What Are The Differences Between Direct Subsidized And Unsubsidized Loans

Like grants, direct subsidized loans are meant for students with exceptional financial need. The U.S. Department of Education will cover the interest while you’re still at least a half-time student and for the first six months after you graduate. By contrast, direct unsubsidized loans are available to families regardless of need, and the interest will start accruing immediately.

The Types Of Loans Are:

- Direct Subsidized: A federal loan for undergraduate students. You dont get charged interest while youre in school. It is need-based, so whether you qualify depends on your FAFSA information.

- Direct Unsubsidized: A federal loan that any undergraduate or graduate student can get . You are charged interest while you are in school. To cut costs, pay the interest as you go.

- Direct PLUS: Federal loans for the parents of undergraduate students, or for graduate and professional students. You must pass a credit check to get these loans.

- Private: Loans offered by banks or credit unions. You should shop around for the best offer you can find. Students generally need a parent or other family member to co-sign.

Depending on where you live and other factors, you may have other options. Some states provide low-cost education loans for residents. There are also nonprofits and other organizations that offer low-or zero-interest student loans, often within a specific city or state.

Checking Your Private Student Loan Balances

Each private student lender handles loans differently theres no national database for private loans. If youre unsure where to start, use these tips:

Read Also: Fha Vs Conventional 97

A Beginner’s Guide To Getting The Loans You Need To Graduate

Unless their parents have somehow saved enough moneyor earn massive salariesmost students need to borrow to pay for college today. Working your way through college is largely a thing of the past, as well. Few students can make enough to pay for college while they’re also taking classes. For that reason, student loans have become increasingly common. Here’s what you need to know about applying.

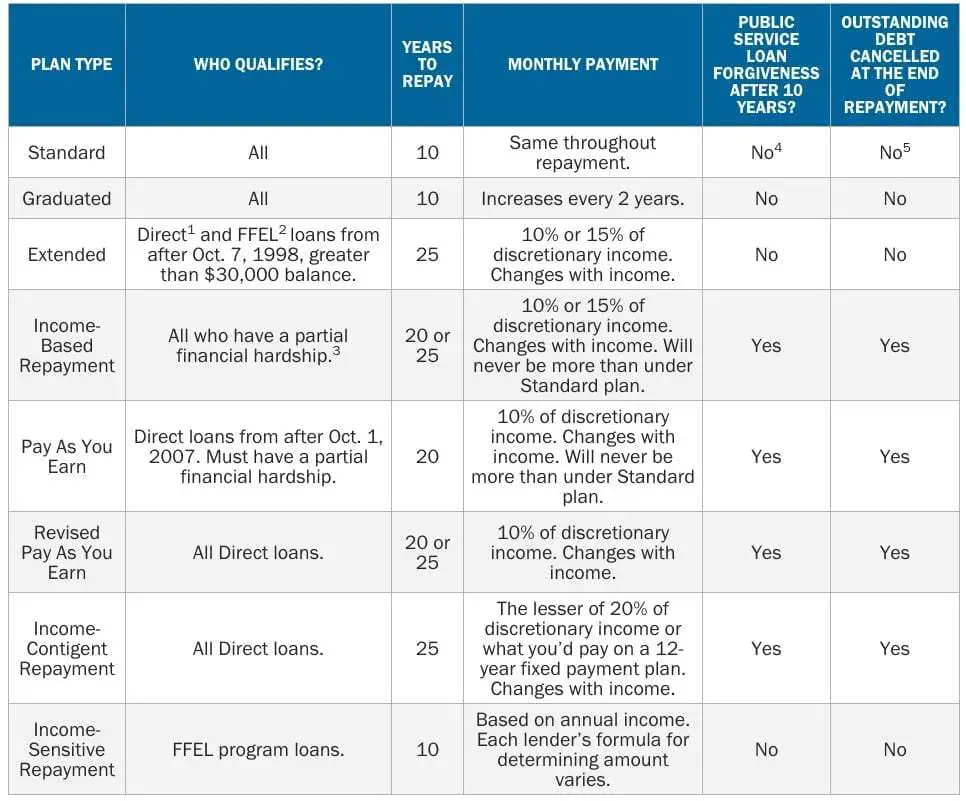

Typical Repayment Cost Of Law School Debt

How much you borrow is only one factor determining how much youll repay over time. Law school student loans tend to have higher interest rates than undergraduate loans even with federal loans and you could take decades to repay your debt, allowing more interest to accrue.

If you had $145,500 in loans with a 10-year repayment term and a 6.28% interest rate, your monthly payment would be $1,636 per month, and your total repayment cost would be $196,306.

But what if you have a longer loan term? Below is what you would pay with a term of 15, 20, or 25 years. As you can see, lengthening the term lowers your monthly payment but increases your total repayment cost.

- If youre eligible for an income-driven repayment plan

- If youre planning on pursuing loan forgiveness.

In general, law school graduates repay their loans over the course of 10 to 25 years.

Donât Miss: Usaa Preferred Car Dealers

Also Check: Usaa Auto Loan Interest Rates

Guide To Every Type Of Student Loan Offered

There are several types of student loans available to help you pay for college, including federal and private student loans.

Edited byAshley HarrisonUpdated October 8, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

If youre headed off to school, its a good idea to learn about the types of student loans you might need first.

In 2017, two-thirds of students who graduated with a bachelors degree had to take on debt to pay for school, borrowing $28,500 on average. Graduate and professional students took on even more debt than that, too, so its likely youll need student loans before finishing your degree.

Here are the major types of student loans you should know about:

How Much You Need To Repay

Verify your loan or line of credit contract to figure out the following:

- the total amount you owe

- the interest rate that will be applied to your debt

- how youll repay your debt

- how much youll pay

- how long it will take to pay back your debt

Contact the organization that provided your student loan or line of credit if you dont have the information listed above.

Recommended Reading: Nerdwallet Loan Calculator

Student Loan Repayment Assistance Programs For Teachers

The Teacher Forgiveness Program isnt your only option for student loan help. Many states also offer loan repayment assistance for teachers. Most of these programs require state licensure, as well as a commitment to working for two years in a qualifying area.

The Teach for Texas Program, for example, gives yearly assistance to teachers in designated shortage areas.

To find programs in your state, check out the full list of loan repayment assistance programs and filter the results by occupation.

What Is The Average Student Loan Monthly Payment

Answers vary, but the most recent data says that students between the ages of 20 and 30 paid an average of $393 per month in 2016. Studentaid.gov breaks it down a bit further: for example, on a $10,000 Direct Unsubsidized Loan with a 6.8% interest rate, the amount of interest that accrues per day is $1.86 . If you are in a deferment for six months and you do not pay off the interest as it accrues, the loan will accrue interest totaling $340.

Don’t Miss: Will There Be Another Ppp Loan

Will Aes Student Loans Be Forgiven

Itâs unlikely that the federal student loans AES services will be forgiven by the president. President Joe Biden campaigned on a platform partly based on loan forgiveness. Since taking office, the Biden administration has announced loan forgiveness for several student loan borrowers under existing programs. He has yet to use his executive authority to cancel $10 thousand in student loan debt.

With each day that passes, it appears lesslikely he will use that power. But even if he does, AES student loans wouldnât be forgiven because they are not owned by the U.S. Department of Education. The loans AES services are either federal student loans owned by a guaranty agency or are private student loans owned by someone other than the federal government.

Order Of Deduction In Scotland

Scottish court order

Do not make any student and, or PGL loan deductions if youre required to apply any of the following:

- an Earnings Arrestment

- a Conjoined Arrestment Order

Deduction of Earnings Order

Make student and, or PGL deductions after the DEO, which is a priority order, but the employees pay must not fall below the protected earnings level.

Scottish court orders and DEOs

Do not make any student and, or PGL deductions if you have a DEO and a Scottish court order to apply.

Scottish Debt Arrangement Scheme

Collection of student and, or PGL deductions is not affected by instructions to make deductions under the DAS.

You May Like: How Much Car Can I Afford Based On My Salary

Starting Student Loan And Pgl Deductions Checking Plan And Loan Type

You should work out the correct figure of employee earnings on which student loan and PGL deductions are due. Use the same gross pay amount that you would use to work out your employers secondary Class 1 National Insurance contributions.

Your employee may be liable to repay a PGL at the same time as a Plan 1, Plan 2 or Plan 4. Start making student loan and, or PGL deductions from the next available payday using the correct plan or loan type or both.

You will need to include these on your Full Payment Submission if any of the following apply:

- your new employees P45 shows deductions should continue ask your employee to confirm their plan or loan type, or both

- your new employee tells you theyre repaying a student loan ask your employee to confirm their plan or loan type, or both

- your new employee fills in a starter checklist showing they have a student loan and or PGL the checklist should tell you which plan or loan type, or both to use

- HMRC sends you form SL1 Start Notice this will tell you which plan type to use

- HMRC sends you form PGL1 Start Notice this will tell you they have a PGL

- you receive a Generic Notification Service student loan and, or PGL reminder ask your employee to confirm their plan or loan type, or both

If youre operating off-payroll you are not responsible for deducting student or postgraduate loan repayments for workers engaged through their own companies. The worker will account for student loan obligations in their own tax return.

Which Loans Are Eligible

ICR offers forgiveness on the following loans:

- Direct subsidized and unsubsidized loans

- Direct PLUS loans made to grad students

- Direct consolidation loans

- FFEL Stafford loans, if consolidated

- FFEL loans made to parents, if consolidated

- parent PLUS loans, if consolidated

- Federal Perkins loans, if consolidated

Read Also: Loan Officer License Ca

How Do I Know If I Have A Federal Student Loan

Once you pull an assessment from National Student Loan Data System you will know which of your loans are federal. All loans listed here are Federal Loans. They will appear with titles similar to this:

- DIRECT STAFFORD UNSUBSIDIZED

- FFEL STAFFORD SUBSIDIZED

- As well as PLUS Loans

- Upon completion of our consolidation service your loans will appear as: DIRECT CONSOLIDATED UNSUBSIDIZED and DIRECT CONSOLIDATED SUBSIDIZED.

Student Lines Of Credit

If you have a student line of credit through your financial institution, you’ll have to pay the interest on the amount of money you borrow while youre still in school.

After you graduate, many financial institutions give you a 4 to 12-month grace period. During this time, you only have to pay the interest on your line of credit. After this period, youll pay back your debt through a repayment schedule agreed upon with your financial institution.

Contact your financial institution to get information about paying back your student line of credit.

Recommended Reading: Credit Score For Usaa Auto Loan

Private Student Loan Refinancing

Refinancing is similar to consolidation in that you bring all your loans into one manageable loan. But refinancing is only done with private lenders the federal government doesnt offer student loan refinancing. That means youll lose federal loan protections when you refinance federal loans into a private one.

You can refinance both private and federal student loans together. Youll complete an application with a lender and detail all the current student loans you want to refinance. When youre approved, youll start making one monthly payment on your new loan to your new lender.

You should refinance if you:

- Have good or excellent credit and can secure a lower interest rate than what youre paying now.

- Have multiple loans with many different lenders, especially private loans.

- Can secure a lower monthly payment by stretching out your loan term.

You should avoid refinancing if you:

- Dont have strong enough credit to get a lower interest rate.

- Have federal loans that are eligible for an IDR plan or youre on track for PSLF.

- Want to keep federal protections and benefits, like deferment and forbearance, in case you experience financial hardship.

Court Orders And How They Affect Student Loan And Pgl Deductions

In addition to student loan and PGL deductions, you may have to consider a court order such as an Attachment of Earnings Order or Deductions from Earnings Order .

The order and amount of student loan and PGL deductions depends on whether the:

- AEO, DEO is a priority or non-priority order

- AEO, DEO is based on specific or percentage amounts

- total deductions including student and, or PGL deductions means your employees pay is less than the protected earnings level specified in the court order

Don’t Miss: Drb Refinance Reviews

Your Student Loan Repayment Term

Your loan repayment term is the number of years you have to pay it back. Federal loans generally have a standard repayment schedule of 10 years.2 For , the repayment term can range anywhere from 5-20 years, depending on the loan. Youâll be given a definite term for your loan when you apply.

Interest rates for federal and private student loans

The average interest rate will be different for federal student loans and private student loans. Federal student loans have a single, fixed interest rate, which means that your loanâs rate doesnât change over time.

You may have noticed that thereâs a range of interest rates associated with a private student loan. Private student loans are . That means the rate youâll be offered depends on your creditworthinessand that of your cosigner, if you have onetogether with several other factors. When you apply for a loan, youâll be given an interest rate, either , depending on which is offered and which type of rate youâve chosen.

How much youâll need to borrow for college

If youâre wondering for collegewhether itâs a public university or private universitythe can help. You can search for college costs and also build a customized plan based on your own situation.

When Are The First Payments Due

Not all loan payments are due on the same day so millions of people won’t all be making payments on May 1. Once the COVID-19 forbearance ends, borrowers will receive a billing statement or notice at least 21 days 3 weeks before the first payment is due. Some borrowers may not have to make their first payment until June. Borrowers should ask their loan servicers what date their first payment after the pause ends is due.

You May Like: Autosmart Becu

Private Student Loans Can Be Used To Fill In The Gaps Of Federal Loans

Federal student loan applications have rigid application deadlines, but you can apply for private student loans at any point in the school year. Private loans could be a good way to cover any education-related costs left over after youve exhausted your federal student loan, scholarship, and college savings options. There are also student loans for living expenses available.

If youre considering PLUS loans, keep in mind that some private student loans might lower have interest rates. Once you factor in origination fees, the annual percentage rate for PLUS loans can be higher than private student loans.

But no matter what type of student loan you choose, take care not to borrow more than you need. Youll have to pay your student loans back eventually, and smaller loan amounts are much easier to handle.

| Lender |

|---|

|

Lowest APRs reflect autopay, loyalty, and interest-only repayment discounts where available | 1Citizens Disclosures | 2,3College Ave Disclosures | 7EDvestinU Disclosures | 8INvestEd Disclosures | 9Sallie Mae Disclosures |

If You Think Youre On The Wrong Plan

Check which plan youre on by signing in to your online repayment account and downloading your active plan type letter.

Then ask your employer which plan they have you on.

If its different from the plan in your letter, show this to your employer so they can update your payroll details. You can get a refund if you should have been on Plan 2 or Plan 4 and you overpaid.

You May Like: When Can You Refinance Fha Loan

Applying For Private Student Loans

Private lenders do not use the FAFSA to determine a potential borrowers creditworthiness. Instead, students interested in borrowing private loans will fill out a loan application directly with a lender. Before applying, lenders will generally allow people to get a quote to see if they pre-qualify and at what rates. This can be helpful when evaluating different lenders.

The terms, interest rates, and borrowing limits on private loans may vary by lender. Lenders will use factors like the borrowers credit score to determine the interest rate they qualify for. When borrowing a private student loan youll generally have the option to choose between a fixed or variable interest rate.

Student loan repayment options will be determined by your lender. Some offer deferment plans while the borrower is enrolled in school and others require payments to start as soon as the loan is disbursed.

Another private student loan option is to consolidate or refinance your existing student loans after graduation. This might be beneficial if it lowers your interest rate and saves you money over the life of your loan. Federal student loans offer unique borrower benefits and protections like income-driven repayment plans. Refinancing federal loans eliminates them from these benefits.

Sl2 Or Pgl2 Stop Notice Received

Stop making deductions from the first available payday after the deduction stop date shown on the notice. The first available payday is the first payday on which its practical to apply that notice.

If the borrower is still employed by you and you use Basic PAYE Tools for this employee edit the employee details in the employer database. You can do this by removing the student loan or PGL borrower indicator and keep the SL2, or PGL2 Stop Notice.

If the borrower is no longer employed by you and you have not submitted leaver details to HMRC:

- leave the box headed Enter Y if student loan deduction is to be made blank

- submit leaver information in Real Time Information and provide employee with P45 parts 1A, 2 and 3

If you have submitted leaver details you should keep the SL2 or PGL2 Stop Notice.

You cannot stop making deductions because your employee asks you to. Your employee should contact the SLC if they think they have overpaid their loan.

Recommended Reading: Www Upstart Com Myoffer