Veterans Uniteds Application Experience

Once youve decided to apply, its easy to get started with Veterans United. They offer an online preapproval and online application fully equipped with digital document uploading. As you move forward with the loan process, youre always able to track your loans progress online. When you reach closing, Veterans United has a hybrid closing option that combines elements of an eClosing and traditional, in-person closing.

Compare To Other Lenders

| NerdWallet rating NerdWallet’s ratings are determined by our editorial team. The scoring formula takes into account loan types and loan products offered, online conveniences, online mortgage rate information, and the rate spread and origination fee lenders reported in the latest available HMDA data. | NerdWallet rating NerdWallet’s ratings are determined by our editorial team. The scoring formula takes into account loan types and loan products offered, online conveniences, online mortgage rate information, and the rate spread and origination fee lenders reported in the latest available HMDA data. |

|

Purchase, Refinance, Jumbo, Fixed, Adjustable, FHA, VA |

Loan types and productsPurchase, Refinance, Home Equity, Jumbo, Fixed, Adjustable, FHA, VA, USDA |

Get more smart money moves straight to your inbox

Become a NerdWallet member, and well send you tailored articles we think youll love.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: Who Has The Best Student Loan Refinance Rates

What Borrowers Say About Veterans United Home Loans

NerdWallets lender star ratings assess objective qualities, including rates, fees and loan offerings. To assess borrowers subjective experiences with lenders, NerdWallet has gathered customer satisfaction ratings from J.D. Power and Zillow.

-

Veterans United receives a 768 out of 1,000 in J.D. Powers 2022 U.S. Mortgage Origination Satisfaction Study. The industry average for origination is 716

-

Veterans United receives a customer rating of 4.78 out of 5 on Zillow, as of the date of publication. The score reflects more than 5,100 customer reviews.

Breakdown Of Veterans United Home Loans Overall Score

- Affordability: VA loan rates through Veterans United Home Loans are somewhat competitive to Bankrates averages. The exact closing costs and fees youll pay depend on your specific loan.

- Availability: Veterans United works with borrowers in all 50 states, with a focus on VA loans.

- Borrower experience: As the top VA lender in the U.S., the Veterans United website is brimming with educational resources for VA borrowers. Notably, you can contact the lender 24 hours a day, seven days a week.

Methodology

To determine a mortgage lenders Bankrate Score, Bankrates editorial team rates lenders on a scale of one to five stars based on a variety of factors relating to the lenders products and services. Bankrates partners compensate us, but our opinions are our own, and partner relationships do not influence our reviews. Here is our full methodology.

Read Also: What Percent Down For Conventional Loan

Veterans United Home Loans Named No 14 On Fortune’s ‘100 Best Companies To Work For 2022’

This will be the company’s seventh year in a row on the list.

COLUMBIA — Where are the best places to work in the nation? According to Fortune Magazine, one of them is Columbias Veterans United Home Loans.

On Monday, Columbias Veterans United was named No. 14 on Fortune’s 100 Best Companies to Work For 2022.

This will be the company’s seventh year in a row on the list. This year, the company moved up 19 spots after being placed No. 33 in 2021.

” a survey that they call the trust index,” August Nielsen, vice president of people services, said. “It’s a series of dozens and dozens of questions that Fortune sends to a random sampling of employees.”

Nielsen said based upon the employee responses, Veterans United is ranked for its trust among employees and how their ability to enhance culture.

According to Great Place to Work, 95% of employees at Veterans United said it’s a “great place to work.”

Fortune said in addition to being the largest VA purchase lender, Veterans United has “various culture-building initiatives, that cultivate what employees call a great atmosphere.

One of these initiatives includes welcoming new hires with a gift box of personalized swag on their first day.

Success! An email has been sent to with a link to confirm list signup.

Error! There was an error processing your request.

“We want to make sure that feel welcome,” Nielsen said.

“It also comes down to meeting employees where they are,” Nielsen said. “And helping them feel comfortable at work.”

Excellent Professionalism And Commitment

There isn’t a sentence that can accurately describe what James and his team has helped me and my family accomplish. From beginning to end, James was always readily available to answer questions and was very personable. Even if I asked redundant or what might’ve seemed like simple questions to anyone else, James demonstrated excellent professionalism and commitment to his work and to me. Kind of like a big brother would.

– Jaime D.

Read Also: Loan In Minutes No Credit Check

You May Also Be Determined Eligible If:

Note: A surviving spouse who remarries on or after age 57 and on or after December 16, 2003, may be eligible for the home loan benefit. However, a surviving spouse who remarried before December 16, 2003, and on or after age 57, must have applied no later than December 15, 2004, to establish eligibility. |

Quick Responses And Extremely Helpful

Chad and his whole team including, Ryan and Kelly, were incredible! We could always count on quick responses and extremely helpful and positive assistance with any questions we had. They made us feel comfortable and confident throughout the entire process and always made sure we were getting the best deal and well taken care of. Highly recommend!!!

– Jacob O.

Recommended Reading: How Do I Calculate My Student Loan Payments

Veterans United Home Loans Variety Of Loan Types

Borrowers choosing VA loans make up the vast majority of Veterans Uniteds customers. Along with purchase loans, the lender offers two refinance options for VA borrowers. The first is the VA Interest Rate Reduction Refinance Loan, or IRRRL, which allows borrowers to take advantage of rate drops. The other is a cash-out refinance, so VA borrowers can tap into their equity. This is the only option for accessing equity, as Veterans United doesnt offer HELOCs or home equity loans.

Veterans United also offers conventional, FHA and jumbo loans, and provides buyer education in the form of online coursework geared toward the VA loan process and credit counseling.

Veterans United Home Loans

VA Loan Expertise from Veterans United

VA Loans provide some key homebuying benefits for our nations Veterans and military families. Veterans United Home Loans can help you maximize these benefits earned through military service, including:

No Down Payment

VA Mortgages are one of the only home loans available today with no down payment required.

Lower Payments

Competitive interest rates and no mortgage insurance mean lower monthly payments.

Easier to Qualify

Less stringent requirements can make qualifying for financing easier than other options.

Veterans United is the nations No. 1 VA Lender. We proudly provided more VA Home Loans to Veterans than any other lender in 2018, according to the Department of Veterans Affairs 2018 Lender Volume Report. Check out our more than 140,000+ reviews from Veterans nationwide.

https://www.veteransunited.com/reviews

VeteransUnited.com | 1-800-884-5560 | 1400 Veterans United Drive, Columbia, MO 65203 | Veterans United Home Loans NMLS # 1907 . A VA approved lender Not endorsed or sponsored by the Dept. of Veterans Affairs or any government agency. Licensed in all 50 states. Equal Opportunity Lender.

Don’t Miss: How Fast Can I Pay Off My Loan

Selected Reserve Or National Guard:

If you are not otherwise eligible and you have completed a total of six credible years* in the Selected Reserve or National Guard and one of the following:

*Individuals who completed less than six years may be eligible if discharged for a service-connected disability. |

Went Above And Beyond

At every step Justin went above and beyond. Every question I had was answered quickly, professionally, and succinctly. Every time a new item was needed, Justin finished it faster then expected with zero issues. There was no confusion or delays with processing anything. His management of the team and process was flawless.

– Nathan G.

Recommended Reading: What Is The Average Boat Loan Interest Rate

Veterans United Home Loans Overview

Established in 2002, Veterans United Home Loans is a full-service direct mortgage lender specializing in VA loans with a team of over 5,000. Veterans United also offers a variety of other loan products. Its a popular choice among military borrowers and has become the leader in the VA loan sector, providing more VA purchase loans by volume than any other lender since 2016. There are more than two dozen branch locations nationwide, but you can also apply for a mortgage or refinance online or over the phone. Depending on the borrower, the lender can issue a preapproval in minutes , and its VA loan closings currently average a brisk 36 days. Notably, the lender is flexible enough to consider non-traditional credit data, and if youre a returning borrower, you might be eligible for a credit.

Veterans United Home Loans is good for

Borrowers looking for a VA loan product, online convenience and 24/7 customer service

Veterans United At A Glance

| 5 stars |

Minimum down payment: 0% to 3% Available loan products and programs: Conventional, VA, FHA, Jumbo |

Our verdict: Veterans United is a good fit for military borrowers looking to purchase or refinance a home. Active-duty service members stationed overseas will especially appreciate the 24/7 availability of its loan officers, but anyone looking for a responsive lender with support tailored to troops and vets may want to consider this lender.

|

You wont find any adjustable-rate loans You wont have access to home equity products You cant get financing for a manufactured home |

You wont find any adjustable-rate loans You wont have access to home equity products You cant get financing for a manufactured home |

On this page

Veterans United Home Loans specializes in loans backed by the U.S. Department of Veterans Affairs and is frequently the No. 1 issuer of VA loans , according to the VAs own data. About 9 in 10 of Veterans United borrowers take out VA loans. The company was founded in 2002 and is headquartered in Columbia, Mo.

Also Check: How Many Years After Foreclosure For Conventional Loan

Veterans Uniteds Mortgage Rates And Fees

Veterans United provides abundant mortgage rate information on its website, covering both purchase and refinance loans, and allows you to customize the rates youre seeing by credit score. Most of the rate quotes include discount points. The VA funding fee is included in the rates as well, since its common for VA borrowers to roll this fee into their loan. Veterans United rate quotes additionally assume the borrower has sufficient VA entitlement and is buying or refinancing a primary residence.

The fees Veterans United will charge to originate a loan arent itemized on the companys website however, this is likely because they specialize in VA loans. The VA sets a cap on lender fees, so you wont pay more than 1% of the loan amount.

| Mortgage rates published online? |

|---|

| Lender fees disclosed? |

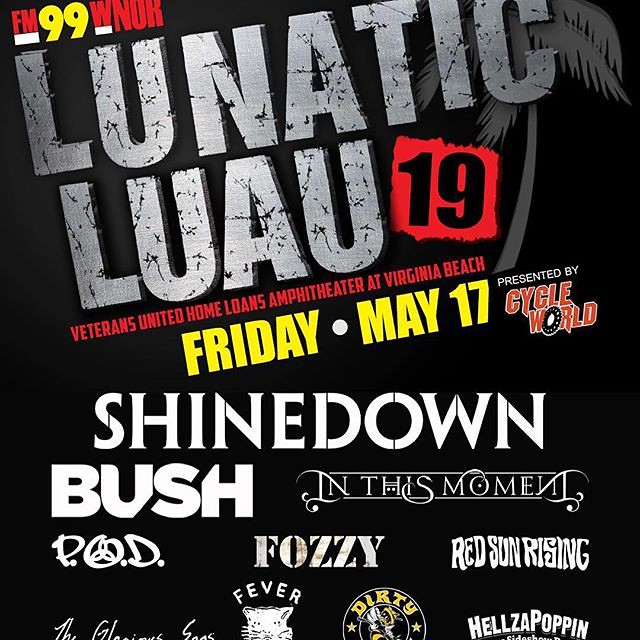

Veterans United Home Loans Amphitheater

This site is not affiliated or sponsored by Live Nation, Ticketmaster or Farm Bureau Live at Virginia Beach. This site links to resale tickets to events at Veterans United Home Loans Amphitheater. See Disclaimer.

The Veterans United Home Loans Amphitheater is an amphitheater also known as the Virginia Beach Amphitheater is located perfectly by the sandy beaches of Virginia. Previously known as the Farm Bureau Live

The venue boasts a seating capacity of 20,000 thousand, with no area of lawn escaping huge crowds of dancing feet! The venue also has a huge canopy, closer to the main stage for those that want to escape the summer sun.

The theater was opened in 1996 and has over years, Increased in popularity, due to it’s perfect summer location and large seating capacity.

Read Also: What Are Home Loan Rates

Veterans United Home Loans Review 2023

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

If You Were Separated From Service:

| Enlisted – After September 7, 1980 |

| Officers – After October 16, 1981 |

Service Requirements:

|

* 90 days applies for wartime

Read Also: Second Chance Personal Loans With Bad Credit

They Helped Me Where No Other Loan Company Could

I can say without a doubt that if I ever need a mortgage, Veterans United is it! No need to think about it or search any further! Their customer service is amazing! They helped me where no other loan company could. Their communication with us was impeccable! I would enthusiastically, without any reservation, recommend Veterans United.

– Jose B.

How To Apply

Purchase Loan & Cash-Out Refinance: VA loans are obtained through a lender of your choice once you obtain a Certificate of Eligibility . You can obtain a COE through eBenefits, by mail, and often through you lender. Learn More

Interest Rate Reduction Refinance Loan: A new Certificate of Eligibility is not required. You may take your Certificate of Eligibility to show the prior use of your entitlement or your lender may use our e-mail confirmation procedure in lieu of a certificate of eligibility. Learn More

Native American Direct Loan Program: First, confirm that your tribal organization participates in the VA direct loan program. NADL loans are obtained through a lender of your choice once you obtain a Certificate of Eligibility . You can obtain a COE through eBenefits, by mail, and often through you lender. Learn More

Adapted Housing Grants: You can apply for an SAH or SHA grant by either downloading and completing VA Form 26-4555 and submitting it to your nearest Regional Loan Center, or completing the online application. Learn More

Recommended Reading: Sba Economic Injury Disaster Loan Modification Request