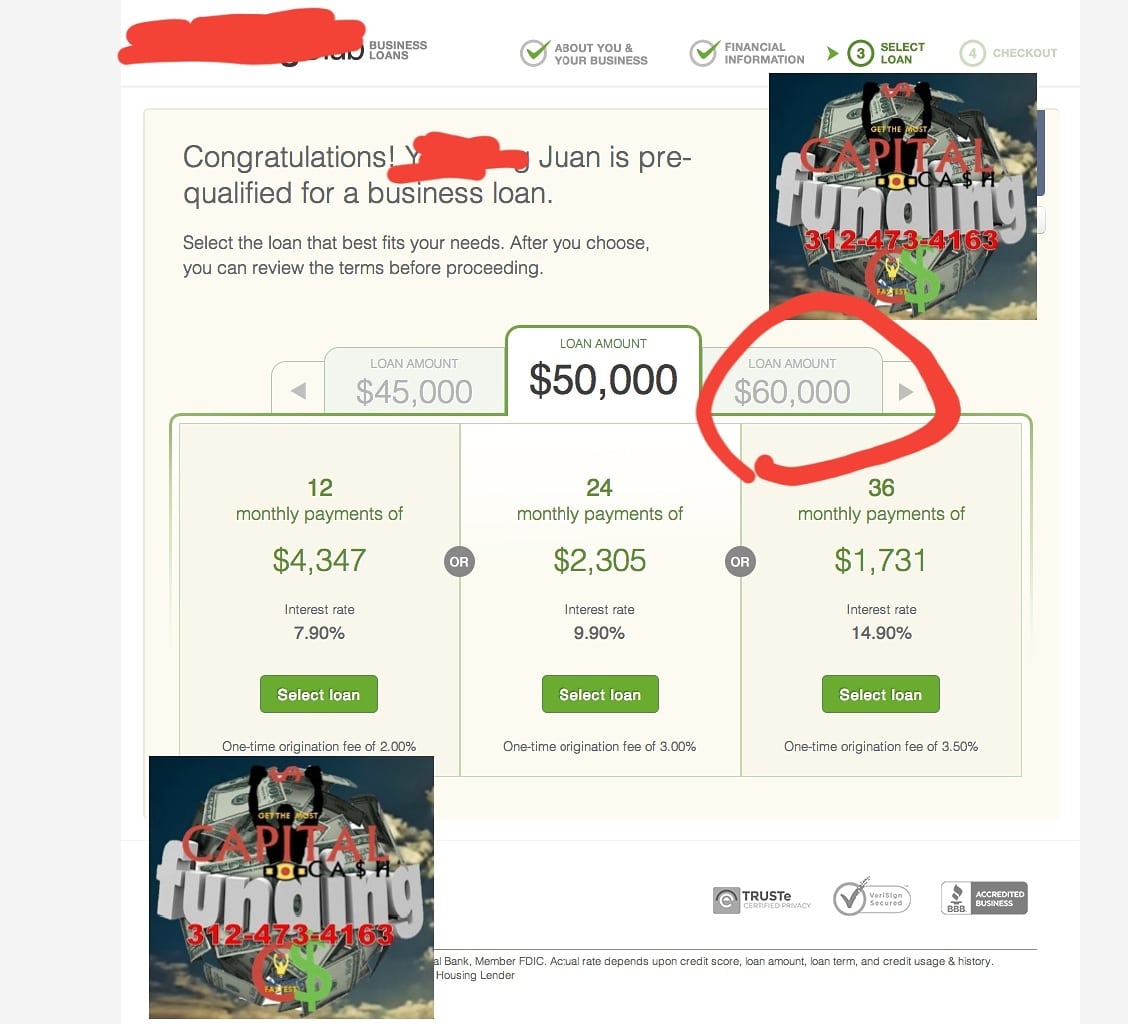

Lending Club: Best Peer

A peer-to-peer loan is when a borrower takes a loan from a nonfinancial institution. LendingClub is a P2P lender that offers financing without strict requirements, and it does so faster than a bank issues a loan. Small businesses only need to be around for one year and have a minimum credit score of 580 and a minimum annual revenue of $50,000. LendingClub does, however, require collateral on any loan over $100,000 and has a higher ordinance fee of up to 8.99%.

Startup Business Loans By Banks

| Name of the lender |

| 17% p.a. to 21% p.a. |

HDFC Bank

- Loans of up to Rs.40 lakh. Rs.50 lakh in select location.

- A processing fee of 0.99% of the loan amount will be charged by the bank.

- Repayment tenures of up to 4 years.

TATA Capital

- Repayment tenures of up to 3 years

- Loans ranging between Rs.50,000 and Rs.75 lakh.

- Processing fee of 2.50% of the loan amount plus GST will be charged by the lender

Kotak Mahindra

Key highlights

- Loans of up to Rs.75 lakh.

- Interest rate charged by the bank will depend on factors such as the loan amount availed by you, the repayment tenure, etc.

- 2% of the loan amount plus GST will be charged as the processing fee.

- Repayment tenures of up to 5 years

Fullerton India

- Loans of up to Rs.50 lakh.

- Repayment tenures of up to 5 years.

- The processing fee charged can go up to 6.5% of the loan amount plus GST.

Startup business loans are of two types –

- Equipment Financing.

Line of Credit

A startup business loan in the form of a line of credit works in a similar manner to a . However, the card is tied to the individuals business instead of their personal credit. One of the best benefits of a small business line of credit is that customers will have no obligation to pay interest on the borrowed sum for the first nine to 15 months, thereby making it easier to cover expenses whilst getting their business to a good start.

Equipment Financing

Accion: Custom Terms And A Small Business Focus

Accion is a nonbank lender and the only nonprofit organization on this list of alternative financial institutions. It specializes in microlending and focuses on small businesses. Accion provides loans through its Opportunity Fund and tailors funding terms to the needs of individual companies.

In addition, there arent any prepayment penalties, and Accion offers coaching and access to a support network. The application takes roughly 15 minutes to complete and requires business owners to enter revenue and expenses from their tax returns manually.

The minimum requirements of the business and owner include:

- Business must be in operation for at least 12 months.

- Owner must own at least 20% of the company.

- Business generates at least $50,000 in annual sales.

- Owner must be 18 years of age or older.

A peer-to-peer loan is when a borrower takes a loan from a nonfinancial institution. LendingClub is a P2P lender that offers financing without strict requirements, and it does so faster than a bank issues a loan.

Don’t Miss: Can The Bank Loan You Money

National Funding: Best For Businesses With Bad Credit

Businesses that have poor, average, or nonexistent credit should consider partnering with National Funding. As a lender, they offer funding options for new applicants with credit scores as low as 475 for applicants who are renewing. They also do not require collateral for businesses that are taking out loans.

National Funding offers small business loans from $5,000 to $500,000, and up to $150,000 for equipment financing and leasing. If a business pays off its loan early, National Funding offers a 6% early payoff discount for equipment financing loans and a 7% early payoff discount for capital customers who pay off their balance within 100 days of signing their contract.

Benefits Of Private Business Loans:

The benefits of getting a private business loan are many, but the most important benefit is usually just simply having access to capital. Banks only provide a 20-40% approval rate for most small business applicants. Private business lenders on the other hand can have approval rates as high as 90% depending upon the companys situation and financial health. Beyond access to capital there is also the ease of obtaining funds, reduced documentation requirements, more flexibility about use-of-funds, little to no covenants, and speed of funding, and all around creativity of private lenders that think outside-the-bank.

Additionally, getting a bank loan without exceptional credit is nearly impossible. If your credit score is below 680 your chances of getting conventional or SBA financing can be very slim and thats before other financial factors are even considered by the bank. Nearly every alternative business lender is a private lender of some sort, and the private lenders can accept credit as low as 500 as long as the company can prove they will repay the loan and offer sufficient collateral to mitigate the lender or private funding companys risk.

You May Like: How Much Home Loan Eligibility Calculator

Choose The Right Nonbank Lender For Your Company

Before exploring alternative lenders, you may wish to see if you qualify for small business grant programs. Doing so can improve your cash flow and help grow your business without you having to worry about paying back a loan.

However, if you need new equipment, have slow-paying customers, or want a safety net during seasonal downturns, use our small business funding guide to determine which loan type suits your needs.

CO aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

for more expert tips & business owners stories.

To stay on top of all the news impacting your small business, go here for all of our latest small business news and updates.

COis committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here.

Recap: Best Startup Business Loans Of 2022

Funding your startup can help increase profits, but it can be risky and expensive. Steer clear of startup loans until you have a well-thought-out business plan in place even the best ideas require careful implementation. And remember that there are plenty of options at every stage of the business process, so read our guide to the best business loans for more options.

Don’t Miss: Where To Get Car Loan For Used Car

Best Private Business Financing Options

There are numerous lending options to explore when applying for a private loan for your company. With alternative lenders offering a wide array of solutions available, how do you make the best choice? That’s where our lending advisors come in. We walk you through all your options to help you get funded with the best rates and terms possible. Here are the most common private funding loan types business owners go with:

Richmond Hill By The Numbers

- Richmond Hill, incorporated in 1957, is placed in Southcentral Ontario. Richmond Hills population: 195,000.

- As per the latest stats, on the average, employment income in Richmond Hill is at the level of $52,200 per month.

- Employment rate: 60%.

- According to the latest research, Richmond Hill has 52,900 registered homeowners .

- Richmond Hills major employment areas are retail trade, professional, scientific and technical services, mining, quarrying, and oil and gas extraction.

Smarter Loans provides access to reputable Bad Credit Business Loan providers in Richmond Hill for all your specific financial needs.

Explore our list of Bad Credit Business Loan lenders to compare the most current Bad Credit Business Loan rates in Richmond Hill

Don’t Miss: What Is The Max Conventional Loan Amount

Features And Benefits Of Startup Business Loan

- No collateral or security needs to be provided to avail a startup business loan.

- Startup business loans come with easy and flexible repayment tenures.

- The documentation required for availing a startup business loan is minimal.

- The funds are swiftly disbursed to the applicants bank account.

- The interest rate charged by the lender will depend completely on the applicants credit history.

Alternative Small Business Startup Loan Options

It can be hard to get a business off the ground without working capital. While there are many ways to go about getting necessary funding, each option has its own drawbacks and advantages. And some startup loans may come with unexpected expenses and fees that can end up limiting a new company in the long run. Those seeking alternative loans for new businesses can consider the following:

- Business Credit Cards: Business credit cards can be a good option for expenses that do not exceed $10,000, especially when you can pay back the invoice each month before interest starts accruing. An added benefit of using this type of financing is that it comes with rewards, like miles or cashback, depending on the card. Keep in mind, though, that a credit card can have higher interest rates than a line of credit. That said, the credit card will be much cheaper if you regularly pay off the card in full each month.

- Angel investor: Young companies can also gain funds through an angel investor. These types of funds often require you to give up some of your equity. Business owners should be careful with this option though, as angel investors could end up owning more of the company than owners might want.

- SBA loan: Individuals who are at the start of their business endeavors, or who may be struggling with current financial imbalances in their companies, can consider applying for grants for small business owners and small business startup loans, such as an SBA loan.

Recommended Reading: What I Need For Mortgage Loan

More Financing Options For Startups

Traditional loans and lines of credit are great, but theyre far from the only way to finance your business.

And in fact, you may have a hard time getting loans, lines of credit, or other business financing for your startup. Lenders prefer to loan money to older businesses with high revenue. If youve got a young businessespecially one without much revenue yeteven the lenders on this list may seem out of reach for now.

No need to panic, though. Like we said, youve got other options.

If you want to grow your startup, you can also consider other small-business funding options like these:

- Personal savings

- Crowdfunding sites

Sure, these alternative funding options have their downsides. It can take a long time to get investors, for example. Business grants are super competitive. And only certain lenders can legally allow you to use a personal loan to finance a business.

But these other forms of financing also have a big advantage: Your businesss age and revenue don’t matter as much.

So while we do hope one of the lenders on this list works out for you, dont forget about all the other options available to you and your business.

Business Line Of Credit

Individuals seeking alternative startup business funding options can consider opting for a business line of credit. This is different from other types of small business funding options because it can be acquired before there is an actual need for the funding. Most other financing options are taken out for a specific need. For example, short-term business loans are usually used to address a sudden expenditure while long-term funding tends to be used for long-term investments.

Also Check: What Does Usda Loan Stand For

Why Work With Us

When you discover the differences between CalPrivate Bank and other lenders, you will understand why so many new businesses come to us for startup loans in La Jolla and nearby communities. We offer a Distinctly Different banking experience to every business we work with, and it shows in the number of satisfied Clients we have.

And its not just about providing startup loans in Newport Beach and other areas, but its also about creating long-term relationships founded on trust. We know that when you trust our judgment, we can deliver the best possible solutions for your unique needs. That is why our customer service record stands alone.

If you run a new business and need a startup loan to get ahead, get in touch with one of our experts today, and well figure out which startup loan package is best for you.

Collateralized Vs Unsecured Private Business Lending

Uses for private business financing cover just about any expense or investment a business may have. While conventional lenders may have restrictions on how their term loans and lines of credit are used, many private lenders will allow the use of funds to be used on just about any business expense one can think of. Some of these uses include:

- Private working capital lenders

- Private commercial real estate lenders

- Private cash advance consolidation lenders

- Private bridge lenders

- Private line of credit lenders

- Factoring companies

Recommended Reading: How To Get The Best Used Car Loan

One: Look For The Low

For alternative funding sources, you may first want to turn to friends and family or even yourself.

Personal Savings

If you have enough funds in your savings account, you can use it to fund your own business pursuits. The benefit of this strategy is that you won’t have to take out a loan. However, if your business fails, you can expect your financial investment to disappear along with it.

Business Credit Cards

If you can’t qualify for a traditional business loan, a business credit card is a smart alternative. With a business credit card, you can secure your own flexible microloan. You will, however, need to personally guarantee repayment and pay high interest rates. “I absolutely recommend that you get a business credit card instead of using your personal card, because it clearly delineates your business expenses versus personal expenses,” said David Ehrenberg, founder and CEO of Early Growth Financial Services, a San Jose-based company that provides financial services and assistance to private venture-backed startups.

Family and Friends

With business loans hard to secure, funding from family and friends is often more readily available. If your loved ones believe in your business venture, they might be willing to loan you the funds you require. Just make sure to get your agreement and repayment plan in writing.

How Does Private Lender Financing Work

Private lender financing allows you to get a private loan through a variety of lenders. From online business loan firms, “fintech” companies, and more. Some private lenders may specialize in short-term loans, while others may know niche markets well, such as franchises.

You’ll have to apply just like any other loan, but the requirements may be different. For example, you may only need a fair credit score, or you may not need collateral. It’s an option worth exploring before going to a bank.

Don’t Miss: How To Get Va Home Loan Certificate Of Eligibility

Can I Get A Startup Business Loan With Bad Credit

Its possible to get a startup business loan with bad credit. But it depends on the type of loan your business needs. There are business loans available for bad credit, and some options like ROBS or crowdfunding wont necessarily rely on your credit score.

You may be able to qualify for some term loans or alternate types of business loans, but be aware that these come with a higher price tag. But if youre just starting out, it may be worth improving your personal credit score before borrowing for your business.

Ondeck: Offers Loyalty Benefits

OnDeck is a small business loan provider that offers loyalty benefits for those who renew their funding contracts. For businesses to apply, they need to be in business for one full year and have a minimum credit score of 600, an annual gross revenue of $100K, and a business checking account. If a borrower extends their regular contract or takes out a new loan, OnDeck will waive the remaining interest on the existing loan, so long as the borrower has paid down 50% of the balance.

For some qualifying businesses, OnDeck also offers a prepayment benefit that waives the remaining interest on a loan if you pay it off before the end of its term. This benefit does, however, come with a higher interest rate.

Don’t Miss: What Kind Of Home Loan Can I Qualify For

Lendio: Best Overall For Startup Loan For Business

Data as of 9/8/22. Offers and availability may vary by location and are subject to change.

*Does not represent the typical rate for every borrower, and other fees may apply.

With everything from equipment financing to lines of credit to long-term loans, Lendio offers one-stop comparison shopping for small-business loans.

Lendio isn’t what you’d call a “traditional” lender. Instead, it’s a lending marketplace that partners with 75 or so lenders to help you find the right loan for your needs. So instead of spending time applying to multiple lenders to see who will approve you and what kind of offers you get, you fill out just one application and get multiple loan offers to compare and choose from.

To qualify for a Lendio loan, youll need to have been in business for six months and have at least a 500 credit score. Now, meeting those bare minimum qualifications wont get you the lowest rates or biggest loans. But given that Lendio works with more than 75 lenders , theres a good chance youll find some kind of funding for your startup.