What Does Ltv Mean For Your Mortgage

The LTV affects the amount you can borrow, and the rate you can borrow at. The lower the LTV, the better the mortgage rates available to you will be.

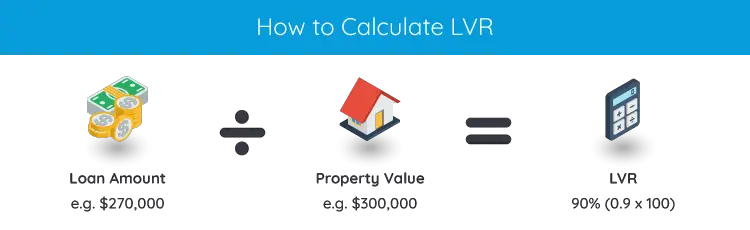

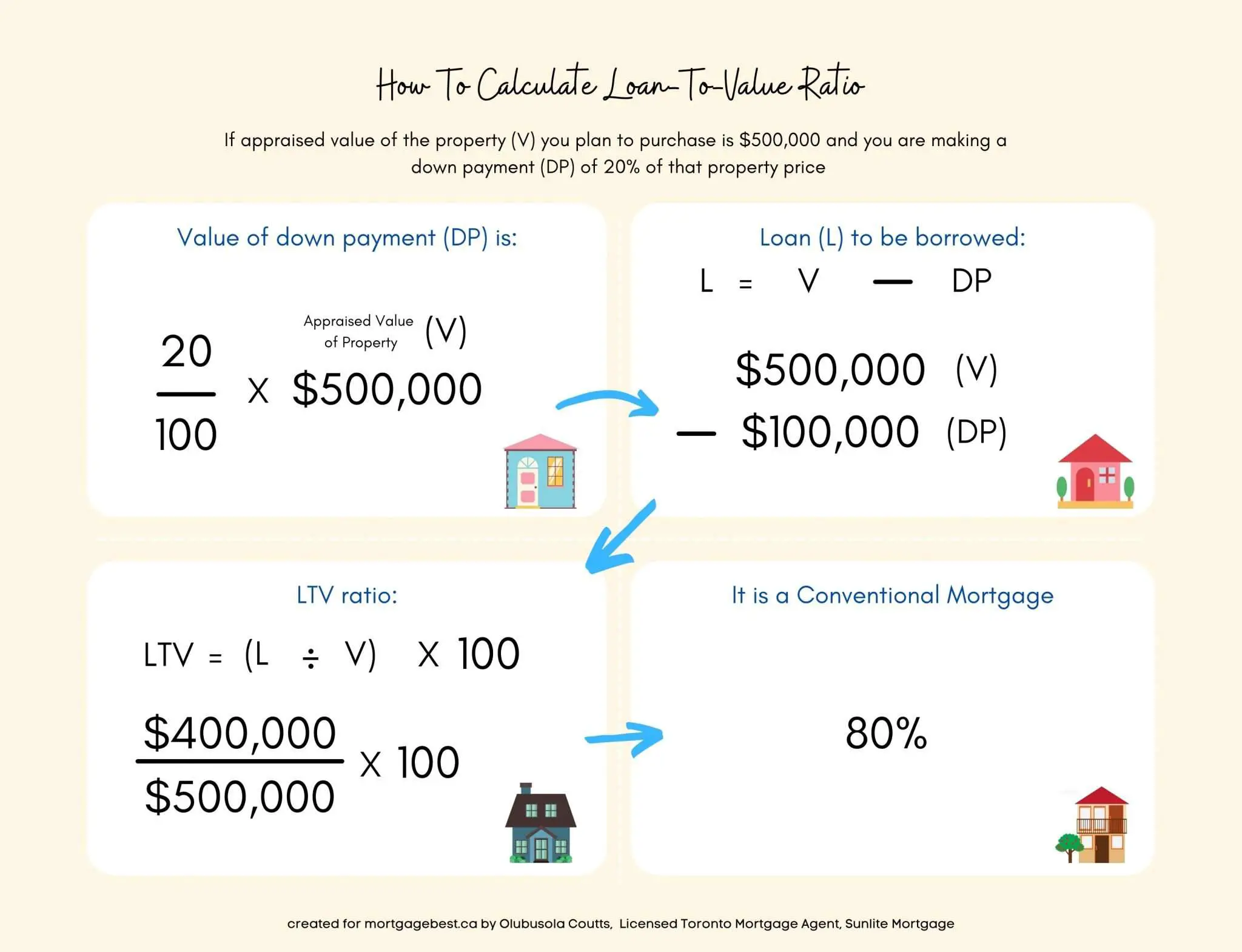

To find out which mortgage deals you are likely to be eligible for, you will need to work out your LTV, which means establishing what percentage of the property value you need to borrow, and how much you can cover with your deposit.

You can do this by dividing your mortgage amount by the value of the property. You then multiply this number by 100 to get your LTV.

For example, if youre buying a property worth £250,000, and have a deposit of £50,000, youll need to borrow £200,000.

To find out what your LTV is, you need to divide £200,000 by £250,000.

This equals 0.8, which, when multiplied by 100, comes to 80%.

That means your LTV is 80% and your deposit is 20%, so you should look for mortgage deals with an 80% LTV.

When Is Pmi Required

You may have to pay for PMI if you’re purchasing a house or refinancing your mortgage. Lenders may require PMI on certain loans if:

- Your down payment is less than 20%. Most conventional lenders require a down payment of at least 20% of the purchase price. You can calculate your down payment percentage by dividing the amount you plan to put down by the lesser of the market value or purchase price of the home. If you can’t afford to put down at least 20% on a purchase, you may have to pay for PMI.

- For refinance loans, your loan-to-value ratio is over 80%. If you’re refinancing your current mortgage, most conventional lenders require an LTV ratio of 80% or less to avoid having to pay for PMI. You can calculate your LTV ratio by dividing your new mortgage amount by the market value of your home. If your LTV is over 80%, you may need PMI.

How Ltv Is Used By Lenders

A LTV ratio is only one factor in determining eligibility for securing a mortgage, a home-equity loan, or a line of credit. However, it can play a substantial role in the interest rate that a borrower is able to secure.

Most lenders offer mortgage and home-equity applicants the lowest possible interest rate when their LTV ratio is at or below 80%. A higher LTV ratio does not exclude borrowers from being approved for a mortgage, although the interest on the loan may rise as the LTV ratio increases. For example, a borrower with an LTV ratio of 95% may be approved for a mortgage. However, their interest rate may be a full percentage point higher than the interest rate given to a borrower with an LTV ratio of 75%.

If the LTV ratio is higher than 80%, a borrower may be required to purchase private mortgage insurance . This can add anywhere from 0.5% to 1% to the total amount of the loan on an annual basis. For example, PMI with a rate of 1% on a $100,000 loan would add an additional $1,000 to the total amount paid per year . PMI payments are required until the LTV ratio is 80% or lower. The LTV ratio will decrease as you pay down your loan and as the value of your home increases over time.

In general, the lower the LTV ratio, the greater the chance that the loan will be approved and the lower the interest rate is likely to be. In addition, as a borrower, it’s less likely that you will be required to purchase private mortgage insurance .

Also Check: How Do I Get An Unsecured Loan

The Connection Between Ltv Ratio And Pmi

Before you go hunting for the lender who will take the highest LTV, though, make note of one more thing: Lenders consider a good LTV ratio on a primary residence to be 80%. For second homes and investment properties, 75% LTV is what meets the Fannie Mae standard. Since many people do not have 25% of a home’s price to put down, there are two ways to work around it:

LTV ratios can sound complicated to the uninitiated, but it’s actually a simple figure to calculate. And once you understand what makes for a good LTV ratio and how to compensate for a less-than-ideal one, you can better position yourself to get the best mortgage for you.

How To Lower Your Debt

To get your DTI ratio under better control, focus on paying down debt with these four tips.

Recommended Reading: How To Qualify For Sba Loan

What Is The Combined Loan

The combined loan-to-value ratio is the ratio of all secured loans on a property to the value of a property. Lenders use the CLTV ratio to determine a prospective home buyer’s risk of default when more than one loan is used.

In general, lenders are willing to lend at CLTV ratios of 80% and above to borrowers with high credit ratings. The CLTV differs from the simple loan to value ratio in that the LTV only includes the first or primary mortgage in its calculation.

Combined Loan To Value Ratio

Combined loan to value ratio is the proportion of loans in relation to its value. The term “combined loan to value” adds additional specificity to the basic loan to value which simply indicates the ratio between one primary loan and the property value. When “combined” is added, it indicates that additional loans on the property have been considered in the calculation of the percentage ratio.

The aggregate principal balance of all mortgages on a property divided by its appraised value or purchase price, whichever is less. Distinguishing CLTV from LTV serves to identify loan scenarios that involve more than one mortgage. For example, a property valued at $100,000 with a single mortgage of $50,000 has an LTV of 50%. A similar property with a value of $100,000 with a first mortgage of $50,000 and a second mortgage of $25,000 has an aggregate mortgage balance of $75,000. The CLTV is 75%.

Combined loan to value is an amount in addition to the Loan to Value, which simply represents the first position mortgage or loan as a percentage of the property’s value.

Don’t Miss: How To Get 150k Business Loan

What To Watch For With A Loan To Value Ratio Calculator

When you apply for a home loan the lender will usually organise their own valuation of the property.

A valuer will take into account:

- The size of your home as well as the size of the block of land

- The type of property for example, whether its a freestanding house, semi or apartment

- The location of the property, and

- The condition of the home.

If the lenders valuation is less than the price you paid for the property, your loan to value ratio will change. This may mean you need to provide a bigger deposit to bring the LVR back down to a level the lender is comfortable with.

As Prices Rise Or Fall In Your Area Your Home Equity Also Shifts Heres A Quick Guide For Figuring Out How Much You Have Plus Tips To Potentially Increase It

WEâVE ALL DONE ITâthat mental calculation where you try to figure out how much youâd clear if you were to sell your house and pay off your mortgage. But it can be more than just an idle exercise. Even if you never sell your home, the equity you have can help you pursue important personal goals. So understanding how to calculate your equityâand how banks view itâis critical, especially if you want to borrow money against that equity to pay for a home improvement project, cover emergency expenses or help pay for your childâs college tuition, for example. In fact, your homeâs equity could also affect whether you need to pay private mortgage insurance and could determine which financing options may be available to you.

Start With a Baseline Calculation

You can figure out how much equity you have in your home by subtracting the amount you owe on all loans secured by your house from its appraised value. This includes your primary mortgage as well as any home equity loans or unpaid balances on home equity lines of credit. In a typical example, homeowner Caroline owes $140,000 on a mortgage for her home, which was recently appraised at $400,000.

Next, Take a Look at How Banks Calculate Equity

Possible Effects on Insurance

What About Home Equity Loans?

Ways to Potentially Increase Your Equity

This article was adapted from Better Money Habits®. Visit BetterMoneyHabits.com for more practical financial information.

More for you icon

Don’t Miss: Who Can Loan Me Money

What Ltv Ratio Do You Need To Refinance Your Home

The rule of thumb is that your LTV ratio should be 80% or lower to refinance. This means you have at least 20% equity in your home.

You may be able to refinance with a higher ratio, though, especially if you have a very good credit score. But if you’re refinancing into a conventional mortgage with a higher LTV ratio, you’ll still have to pay for private mortgage insurance. Your lender will also probably charge you a higher interest rate.

LTV ratio requirements are more lenient when you refinance into a government-backed mortgage, including an FHA, VA, or USDA loan. Your ratio can be as high as 96.5% for an FHA mortgage, and you could refinance with no equity in your home with a VA or USDA mortgage.

Just remember that lenders look at more than just your LTV ratio when deciding whether to approve your refinance application. For example, you may technically be able to refinance into a VA mortgage with a high LTV ratio, but a lender could still reject your application if you have a poor credit score.

Fha Loan: Up To 965% Ltv Allowed

FHA loans are insured by the Federal Housing Administration, an agency within the U.S. Department of Housing and Urban Development .

FHA mortgage guidelines require a downpayment of at least 3.5 percent. Unlike VA and USDA loans, FHA loans are not limited by military background or location there are no special eligibility requirements.

FHA loans can be an especially good fit for home buyers with less-than-perfect credit scores.

Also Check: Does Fha Loan On Manufactured Homes

Invest In Home Improvements

You could increase your home value by making significant improvements, such as remodeling your kitchen or fixing the roof. Just ask yourself which will save you more money in the long run: Paying for improvements to secure a better deal on refinancing, or paying more to refinance now?

Understanding your LTV ratio can prepare you for the refinancing process, and hopefully get the best deal possible.

Loan To Value Ratio Definition

The Loan to Value Ratio Calculator is a financial calculator that will instantly calculate the loan to value ratio of any property if you enter in the mortgage amount and the property value. The loan to value calculation is an important financial calculation that is done by homeowners and lenders to determine if the homeowners has enough equity in their home to qualify for certain mortgage interest rates when refinancing.

Enter the current appraised value or fair market value of the property in the property value field and then enter in the total mortgage amount on the property in the mortgage amount field to calculate the loan to value ratio. The lower the loan to value ratio then the better for the homeowner because the loan is generally considered less risky. The higher the loan to value ratio then the more risky a loan is considered to be.

Don’t Miss: How To Refinance Sba Loan

Build Sweat Equity With Home Improvements

Paying off principal on a loan will lighten the top shelf, but you can stabilize the bottom shelf in an existing home by increasing the property value. Several studies have found that a well-designed landscape can increase property value.

One study found that 68.2% of respondents agreed that a well-designed landscape could influence their decision to rent or buy a home. There are plenty of ways to build sweat equity in your home before you get it reappraised.

What Does The Loan

The LTC ratio is used to calculate the percentage of a loan or the amount that a lender is willing to provide to finance a project based on the hard cost of the construction budget. After the construction has been completed, the entire project will have a new value. For this reason, the LTC ratio and the LTV ratios are used side by side in commercial real estate construction.

The LTC ratio helps to delineate the risk or risk level of providing financing for a construction project. Ultimately, a higher LTC ratio means that it is a riskier venture for lenders. Most lenders provide loans that finance only a certain percentage of a project. In general, most lenders finance up to 80% of a project. Some lenders finance a greater percentage, but this typically involves a significantly higher interest rate.

While the LTC ratio is a mitigating factor for lenders that are considering the provision of a loan, they must also consider other factors. Lenders will also take into account the location and value of the property on which the project is being built, the credibility and experience of builders, and the borrowers’ credit record and loan history as well.

Recommended Reading: Is There Any Loan For Buying Land

Common Uses For Helocs

The most popular uses for a HELOC, tend to be purchases like home repairs, annual education costs, a large expense, and debt consolidation.

| Type of Use | |

|---|---|

| 11% | 9% |

For the annual costs, like a yearly tuition, a HELOC can be a smart move, offering you enough credit to cover the bill every year, and then time to pay some of it back to restore your credit line. Likewise, for the home repairs these can be bills that are spread out over time, but need immediate attention to keep your projects rolling, so a HELOC can make a smart move to get it done.

Though a lot of consumers may look to a HELOC as a way to consolidate debt, it may be wise to look more specifically at how it compares in cost and risk to a home equity loan or a cash-out refinance.

Using Excel To Calculate The Loan

To calculate your LTV ratio using Microsoft Excel for the example above, first right click on columns A, B, and C, select Column Width and change the value to 30 for each of the columns. Then, press CTRL and B together to make the font bold for the titles.

Enter “Property 1” in cell B1 and enter “Property 2” in cell C1. Next, enter “Mortgage Amount” in cell A2, enter “Appraised Value of Property” into cell A3, and enter “Loan-to-Value Ratio” into cell A4.

Enter “$350,000” into cell B2 and enter “$1,850,000” into cell C2. Next, enter “$500,000” into cell B3 and “$200,0000” into cell C3. Now, the loan-to-value ratio can be calculated for both properties by entering “=B2/B3” into cell B4 and “=C2/C3” into cell C4.

The resulting loan-to-value ratio for the first property is 70% and the loan-to-value ratio for the second property is 92.50%. Since the loan-to-value ratio for the first property is below 75%, you are likely to be able to get a mortgage, and you would not have to pay for private mortgage insurance.

On the other hand, it would be difficult for you to receive a loan to purchase the second property because the loan-to-value ratio is well over 75%. Not only would you not qualify for the PMI exemption but most likely you would not qualify for the loan at all, as the lender would deem it too risky.

Read Also: Is Prosper Personal Loan Legit

How Is Ltv Calculated

LTV is a relatively straightforward concept with massive implications for borrowers. Want to know your LTV ratio? Just use this simple formula:

* 100 = LTV

In this case, LA refers to your loan amount and PV is the property value. Lets quickly walk through each step you need to take to figure out LTV:

How does that work in a real-world scenario? Heres how itd look if you were buying a $500,000 house with a 10% down payment option: