How Large Can My Loan Be

In general, borrowers may receive a loan amount of up to 2.5X the average monthly payroll costs in the one year prior to the loan or the calendar year . No loan can be greater than $2 million. If you are a seasonal or new business, you will use different applicable time periods for your calculation. Payroll costs will be capped at $100,000 annualized for each employee.

When Can I Apply For Ppp Loan Forgiveness

You can apply for PPP loan forgiveness as soon as all of your loan proceeds have been used, which at the earliest is the first day after your selected covered period .

However, you must apply for loan forgiveness within 10 months of the last day of your covered period in order to receive a deferment on your loan payments. If you wait longer, youll have to start making payments on the balance and deferred interest of your loan .

Ppp Loan Forgiveness Ifr Revisions And Revised Application Key Observations Part V

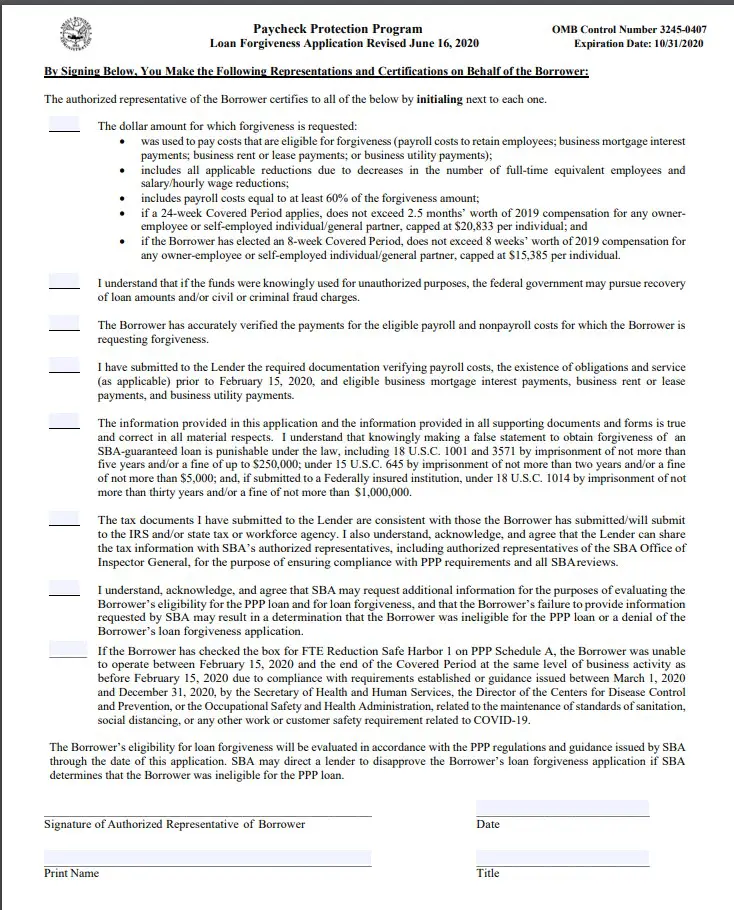

Once again, the SBA is doling out guidance in small doses, solving some questions, creating new questions and leaving most questions still unanswered. On June 16, 2020, the SBA issued a revised PPP Loan Forgiveness Application, along with related instructions, and new PPP Loan Forgiveness Application Form 3508EZ, also with related instructions. On June 22, 2020, the SBA issued Revisions to Loan Forgiveness Interim Final Rule and SBA Loan Review Procedures Interim Final Rule. The following is a list of our key observations on these latest developments.

1. Form 3508 EZ.

2. PPP Lender to Notify Borrower of First Payment Date After SBA Makes Forgiveness Determination.

3. PPP Loan Forgiveness Applications Can Be Filed Any Time Prior to Maturity, Including Prior to End of Covered Period.

4. Revised Caps on Owner-Employee and Self-Employed Individuals Payroll Costs.

6. New Exemptions From FTE Loan Forgiveness Reductions.

You May Like: How To Pay Off Debt With Home Equity Loan

When To Use The 3508ez Form

The 3508EZ form is for borrowers that received first or second draw PPP loans of more than $150,000.

If youre eligible to use the 3508EZ form when applying for PPP loan forgiveness, youll get to save some time and energy compared to those who have to fill out the regular 3508 form. However, youll have to meet at least one of the following three criteria to be eligible to use the 3508EZ form:

- You are a self-employed individual, an independent contractor, or a sole proprietor who had no employees at the time you applied for a PPP loan

- You didnt reduce the salaries or wages of employees making under $100K/year by more than 25%, and you didnt cut any FTE employees or reduce the average number of hours that your staff works

- You didnt reduce the pay of employees making under $100K/year by more than 25%, and you were unable to operate at the same level as you had before February 15th, 2020, because of COVID-19 health and safety restrictions imposed by federal agencies

Who Can Use Form 3508

Any borrower who received a Paycheck Protection Program loan can use Form 3508 to apply for forgiveness.

But because it is the most complex form, you should only use this form if you do not qualify to use Form 3508EZ or 3508S.

Form 3508 is five pages long and broken down into the following parts:

- Calculation form

- Schedule A worksheet

- Demographic information form

Why so long? Form 3508 requires significantly more calculations than the other forms because it has an additional calculation for borrowers who reduced their employee numbers and/or salaries. And like Form 3508EZ, the regular 3508 requires borrowers to calculate their payroll and nonpayroll costs using the 60% / 40% rule.

Borrowers who reduce their full-time equivalent employees, employee salaries, or both also reduce their PPP forgiveness amount. This form has a calculation for determining how much you reduce your loan forgiveness amount by for these adjustments.

Recommended Reading: Is Federal Student Loan Forgiveness Real

Choosing Between Ppp Loan Forgiveness Forms

The Paycheck Protection Program ended on May 31, 2021.

- Learn more about Royal’s current business loan and credit options.

- Any information provided about PPP loans on this or other rcu.org pages is for historical reference only.

This information explains the different Paycheck Protection Program loan forgiveness form options. Borrowers can can use this guide to choose the right form for their situation.

Paycheck Protection Program Loan Forgiveness

Eligible clients can apply now for PPP loan forgivenessOur PPP loan forgiveness portal is now open and includes a simplified forgiveness application for PPP loans of $150,000 or less. We will email clients with a link to access our loan forgiveness application over the coming weeks, when the application becomes available to them.

When can I apply for PPP loan forgiveness?

The simplified SBA Form 3508S is now available, in addition to the revised SBA Form 3508EZ and SBA Form 3508 applications. Eligible clients will receive an email with a link to access our loan forgiveness application when it becomes available to them.

As a reminder, based on the latest updates from the SBA, you now have more time to gather your documents and prepare your application. The timeframe for applying for loan forgiveness in the promissory note no longer applies.

For additional assistance with PPP loan forgiveness documentation, view our documentation guide.

Is Bank of America participating in the SBA Direct Forgiveness program for applications equal to or less than $150,000?

The Small Business Administration announced on July 28, 2021 a new initiative that will allow borrowers of participating lenders with loans less than or equal to $150,000 to apply for forgiveness through the SBAs direct forgiveness online portal.

Do I need an Online Banking ID to access my PPP loan forgiveness application online?

Yes, you need a profile set up for Business Advantage 360, our small business online banking.

Also Check: How To Deal With Specialized Loan Servicing

Before You Start Your Online Application:

- Determine the form you plan to use. Youll either use Form 3508S, Form 3508EZ, or Form 3508, depending on your circumstances.

- Form 3508S. Consider using this form if your loan is $150,000 or less. This simple form requires you to provide less information and the processing time may also be shorter than other forms.

- Form 3508EZ. Consider using this form if you are not eligible for Form 3508S, and you meet one of the two eligibility conditions.

- Form 3508. Consider using this form if you do not meet the eligibility conditions for either of the other forms.

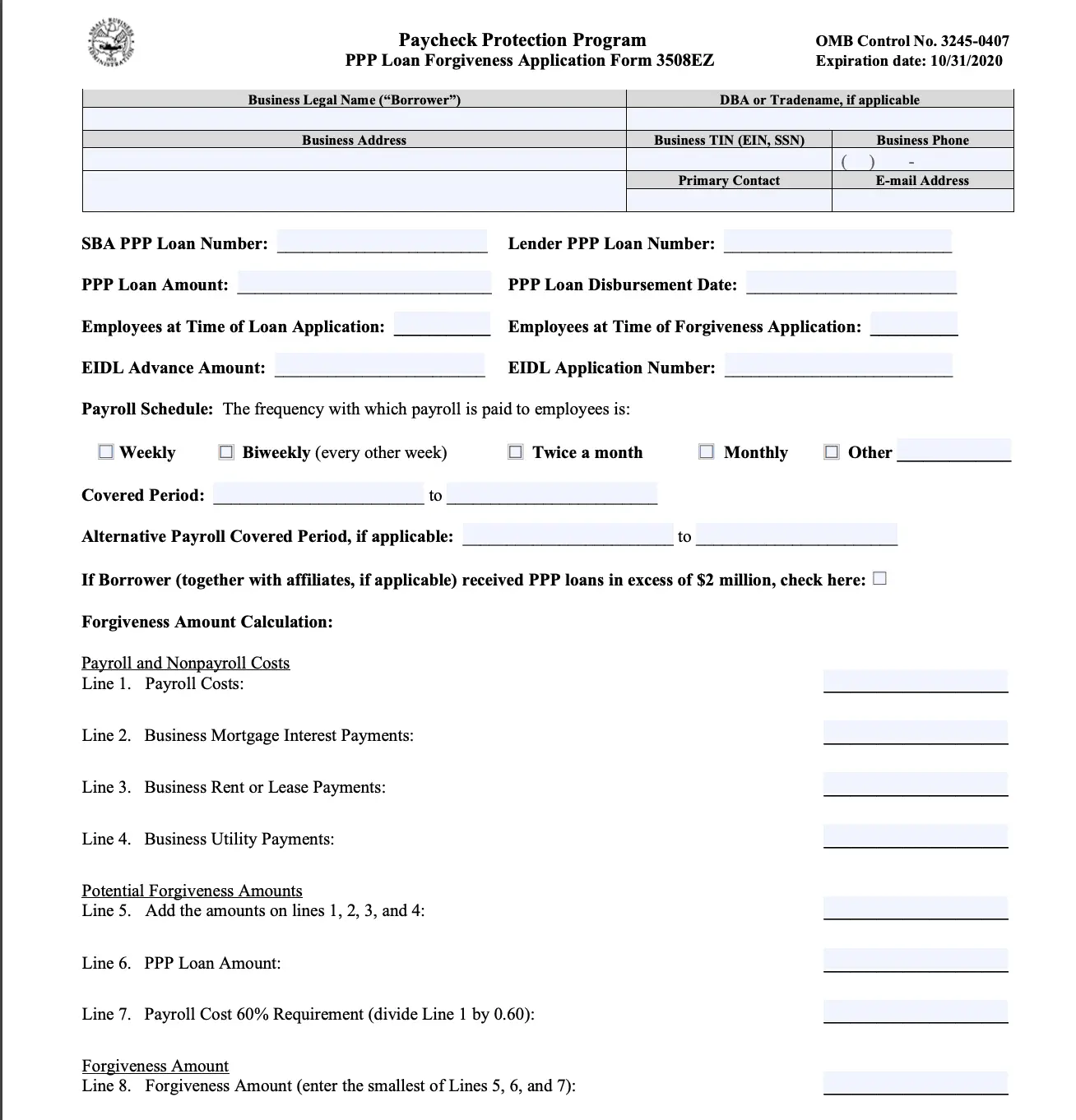

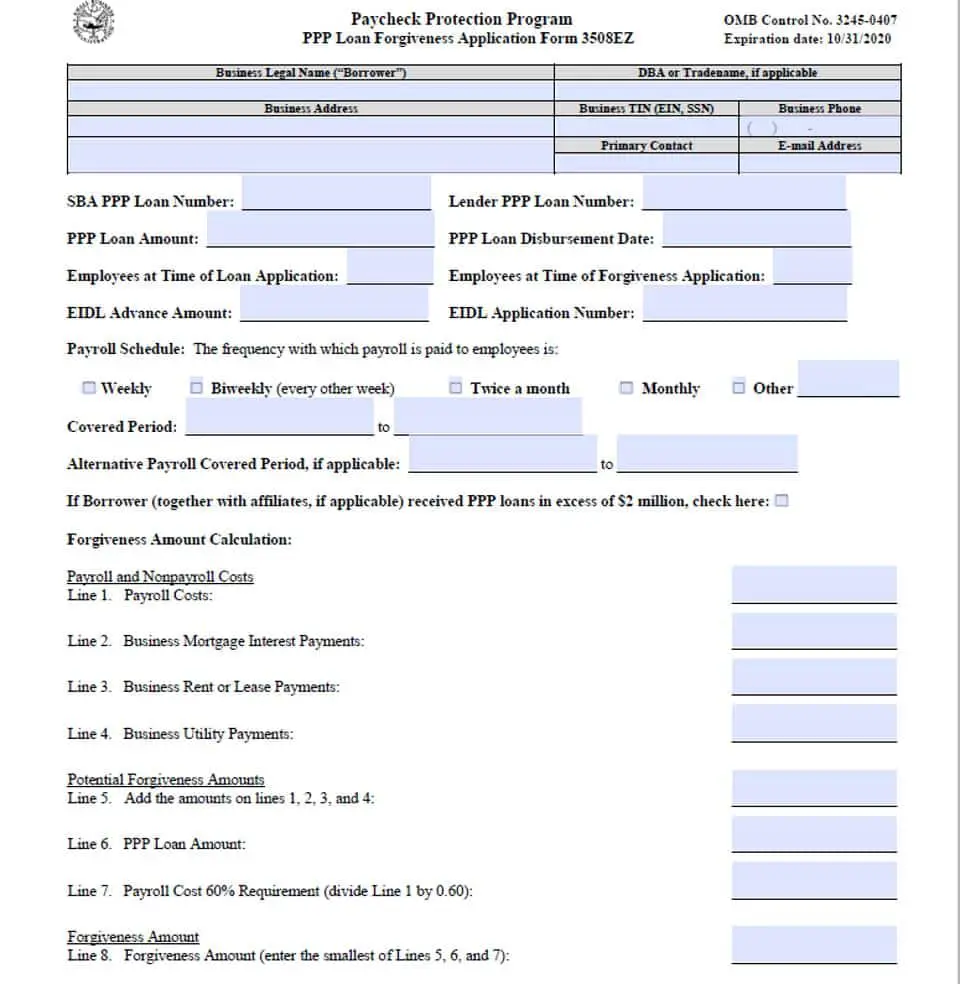

Revised Ppp Application Form 3508 And Form 3508ez

The Treasury and SBA also released revised PPP loan forgiveness application Form 3508 and Form 3508EZ. Form 3508-EZ is a simpler forgiveness application form for borrowers who meet specific safe harbors. The new Form 3508 is the complete PPP forgiveness application for those who do not qualify to use Form 3508S or Form 3508EZ.

Borrowers who apply for forgiveness with these forms must submit required payroll and nonpayroll documentation, which is listed on the forms.

Read Also: How To Discharge Student Loan Debt

Finishing Page : Ppp Loan Forgiveness Calculation Form

Line 1: Payroll Costs

From Schedule A, line 10.

Line 2: Business Mortgage Interest Payments

Enter the sum of interest payments on any business mortgages that were in effect before February 15, 2020. Prepayments are not allowed. You do not need to report any expenses you donât want to claim for forgiveness.

Line 3: Business Rent or Lease Payments

Enter the sum of business rent or lease payments, where the rent/lease agreement was in effect before February 15, 2020. You do not need to report any expenses you donât want to claim for forgiveness.

Line 4: Business Utility Payments

Enter the sum of business utility payments, where the utility agreement was in effect before February 15 2020. You do not need to report any expenses you donât want to claim for forgiveness.

Line 5: Covered Operations Expenditures

Enter the sum of any software, cloud computing, or other human resources and accounting needs . You do not need to report any expenses you donât want to claim for forgiveness.

Line 6: Covered Property Damage Costs

Enter the sum of any costs from damages due to public disturbances occurring in 2020 and not covered by insurance. You do not need to report any expenses you donât want to claim for forgiveness.

Line 7: Covered Supplier Costs

Enter the sum of any purchase order or order of goods made prior to receiving a PPP loan essential to operations. You do not need to report any expenses you donât want to claim for forgiveness.

From Schedule A, line 3.

ââ

Application Process For A Third

New first- and second-draw loans followed a pattern similar to that followed with previous PPP loans. Business owners could download and fill out the loan application from the SBA website.

The first-draw application was five pages long, including instructions, and the second-draw application was six pages, including instructions.

You May Like: How To Make Personal Loan Agreement

Recommended Reading: How Much Interest Is On An Unsubsidized Loan

Ppp Loan Forgiveness And Review: Key Observations Part Ii

The SBA issued an Interim Final Rule regarding PPP loan forgiveness on May 22, 2020, to supplement the PPP Loan Forgiveness Application and instructions issued one week earlier. While the new IFR did not provide a great deal of new guidance, below is a list of our key observations, which supplements our prior observations on the application itself, which are repeated at the end of this Alert.

We understand that the SBA plans to issue additional FAQs regarding loan forgiveness that hopefully will address some of our open questions.

On May 22, 2020, the SBA also issued an IFR on the review process for PPP loans by the SBA, which we also address below.

1. Alternative Payroll Covered Period.

- The IFR reiterates that the borrower must use a bi-weekly or more frequent payroll schedule to use the Alternative Payroll Covered Period . Borrowers using a monthly or bi-monthly payroll schedule must use the Covered Period .

2. Paid or Incurred.

3. Accrued Interest on Forgiven Amounts is Forgiven.

- The IFR makes clear that the accrued interest on the forgiven amount also is forgiven.

4. Payroll Costs Includes Bonuses/Hazard Pay.

5. Owner-Employee Payroll Cost Forgiveness Limited to 2019 Levels.

6. Health Care/Retirement Benefits for Self-Employed Individuals Not Forgiven.

7. FTE Reduction Exception.

8. PPP Loan Forgiveness Process.

9. PPP Loan Review Process.

Revised Ppp Loan Forgiveness Application Forms Released

On Tuesday, the US Treasury and Small Business Association released updated Paycheck Protection Program forgiveness application forms and guidance to reflect changes made the the Paycheck Protection Program under the Consolidated Appropriations Act. This includes a one-page application, the PPP Loan Forgiveness Application Form 3508S, for borrowers who received a PPP loan of $150,000 or less.

Read Also: How To Cut Interest On Car Loan

Which Loan Forgiveness Application Should Sole Proprietors Independent Contractors Or Self

Sole proprietors, independent contractors, and self-employed individuals who had no employees at the time of the PPP loan application and did not include any employee salaries in the computation of average monthly payroll in the Borrower Application Form automatically qualify to use the Loan Forgiveness Application Form 3508EZ or lender equivalent and should complete that application if they borrowed over $150,000.

If they borrowed $150,000 or less, they should use the new streamlined form 3508S with January 19, 2021 revision date.

Recommended Reading: How To Find My Student Loan Account Number For Irs

Summary: Regular 3508 Vs 3508ez Vs 3508s Form

Heres our final word on the PPP forgiveness 3508 vs. 3508EZ vs. 3508S comparison:

The 3508S form is only for borrowers with PPP loans of $150,000 or less. If your PPP loan was for more than $150K, youll have to use either the regular 3508 form or the 3508EZ form.

The 3508EZ form was conceived as a way for businesses with PPP loans of over $150K to reduce the amount of paperwork required to apply for forgiveness. However, only certain businesses are eligible to use the simplified form. While anyone who is self-employed, an independent contractor, or a sole proprietor who had no employees when they applied for a PPP loan is eligible to use the EZ form, it gets more complicated from there.

If you reduced employees pay by more than 25%, use the regular 3508 form. If you didnt reduce the pay of your employees by more than 25% and can meet one of two other conditions , you can use the simplified 3508EZ form.

And dont forget that you may be eligible to use the SBA PPP Direct Forgiveness Portal, which further simplifies the process. To use the portal, you must have received a loan of $150,000 or less, and your lender must have opted-in to allow borrowers to use the portal. More information from lenders and the SBA will be forthcoming as the portal launches to the public.

Recommended Reading: Signs Your Loan Will Be Approved

Do I Qualify To Apply For A Ppp Loan Using Womply

In general, yes, but here are the basic qualifications :

- Sole proprietor

- self-employed individuals

- pretty much anyone who has 1099 income

As long as you were in operation on or before February 15, 2020 and reported taxable earnings/income for 2019 or 2020, you can likely apply for PPP assistance.

What about if you collected unemployment? According to Womply, If you are self-employed or a 1099 then you likely cannot use your PPP funds to pay yourself and continue to collect unemploymentbecause the payment you make to yourself counts as income, which in most cases will disqualify you from continuing to receive unemployment..

Basically, you cant get a PPP loan and unemployment at the same time.

Wondering how you can use your PPP loan money? Heres what you can use your PPP loan on

- Payroll costs, including benefits

Form 3508 Vs 3508ez Vs 3508s: Whats The Difference

Form 3508EZ and S are simplified documents for eligible employers and solopreneurs. Unless you qualify to use the EZ or S versions, you must apply with the regular Form 3508.

The difference between the forms lies in the calculations you need to do. Form 3508 requires the most calculations, Form 3508EZ requires less calculations, and Form 3508S is nearly calculation-free .

The form you use depends on certain factors such as:

- How much you borrowed

- Whether you reduced employee salaries and headcount

Take a look at details about each form as well as their eligibility requirements to determine how you can apply for PPP loan forgiveness.

Recommended Reading: Is Homeowners Insurance Included In Fha Loan

Rundown On Ppp Forgiveness Eligibility

For full PPP forgiveness, you must meet a few requirements. Borrowers must use Forms 3508 to not just request loan forgiveness, but also to determine the amount of forgiveness.

To get your PPP loan forgiven, you must:

- Use it for eligible expenses

- Keep your employee full-time equivalent levels up

- Not reduce employee wages by more than 25%

So which Form 3508 do you need for PPP forgiveness?

What Do I Need To Apply

You will need to complete the Paycheck Protection Program loan application and submit the application with the required documentation to an approved lender that is available to process your application. The program expires on March 31, 2021, but we recommend applying as soon as possible, as funds are expected to go quickly.

Dont Miss: How Much Can The Bank Loan Me

Read Also: What Is Origination Fee In Personal Loan

The Amount Of Forgiveness Of A Ppp Loan Depends On The Borrowers Payroll Costs Over An Eight

The eight-week or 24-week period starts on the date your lender makes a disbursement of the PPP loan to the borrower. The lender must disburse the loan no later than 10 calendar days from the date of loan approval. The Paycheck Protection Program Flexibility Act of 2020, which became law on June 5, 2020, extended the covered period for loan forgiveness from eight weeks after the date of loan disbursement to 24 weeks after the date of loan disbursement, providing substantially greater flexibility for borrowers to qualify for loan forgiveness. The 24-week period applies to all borrowers, but borrowers that received an SBA loan number before June 5, 2020, have the option to use an eight-week period

Recommended Reading: Best Loan To Consolidate Debt

Can I Use Scanned Copies Of Documents E

Yes. All PPP lenders may accept scanned copies of signed loan forgiveness applications and documents containing the information and certifications required by SBA Form 3508, 3508EZ, or lender equivalent. Lenders may accept any form of Econsent or E-signature that complies with the requirements of the Electronic Signatures in Global and National Commerce Act .

As with all documents in the PPP process, its important to make sure that any documents you send to your lender are easy to read and are as high-quality as you can make them. This will make the process significantly faster and easier.

If electronic signatures are not feasible, then when obtaining a wet ink signature without in-person contact, lenders should take appropriate steps to ensure the proper party has executed the document. This guidance does not supersede signature requirements imposed by other applicable law, including by the lenders primary federal regulator.

Be sure to provide good-quality copies of all your documents, and make sure theyre legible, properly filled out, and accurate.

for loan forgiveness?

Don’t Miss: How To Calculate Personal Loan Interest Rate