Washington State Fha Loan Limits For 2023

View limits for VA| FHA | Conforming

FHA loan limits for 2023 for Washington state have recently been released. What are these new numbers, and how do they affect you?

Washington State FHA loan limits are established by the Department of Housing and Urban Development and revised every year. Below, you will find the 2023 FHA loan limits for all counties in Washington State, and for all property types. They were increased from 2022 to 2023, in response to rising home prices, and range from $472,030 to a staggering $977,500.

What Are 2022 Fha Loan Limits

The FHA establishes loan limits annually based on the median home prices in metro areas and counties. The maximum loan amount is 115% of the areas median home price, subject to a national floor and ceiling.

For example, in 2022, the national floor is $420,680, and the national ceiling is $970,800. But if 115% of the median house price in a certain area was $330,000, the FHA could still insure mortgages up to $420,680 in that area.

Likewise, if 115% of the median house price in a certain area was $1 million, the FHA would cap mortgages in that area at $970,800. The FHA insures home loans with a principal balance at or under the ceiling.

Some of the areas with FHA loan limits at the ceiling include Breckenridge, Colorado Jackson, Wyoming and most of the counties making up the Bay Area of California, the New York City/Newark New Jersey metro area and the Washington, D.C. metro area.The FHA adjusts the upper mortgage limits for Alaska, Hawaii, Guam and the U.S. Virgin Islands to account for the higher cost to buy a house in these areas.

You Inherited A Title Whats Next

Inheriting a property is a big deal, and along with that property comes a title. However, its not often a cut-and-dry process. There may be many legal steps involved before you own that property free and clear. The process itself can be a bit overwhelming, especially if you dont have professional guidance.

Make it Legal

The first thing you need to do after inheriting a title is transfer it to your name. However, a title can only be transferred if you have substantial proof to claim it. The most legally binding document of verification would be a will and testament. If there isnt one, it could get a little tricky. In this case, the property, and therefore the title, would go to the legal heirs. Then, the distribution would be decided mutually or through the court. Legal heirs can pass on their rights to a single heir or another person if they choose. Once all this is decided and made legal, documents can be transferred to make it official.

Transfer of Property Title

Once the property is legally transferred to your name, youll need to apply for transfer of the property title. This process records the transfer of the title from one person to another in the land revenue records. Legally this is necessary for the purpose of property tax payments or utility connection transfers. Innovation Title is happy to assist in this process.

If youve inherited a title and dont know where to begin, dont worry just call Innovation Title.

Don’t Miss: Home Equity Loan Vs Home Equity Line Of Credit

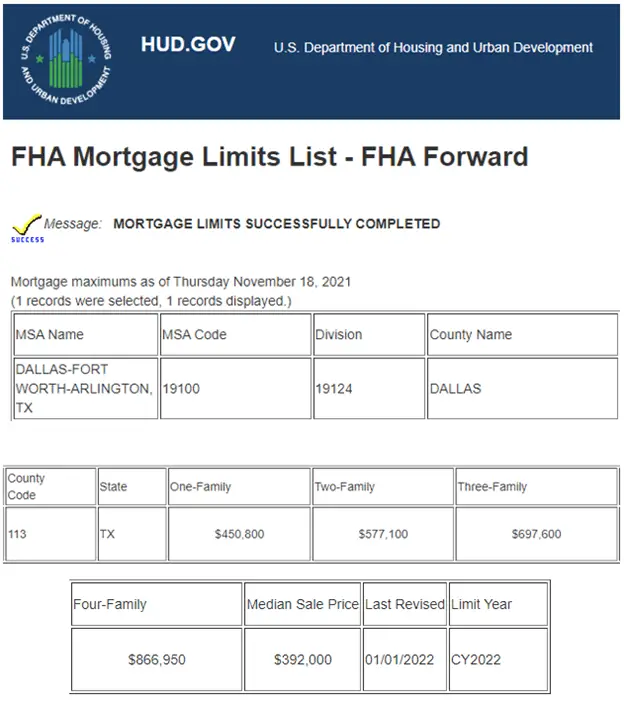

Fha Mortgage Loan Requirements In Texas

The FHA loan is one of the most popular loan options in the United States, with more than 25% of all house purchases financed with an FHA Loan. Before you start looking for a home, learn about the FHA loan standards so that the whole process goes faster. There are specific FHA rules that exist in the handbook, and since there are hundreds of pages to go through, weve summarized the most essential facts here.

FHA loans have a few other benefits, as well. For example, FHA loans dont come with prepayment penalties, so you can refinance your loan if you want to. And, FHA loans are assumable, which means that if you sell your home, the buyer can take over your loan. The downside of FHA loans is that they do require mortgage insurance. Mortgage insurance is an extra monthly fee that protects the lender if you default on your loan. The good news is that mortgage insurance premiums are tax-deductible.

About 2022 Fha Loan Limitations

To qualify for an FHA loan, your mortgage must not exceed the maximum loan amount insured by the FHA. These maximums, known as FHA loan limitations, vary by county.

In 2022, the Department of Housing and Urban Development will raise FHA lending restrictions in 3,188 counties while maintaining them in 45 counties.

FHA loan limitations include four distinct pricing tiers: regular, mid-range, high-cost, and special exemption.

Single-family FHA loan restrictions are now set at $420,680 in low-cost areas.

In areas with high housing costs, the FHA single-family loan ceiling is $970,800.

Nevertheless, many counties lie midway between the minimum and maximum limitations.

Using this search engine, you may determine your local FHA loan limitations.

Also Check: How To Get Fixer Upper Loan

Fha Loan Limits Rise By Over $50k

FHA loan limits are increasing in 2023. The new baseline limit which applies to most single-family homes will be $472,030. Thats an increase of more than $51,000 over last years FHA loan limit of $420,680.

Caps are even higher in areas with expensive real estate, where FHA loan limits will now reach above $1 million.

The Federal Housing Administration is raising its lending limits to keep pace with home price inflation. With these higher limits, borrowers have access to a wider range of homes using affordable FHA financing.

In this article

Do You Have Questions About Qualifying

Read Also: How To Calculate Loan To Debt Ratio

What Factors Affect Fha Loan Limits

There are three factors that affect FHA loan limits in your area:

Todays Fha Loan Rates

FHA loan rates have risen from their all-time lows, alongside conventional and VA loan rates. But borrowers can almost always find a better deal by shopping around.

Compare rates from at least three FHA-approved lenders to find your lowest available rate. A little work could lead to big long-term savings. Ready to get started?

Also Check: How To Fill Out Schedule C For Ppp Loan

How Texas Fha Loan Limits Are Calculated

The Texas FHA loan limits for were increased from 2022 to 2023. The maximum loan limit in Texas is now $472,030for a 4-bedroom home.

The Federal Housing Administration sets loan limits for each county in the U.S., based on median home prices in that area. The Texas FHA loan limits are set at $472,030for a single home family. For duplex, the maximum FHA loan amount you can borrow is $604,400. Triplexs max loan amount in TX is $730,525. For multifamily 4-unit property, you can borrow up to 907,900. This is an increase from the previous years loan limits for $416,300.

Most Common Questions Regarding A Property Title

During a real estate transaction, your client may have some questions about the title process. To help you be prepared, here are the most common questions regarding a property title.

Why do you need to do a title search?

After a buyer makes an offer on a property, everyone hopes the closing will happen quickly and smoothly. However, in order to have a title legally transferred to the buyers name, the sellers full rights to the property must be verified. A title search makes sure the deed can be appropriately transferred and that the buyer will be able to enjoy full ownership rights.

Is it easy to get a lien removed from a property title?

Discovering a lien on a property title is a complicated situation. It doesnt necessarily mean your client should give up on the property, but it could make things tricky. When a seller has unpaid debts or taxes, the lender or government owed can place a lien on the property. A lien means that the person or business owed the money has established a legal claim of ownership on the property. In most cases, the lien will not be removed until the debt is paid. However, there are cases where liens are placed by mistake. In this case, the title company would need to do further research.

What happens in an ownership dispute?

Do you have questions about a property title? Innovation Title has got you covered! Give us a call today to speak to our property title professionals.

Also Check: What Is Bonus Entitlement For Va Loan

Va Loan Limits Dont Exist In 2022

In 2020, the U.S. Department of Veteran Affairs removed the maximum loan amount it would grant its borrowers. Eligibility includes veterans, activeduty service members, National Guard members, reservists, and surviving spouses.

VA loans also come with the benefits of no required down payment or mortgage insurance and the lowest interest rates on the market.

VA loans have an upfront funding fee, which most borrowers will roll into the mortgage closing costs. Those fees carried over from 2021 to 2022 as follows:

| Down Payment |

> Related: Check our VA loan guide

How Does An Fha Loan Work

The FHA loan is a type of mortgage meant to help lower-income and/or lower-credit buyers become homeowners.

With looser eligibility standards, the FHA program makes it easier to qualify for a mortgage even if your finances arent perfect.

Exact rules can vary by mortgage lender. But you can typically qualify for an FHA loan with:

- A credit score of 580 or higher

- A down payment of 3.5% or more

- A debt-to-income ratio of 45% or less

- Stable income and employment

- A two-year employment history

Its important to note that the Federal Housing Administration is not a lender. So you wouldnt go to the FHA to get a mortgage loan. Rather, the FHA insures these mortgages and mainstream lenders offer them. So you could get an FHA loan from most any bank, lender, or credit union.

Also Check: Pnc Bank Auto Loan Rates

How Expensive Is To Buy A House In Texas

There are different fees associated with FHA loans in Texas. One of the most common fees is the mortgage insurance premium . This fee is charged to help protect the lender in case the borrower defaults on the loan. The MIP amount varies based on the size of the loan and the down payment amount.

Another fee associated with FHA loans is the upfront mortgage insurance premium . This fee is charged when the loan is originated and helps to cover the costs of the FHA program. The UFMIP amount is generally 1% of the loan amount.

There are also some closing costs associated with FHA loans. These costs can vary, but typically include the cost of the appraisal, credit report, and title search. It is important to note that borrowers are not required to pay all of these fees. The UFMIP can be financed into the loan, and the closing costs can be rolled into the mortgage. If you are considering an FHA loan, it is important to understand the different fees involved. Talk to a lender to find out more about the specific fees associated with your loan.

- The different fees associated with FHA loans in Texas

- Borrowers are not required in Texas to pay all of these fees

Talk to a lender to find out more about the specific fees associated with your loan or sign up for this form and we will match you with a local mortgage broker who does FHA loans in Texas

Fannie Mae Loan Limits In California

Fannie Mae and its counterpart, Freddie Mac, are two of the most well-known federally backed mortgage buyers in the United States. Although they are each autonomous companies, both were established by the federal government to help regulate and boost the housing market. They both provide financing for mortgage lenders ranging from large commercial finance companies to smaller thrift banks.

In November of 2022, the Federal Housing Finance Agency announced an increase in the 2023 Fannie Mae loan limits in California. As a result, Fannie Mae and Freddie Mac loan limits in 2023 rose to $726,200 for a single-unit family home, which was an increase of $79,000 from the previous calendar year of 2022.

- However, because California is considered a high-cost area, the 2023 Fannie Mae loan limits in California for a single-unit family home is now $1,089,300 .

This means lenders and borrowers can remain within the Fannie Mae and Freddie Mac loan limits in 2023 while receiving up to $1,089,300 for a home purchase. Of course, this figure represents the highest amount possible, and not necessarily the amount every borrower will qualify for. In order to know what amount you might qualify for, we welcome you to contact us so we can discuss your individual situation and unique needs.

Don’t Miss: What Form Is Student Loan Interest Reported On

The Floor And Ceiling Lending Caps

According to the Department of Housing and Urban Development, the maximum FHA lending amount for high-cost metropolitan areas rose to $970,800 for calendar year 2022 . In areas with lower housing costs, the FHA limit can be as low as $420,680.

Obviously, theres a broad spectrum in between.

These are the floor and ceiling limits for FHA loans in 2022. In all other areas, loan limits are typically set at 115% of the median home price for the county, as determined by HUD. By design, the maximum FHA lending amounts are intended to be slightly higher than the median home price within a particular area. This makes the program suitable for buyers seeking a modestly priced home.

In most real estate markets, the 2022 limits should give buyers plenty of properties to choose from. But it wont accommodate those who are shopping on the higher end of the price spectrum nor is it intended to. The FHA loan program was created to support low- and moderate-income home buyers, particularly those with limited cash saved for a down payment.

The Community Promise Program In Texas

The Community Promise program from the Federal Home Loan Bank of Dallas offers downpayment mortgage assistance for first-time and low- to moderate-income homebuyers.

The program provides a five-year forgivable second loan up to 3% of the original loan amount that can be used toward closing costs and/or a down payment. The Community Promise downpayment mortgage assistance program is designed to help homebuyers with limited financial resources get the chance to purchase a home. For first-time homebuyers or those with low to moderate income, getting your foot in the door of homeownership can feel out of reach.

But thanks to the Community Promise mortgage assistance program from the Federal Home Loan Bank of Dallas, that dream is within arms reach! This five-year forgivable second loan offers eligible borrowers up to 3% of their original loan amount for closing costs and/or a down payment. Keep reading to learn more about this incredible opportunity and how you can take advantage of it.

The Community Promise downpayment mortgage assistance program might just be the answer to your prayers. This comprehensive program is designed to help homebuyers with limited financial resources get the chance to purchase a home through reduced mortgage payments and additional housing opportunities.

Recommended Reading: Which Loan Options Are Best For First Time Home Buyers

Fha Loan Limits For 2022

The FHA, aimed at helping borrowers with moderate incomes and credit scores, also upped its loan limits for 2022.

| $809,151-$1,867,274 | $1,867,275 |

In 2022, you can get an FHAinsured mortgage up to $420,680 for a one-unit property or up to $970,800 in particularly expensive areas.

For a two-unit home, the standard FHA mortgage limit is $538,650 for a three-unit home, its $651,050 and $809,150 is the cap for a four-unit home.

Just like with conforming mortgages, the limits depend on location, differing for low, medium, and high-cost counties.

Alaska, Hawaii, Guam, and the U.S. Virgin Islands also have their own limits set higher due to elevated costs of construction. In those four places, the 2022 baselines are $1,456,200 for one-units $1,864,575 for two-units $2,253,700 for three-units and $2,800,900 for four-units.

> Related: Check our FHA loan guide

Va Home Loan Limits In California

The Department of Veterans Affairs provides patient care and federal benefits to veterans and their dependents. Unlike FHA and Fannie/Freddie loans that are available to just about every qualifying homebuyer in the United States, the VA has stringent requirements for who is eligible to receive home loans. For those who qualify, VA home loans are extremely popular because of the generous terms and conditions granted to those who have served and sacrificed so much of themselves to ensure our freedom.

- To learn more about the VAs requirements, and to see if you qualify for a VA home loan, please .

Per the newly passed Blue Water Act, the VA no longer sets caps on maximum loan amounts, but they do set limits on the maximum amount of liability VA can assume, which does determine the amount of money a lender will provide you. And just like the FHA and Fannie Mae-Freddie Mac, the 2022 VA home loan limits in California have increased from the previous year.

Along these lines, 2023 VA home loan limits in California reflect the FHFAs designation of the Golden State as a high-cost area. This means borrowers in San Diego can receive up to $977,500 toward a single-unit family home purchase. Eligible borrowers interested in purchasing multi-family unit housing as in investment property can also benefit from VA home loans.

Of course, 2023 VA home loan limits in California are based on county, and you can learn more about the maximum amount available in each county here.

You May Like: How Can I Get 20000 Loan