What Types Of Car Loans Does Pnc Bank Offer

PNC Bank offers the basics, plus some hard-to-find car loan options:

- New and used car loans. Financing to purchase a car from a dealership with rates starting at 3.69% and amounts starting at $7,500.

- Private party car loans. Funding to pay for a loan from a nondealership seller with rates starting around 3.24% APR.

- Lease buyouts. A loan to purchase a car youre currently leasing with rates starting at about 3.09% APR.

- Refinancing. Trade in your current car loan for a better deal with rates starting at 3.09% APR.

Pnc Auto Refinance Review Introduction

If youre looking for auto refinance options from an established, reputed firm, then PNC Auto Refinance should be on the top of your list. The Pittsburgh National Corporation is headquartered in Pittsburgh, Pennsylvania and is one of the largest banks in the country trusted by millions of auto loan borrowers.PNC Auto Refinance offers quick, reliable refinancing options for borrowers with a decent-to-good credit score. It is a great option if youve already made up your mind to auto refinance and are not looking to shop around for other offers.The Way.com Refinance team has done an in-depth PNC auto refinance review , including the eligibility criteria, key features, and drawbacks. Once youre done with this review, you can make an informed decision about refinancing.

Pnc Auto Loan Login: How To Make Your Pnc Auto Payment

Find information on how to manage your auto loan account online on the PNC Auto Loan Login portal. Access your auto loan account with PNC Online Banking. PNC Online Banking is your secure online resource for viewing important account information and accessing helpful tools to manage your loan account. Once logged into Online Banking you can:

- Get organized and save paper with paperless statements

- Set up account alerts to stay informed

- Schedule payments for your account

Recommended Reading: Speedee Oil Change And Auto Service

Also Check: Personal Loan Against Income Tax Return

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

What Sets It Apart

PNC Bank offers a wider range of financing options than youll find with most providers. And its online application sets it apart from other regional banks, which often require you to visit an office in person.

But you might be able to find a lender thats more transparent about fees. And where most lenders offer everyone a 0.25% autopay discount, you must have a PNC Bank checking account to get a reduced rate.

Want to look for better rates or just shop around before you apply? Compare more providers with our guide to car loans.

Don’t Miss: What Is The Current Interest Rate For An Fha Loan

Pros And Cons Of Pnc Bank Auto Loans

- Fast funding timeline. With PNC Banks Check Ready Loan, you can apply online for a new or used car loan and receive a check in the mail overnight. Private party purchases and auto loan refinancing require a branch visit, but you can still pick up your check the same day you apply.

- PNC Total Auto program. PNC Total Auto guides you through the car-purchase experience from car comparison to loan application. It lets you see what other people in your area paid for cars, letting you better estimate the loan amount to apply for.

- Large branch footprint. If you prefer in-person service, PNC could be a good option. It has more than 2,600 branches in more than 25 states.

Things To Consider Before Refinancing

Recommended Reading: How To Calculate Car Loan Amortization

How To Set Up Pnc Bank Automatic Payments

You should always make sure your bank account has enough funds for the payment a few days before the due date, to be safe. And once you’re enrolled in automatic payments, dont forget to review your recent transactions regularly.

Payment plan you set up with your bank / financial institution, so that they send your minimum payment for your credit cards or other debt sources each month.

Our Thoughts:

Automatic payment eliminates the penalties for late payments. We recommend you contact your bank to set up an automatic payment transfer of the minimum payment from your checking account to your credit card account each billing cycle you can always pay more later.read full answer

How do you stop recurring payments on a credit card?

Here’s how to stop recurring payments on a credit card:

Can you pay a credit card with a debit card?

Bottom Line:

Up To 100% Auto Financing

Fixed or Variable, based on CIBC Prime*

Term

Fixed or Variable, based on CIBC Prime*

Term

More resources

*CIBC Prime is the variable rate of interest per year declared from time to time to be the prime rate for Canadian dollar loans made by CIBC in Canada. The interest rate on your line of credit will change whenever CIBC Prime varies.

Rates are determined by a number of factors, including the Bank of Canada prime lending rate, the term and amount of the loan, whether or not the loan is secured, and by the borrower’s credit rating.

Applicants must meet all CIBC lending criteria. Certain conditions and restrictions apply. Credit limit determined by CIBC, in its sole discretion. Products, their features and advertised interest rates may change at any time. This is a general description only for more information and product terms and conditions, consult product brochures or call CIBC at .

Need to meet?

Recommended Reading: Navy Federal Auto Loan Pre Approval

What Is A 5 1 Arm Mortgage Loan

Category: Loans 1. What Is a 5/1 Hybrid Adjustable-Rate Mortgage ? 5/1 hybrid adjustable-rate mortgages offer an introductory fixed rate for five years, after which the interest rate adjusts annually.5/1 Hybrid ARM: Fixed-Rate Mortgage A 5/1 adjustable rate mortgage is an adjustable-rate mortgage with an

Dont Miss: Car Rental Albany Ny Airport

Pnc Is Best For Borrowers Who:

Are existing PNC banking customers. All loans and lines of credit require an automatic payment deduction from a PNC business checking account. If youre not an existing business customer, then youll need to be willing to open an account with PNC.

Prefer to work with a traditional bank. If you prefer to work with a conventional bank, PNC is one to consider with its range of lending products. Online and mobile banking are also available to customers who prefer digital banking.

Have an established business. Per PNC credit guidelines, your business will need to have been in existence for a minimum of three years under the same ownership.

Dont Miss: Bank Of America Auto Loan Credit Score

Read Also: What Does Loan Apr Mean

How To Apply For A Pnc Car Loan

When you apply for an auto loan or refinancing at PNC, youll need to first check that there is a branch within 50 miles of your location. If not, then you are not eligible for an auto or refinancing from the bank. You can either use its location finder or call the customer service line to see if your area is serviced by PNC.

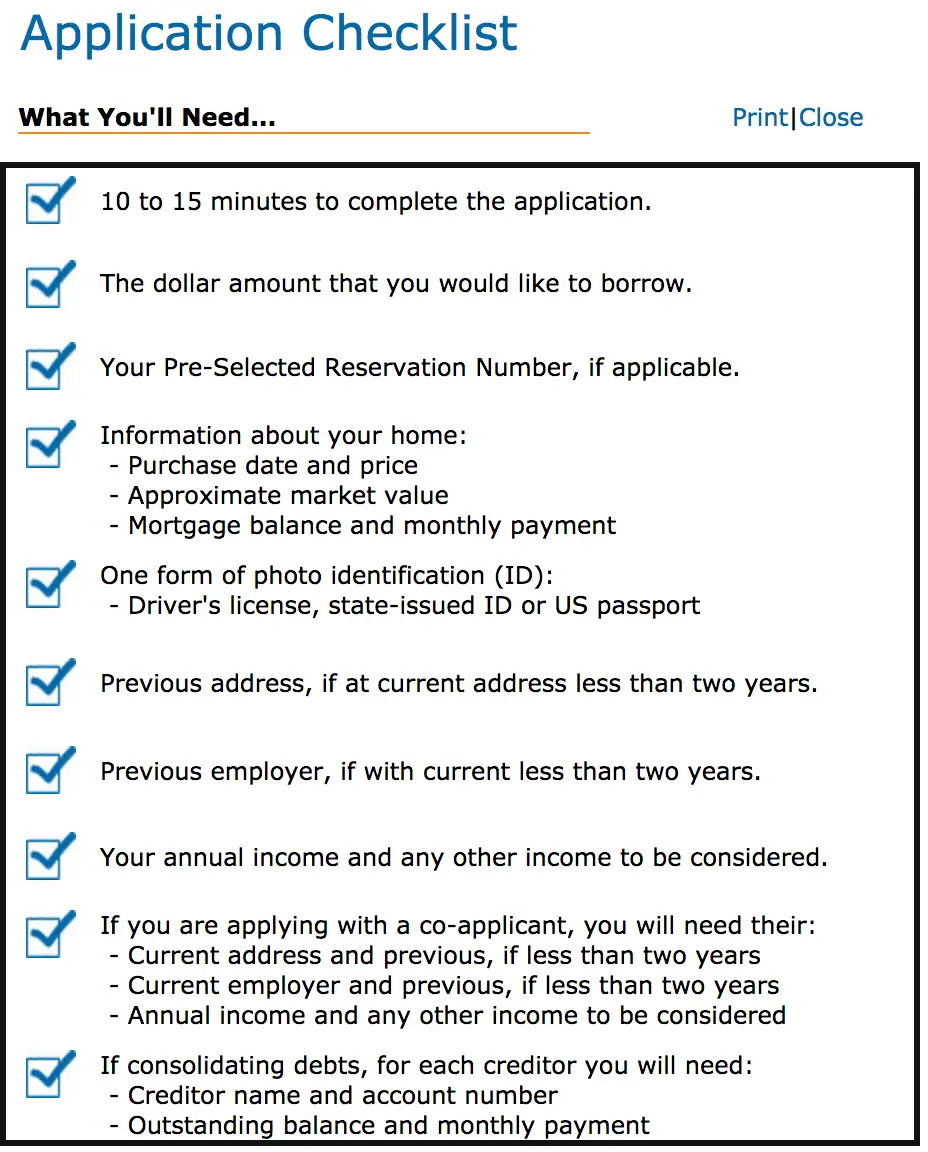

Once youve determined that you are in an area that PNC services, you can start an application for a new or used car auto loan either online, by phone or in-person at a local PNC branch. For new and used car auto loans youll need the following documents:

- The amount of the loan

- Your government-issued ID

- Your address: If youve been at your current address for less than two years, youll need your previous address as well.

- Employer information: If youve been at your current job less than two years, youll also need the name and address of your previous employer.

- Proof of income

- Your co-applicant or co-signers information, if you have one.

- Vehicle information if youre purchasing used .

For a private-party auto loan youll need to bring all the information you need for financing a new or used vehicle plus:

- Vehicle selling price, year, make and model

- Vehicle trade-in value, year, make and model

- Down payment, if any

- VIN of vehicle to be refinanced or purchased

If you want to refinance youll need all the above information plus:

- The 30-day payoff amount, interest per day , account number and overnight mailing address for sending the payoff check

Types Of Personal Loans Offered By Pnc

PNC personal loans are flexible and can be used for several purposes, including debt consolidation, home improvement, medical expenses, moving and relocation, events, and other large purchases. PNC personal loan funds cannot be used for postsecondary educational expenses or to refinance student loan debt. However, PNC offers student loan refinancing options through pnconcampus.com.

PNC does not disclose the minimum required or maximum debt-to-income ratio allowed to qualify for a personal loan.

Many lenders require that borrowers have at least good FICO score to be approved for a loan. A good FICO score falls within the range of 670-739.

You May Like: Veterans United Home Loans Review

What Is The Difference Between An Automated Payment And A Recurring Payment

Automated payments are set up through the Automated Payment Program managed by PNC. Your monthly payment is automatically drafted from your PNC or non-PNC checking or savings account each month and applied to your PNC loan or line of credit as the payment due date. To sign up for automated payments, you will need to complete, sign and return the Automated Payment Authorization Form to the fax number or mailing address listed on the form, or to a PNC branch.

Recurring payments are set up by you directly through PNCs Online Banking. You can schedule a recurring payment to your PNC loan or line of credit from with a PNC or non-PNC checking or savings account by clicking Make a Payment from your account activity page. With PNC Online Banking, you have the ability to manage, change or cancel your reccurring payments at any time.

Recommended Reading: Car Rental San Francisco International Airport

Pnc Auto Loan Login Steps

After register to access your PNC Auto account online then the next step is to log in to your account and access your statement, payment history, make payments online, sign up for automatic payments, view and print your payment history, view your statements online, review and update your account information.

Follow the steps below to access your account

Go to and enter your username and password. When you sign on to Online Banking, you can select the Save User ID box to have Online Banking remember your User ID. After enabling Save User ID and successfully signing on to Online Banking, the last 4 characters of your User ID will be displayed in the Sign On box for future sessions. If more than one User ID is saved, you can choose the User ID you wish to use from a drop-down list.

If you have forgotten your username or password, Click the Forgot User ID or Password? link in the log in area, enter your username and the last 4 digits of your social security number or Federal Tax ID Number /EIN, and then click Continue. Next, answer the security question, and click Continue then enter a password and click Submit. Once complete, log in to your account.

You May Like: Lees Auto Body Shop

Also Check: What Is An Asset Based Loan

Pnc Personal Loans At A Glance

|

Minimum credit score |

|

|

Late fee: $40 or 10% of the payment . |

|

|

Loan amount |

|

|

6 months to 5 years. |

|

|

Time to fund after approval |

Same-day funding for existing online banking customers. Other borrowers need to close at branch and funding may take 3 to 10 days. |

|

Loan availability |

Loans available in 50 states and Washington, D.C. |

Paying Off Your Car Loan Early: Things To Consider

Thinking of paying off your car loan? While theres the benefit of reducing your debt, take time to assess your personal financial position before making a decision. In this article, we highlight some of the important considerations to keep in mind.

3 min read

Timing can be an important factor in the car buying process. Learn when the best time to buy a car is and how timing can impact your decision making.

4 min read

There are many important factors to consider when deciding whether to buy a new or used car. Read more about the pros and cons of each car buying option.

4 min read

Read Also: How To Refi Out Of Hard Money Loan

Where Pnc Personal Loans Fall Short

Product varies based on location: Rates and available loan amounts vary by state. Enter your ZIP code on the lenders website to find out whats available in your area.

Funding for non-customers: Current online banking customers can receive funds in their account the same day they sign the loan documents. However, applicants who aren’t customers have to visit a branch to close the loan, and funding time can range from three to 10 days, so its not a good option if you’re a non-customer who needs money fast.

» MORE:Best loans for quick cash

No large loan amounts: PNC has you covered if you want a small- or medium-sized personal loan. But if youre looking to cover an especially large purchase, or to fund an expensive project like a major home repair, youll need to look elsewhere.

» COMPARE: Best home improvement loans

How To Apply For A Loan With Pnc Bank

Applying for a new or used vehicle from a dealership using PNCs Check Ready Loan is the easiest option. The application can be filled out entirely online, and if you are approved, a check can be mailed to you overnight.

The process looks different for private party auto loans and refinancing loans. With a private party auto loan, you need to visit a branch to apply, and you can either pick up your check at the branch or have it mailed to you once youre approved.

For refinancing, you can apply online, by phone or at a branch, but to close your loan you will need to either visit a branch or have the documents mailed to you.

Be prepared to provide:

- 30-day payoff amount if you are refinancing.

- Personal details about your co-applicant if youre submitting a joint application.

Also Check: How Can I Get Loan From Bank

Unique Features Of Pnc Auto Refinance

Lets take a detailed look at the fine print in the PNC Auto refinance process.

- PNC auto refinance credit score: You need a credit score between 630-850 to qualify for PNC auto refinance rates.

- Good refinance loan term: PNC auto refinance offers loan terms varying from 12-72 months, which is optimal. Anything more than 72 months can accrue higher interest charges.

- PNC auto refinance does not charge any prepayment or origination fees

- Auto refinancing APR range: You can access rates ranging from 2.89-9.74%. If you already have a PNC checking account, you can get a discount on choosing auto payment.

- Hard credit inquiry: There is no soft inquiry or PNC auto refinance pre-approval process. You can only apply after filling in all your details and personal information, which will then result in a hard credit inquiry.

- Large loan amount refinancing: PNC will refinance loan amounts from $5000 to $100,000.

- Vehicle model, age, and mileage: PNC only refinances cars and trucks that are not older than 8 years. There is also a maximum mileage of 80,000.

Pnc Auto Refinance Requirements

Before applying for PNC auto refinance, check the table below to see if you meet all the requirements.

| Criteria |

|---|

- If you are a serving member of the armed forces, the PNC Auto refinance rates offered to you will be covered under the Military Lending Act.

- PNC auto refinance also refinances lease buyouts.

Recommended Reading: How To Get Loan Estimate

What Do You Need To Qualify For Pnc Auto Loans

PNC Auto Loans does not have or does not disclose a minimum annual income eligibility requirement. PNC Auto Loans only considers borrowers who are employed. Note that borrowers can add a cosigner to either meet eligibility requirements or qualify for lower interest rates.

The Military Lending Act prohibits lenders from charging service members more than 36% APR on credit extended to covered borrowers. Active duty service members and their covered dependents are eligible to apply for a loan via PNC Auto Loans. Their rates fall within the limits of The Military Lending Act.

U.S. citizens are, of course, eligible for the services offered by PNC Auto Loans. Permanent resident / green card holders are also eligible to apply.

To qualify, applicants may need to provide the following documentation:

- Recent pay stubs

- Proof of citizenship or residence permit