Personal Loan Interest Rate In India

With a Bajaj Finserv Personal Loan, you can get up to Rs. 25 lakh at an attractive interest rate. The loan comes with no hidden charges, 100% transparency and an affordable personal loan interest rate in India, making your overall borrowing experience seamless.

|

Types of fees |

|

|

Up to 4% of the loan amount |

|

|

Penal interest |

Delay in payment of monthly instalment shall attract penal interest at the rate of 3% per month on the monthly instalment outstanding, from the respective due date until the date of receipt. |

|

Part-prepayment charges** |

|

|

Bounce charges |

Rs. 600 – Rs. 1,200 per bounce |

| Stamp duty | Payable as per state laws and deducted upfront from loan amount |

| Mandate rejection charges | Rs. 450/- per month from the first month of due date for mandate rejected by customers bank until the new mandate is registered |

| Flexi fee | Flexi variant Rs. 1999 for loan amount is < 2 lakhRs. 3999 for loan amount > = Rs. 2 lakh and < Rs. 4 lakhRs. 5999 for the loan amount is > = Rs. 4 lakh and < Rs. 6 lakhRs. 6999 for the loan amount is > = Rs. 6 lakh and < Rs. 10 lakhRs. 7999 for the loan amount is > = Rs. 10 lakhWill be deducted upfront from the loan amount |

*Flexi fee is not applicable for PLCS & RPL

**These charges are not applicable for the Flexi loan facility. Moreover, the part-prepayment should be more than one EMI.

How To Get The Lowest Personal Loan Interest Rates

Borrowing with a cosigner who has strong credit is one way to get a good rate, but its not the only one. Making yourself as low-risk of a borrower as possible is key to qualifying for the best possible rate. Heres how:

- Check your credit report before you apply and look for opportunities to improve your credit score. Paying down debt, paying off forgotten collection accounts, and correcting any errors you find could boost your credit score enough to reduce your rate.

- Select as short a loan term as possible. Longer terms carry higher risk of default, which is why they typically come with higher interest rates.

- Borrow only the minimum amount you need. The smaller the loan amount, the less risky it is to lenders and the sooner youll be able to repay the loan.

- Maximize your income. Taking a temporary side gig will boost your income and reduce your debt-to-income ratio, which could qualify you for a better interest rate.

- Borrow from a bank or credit union where you have existing accounts. Some financial institutions offer relationship discounts on interest rates if youre already a customer.

Before submitting your application for a personal loan, its a good idea to shop around and compare offers from several different lenders to get the best rates. But dont worry: This doesnt have to be a time-consuming process.

Whats The Difference Between A Secured And Unsecured Loan

Secured loans require collateral, such as a car, home, bank or investment account, or other asset, as part of the loan agreement. If you fall behind on payments and default on the personal loan, your collateral could be forfeited to your lender. Most personal loans, which are unsecured, do not require collateral.

Recommended Reading: Are Student Loan Payments Tax Deductible

Where Can I Get A Personal Loan

When it comes to shopping for personal loans, the better your credit score, the more options you have. Generally speaking, there are three main places to get a personal loan:

Average Interest Rate On A Personal Loan

The average APR on a 24-month unsecured personal loan in the U.S. is 9.41% as of February 2022. The rate you pay, depending on the lender and your credit score, can range from 6% to 36%. For comparison, the average APR on a 48-month secured new car loan is 4.90%. This shows the interest-lowering power of a secured loan over an unsecured loan.

You May Like: Capital One Auto Loan Address

What Are Interest Rates On Personal Loans

Personal loans are a type of closed-end credit, with set monthly payments over a predetermined period . Interest rates on personal loans are expressed as a percentage of the amount you borrow .

The rate quoted is the nominalannual percentage rate or the rate applied to your loan each year, including any fees and other costs, but not including costs related to compounding or the effect of inflation. Most personal loans actually use the monthly periodic rate, arrived at by dividing the APR by 12. When applied to the principal, the APR determines the additional amount you will pay to borrow the principal and pay it back over time.

Eligibility Criteria For Personal Loan:

PERSONAL LOAN

Don’t Miss: Capital One Refinance Car Loan

What Documents Are Required For Personal Loans

You will generally need several documents to apply for a personal loan, including documents that prove your identity and financial status. You’ll generally need at least ID, income verification and proof of address. These documents and the rest of your information will help the lender determine what origination fee you will pay if applicable.

How Do I Find The Best Personal Loan Rates In Canada

You can find the best rates for personal loans in Canada by ensuring your finances are in great shape before you apply and comparing offers from multiple lenders. To qualify for low interest loans, youll need a good to excellent credit score, a solid history of on-time payments and your monthly debt payments should be less than 20% of your monthly income.

To compare offers, get personal loan pre-approval from your top choices. Banks, credit unions and select online lenders tend to offer the best personal loan rates in Canada.

Recommended Reading: What Loan Can I Get Approved For

Best For Refinancing High

Who’s this for? SoFi got its start refinancing student loans, but the company has since expanded to offer personal loans up to $100,000 depending on creditworthiness, making it an ideal lender for when you need to refinance high-interest credit card debt.

If you have high-interest debt on one or more card, and you want to save money by refinancing to a lower , SoFi offers a simple sign-up and application process, plus a user-friendly app to manage your payments.

Another unique aspect of SoFi lending is that you can choose between variable or fixed APR, whereas most other personal loans come with a fixed interest rate.Variable rates can go up and down over the lifetime of your loan, which means you could potentially save if the APR goes down . However, fixed rates guarantee you’ll have the same monthly payment for the duration of the loan’s term, which makes it easier to budget for repayment.

By setting up automaticelectronic payments, you can earn a 0.25% discount on your APR. You can also set up online bill pay to SoFi through your bank, or you can send in a paper check.

Once you apply for and get approved for a SoFi personal loan, your funds should generally be available within a few days of signing your agreement. You can both apply for and manage your loan on SoFi’s mobile app.

What If I Have Trouble Repaying A Personal Loan

Life happens, and sometimes you may be unable to make your loan payments due to an unexpected expense. You must communicate with your creditors if this occurs. They would rather work out an arrangement, such as reducing your monthly payments or lowering your interest rate, than take you to court or charge off your debt.

By contacting your lender, you may be able to avoid having your loan go into collection. You may also want to work with a nonprofit credit counselor who can show you how to restructure your finances and prepare for the occasional unexpected expense.

Some consumers take a more aggressive approach and hire a debt settlement company. This maneuver is risky because you redirect your debt payments into an escrow account while asking for partial loan forgiveness.

Your creditors may accept your demands and reduce your debt, or they may refuse and take you to court instead. Settlements appear on your credit reports and remain there for seven years.

Debt settlement can cause significant damage to credit scores, but probably not as much as filing for bankruptcy, which can linger on credit reports for up to 10 years.

Don’t Miss: What Is Escrow In Mortgage Loan

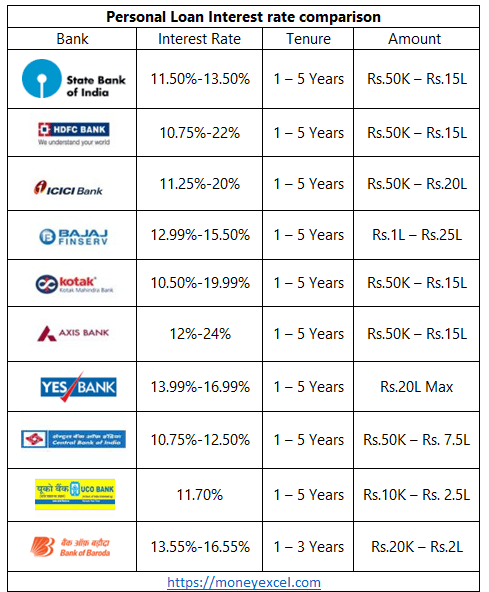

Current Personal Loan Rates For Pensioners

In contrast to the general public, various lenders, such as SBI and PNB, offer concessional personal loan interest rates to pensioners. The personal loan rate discount may be much higher as pensioners repay a loan from the same bank when keeping a pension account. The lowest personal loan interest rate, though, is 10.40 percent.

What Is The Average Interest Rate On A Personal Loan

The average interest rate on a personal loan is 9.41%, according to Experian data from Q2 2019. Depending on the lender and the borrower’s credit score and financial history, personal loan interest rates can range from 6% to 36%. It’s important to learn how personal loan interest rates work to better understanding how much your monthly payments will be for the loan, and how much you will pay for the lifespan of the loan.

A personal loan is a form of credit that allows consumers to finance large purchases, such as a home renovation, or consolidate high interest debt from other products like credit cards. In most cases, personal loans offer lower interest rates than credit cards, so they can be used to consolidate debts into one lower monthly payment.

The average personal loan interest rate is significantly lower than the average credit card interest rate, which was about 17% as of November 2019, according to the Federal Reserve.

You May Like: How To Take Out Equity Loan

Average Loan Rates By Lender Type

While local banks and credit unions with brick-and-mortar stores promise competitive personal loan products, online lenders often offer loans with lower starting interest rates for consumers with excellent credit. Consumers who want to find an affordable loan product to suit their needs should compare their bank or credit unions offerings with any online lenders they may be familiar with.

Rates are accurate as of September 14, 2022. Check with the lender for any updated details.

What Is A Low

Personal loans are the generalists in the lending world since you can use the proceeds however you wish. For example, contrast a personal loan with a single-purpose car loan, student loan, or home equity loan.

Personal loans are usually unsecured, meaning only your signature is necessary for loan approval. That is why they are sometimes referred to as signature loans.

Secured personal loans are also available to consumers who dont qualify for an unsecured personal loan. A secured loan may charge less interest than an unsecured loan, depending on the source.

Low interest personal loans have a maximum annual percentage rate of 36%. The actual rate youll receive depends on your credit history, income, and debts. The personal loan rate range matches that for credit card cash advances, which also top out at 36%.

Folks with good credit can expect a much lower personal loan interest rate that is usually lower than the interest rate available from a credit card and closer to the prime rate.

Average personal loan interest rate by credit score, as of September 2022:

| 28.50%-32.00% |

Data collected from Bankrate.

You repay personal loans in a series of installments running from three to 60 months. The monthly payment is a fixed amount throughout the loan term. There is typically no prepayment penalty, so you can save interest expenses by repaying the loan ahead of schedule.

You May Like: What Is The Best Loan App

What Affects Interest Rates On A Personal Loan

Your financial situation has a big effect on your interest rate, and your credit score is among the most important factors. In most cases, youll need a credit score of at least 670 to qualify for a personal loan with a good rate.

Borrowers with very good and excellent credit are generally offered the lowest interest rates. Your takes into account your payment history, credit utilization, length of credit history, credit mix and the number of credit inquiries.

If your DTI ratio is higher than 35% to 40%, you might not qualify for the best interest rate on a personal loan.

The lender will also factor in your income. If your income is on the higher end , you should be able to secure an interest rate on the low side.

Lenders will calculate your DTI ratio, which shows how much of your gross monthly income goes toward paying debts. As a general rule, you want a DTI of 35% to 40% or below to qualify. You could still qualify with a higher DTI ratio, but it may mean youll pay higher interest rates.

Most personal loans are unsecured, which means theyre not backed by collateral. Unsecured loans are riskier for lenders because they dont have an asset to sell to recover their losses if you default this translates to higher rates for borrowers.

Some lenders offer secured personal loans with lower rates these loans are backed by a vehicle, a savings account or another form of personal property.

Can I Get A Personal Loan With Bad Credit

It is possible to get a personal loan with bad credit, but it is generally more difficult to qualifyespecially for competitive rates. Less creditworthy applicants also face lower borrowing limits and higher interest rates than more qualified applicants. However, some lenders specialize in personal loans for borrowers with bad credit, instead basing lending decisions on alternative credit data.

You May Like: How To Get 0 Car Loan

What Is A Good Personal Loan Rate

If you need cash or are looking to consolidate debt, a personal loan is one option you might consider. These loans offer one-time, lump-sum payments, and you can use the funds for anything you like.

They’re also unsecured, meaning you don’t need any sort of collateral to qualify.

If you think you could benefit from taking out a personal loan you can get started today. You may be eligible to get cash in a lump sum quickly.

If you’re considering taking out a personal loan here’s what you need to know about personal loan rates and how to get the best one.

Factors Affecting Personal Loan Interest Rates

Lenders fix interest rates primarily on the basis of their cost of funds and the credit risk evaluation of their loan applicants. Here are some of the key factors that can influence your personal loan interest rates:

- Many lenders have started factoring in the credit scores of their loan applicants while setting their interest rates. Those having higher credit scores are offered personal loans at lower interest rates than others. Hence, try to maintain credit scores of 750 and above. Good financial habits like repaying your credit card bills and EMIs by their due dates, avoiding multiple loans or credit card applications within a short period would help you maintain higher credit scores.

Note that errors in your credit report can also pull down your credit score. Therefore, applicants should check their credit reports at regular intervals to identify such errors in time and take necessary steps to avoid adverse effect on their credit score. To check your credit scores for free either avail free credit report once a year from each of the credit bureau or visit Paisabazaar.com to view your credit scores from multiple bureaus along with their monthly updates. Those having no or low credit scores can improve their credit scores by availing lifetime free Paisabazaar Step UP Credit Card.

Check:How much personal loan can you avail based on your salary?

Check: Personal Loans for Salaried Employees

Check Free Credit Report before you apply for personal loans Check Now

You May Like: How Much Is My Student Loan Payment