Unique Features Of Capital One Auto Refinance Auto Loan

Lets take a detailed look at some of the core features of the Capital One refinance auto loan process.

- Minimum Income: Capital One refinance auto loans require a minimum annual income of $18,000, which is lower than the average.

- Wide range of refinance rates: Capital One auto refinance rates start at 4.1% for excellent credit scores and go as high as 24.99%

- Poor credit score accepted: Credit scores as low as 540 can still get you decent loan terms

- Vehicle age: Your car should not be more than 10 years old

- Co-signing accepted: Having a co-signer can reduce your refinance rates to a manageable level

- No origination fees: Capital One will not charge you a processing fee during application

- Can refinance large loans: Capital One will refinance loans ranging from $7,500 to as high as $50,000

Positive Capital One Reviews

Positive customer service reviews for Capital One are limited on the BBB. Existing reviews praise the companys professional service and its wide range of financial products. When it comes to auto loans and refinancing, customers report finding better interest rates with Capital One than with competitors.

Prequalification For Capital One Auto Refinance Expires After 30 Days

If you are in the market for a new car, you should know that you can only qualify for an auto refinance with Capital One if you are currently paying a different lender. You can refinance your existing car loan through Capital One, but only if the lender is registered in the state you live in and reports to major credit bureaus. Unlike other auto refinancing companies, you can also get financing for a car loan if you are a military member or are a registered lender with the Military Lending Act. In addition, you must submit the title of your vehicle to Capital One. Some auto finance companies require you to provide a vehicle title, but most banks, credit unions, and larger auto finance companies meet this criterion.

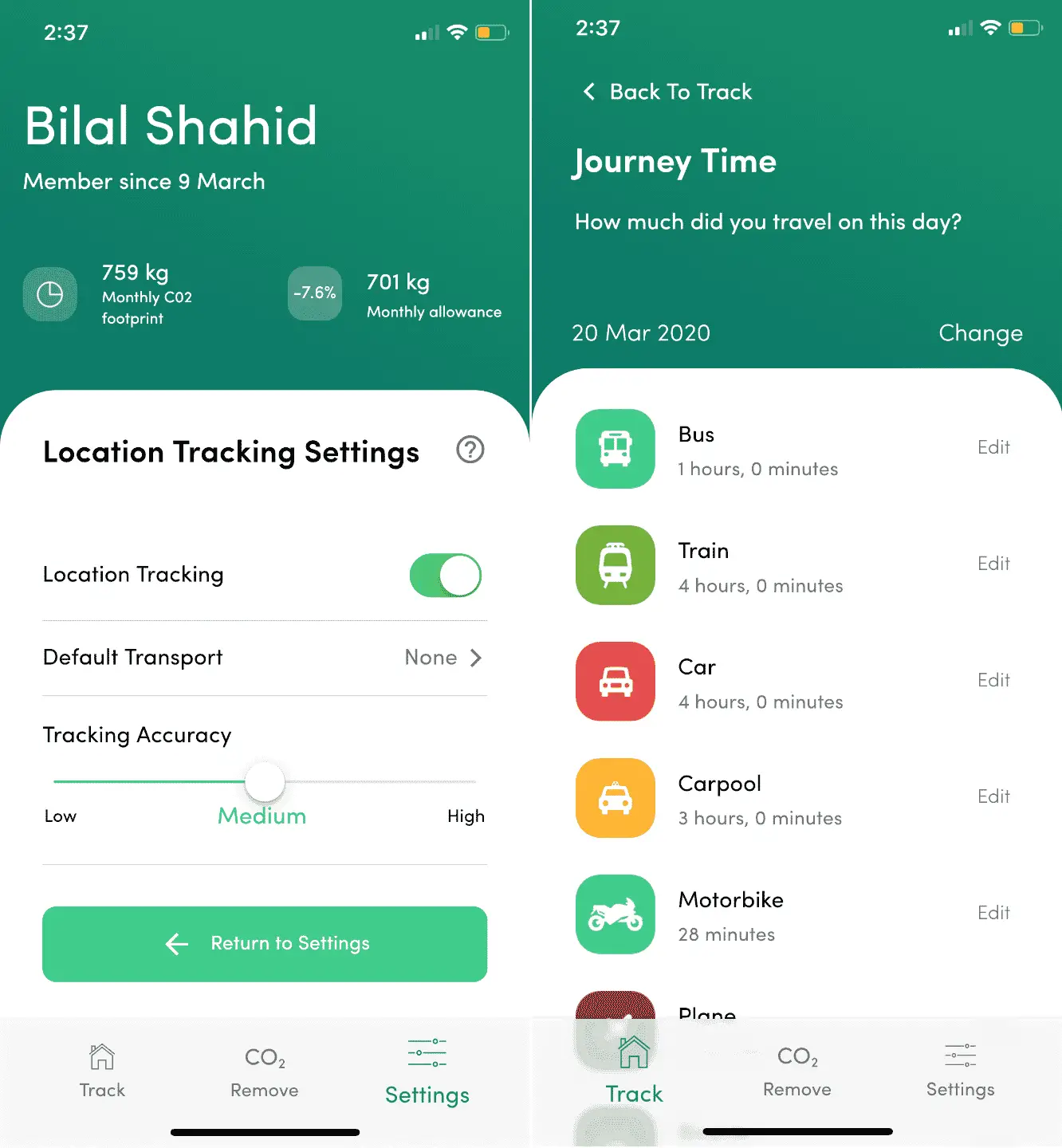

The company’s mobile application can be a valuable tool for those looking for a car loan. Capital One’s mobile app is free to download and has a 4.8-star customer rating in the App Store and Google Play. As of the date of this writing, it is among the best finance apps on Google Play and the App Store. However, before you can get a loan with Capital One, you must first complete the application process. Then, once you have been pre-approved, you can begin shopping for a new car.

Don’t Miss: What Type Of Student Loan Do I Have

What Are Car Loans And How Do They Work

Auto loans are secured loans that use the car you are buying as collateral. You are typically asked to pay a fixed interest rate and monthly payment for 24 to 84 months, at which point your car will be paid off. Many dealerships offer their own financing, but you can also find auto loans at national banks, local credit unions and online lenders.

Because when you finance a car it is a secured loan, they tend to come with lower interest rates than unsecured loan options like personal loans. As of September 8, 2022, the average APRs according to a Bankrate study are the following.

Wright Patt Credit Union Centerville Ohio

Category: Credit 1. Wright-Patt Credit Union Centerville, OH at 5419 Wright-Patt CU Cornerstone Member Center Branch hours, phone, reviews, map at 5419 Cornerstone North Boulevard, Centerville, OH. Wright-Patt CU Cross Pointe Member Center Branch hours, phone, reviews, map at 277 East Alex Bell Road, Centerville, OH. 34 Member

You May Like: List Of Tribal Loan Lenders

Capital One Auto Loan Prequalification

Capital One Auto Loan Prequalification can be done online and requires you to complete a brief questionnaire about your vehicle, income, and housing situation.

Note that prequalification is not the same as preapproval. A preapproval is a guaranteed loan offer, while a prequalification is a tentative statement that you qualify for certain loan terms. Capital One does not offer preapprovals, only prequalifications.

After prequalifying, you will be given loan offer details like APRs, monthly payment amounts, and even a list of for-sale vehicles from participating dealerships. Capital One does not run a hard check on your credit report during the prequalification process, meaning that you can see your loan offers without potentially lowering your credit score.

Should I Get An Auto Loan From The Dealership Or The Bank

Choosing between a dealership and a bank for an auto loan is complicated. In general, dealerships may offer higher rates than banks but this may not be the case for used cars. Regardless, it is important to get quotes from a few banks or online lenders first that way you can come to the dealership prepared. Ask for a quote from the dealership as well, comparing rates, terms and any additional fees.

You May Like: Average Interest Rate On Home Loans

Positive Capital One Auto Loan Reviews

Customers who are happy with their Capital One auto loans mention positive customer service experiences and satisfaction with loan terms. Several customers with poor credit were also grateful to be able to secure loans with Capital One.

I recently was approved and now have a new car. That experience alone was the best I have ever had. My credit was literally beyond bad, and thanks to Capital One, I am on the right track and my credit score keeps going up.

Susie Moore Young via Trustpilot

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: How Do You Get Your Student Loan Account Number

Qualifying For A Personal Loan

Letâs say you want to apply for a personal loan. How does a lender decide whether you qualify?

Keep in mind that every lenderâs process may be slightly different. But here are a few things that might be part of a personal loan application:

- Remember, the CFPB says a higher credit score usually makes it easier to get a loan and could also help you get a better interest rate. Factors that can affect your credit scores include your credit history, , credit mix, credit age, new credit applications and total debt.

- Proof of employment: Lenders may want to verify that youâre employed. They might request your length of time on the job as well.

- Proof of income: Lenders may want to verify how much income you make by requesting your pay stubs or bank statements.

- Debt-to-income ratio: Simply put, this is how much debt you haveâwhat you oweâcompared with how much income you haveâwhat you earn. Your total debt might include things like student loans and car loans in addition to credit card balances.

To keep an eye on where your credit stands, you may want to check your credit report regularly. Doing so could give you an idea about your potential creditworthiness.

Positive Capital One Auto Finance Reviews

While Capital One Auto Finance reviews from customers tend to be mixed, there are quite a few upbeat reviews. Here are two we thought were worth sharing:

Every time I use , I have a good experience. Ive had two auto loans with them, and both times they worked hard to give me a significantly better interest rate than the other lenders.

Reese T. via BBB

I recently was approved and now have a new car. That experience alone was the I have ever had. My credit was literally beyond bad, and thanks to Capital One, I am on the right track, and my credit score keeps going up.

Susie Y. via Trustpilot

Don’t Miss: Bad Credit Personal Loan Direct Lenders

Capital One Auto Loan Credit Score Requirements

If you have a credit score between 501 and 600 and are looking for a bad credit car loan, Capital One may be a solid choice.

In 2016, the Washington Post reported that approximately half of Capital Ones auto loans went to subprime borrowers. So if youre worried about qualifying for a loan, Capital One can be more forgiving. Even so, a participating auto dealer can still turn you away for poor credit.

| Capital One Auto Finance Application Details |

|---|

| Minimum Credit Score |

| Varies by credit score |

How Bankrate Rates Capital One

| Overall score | ||

| Captial One’s minimum and maximum APRs aren’t available, and it doesn’t advertise a discount for autopay. | ||

| Customer experience | 4.6 | Prequalification rates are valid for 30 days, and Capital One offers an online chat function once you sign up. It also has an app, and customer service is available six days a week. |

| Transparency | 4.0 | While it does offer prequalification, Captial One doesn’t offer a ful APR range before you hand over your information. |

Also Check: How Much Personal Loan Can I Get On 30000 Salary

How Do You Get Prequalified For An Auto Loan

You can get prequalified for an auto loan online and without ever leaving your home. All you have to do is select one of the lenders on this list and choose its online option to get prequalified or apply for a loan. Many lenders let you get prequalified for an auto loan without a hard inquiry on your credit report.

How To Get An Auto Loan

Once you find the right auto loan for your situation, follow these steps:

1. Shop around. It is usually best to compare rates and terms from at least three lenders before moving forward with an auto loan.

2. Prequalify. Prequalifying with lenders lets you see your potential rates without a hard credit check.

3. Complete your application. To complete your application, you will likely need details about your car, including the purchase agreement, registration and title. You will also need documentation like proof of income and insurance, proof of residence and a driver’s license.

4. Make payments. Your payment schedule will start as soon as you receive your auto loan. If needed, set up a calendar reminder or automatic payments to keep you on track with your monthly bill and avoid late payments.

Also Check: What Is The Maximum Direct Plus Loan Amount

How Do Repayments Work

Although the dealership you buy from will be the primary lien holder on your vehicle, Capital One will still service your loan. To make a repayment, you can log in to your Capital One account online or through its mobile app. From there, you can schedule a one-time payment or set up recurring payments. If needed, you can also change your due date but it isnt clear how many times you can do this.

You can also make payments by mailing a cashiers check, money order or personal check to Capital One or by sending a payment through Western Union or MoneyGram.

Capital One Auto Loans Structures

Cap One has, as with most all other auto lenders, tightened up a bit and it now seems that the max front end advance they allow is in the 110% range, plus:

- Approved back end products, i.e. vehicle extended warranty, GAP insurance, Credit Life and Disability insurance.

The 110% is the advance based on a new cars invoice, Kelley blue book wholesale or NADA wholesale, if used.

An example, if a vehicle had a $10,000 wholesale blue book value, then Cap One would be willing to loan $11,000 , plus the extras from above.

It appears that they are limiting the total loan to value , including TT& L and back end products to 120%. This is for the better tier credit customers.

This is a tougher and more limited structure than they used to offer and can make it hard to do a no money down loan.

This is especially true if there is any negative equity to be rolled into the new loan.

Cap One is also limiting some of their advances on select vehicles like trucks and SUV’s. So be prepared to put some money down.

They have a max finance term of 72 months and the length of term will be determined more by the mileage of the vehicle then the amount financed or the age of the vehicle.

Other restrictions may apply, i.e. advance %, overall credit history, etc.

Capital One auto loans and approvals for them seem to come easier for customers with larger down payments.

Bigger is definitely better when it comes Capital One auto loan approvals!

Also Check: How To Approve Mortgage Loan

Is Capital One Right For You

Our Auto Navigator tool does a soft credit check for pre-qualification. The tool allows you to check even on minor finance details if you are buying on a tight budget. Remember, we provide loans to those who want to build their credit score. We offer a handy loan calculator if youre going to check numbers before applying for pre-qualification. Our network of dealers is from all states except Alaska and Hawaii, with millions of cars in our inventory.

Capital One Auto Finance Review: Conclusion

Capital One can be a solid option if youre looking to compare rates and dont want to damage your credit score. Having an in-house system of cars to choose from is a plus if youre eager to streamline the shopping process, but it doesnt necessarily mean youll land the best deal. We recommend you shop around and compare options before committing to any auto loan offers

Also Check: How To Qualify For Fha Loan First Time Home Buyer

Capital One Student Credit Card Requirements

Establishing a credit profile is an important first financial step for modern consumers. In an effort to help credit newbies build credit the right way, many issuers, including Capital One, offer credit cards aimed at college students starting their credit journey.

| $0 | Average, Fair, Limited |

Unlike most entry-level credit cards, the Journey Student Rewards from Capital One offers both cash back purchase rewards and no annual fee. Cardholders are even rewarded for good credit habits with extra cash back for paying your card bill on time.

Like many Capital One credit cards, the Journey Student Rewards from Capital One gives cardholders access to an increased credit line after making their first six monthly payments on time. Plus, it also comes with the full range of Capital One card benefits, including the free CreditWise® monitoring app, $0 fraud liability, and customized mobile alerts.

Make Sure You Have Good Credit

Having a good credit score is essential if you want to get approved for an auto loan with decent terms. In general, a good FICO® Score ranges from 670 to 739, and a higher score is even better.

Auto lenders typically use the FICO 8 or FICO Auto Score models to determine your score. Keep in mind, though, that lenders may have their own rubric for determining what they consider to be good or not. But if your credit score is at least in the good range, youll have a relatively good chance of getting approved.

Also, note that lenders may choose to approve you for a car loan even if you have a less-than-ideal credit score. But they may charge you a higher interest rate or require a cosigner with strong, established credit. Some lenders specialize in working with people who have bad credit scores, but these loans can be expensive, so its a good idea to work on improving your score before you apply.

Read Also: One Main Financial Approval Odds

Also Check: How To Get Loan Without Documents

Can You Negotiate Auto Loan Rates

Just like the price of a car, auto loan rates often can be negotiated. Sometimes you can negotiate the rate with the dealer or directly with the lender. The better your overall financial picture, the more success you will have negotiating your rate. You also can negotiate loan terms. For example, maybe you dont want to make a payment for the first 90 days, or you want to finance the vehicle for 60 months instead of 48.

Capital One Auto Refinance Reviews: Conclusion

We rate Capital One auto refinance an 8.3 out of 10.0. The financial institution is reputable, established and offers large loan amounts for car refinance. While the company has negative reviews on the BBB, this number is low and insignificant to the amount of business the company produces. We recommend reaching out to Capital One and the other recommendations below to find the best auto refinance rates.

Recommended Reading: Do You Have To Repay Ppp Loan

Auto Refinance Data Methodology

The auto refinance rates published here are based on the results of comparative research done by Way.coms data team. We’ve used a mix of public and internal data to analyze refinance rates across thousands of lenders, credit scores, vehicle types, and all U.S. ZIP codes

The rates shown here are based on a national average of our findings, and may typically vary for each individual depending on your personal financial position and the US state you are in.

However, you can quickly determine where you stand by going through our Auto Refinance form. In just a few steps, find out how much you can save with way.com!

Best For Shopping Around For Refinancing: Lendingclub

LendingClub

-

Not available in all states

-

Some vehicle restrictions

Although LendingClub made a name for itself with peer-to-peer personal loans, the online lender now offers auto-loan refinancing. If you’re looking for ways to lower your monthly bills, LendingClub can help by showing you your refinancing options.

First, complete the initial application and get instant offers. This step is a soft pull on your credit that won’t change your score. Then you can compare the details of each proposal to see which best fits your needs. Whether you need to lower your interest rate, increase the length of your loan, or both, you can find the right lender.

Once you decide on an offer, you can finish the official application. The process is entirely online and easy, and you won’t pay an origination fee for your loan. Sit back and enjoy a smaller monthly payment. Rates start at 2.99%. Whether you’re sure you want to refinance or just seeing what’s out there, LendingClub is a great option.

You May Like: How Long Can You Finance An Rv Loan