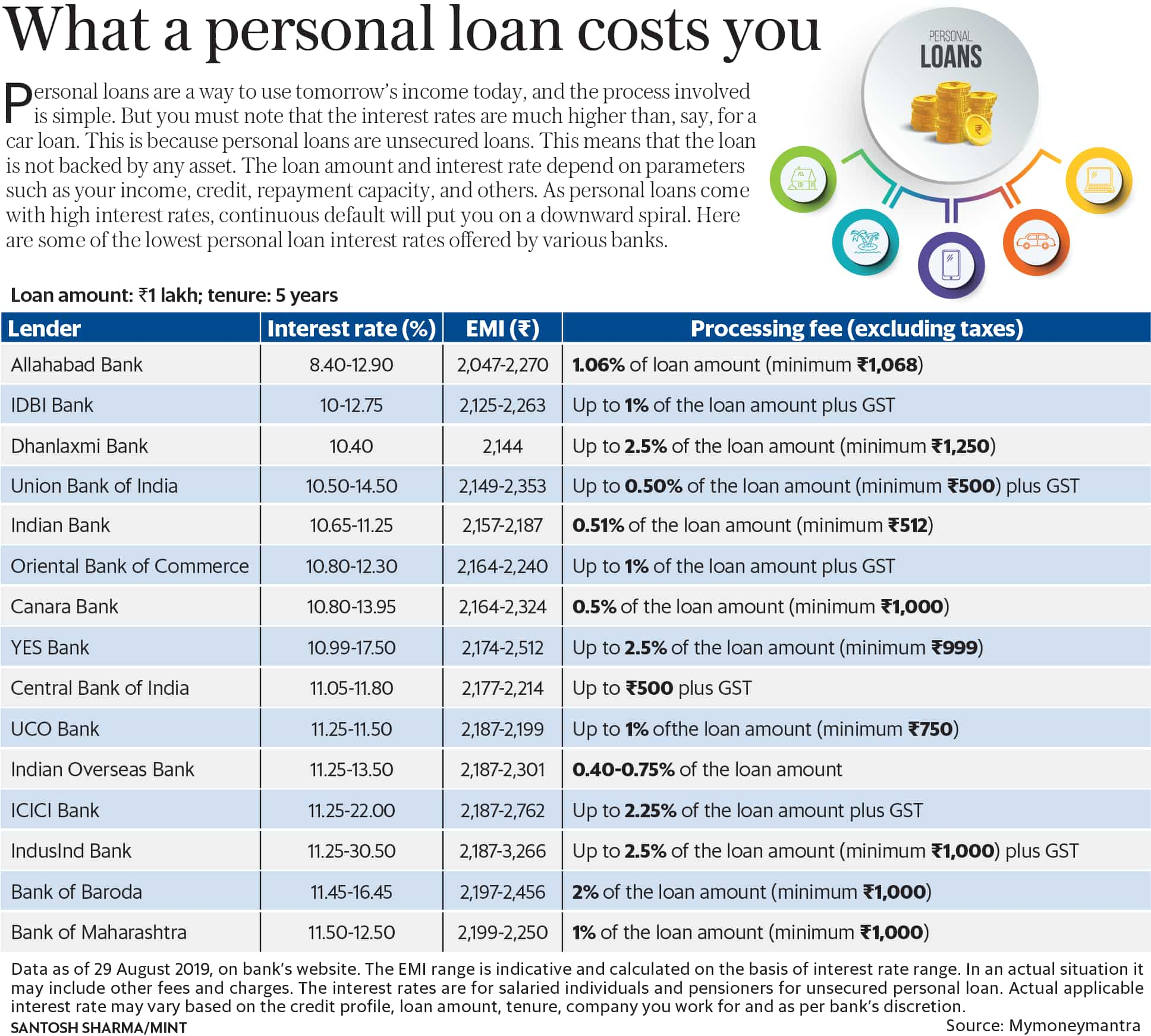

Yes Bank Personal Loan Interest Rates

If you believe in instant solutions to your personal finance problems then Yes bank Personal Loan is for you. With interest rates starting from 10.99% that can go upto a full blown 24%, Yes bank offers a credible way out to sort out your financial requirement. For a period of 5 yrs, a Rs 1 lakh loan can give you an EMI of Rs 2174

How To Compare Personal Loans

Shopping around and comparing offers from multiple lenders is the best way to make sure you’re getting the best deal.

Fortunately, some lenders will let you estimate your interest rate without submitting a full application, a process called prequalification. This results in a soft inquiry, which won’t affect your score.

When considering offers, compare the following:

- : APR incorporates both your interest rate and fees, it reflects the total cost of your loan. It’s likely the most important piece of information to use when comparison shopping.

- Loan term: This is the length of time or number of installment payments it will take to pay off the loan. Often, shorter loan terms lead to cheaper APRs.

- Fees: Understand how much each lender charges in origination fees, late fees and other charges. The big one is the origination fee, which can range from 1% to 10% of the loan amount. Some lenders don’t charge one at all, though.

- Monthly payment: Between the APR and loan term, it’s important to understand how much you’ll pay per month and whether that figure fits within your current budget. It’s especially important to make sure you can cover monthly payments on your other debts, as well as your essential expenses.

- Discounts available: You may be able to lower your rate by getting a loan from a bank or credit union where you already have other accounts or if you set up automatic payments.

Also Check: How To Deal With Specialized Loan Servicing

What Are The Requirements For A Personal Loan

To get a personal loan, youll likely need to have steady income, a decent credit score, and a track record of making payments on time. Most loans are unsecured, but some are secured, which means you would need to put up an asset as collateral. If you have no credit, bad credit, or not established in your credit history, you may need to add a cosigner someone with good credit who will be on the hook for the loan if you fall behind on payments.

Best Personal Loans In Malaysia 2022

Need a quick look at the best personal loan rates in Malaysia? Check out the compiled list in the table below.

| Bank | |

| 12 – 60 months | Yes |

When should you apply for a personal loan? The truth is, there is never the best time to apply for a personal loanwhen you are not prepared for it.

In this article, you will find out the dos and donts of a personal loan application based on the experiences and best practices of ordinary Malaysians.

Read on to learn what a personal loan is about, how can you apply for a personal loan at the lowest rate and highest amount, and what should you do after a loan is approved or rejected.

You May Like: How Much Car Loan Can I Afford Based On Income

Personal Loan Rates At Credit Unions

The average rate charged by credit unions in September 2022 for a fixed-rate, three-year loan was 9.15%, according to the National Credit Union Administration. Federal credit unions cap the APR on personal loans at 18%.

You have to become a member of a credit union to apply for a loan, which may mean paying fees or meeting certain eligibility requirements.

» MORE:

What Should You Consider When Taking Out A Personal Loan

While loan amounts, terms, and fees can vary from lender to lender, you should generally consider the following:

- Loan amount Most personal loan lenders usually offer loan amounts between $1,000 and $50,000. But in some instances, you may be able to qualify for a loan of up to $100,000 depending on your credit and other factors.

- Loan term Loan terms typically range from 12 to 60 months, though some lenders might offer longer terms. Just keep in mind that the longer the loan term, the more interest youll pay over the life of the loan.

- Interest rates Lender annual percentage rates, or APRs, typically range from 5% to 36%. But rates fluctuate daily, and the rate you receive will depend on your credit, the amount you want to borrow, the repayment term, and other financial qualifications.

- Fees Some lenders charge origination fees to process your loan, while others charge late fees or fees for incomplete payments. Others may charge a prepayment penalty if you pay off the personal loan early.

Comparing rates from multiple lenders can help ensure you receive the best personal loan available to you. Checking rates is easy when you use Credible.

You May Like: Can I Get Home Equity Loan On Investment Property