The Fico Mortgage Shopping Period

If your mortgage shopping spans a few months, it will look back at older inquiries grouped together in those specified shopping periods and treat them as just one inquiry.

So if you shopped with mortgage lenders A, B, and C in a 14-day period two months ago, but didnt actually close your loan, then decide to restart the process, those three credit pulls would only count as one.

Unlike a credit card application where you apply just once, a home loan may involve multiple credit pulls with a variety of different lenders.

Instead of making it appear like youre on a debt rampage, they bundle these similar inquiries into one group if they occur in a designated time period.

Ultimately, you could have your credit pulled by 10 mortgage lenders in a week and it would only count as a single inquiry.

This shopping period can range from 14-45 days, depending on which version of the FICO scoring formula is being used.

The latest FICO version allows a 45 day shopping period, while the oldest just 14 days. Unfortunately, many mortgage lenders use older versions of FICO.

Either way, one credit inquiry will likely only lower your credit score by five points or less, so it may not even be a concern if you already have a solid credit score.

Of course, mortgage inquiries can and will affect consumers differently based on their credit profile, so theres no absolute rule in terms of impact.

What If Your Credit Score Goes Down Before Applying For A Mortgage

- Its possible to be negatively impacted by a credit inquiry such as a mortgage application

- It can push you below a key credit scoring threshold, such as from 625 to 619

- This could make you ineligible for a home loan or increase your interest rate

- In this case you could ask for an exception or take action to boost your scores

There are cases where a credit score just a few points lower could actually result in a higher mortgage rate, or completely jeopardize your loan application.

For example, a 620 FICO score is the general cutoff for Fannie Mae- and Freddie Mac-backed mortgages.

If for some reason one of your scores dropped from 625 to 619 just as you applied, you could be out of luck.

Assuming you find yourself right below a certain credit scoring threshold, you may be able to use an older credit report if all the information is the same other than the mortgage inquiries.

Or you can ask for an exception from the lender if theres a clear and compelling reason.

After all, it wouldnt be fair to penalize you simply for shopping around for the lowest mortgage rate, now would it?

Alternatively, you could take a few quick actions to boost your scores, such as paying off some debt to reduce your credit utilization.

Then look into a rapid rescore. Your loan officer or mortgage broker should have skills in this department to help.

What Is A Soft Vs Hard Credit Inquiry

There are 2 different ways for an institution to check your credit: a soft pull and a hard pull. Soft inquiries can be done without your permission and typically wont affect your credit.

For example, a credit card company might conduct a soft pull on your credit check to see if you qualify for certain credit cards. An employer might complete a soft pull if you are applying for an accounting position.

In most cases, you might not realize that your credit score was pulled unless the organization that pulls it lets you know.

You typically need to authorize a hard credit inquiry because the hard pull can impact your credit score. Your score may drop a few points, and the hard pull will be recorded in your financial history.

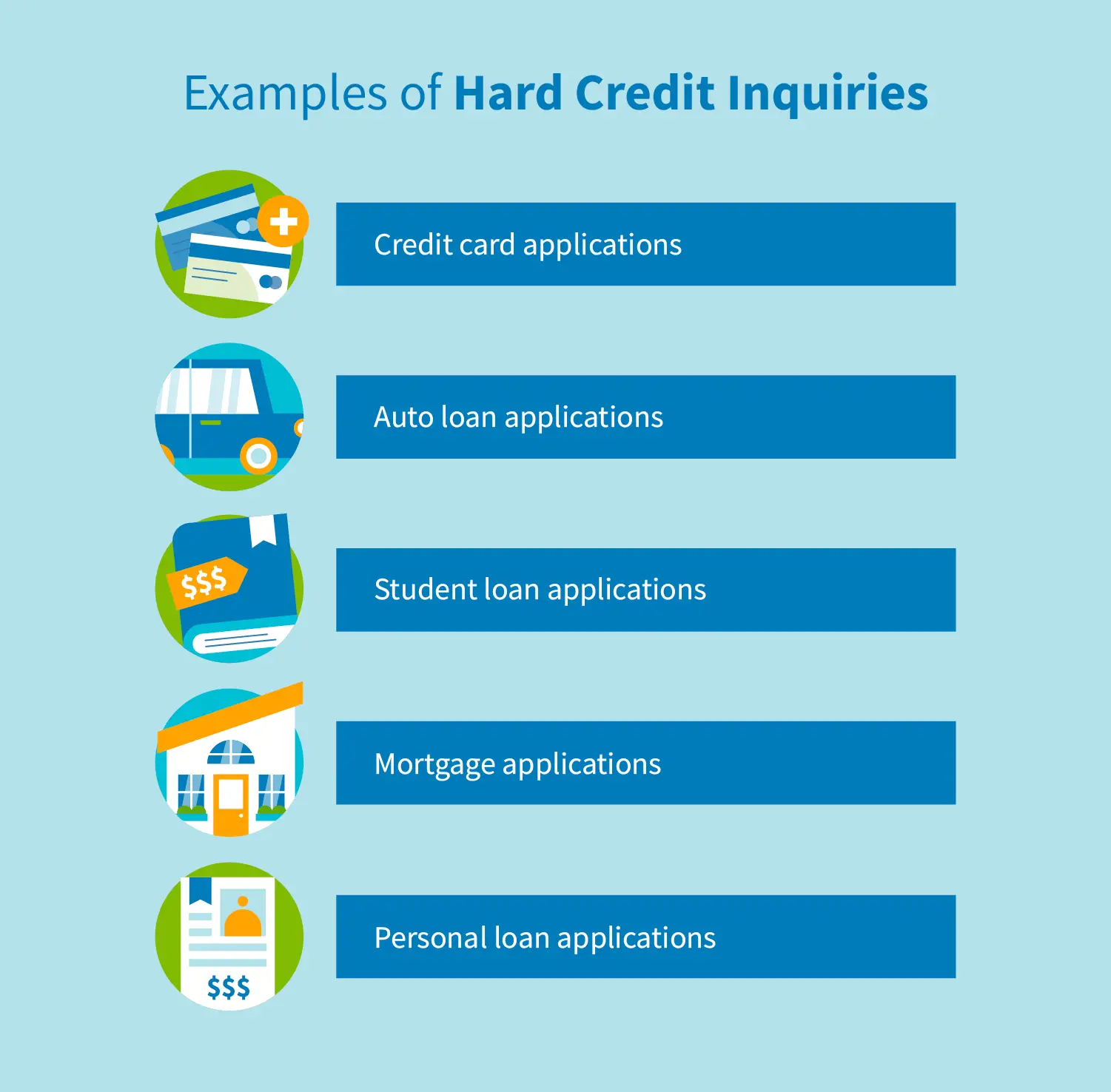

Hard credit inquiries are often done when you plan to take out a loan or mortgage. They will also be completed by credit card companies if you decide to apply for the cards they offer.

A hard credit inquiry isnt necessarily a bad thingand might not affect your credit at all. For example, if you seek out financing to buy a car, other lenders wont see that hard pull as an issue. However, if you have multiple hard queries over a short period, it could serve as a warning sign to lenders that you are trying to accumulate a large sum of money or that your applications arent getting approved.

Read Also: How Long Does It Take For Sba Loan Approval

Multiple Inquiries For The Same Type Of Loan

If all credit checks are done within a 30-day period all hard inquiries listed on your credit report will be treated as one when your FICO score is calculated.

You will have to commit to one hard inquiry, which will shave about 5 points off your FICO score. But, thats a small price to pay to find a low interest rate loan.

An excessive amount of credit checks can slowly chip away at your credit score. So, make sure to keep your auto loan search brief to benefit from the 30-day credit check bundling.

Hard Inquiries Vs Soft Inquiries

The essential difference between a hard inquiry and a soft inquiry is whether or not you gave the lender permission to check your credit report.

Generally speaking, if you let a lender scrutinize your credit report, its a hard inquiry. If a lender or bank peers into your credit report without your knowledge or permission, its a soft inquiry.

As far as your credit score is concerned, soft inquiries are harmless and will mostly go unnoticed. Hard inquiries, however, can leave a mark on your credit report, especially for anyone rapidly applying for credit in a short time span.

Recommended Reading: Usaa Car Loan Calculator

So How Many Points Are We Talking Here

The credit impact from a hard inquiry will vary from person to person depending on their individual credit history as well as all the other information in the credit report. FICO says that one new inquiry typically results in a less than five-point drop in your credit score.

Five points isnt a colossal amount, but it could drop you into a lower rate tier. Generate a few hard inquiries in a short period of time, and the points can add up to a more significant drop in your scores.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

How Can I Prepare For Or Offset Those Effects

Plan Ahead.

Palanjian advises preparing as much as you can before making your purchase and taking out the loan. If you are planning to buy a house, dont buy a car until home purchase is complete. Pay off any other debt you may have to lower your revolving balance, and dont plan on making any other large purchases soon after your car purchase.

Too many inquiries in a short period of time can have a negative impact on your credit score. In the case of a car loan, you could be offered a higher APR based on that lower credit score. When the average financing period can stretch up to 72 months, that change in APR can make a big difference.1

Be Diligent With Payments.

Making payments on time will also help offset any negative effects, Freeman advises. If you make regular payments on time it helps to boost your credit score. The faster you pay down the car loan, the quicker you reduce your credit utilization, which will increase your credit score.

If your credit score is mostly based on rolling lines of credit , the addition of a car loan can actually help you in the long run. A diverse credit portfolio helps bolster your score by demonstrating that you are consistently reliable. It also shows that youre not dependent on the type of credit you receive. However, this strategy will only work if you keep up with your regular payments.

References

Recommended Reading: Can You Self Report To Credit Bureaus

Recommended Reading: How To Get Mortgage License In California

What To Know About Car Loan Shopping

Your application for auto financing will show up in one more place: credit inquiries. Inquiries made when you apply for credit can cost you points on your credit score. But if you group applications for car financing close together, they should count as just one.

While youre shopping for the lowest auto loan rates, you may allow multiple lenders to run credit checks and end up with several hard inquiries listed on your credit report. Thats OK.

Generally speaking, if youre shopping for an auto loan within a 30-day period, all those hard inquiries that are listed on your credit report will only count as one when your FICO score is calculated. The VantageScore has a 14-day rolling window for shopping. Play it safe and keep your search brief so that your credit score doesnt take an unnecessary hit.

About the authors:Claire Tsosie is an assigning editor for NerdWallet. Her work has been featured by Forbes, USA Today and The Associated Press. Read more

Bev O’Shea writes about credit for NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

Do Multiple Loan Inquiries Affect Your Credit Score

Consumer credit reports contain a wealth of information about you and your financial relationships with lenders. Auto loans, credit cards, mortgages, student loans and other creditor relationships commonly appear on your credit reports. What they all have in common is that you likely applied for credit with these lenders and they, in turn, pulled a copy or copies of your credit reports before approving your application.

Each time your credit report is pulled, that credit inquiry appears on your credit report for a period of time. Credit inquiries include the date they were made and the inquiring company’s name. Some inquiries are considered by credit scoring systems and can affect your credit score. However, multiple loan-related inquiries made within a short period of time are either entirely ignored or treated as a single search for credit, thus protecting your credit scores.

Recommended Reading: 600 Fico Score Auto Loan

Multiple Inquiries May Appear From Just One Application

When a car dealership “shotguns” a loan application, they send it to many different lenders with which the dealership has relationships. The process usually only takes a few minutes and enables lenders to compete for the loan and for the car dealership to help their customer find the best loan terms.

Often, the customer can pick the car they want, apply for credit, get approved and drive off the lot within a matter of hours, all without leaving the dealership.

Each individual lender that accesses the borrower’s credit report will appear on the report as a separate inquiry. But, because credit scoring systems count multiple auto loan inquiries as a single inquiry, this process of shopping for the best rate does not affect a person’s ability to qualify for credit.

What Is The Impact

The impact on your credit due to inquiries will vary depending on your credit history. In general, credit inquiries have a minor impact, if any, on a person’s credit score. The number of accounts and length of credit history can play a factor. MyFico.com notes that “while inquiries can often play a part in assessing risk, they play a minor part. More important factors like bill payment and debt burden play a larger role. Also, inquiries for mortgages, car financing, and student loans are treated differently than inquiries for credit cards and other consumer loans.”

Read Also: What Loan Options Are Strongly Recommended For First Time Buyers

Why You Want To Avoid Too Many Inquiries

Hard inquiries are a necessary evil if you are trying to open a new account with a lender of some kind. But they can also raise red flags if you rack up too many in a short period of time. The average consumer is expected to acquire one or two hard inquiries a year.

Depending on your existing credit history, these might drop your score by a handful of points or not even have a noticeable impact. However, apply for additional accounts in a 12-month period, and youll begin to feel the pinch.

Accumulating too many inquiries over the course of a year can signal to lenders that your financial situation is unstable even if thats not really the case. They could assume that youre trying to use lines of credit to stay afloat. Or, they might believe that an influx of new accounts could hinder your ability to stay on top of your finances.

Plus, keep in mind that every inquiry has the potential to drop your score. Depending on the length of your credit history and the number of accounts you carry in good standing, each inquiry could mean score points dropped.

Did you actually follow through with opening new accounts following each of those inquiries? Then your score will also drop in term of your average age of accounts .

What About Business Loan Inquiries

Business loan applications are subject to similar inquiries about the financial capability of the business, which can affect their credit score. Unfortunately, many small businesses in Australia either do not know about or neglect the importance of business credit scores. On the other hand, your business credit score is separate from your personal credit score. This means any inquiries you make as a business, as long as youve registered your business name with ASIC, wont impact your personal credit score.

Did you find this helpful? Why not share this article?

This article was reviewed by Personal Finance Editor before it was published as part of RateCitys Fact Check process.

Jodie Humphries

Personal Finance Editor

An Editor for Personal & Home Finance working across the site, Jodie has worked for banks and comparison websites for a number of years, writing articles across Sharesight, Finder, and other places. Now, Jodie spends her time working on ways to make money make sense for everyone else.

You May Like: Shopify Capital Eligibility Review

Recommended Reading: Nerdwallet Loan Calculator

Wed Like To Introduce Ourselves

Were Kasasa® a financial and technology services company. We believe that small banks and credit unions supply critical resources to drive the growth of businesses and families. Nobody knows your communitys needs the way you do.

At Kasasa®, we also partner with institutions like yours, providing our relationship platform, Kasasa, as a comprehensive strategy. It begins with innovative banking products and includes marketing, training, compliance, research, support, and consulting.

Together we can show the next generation of banking customers an experience the mega-banks will never match.

What Factors Into Your Credit Score

To understand how taking out a personal loan affects your credit score, you must know how the score is calculated. The most widely used credit score by lenders is FICO, which was created by the Fair Isaac Corporation. FICO scores range between 300 and 850.

The scores are calculated based on five factors: payment history, amounts owed, length of credit history, new credit, and credit mix. The exact percentages may vary among the three major credit rating agencies, but here is a breakdown of how much weight each factor has in the calculation, according to FICO:

- 35% is based on your payment history

- 30% is based on the total amount of your outstanding debt

- 15% is based on the length of your

- 10% is based on any new debt or newly opened lines of credit

- 10% is based on credit mixthe number of that you have open

The three major credit reporting bureaus in the United States that lenders turn toEquifax, Experian, and TransUnionprovide similar scores on your creditworthiness, but there can be small differences.

Read Also: Student Loans Fixed Or Variable

Types Of Credit Inquiries

There are two types of inquiries that happen when your credit is checked:

- Hard Inquiries A hard inquiry occurs when your credit report is checked by a lender when you request credit. Hard inquiries do impact your credit score, but the impact they have is minimal sometimes dropping it only a few points and varies by inquiry. These inquiries are visible to other lenders for 12 months, and fall off your credit reports after two years.

- Soft Inquiries A soft inquiry happens when you check your own credit or when a lender solicits you with an offer of credit. Soft inquiries dont lower your credit score.

The good news is that if you need to get an auto loan, there’s a rate shopping window that treats all hard inquiries for the same type of credit as one single hard inquiry, which minimizes the hit to your credit score. The rate shopping window typically lasts between 14 and 45 days, so you should complete your loan shopping in under two weeks to be safe when applying for a car loan.

If Youre Planning To Take Out A Loan Rate Shopping Makes Sense If You Want To Compare Offers And Identify The Best Terms For Your Situation The Downside It Could Bruise Your Credit

Many people face this dilemma, whether theyre looking to take out a mortgage, auto loan or other type of debt. Even a slightly lower interest rate can add up to big savings over the life of a loan, so its best to gather and compare several quotes from different lenders.

But lenders will typically conduct a hard credit inquiry when you submit your application and an influx of these inquiries on your credit reports may temporarily ding your credit scores.

Read on to find out how this happens and how to lessen the impact on your credit.

Read Also: Usaa Car Loan Refinance