Va Home Loan Vs Conventional 30

A conventional mortgage the most common type of home loan is one that isnt backed by a government agency. VA loans and conventional mortgages may have many similarities, including their loan terms and some of the factors needed to qualify for a loan.

There are also some critical differences between the two loans, including that VA loans can have fewer fees, more flexible lending terms, and no down payment requirement.

One critical difference between VA loans and conventional mortgages is the interest rate available. VA loans often have more favorable interest rates than the rate on a 30-year fixed-rate mortgage.

When you compare the average 30-year VA loan to a 30-year conventional loan, youll see that VA loans tend to be between 0.25% and 0.42% lower than conventional mortgages. As a result, this type of mortgage can be quite enticing for borrowers who qualify.

How Va Loan Rates Compare Other Mortgage Rates

Thanks to the government insurance of these mortgages, lenders are able to offer competitive VA loan rates that are usually lower than conventional mortgages.

For example, in March 2021, a typical 30-year fixed mortgage would come with an interest rate of 3.125%. In that same month, a VA loan on the same 30-year plan would come with 2.875% interest attached.

A difference of less than a percent might not seem like much, but throughout the term of the loan, you will have saved thousands in interest with the lower rate. Check out the links below for interest rates on other types of mortgages and how they stack up to VA loans:

Who Qualifies For A Va Refinance Loan

To be eligible for an IRRRL refinance loan, you need to have an existing VA loan for the property and meet the following requirements:

For a VA cash-out refinance, the requirements are different:

- You must live in the home you are refinancing.

- You can refinance any type of existing mortgage VA loan, conventional or other mortgage into a VA loan.

- You must qualify for a VA certificate of eligibility .

- You must meet the VAs and your lenders credit and income requirements.

- Your lender will order a professional home appraisal.

Read Also: Auto Loan Usaa

Va Home Loan Benefits

The goal of the VA loan program is to make homeownership more accessible for veterans and service members.

As such, VA loans offer unique benefits not available to most other borrowers.

These loans are especially attractive for first-time home buyers, since you dont need to worry about saving for a down payment.

Although theyre backed by the federal government, VA loans are offered by private lenders. That means youre free to shop around and compare mortgage companies to find the lowest rate.

Who Is Eligible For A Va Loan

VA loan eligibility is based on your length of service, your duty status, and the character of your service. Current service members generally must have 90 continuous days of service to be eligible for a Certificate of Eligibility . Former military members must have served for at least 24 continuous months or a certain number of days of active duty.

Also Check: Can You Put Closing Costs Into Va Loan

A Historic Opportunity To Potentially Save Thousands On Your Mortgage

Chances are, interest rates won’t stay put at multi-decade lows for much longer. That’s why taking action today is crucial, whether you’re wanting to refinance and cut your mortgage payment or you’re ready to pull the trigger on a new home purchase.

The Ascent’s in-house mortgages expert recommends this company to find a low rate – and in fact he used them himself to refi . and see your rate. While it doesn’t influence our opinions of products, we do receive compensation from partners whose offers appear here. We’re on your side, always. See The Ascent’s full advertiser disclosure here.

How To Get The Lowest Va Interest Rate

To get the lowest interest rate possible on your VA mortgage, youll want to make yourself into the most attractive borrower possible, while also finding the lender who offers you the best deal.

If you take the time to do both, youre likely to end up with a lower interest rate something that could save you thousands of dollars over the life of your VA loan.

Please contact our support if you are suspicious of any fraudulent activities or have any questions. If you would like to find more information about your benefits, please visit the Official US Government website for theDepartment of Veteran Affairs or the US Department of Housing and Urban Development.

MilitaryVALoan.com is owned and operated by Full Beaker, Inc. NMLS #1019791.

Full Beaker, Inc. is not licensed to make residential mortgage loans in New York State. Mortgage loans are arranged with third-party providers. In New York State it is licensed by the Department of Financial Services.Please click here if you do not wish us to sell your personal information.

You May Like: 18009460332

How Much Does A Va Loan Cost

Your VA mortgage rate will affect the overall cost of borrowing. A higher rate will mean a higher monthly mortgage payment and more interest paid over the life of the loan.

VA loans include other costs, too. Most borrowers will pay a VA funding fee. The fee varies depending on several factors, including whether the loan is for a home purchase or mortgage refinance, the down payment amount and whether this is your first VA loan.

For purchase loans with a zero-down payment, the VA funding fee is 2.3% of the loan amount if this is your first VA loan. It can be lower for some refinances and can be waived for disabled veterans and some surviving spouses. Active-duty service members who have received a Purple Heart are exempt from the funding fee. Youll also be responsible for other closing costs, such as appraisals and inspections.

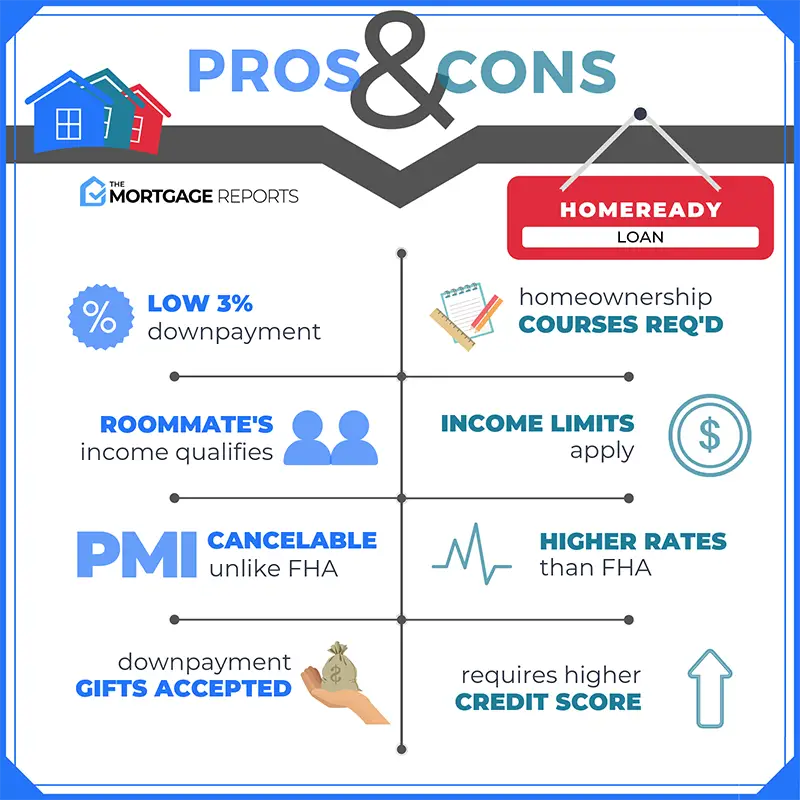

Consider Different Types Of Home Loans

The 30-year fixed rate mortgage is the most common type of home loan, but there are additional mortgage options that may be more beneficialdepending on your situation.For example, if you require a lower interest rate, adjustable-rate mortgages offer a variable rate that may be initially lower than a 30-year fixed rate option but adjusts after a set period of time . Given that ARM loans are variable, the interest rate could end up being higher than with a 30-year fixed rate mortgage that has a locked-in mortgage rate. A 15-year fixed rate mortgage, on the other hand, may offer a lower interest rate that wont fluctuate like an ARM loan but requires a higher monthly payment compared to a 30-year fixed rate mortgage. Consider all your options and choose the home loan that is most comfortable for you.

Recommended Reading: Mountain America Mortgage Rates

First Mortgage Direct Best Online Lender

First Mortgage Direct is the online division of First Mortgage Solutions, based in Kansas City, Missouri.

Strengths: You can get prequalified in under a day, and, as with other lenders, if you find a favorable VA loan rate, First Mortgage Direct locks it in for you in case rates go up.

Weaknesses: First Mortgage Direct is only licensed in 17 states, so borrowers outside of this range will need to look elsewhere for refinancing.

Read Bankrate’s full First Mortgage Direct review

What Are Points On A Mortgage

Discount points are a way for borrowers to reduce the interest rate they will pay on a mortgage. By buying points, youre basically prepaying some of the interest the bank charges on the loan. In return for prepaying, you get a lower interest rate which can lead to a lower monthly payment and savings on the overall cost of the loan over its full term.

A mortgage discount point normally costs 1% of your loan amount and could shave up to 0.25 percentage points off your interest rate. The exact reduction varies by lender. Always check with the lender to see how much of a reduction each point will make.

Discount points only pay off if you keep the home long enough. Selling the home or refinancing the mortgage before you break even would short circuit the discount point strategy.

In some cases, it makes more sense to put extra cash toward your down payment instead of discount points If a larger down payment could help you avoid paying PMI premiums, for example.

Don’t Miss: Capitalone Autoloans.com

Current Va Loan Rates

As of the beginning of October 2020, mortgage rates are still trending downward. Keeping in mind that mortgage rates have hit all-time lows several times over the course of the year, its more important to look at overall trends than VA loan rates for today.

Even though you can check up on current VA loan rates regularly, this will only give you a general insight into the market, not necessarily the loan rate that youll qualify for. Since VA loan rates are highly individualized, personal financial factors, among other interest rate aspects, will significantly impact the rate you can qualify for.

Learn more about our VA loan rates and see what you qualify for today.

How Are Va Loan Rates Determined

Mortgage rates can fluctuate often, and the rate that one borrower is eligible for may not be available to someone else.

There are several external factors that affect mortgage rates, including the current state of the economy and actions taken by the Federal Reserve. During certain times including throughout the pandemic the Federal Reserve cuts interest rates to stimulate economic growth. When this happens, mortgage rates often go down.

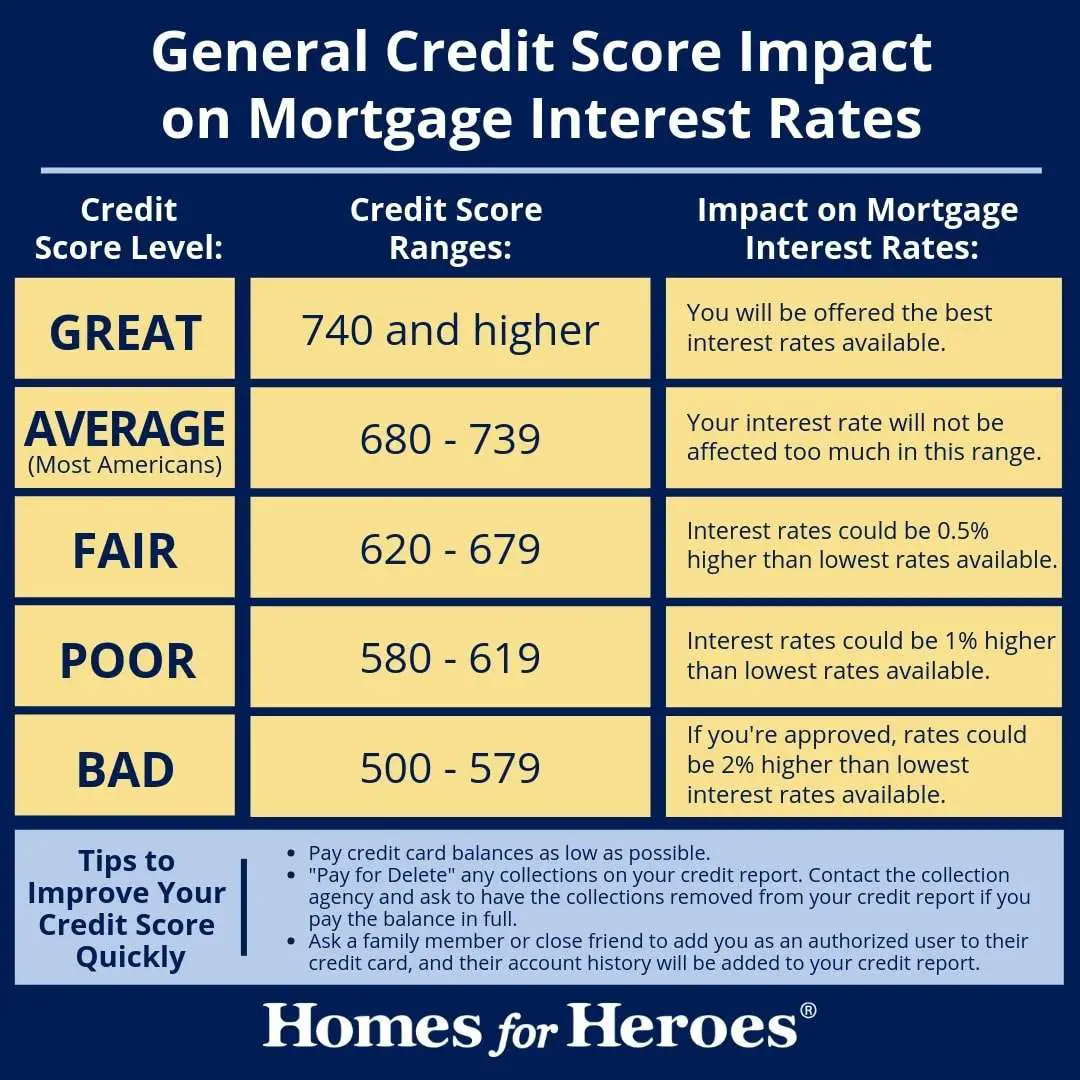

There are also internal factors that affect a borrowers interest rate. One of the most important factors is a borrowers . Generally, borrowers with credit scores above 740 are eligible for the best rates. Other personal factors that affect your mortgage rate include your debt-to-income ratio and the size of your down payment.

While VA loans dont require a down payment, borrowers may qualify for a lower rate if they do choose to put down money upfront. Additionally, while VA loans usually require a DTI of 41% or less, borrowers with lower DTIs may be eligible for the best rates.

Finally, the loan term you choose will impact your VA loan. In general, 15-year loans tend to offer lower interest rates than 30-year loans.

Recommended Reading: Ida Auto Finance

What Is The Va Loan Interest Rate

The interest rate is what youll pay annually to borrow the loan. So if you take out a VA loan for $200,000 at a 3% rate, youd pay $6,000 across the year . When you get a quote for a VA loan, youll also be given an estimated APR or annual percentage rate. This is the total annual cost of the loan, including the interest and any other fees youll owe.

Should You Refinance Your Mortgage When Interest Rates Drop

Determining whether it’s the right time to refinance your home loan or not involves a number of factors. Most experts agree you should consider a mortgage refinancing if your current mortgage rate exceeds today’s mortgage rates by 0.75 percentage points. Some say a refi can make sense if you can reduce your mortgage rate by as little as 0.5 percentage point . It doesn’t make sense to refinance every time rates decline a little bit because mortgage fees would cut into your savings.

Many of the best mortgage refinance lenders can give you free rate quotes to help you decide whether the money you’d save in interest justifies the cost of a new loan. Try to get a quote with a soft credit check which won’t hurt your credit score.

You could increase interest savings by going with a shorter loan term such as a 15-year mortgage. Your payments will be higher, but you could save on interest charges over time, and you’d pay off your house sooner.

How much does the interest rate affect mortgage payments?

In general, the lower the interest rate the lower your monthly payments will be. For example:

- If you have a $300,000 fixed-rate 30-year mortgage at 4% interest, your monthly payment will be $1,432 . You’ll pay a total of $215,608 in interest over the full loan term.

- The same-sized loan at 3% interest will have a monthly payment of $1,264. You will pay a total of $155,040 in interest a savings of over $60,000.

Recommended Reading: Stilt Interest Rates

What Is A Good Va Mortgage Rate

Many factors influence the mortgage rate youre offered, including the economy, your financial details and the lender. The best way to find out if youre being quoted a good VA mortgage rate is to apply with multiple lenders. When you make lenders compete, you can compare loan offers and determine which has the best combination of rate and fees.

With a Loan Estimate from each lender compared side-by-side, youll be able to see which lender is giving you a good mortgage rate combined with the lowest origination fees.

What Determines My Va Loan Rate

There are lots of factors that influence your unique VA loan interest rate, including the larger economy, inflation, and more. Your credit score, payment history , your down payment, and your debt-to-income ratio also factor in. Higher credit scores and larger down payments typically qualify you for a lower interest rate.

Don’t Miss: Can Mortgage Lenders Verify Bank Statements

What Determines My Rate

When it comes to your VA loan rate on an individual basis, it really comes down to your financial health, including your credit score and income. This is because your credit and borrowing history, as well as your ability to make your loan payments, determines how much risk you present to the lender.

If youre looking for a way you can get a better VA home loan interest rate in the near future, you should focus on improving your credit score. But even then, this process can take months or even longerespecially if you need to make a significant improvement in order to reach the next credit score range. While you only need to have a minimum 580 FICO score as part of Griffin Fundings VA loan requirements, youll likely be able to qualify for a lower rate if you can raise your credit score to a good or excellent rating.

If you have a longer timeline that youre working with in order to purchase or refinance your home, you could focus on increasing your income. This could be by getting a promotion or creating a second source of income.

Think you qualify for a loan? Contact us today to find out!Contact Us

Think you qualify for a loan? Contact us today to find out!

Va Home Loan Eligibility Requirements And Qualifications

- Military members To be eligible for a VA loan, you must be an active-duty or former member of the armed forces with at least:

- 90 days of consecutive service during wartime, or

- 181 days of service during peacetime, or

- 6 years of service in the National Guard or reserves.

Recommended Reading: How Long Does Pmi Stay On Fha Loan

Who Qualifies For A Va Loan

VA loans are made by private lenders and are available to active duty service members, veterans, current and former National Guard and reserve members, and surviving spouses. Interested borrowers will need to obtain a certificate of eligibility from the U.S. Department of Veterans Affairs.

- Veterans

- Active duty servicemember

- Current or former National Guard or Reserve member

- Discharged member of the National Guard

- Surviving spouse

Eligible homebuyers can apply for a certificate of eligibility in several ways: by mail, online or through your lender.

Who Can Take Advantage Of Va Loan Rates

Mortgage borrowers who take out a VA loan are eligible. A VA loan is a mortgage that requires no down payment, no mortgage insurance and is available to active-duty military, veterans, certain military spouses, reservists and National Guard members. The VA loan program, backed by the U.S. Department of Veterans Affairs, aims to help service members and veterans enjoy the benefits of homeownership.

Don’t Miss: Car Refinance Rates Usaa

Cardinal Financial Company Best For Low

Cardinal Financial Company, which also operates as Sebonic Financial, is a mortgage lender offering a range of loan products, including VA cash-out refinances and Interest Rate Reduction Refinance Loans .

Strengths: Cardinal Financials Octane loan system allows you to compare interest rate quotes side by side, among other conveniences. Plus, you could qualify for a VA loan with a credit score as low as 550 .

Weaknesses: In order to view rates, youll need to contact a loan representative and register for the Octane system.

Read Bankrate’s full Cardinal Financial mortgage review

How Can I Get The Best Va Loan Interest Rates

While VA loans often come with favorable interest rates, the best rates are ultimately available to borrowers with good credit scores. One of the best ways to increase your chances of a low rate is to build up your credit before applying.

Its also important to shop around for your rate. The rate youre eligible for may vary from one lender to the next, and getting quotes from multiple lenders can help to ensure you get the best rate.

Don’t Miss: Fha Loan Maximum Texas