Increase Your Income And Reduce Expenses

Another time-tested approach to paying off student loans earlier is adjusting how much you have left over each month to pay toward debt. You can accomplish this in two ways: cutting costs and earning a higher income.

Start by reviewing your bank and credit card statements for the past few months and write down everything you spent money onand how much you spent. Now, consider each charge in turn: are there things you can substitute with cheaper options or even eliminate entirely? Some common expenses people cut are cable , dining out and groceries .

If youre financially savvy, you may have already reduced your spending. However, most people still have areas where they can cut back on monthly expenses. This may not be as easy as cutting out avocado toast or lattes, so take some time to review your transactions to see where you might be overspending.

Depending on your position, you also may be able to increase your income by taking on additional hours or talking to your boss about a raise. If you already maxed out earnings at your current jobor if you just cant spend another minute thereit may be worth exploring other roles. Finally, if youre looking for a creative outlet or new hobby, consider building a lucrative side hustle to accelerate your debt-payoff timeline even faster.

If You Have An Emergency Fund

Yes, paying off your student loans early is a good idea.

Before considering making extra payments toward your loans, its a good idea to have an emergency fund. An emergency fund is money set aside in a bank account to cover sudden crises, such as an unexpected car repair, job loss, or illness.

Having an emergency fund ensures you wont have to turn to credit cards when faced with a problem. But if you dont have an emergency fund yet, you should consider holding off on making extra payments on your loans and put that cash toward your savings first.

Tip:

When Do You Start Paying Off Student Loans

You must start repaying federal student loans six months after you graduate, unenroll, or drop below half-time enrollment. If you have private student loans, your repayment terms may be differentyou may even need to make payments while you’re in school. Check your loan agreement for more information.

Read Also: How To Apply For Fema Loan

What Is The Student Loan Repayment Threshold 2022

You might be wondering when do you start paying back your student loan? The threshold is when you earn over a certain amount. Find out more here about the student loanrepayment changes for 2022.

The threshold differs depending on the type of student loan known as a plan thatyou hold. This in turn will depend on whether you are an undergraduate or a postgraduate, where you are from, and when you started to study.

Most English or Welsh people who are taking out student loans now are on Plan 2. The threshold normally changes on April 6 every year, roughly in line with inflation. But it has been frozen for the 2022-23 tax year for former students on Plan 2.

Scottish and postgraduate students, as well as those who took out loans before 2012, are on different schemes. There is a full explanation of thishere.

Should You Pay Off Your Student Loans Early

Although you won’t be penalized for getting rid of your student debt early, whether it makes sense to go that route will depend on your bigger financial picture. Your primary financial goal, regardless of how much debt you have, should be to build an emergency fund with enough money to cover three to six months of essential living expenses. Without that cash tucked away in a savings account, you could face serious consequences if you get laid off at work, fall ill to the point that you need a leave of absence from your job, or need to pay for a major home or vehicle repair.

Once your emergency fund is fully loaded, you can then feel free to tackle other financial objectives, which may include paying off your student loans ahead of schedule. But before you do, take a look at your total debt. Are you carrying a credit card balance? More than one credit card balance? If so, you’re generally better off paying off that credit card debt before moving on to student debt. This is because credit card companies typically charge higher interest rates than student loan issuers . And, having too high a credit card balance could damage your .

Now, what if you’re good on emergency savings and have no credit card debt? Should you go ahead and pay off your student loans early?

You May Like: Is My Home Loan Secured

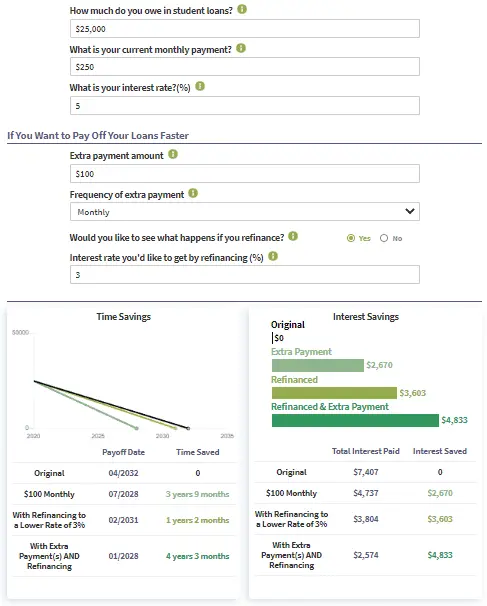

Refinance Your Student Loans

To get rid of your loans as quickly as possible, consider student loan refinancing. If you have good credit, you could qualify for a lower interest rate. More of your payment will go toward the principal instead of interest charges, so youll pay off the debt sooner.

Should you pay off student loans early? The answer to that question is dependent on you and your goals. By evaluating the pros and cons and thinking about what your aspirations are, you can come up with a repayment strategy that works for you.

If you want to move forward with student loan refinancing, use Purefys Compare Rates tool to get quotes from a variety of student loan refinance lenders in one convenient location.

Will Paying Off My Student Loans Help My Credit

Initially, paying off your student loan could cause your score to dip slightly. That’s because it takes one account out of your credit mix and might give more weight to other accounts like your credit cards. However, your score will bounce back after a few months and may even improve over time, as long as you maintain other good credit habits.

Also Check: What Is Credit Card Refinance Loan

Dont Pay Off Your Student Loans Early If:

- Youre not saving for retirement. If youre not saving for retirement yet, you should take care of this part of your finances first. At the very least, you should contribute to your workplace retirement account up to any amount your employer will match. If youre self-employed, contributing to an account like a or a solo 401 can help you prepare for retirement while lowering your taxable income.

- You have high-interest debt. If you have other kinds of debt, you should prioritize paying down whatever balances carry the highest interest rates. For instance, the average credit card interest rate is well over 17 percent, which is much higher than most student loans charge.

- You dont have any savings. If you dont have any cash for emergencies or other goals, put any extra money there first.

- You may want to utilize federal programs. If you have federal student loans and are considering signing up for an income-driven repayment plan or Public Service Loan Forgiveness, hold off on putting extra money toward your loans. Both of these programs give you the opportunity to have some of your balance forgiven.

Refinancing Your Student Loans

Theres good chance that your student loan debt is financed at an interest rate that was reasonable at the time, but now is much higher than you should be paying.

Todays interest rates are at historic lows and refinance options could include opting for a lower interest rate and a shorter repayment term with you paying a bit more monthly than you are currently paying.

Lets say you have student loans of $28,000 and are paying 7.2% over 9 years. That means that your monthly payment is $353 with a total interest paid of $10,126 over the life of the entire loan.

If you were to refinance the same $28,000 with an interest rate of 1.8% over 5 years, your payment would go up to $488, but it would be paid off in almost half the time and your total interest would be just $1,299.

Read Also: How Much Does My Loan Cost

If Your Student Loans Have High Interest Rates

Yes, paying off your student loans early is a good idea.

If you have high student loan interest rates federal student loans can have rates as high as 8.5%, while private loans can be even higher a good deal of your monthly loan payment goes toward interest rather than principal, increasing how much youll pay over time. Paying off your private or federal loans early can help you save thousands of dollars over the life of your loan since youll be paying less interest.

If you do have high-interest debt, you can make your money work harder for you by refinancing your student loans. With a stable income and good credit score, you could qualify for a low interest rate, helping you save more and become debt-free faster. Plus, theres no limit to how many times you can refinance and you wont pay any fees either.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: What Is The Biggest Loan I Can Get

Student Loan Refinancing With Lantern:

student loan interest ratesrefinance student loansFind and compare student loan refinance options with Lantern.The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Paying Off Student Loan Early

In many cases, student loans are never fully cleared. And if your wages never hit the threshold at which you should start repaying, you may never pay back a penny.

Student loans do not have an impact on your credit file either. However, you may not be able to borrow so much towards a mortgage if you have regular payments to meet.

All of these factors need to go into a calculation about whether or not it is worth paying off student loans early if you can.

How much student loan you would repay on a £30,000 income

Under current rules, someone with an income of £30,000 would pay back £243.50 a year on a Plan 2 loan.

The average student debt is £45,000 plus interest. And if they remained on this salary, they would only have paid back £7,305 by the time the loan was written off 30 years later.

In this situation, it would not have been worth paying off the loan early.

However, if you earn far more, or borrowed a smaller amount as a loan, the calculation would be very different.

How much student loan you would repay on a £60,000 income

Someone on a salary of £60,000 would be £32,705 above the £27,295 Plan 2 threshold. They would pay back 9% of everything they earned above the threshold each year, around £2,945.

If interest rates remained at 4.1% and their salary remained constant, this would result in them paying a total of over £70,000 on a £45,000 debt over 25 years, but paying it off completely in that time.

You May Like: How To Check Car Loan Balance

When You Need To Lower Your Debt

Your debt-to-income ratio is the sum of your monthly debt payments divided by your gross monthly income, expressed as a percentage . A low DTI signals to lenders that you can likely make timely monthly payments and are able to handle debt responsibly. Paying off student loans early can help you lower your DTI and take on other debt more easily, such as a mortgage or practice loan.

Pay Off The Past While Working For The Future

Yes, we all must pay off our debt. But we also need to simultaneously build short-term and long-term savings, even if it means taking a bit longer to get out of debt. Focusing exclusively on debt repayment is the worst thing you could do for your emotional, physical and financial self.

Spending years paying off debt without saving a dime will crush you in the long run. Sure, getting out of debt is a net positive experience. But if youre sacrificing so much of your day-to-day life and income to pay off debt, youll have nothing to show for it once your debt is paid off. However long it takes, youll be waiting years before you can start putting anything away, and that can be a serious drag on your emotional and mental health.

Ive seen clients who are so focused on getting out of debt that it clouds their ability to see the future, making them afraid to set goals and even talk about their finances. I often hear clients say, I can’t possibly think about the future when I’m in this much debt. But here’s the reality: Debt and your future have very little to do with each other. Having debt should not deter you from making plans and living the life of your dreams.

Also Check: Does Advance Auto Loan Out Tools

Take Steps Now So You Dont Pay Your Lender More Later

Once you are finally ready to make payments on your student loans, it might seem like a pretty straightforward thing to dojust start paying, right? But depending on when you pay and even when you dont pay, you can get burned and end up owing your lender way more money than you assumed you would.

So how do you make sure that you end up paying exactly what youre supposed to? Here are five tips to help you get started.

The Pros And Cons Of Paying Off Student Loans Early

Despite what you may think, paying off your loans as soon as possible isnt always the best thing to do.

Getting ahead of your debt is, in general, a smart move however, if it comes at the cost of avoiding other debt, or overshadowing other benefits you may be receiving, it could set you back in the long run. In this article, well run through the pros and cons of paying off student loans early.

Read Also: Can You Get More Than 1 Va Loan

Should I Pay Off My Student Loans Early

Whether or not you should pay off your student loans early depends a lot on your specific circumstances. Peter Dunn, CEO of Your Money Line, says that although paying your loans early is a big achievement, you need to make sure that it wont be at the expense of other foundational financial goals.

Establish an emergency fund, contribute to your employers retirement plan at least up to the match and prioritize any other high-interest debt before attacking your student loans, Dunn says. Once youre on track with your core financial habits and obligations, then start looking at systematically paying down your student loans.

Get Help Paying Off Your Student Loans

You may be able to access other resources to help you pay off your student debt faster. For example, ask your employer if it offers any student loan repayment benefits. Some plans offer employees up to $5,250 annually in student loan repayment, but it depends on the employer.

Certain professions may even be eligible for loan forgiveness. For example, the Public Service Loan Forgiveness Program is available for federal student loan borrowers working full-time for a qualified government or not-for-profit organization. After you make 120 qualifying payments under an income-driven repayment plan, your remaining loan balance will be forgiven.

And you may qualify for student loan discharge if you have a total and permanent disability. To be eligible for a total and permanent disability discharge, youll have to complete an application and supply the necessary documentation.

Recommended Reading: What Is An Sba 504 Loan

Check Your State Forgiveness Plans

State-funded student loan forgiveness plans are also available depending on where you live. These programs often require you to work in an underserved area.

Most of the plans offered are for nurses, doctors, lawyers, teachers, and veterinarians. But you can also find programs for other professions.

For example, New York offers repayment for social workers through the NYS Licensed Social Worker Loan Forgiveness Program. This program offers up to $26,000 in loan forgiveness.

A few requirements for the program include:

- You must live in NY for a year

- You must be a licensed social worker

- You must not be in default on your student debt

Texas offers the Loan Repayment Program for Speech-Language Pathologists and Audiologists. This program encourages students to work in speech-language pathology. The requirements and amount offered may differ.

TIP:

Pay Off Capitalized Interest

Capitalized interest happens when unpaid interest is added to your student loan principal. This increases your overall student loan balance, which means youll pay even more interest in the future.

Capitalized interest usually happens during loan forbearance or during your grace period after graduating from college. Paying off this capitalized interest can reduce your overall loan amount and allow you to repay the debt sooner.

Read Also: Where To Get Heloc Loan

You Might Qualify For Student Loan Forgiveness

One of the redeeming qualities of student loansespecially federal student loansis that there are quite a few student loan forgiveness programs.

For example, the Public Service Loan Forgiveness program forgives your loans after you make 120 loan payments while working for a public employer and meet other qualifications. In cases like this, it might be better to carry that debt until its forgiven. That way, you can put that extra money to better use elsewherelike saving for retirement or a down payment on a house.