What Credit Score Is Needed For Auto Loan Approval

For the auto loan networks reviewed above, a credit score is not a decisive factor to get loan approval. Remember, these loans are secured by your car, and the dealer can resort to repossession if you stop making loan payments.

Of course, youre likely to access better deals if you can improve your FICO credit score to 620 or more, as you can see in the graphic below from Experian:

You can improve your prospects by depositing a down payment and/or supply a trade-in vehicle. The larger the deposit and more valuable the trade-in, the more likely youll obtain loan approval. Cash-out refinancing is even easier since you are supplying the vehicle upfront.

It never hurts to raise your score before applying for credit. That means paying your bills on time, keeping your debts in check, and fixing mistakes in your credit reports. You can clean up your credit reports yourself or use a credit repair agency to do all the hard work.

How To Apply For A Personal Loan With A Cosigner

May 14, 2016 The first thing a lender looks at when considering your application for a personal loan is your credit score. If you have less-than-stellar

Jan 24, 2022 If youre plagued by a low credit score, getting a co-signer or co-borrower can help. Some lenders will allow that as an option when youre

Achievable Credit Score Requirement

Each lender has a minimum FICO credit score that includes people in the fair credit score range, which includes scores between 580-669.

The above rates and loan information is accurate as of August 8, 2022. The NextAdvisor editorial team updates this information regularly, though it is possible APRs and other information has changed since it was last updated. Some of the lowest advertised rates might be for secured loans, which require collateral such as your home, car, or other asset. Also, some loan offerings may be specific to where you live.

Don’t Miss: Will Student Loan Forgiveness Happen

Who Makes A Good Cosigner

Not everyone makes a good cosigner, and no one is required to agree to be one. A cosigner can be a friend, family member, or spouse, and they should:

- Have great to excellent credit .

- Be able to afford the monthly loan payments if youre unable to make them, and prove they have sufficient income to make those payments.

- If they have low debt, and understand by cosigning, they are taking on more debt and their credit score and history will be impacted, and their debt-to-income ratio is also increasing.

Ideally, the cosigner has a DTI less than 40% before taking on additional loans, so calculating that beforehand can be helpful.

How Does A Cosigner Help With A Loan

Any time you apply for a loan, whether its from a traditional bank or a personal loan site, they pull your credit report and FICO score. Thats how they estimate the interest rate on your loan and whether youre likely to pay it back.

Any lender that claims not tolook at your credit report or score is either a scam or just plain lying.

Now if youre in the same spot I was after the financial crisis, the loan officer is probably going to look at your and either break out laughing or quickly ask you to leave. Yeah, my credit was that bad!

Maybe Im not being fair tothe lenders. I had bad credit because I wasnt able to make payments on creditcards and rental property mortgages. Why should they think I was going to paythis new loan back?

Banks arent in the helping you out business. Theyre in the business of lending money and getting it back with interest. If your credit report says you might not pay back the money, theyre either going to flat out deny your loan application or charge an interest rate you cant afford.

When someone comes on as acosigner to your loan, theyre not only vouching that youll pay back the moneybut also putting their money on the line to pay it back. If your cosigner hasgood credit then the lender is better assured that theyll get the money backeither from you or from the cosigner.

Ive seen students with nocredit score and no credit history get a loan because their parents had excellentcredit.

Recommended Reading: How To Obtain Home Improvement Loan

What Types Of Lenders Accept Cosigners

Join millions of Canadians who have already trusted Loans Canada

Have you made a few bad choices in your financial past that have caused your to suffer? Are you having trouble securing a loan because of your poor credit history? If so, you might be able to get approved for the loan you need by getting a cosigner.

Maha Revolving Line Of Credit

T& I Credit Union has partnered with the Michigan Amateur Hockey Association to create a financially manageable way for kids to play hockey. Instead of having to worry about paying fees or dues all upfront or paying for new equipment at spontaneous times, we have created a way for you to have monthly payments

This revolving line of credit would be specifically for Hockey related expenses for MAHA families. Expenses include, but may not be limited to:

- Team expenses/dues

*All Loans are subject to credit review and approval. Rates and offers are subject to change without notice. Actual rates may vary based on credit score. Existing T& I loans excluded. T& I Credit Union is an Equal Opportunity Lender. Effective 06/30/2022.

Don’t Miss: How To Get Loan For Property

Getting A Personal Loan If You Have Bad Credit: Should You Do It And How Do You Do It

- Print icon

- Resize icon

Even if you have a low credit score, you may still qualify for a personal loan but if youre in this situation, you should be prepared to pay a higher interest rate and potentially other fees such as an origination fee, late fees or early payoff penalties, says Kaitlin Walsh-Epstein, senior vice president of growth and marketing at Laurel Road. Heres what you need to know if your credit score isnt stellar and youre considering a personal loan.

What is a personal loan, and what should those with credit issues use one for?

A personal loan is a loan issued by an online lender, bank, or credit union, usually in a lump sum amount ranging from about $1,000 to $100,000 that you often repay at regular intervals, such as each month, over anywhere from one to seven years. For those with credit issues, a personal loan might make sense to consolidate high-interest debt, for example, but only if the rate you get on that loan is lower than the rates youre paying. The best personal loans help you achieve a financial goal, like getting rid of credit card debt, but be sure to compare them with other financing options to find the right fit, says Annie Millerbernd, personal loan expert at NerdWallet. Experts say it may also make sense to use personal loans to pay off medical debt or an emergency that arises. But dont use a personal loan to fund discretionary expenses like weddings and vacations, experts say.

How to apply for a personal loan

Frequently Asked Questions About Cosigner Loans

Here are answers to questions you might have about getting a personal loan with a cosigner.

How does a cosigner differ from a guarantor?

A guarantor is associated with apartments or rentals where only the primary applicant is living at the residence, although it’s also used with personal loans on occasion. The main difference is that a cosigner is responsible for late or missing payments as well as loan default, whereas a guarantor is only responsible if you default.

Is it easier to get a loan with a cosigner or coborrower?

It depends. A cosigner or coborrower can be helpful because they minimize risk for the lender. But if they have a poor credit score or rocky financial history, they may not make the approval process any easier.

On the other hand, if your cosigner or coborrower has stellar credit, they may increase the odds of you being accepted for a loan. And they may even be able to score you a better rate than you wouldve been offered on your own.

Can I remove a cosigner from my loan down the road?

Yes, its possible to remove your cosigner from your loan by either refinancing or consolidating the debt in your own name. Another option is to take out a balance transfer credit card and use that to pay off your loans remaining balance. You can learn more with our guide to removing a cosigner from your loan.

Don’t Miss: What Is Equity Loan On House

Smaller Banks And Credit Unions

Min. credit score required without a cosigner: Varies

While most major banks no longer offer personal loans, smaller banks and credit unions still do. And many of them allow you to add a cosigner to your application, helping you qualify for a lower rate. Its a good idea to stop in at your local bank or credit union to see what rates they can offer you. If you already have a bank account with them, for example, you might be able to get a better rate.

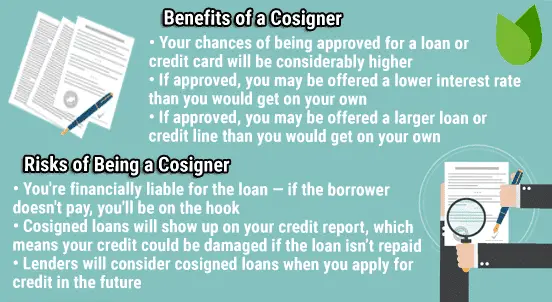

What Are The Risks For A Cosigner

Being a cosigner carries a lot of responsibility, and before you ask someone to cosign your loan, you should understand exactly what youre asking for.

A cosigner essentially offers their own credit history as collateral for the loan. If you make the monthly payments on time and pay the loan off, they lose nothing.

However, if you cannot or do not make the necessary loan payments, your cosigner is on the hook. And if their financial situation has changed or they are otherwise unable to make your payments for you, their credit can take a major hit.

Don’t Miss: Who Can Get Personal Loan

When Is A Co

Lenders use information like your credit and income to decide whether you qualify and what your loan amount and annual percentage rate should be. Adding someone with better credit, higher income and low debt to support your application makes a lender more confident that the loan will be repaid.

A co-signer can help if:

-

You have bad credit. There are personal loans for bad credit, but few lenders approve applicants with credit scores below 600. If thats you, a co-applicant with better credit could increase your approval odds.

-

You want a larger loan. Lenders offer the largest loans to well-qualified applicants, so including a co-applicant could increase the size of your loan.

-

You need a lower rate. Since the APR affects your monthly payments, adding someone to the application could get you a lower rate, meaning a less expensive loan.

How much a co-signer or co-borrower helps depends on factors such as:

-

The co-applicants credit score.

-

Both your credit histories.

-

The lenders underwriting criteria.

What Factors Determine Origination Fee And Apr

An origination fee is a one-time, loan processing fee. It is a percentage of your total loan: A loan of $10,000 with a 5% origination fee will require you to take out $10,500.

The factors that determine your origination fee amount and APR are the same that determine your eligibility for a personal loan: Your credit score, credit history, income, loan amount, loan terms and status as a single applicant or co-applicant will likely have an impact. As always, applicants with higher credit scores and established credit histories will qualify for the lowest rates. Shorter loan terms and larger loan amounts also usually have lower rates.

You May Like: Credit Score Requirements For Va Loan

When To Apply With A Coborrower

Consider a coborrower if you can meet the lenders basic requirements, but find yourself in one of the following scenarios:

- Youre sharing the expense with a friend, parent or spouse like consolidating debt from a joint credit card

- You need to borrow more money than you can qualify for on your own

- Your coborrower is eligible for rate discounts

- Your coborrowers credit score is higher enough to help you get a lower rate

Youre Both Taking On Significant Financial Risk

While many people go into a new loan with the best of intentions, a change in circumstances could lead to late or missed payments. Before signing on a loan with a co-signer, make sure you can afford the monthly payments.

A single late payment may not seem like a big deal, but both you and your co-signers credit can take a hit. And if you become unable to make loan payments, your co-signer will have to pay off the loan to prevent it from going into collections, along with any late fees or collection costs. If your co-signer cant pay, the account can go into collections and the lender could even seek to garnish their wages.

Missed payments and collections will also have a negative effect on both your and your co-signers credit. That negative information may remain on both of your . All of this can have a major impact on your relationship with your co-signer.

On the flip side, making on-time payments on the loan can boost both your and your co-signers credit.

Recommended Reading: How To Calculate Income For Usda Loan

Getting A Personal Loan With A Cosigner: What You Should Know Before You Apply

If youre thinking about getting a cosigner on a personal loan, there are a few things youll need to think about before you apply. We tackle some of the big issues, including when it makes sense to have a cosigner, what lenders offer cosigned loans and what alternatives exist, in the article below.

Applying For A Loan With Collateral

You might have a better chance of being approved for a secured personal loan. This type of loan is backed by collateral, like a savings account or certificate of deposit, meaning the lender takes on less risk and you take on more. Take note: If you dont pay back the loan, the lender may take your assets as repayment.

Recommended Reading: What Is The Average Auto Loan Interest Rate

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Benefits Of T& i Credit Union Personal Loans

T& I Credit Union is committed to helping people improve their lives by allowing them to borrow against their future for the help they need now.

We also offer additional money-saving tips and member benefits to help you make the most of your money. As a T& I Credit Union banking, youll have access to online banking, credit score analysis, and a financial tracker.

You May Like: What Type Of Car Loan Is Best

Lenders That Accept Co

There are plenty of lenders out there who allow cosigners to sign on a loan. In Canada, these lenders may allow you to apply with a cosigner:

Banks

Depending on where you look, some financial institutions accept co-signers on certain types of loans. If youre an existing client who has a good long-standing relationship with the bank, that may affect your banks likelihood to lend to you. This is especially true if your income and/or credit arent great.

offer many of the same services as banks, only they operate as non-profit organizations that are owned by their members. All members have a partial stake in the union and can elect a board of directors to manage the communitys best interests.

Earnings are then dispersed amongst the members in the form of low-interest rates, reduced fees and good payment terms on products, like loans. Credit unions may also provide small loans for individuals with bad credit if they have a cosigner or collateral.

Private Lenders

Unfortunately, some financial institutions will turn you down as a non-member or someone with weak finances. In that case, you may be able to find an alternative or peer-to-peer lender in Canada where you can get a loan with a cosigner.

Although private lenders dont always offer this service, some are more lenient with their lending policies and requirements, once you show them that your loan will be repaid, regardless of the circumstances .

Mortgage Lenders

Car Loan Lenders

Additional Reading

Is It Easy To Get A Loan With A Cosigner

It is not that easy if you dont have a relative with strong credit score. A cosigners credit history is extremely important for getting a loan and will help you lower your interest rate, , and terms. This way, you can pay off the loan sooner.

Before you apply for a personal loan, you need to find a cosigner. Most of the time, family members or close friends will step in as cosigners. However, you should keep in mind that cosigning on a loan is a long-term commitment that can end badly if you dont make the payments. If youre not able to find a cosigner, you should learn about alternative loans.

Read Also: When Interest Starts On Education Loan