What Can You Do To Speed Up Your Tax Refund

If you insist on getting a tax refund anticipation loan, please perform your due diligence. Go for the fee free loans of up to $1,300 and by all means stay away from the lines of credit and all other loans that charge fees and hefty interest.

If for some reason you cant get a free anticipation loan, youre much better off simply waiting for your tax refund to come in. If you want to speed up that tax refund heres what you should do:

File Early You can file your taxes as early as Jan. 1st although we estimate that the IRS wont start accepting returns until Jan. 25, 2022. You can use a tax prep service or file online through one of these places.

Don’t Forget About The Delay For EITC and ACTC – If you are filing with the Earned Income Tax Credit or Additional Child Tax Credit, your return will automatically be held until February 15 to be processed, so you likely won’t even get your return until late February or early March.

Have All of Your Information Together Before you file make sure you have everything that you need. Impatience could cause an error on your part and delay your tax refund. Heres a list of items youll need to file.

File Electronically Filing electronically is much quicker than filing a paper return and should result in a faster refund. Remember, if you file by mail, you have to mail in your return , and the IRS has to manually put it into the system . Filing by mail typically adds 12 weeks to your original 21 days if you e-file.

Tax Refund Loans: The Basics

Some financial institutions will offer you a short term loan based on your upcoming tax refund. This is often referred to as a Refund Advance Loan or a Refund Anticipation Loan .

You could also get a Refund Anticipation Check , which usually occurs when you indicate to your tax preparer that youll pay their fees out of your refund. The government then sends your refund as a check to your financial institution, which disburses the funds appropriately.

If you decide to get a tax refund loan, your tax preparer or loan agent will review your return, your income and your credit when you e-file your taxes. Based on all of this information they could loan you a portion of the money youre anticipating to receive back from the government.

Your RAL will then be loaded onto a card or deposited into a bank account. A temporary bank account is set up for your tax refund so that when it arrives, the amount of the RAL and any interest or fees are deducted automatically. Youll keep whatever is leftover.

Traditional RALs were known for having high interest rates, but today some tax preparers offer them at 0% APR as a way to entice customers.

What Is An Early Tax Refund Anticipation Loan

An early tax refund anticipation loan is a loan that you get from a tax preparation service instead of waiting for your refund to come. These loans can be given as early as the day your tax return is accepted by the IRS. They normally have tax preparation fees deducted from them and may come with other fees for taking out the loan.

These loans are popular since they can help taxpayers receive their refunds early. Anticipation loans are generally given out by a special debit card, check or direct deposit.

Note: Be very careful when getting a debit card or gift card. If you enter the wrong information or email, your refund can be “lost” and it can be nearly impossible to get your money back.

When your actual tax refund is available, the check will be sent to the tax preparer who gave you the loan, automatically paying your anticipation loan back.

WARNING About Refund Anticipation Loans

I DO NOT recommend using your tax refund for a cash advance or to fund any type of refund anticipation loan. As you will see below, they are expensive compared to other options available.

Furthermore, some unscrupulous tax preparers may charge higher fees than they are allowed to . You need to do your due diligence!

If you’re in a pinch and think this is the only way, be smart about your choices. Many people looking for a loan might be better served by one of the options on our best personal loans list.

You May Like: What Is The Max Va Loan Entitlement

Loan Places San Antonio

1. Personal Loans in San Antonio, TX | Atlas Credit Personal Loans in San Antonio, TX Atlas Credit Store #35. 2143 E Houston St #1. San Antonio, TX 78202. 225-6536 Atlas Credit Store #51. 803 S.W. Company nameAddressZip codePhone numberAll American Payday Loans13423 Blanco Road #42478216 3133135Stress

Pros Of A Tax Refund Loan

Here are some benefits of a tax refund loan:

- Get access to your funds quickly. If you need money now, a tax refund loan could help you pay for immediate expenses.

- Stay on top of your finances. If youre accruing interest because of unpaid bills, paying them off with a tax refund loan could save you money.

- Could cost nothing to access your funds now. If your tax preparer is offering an advance on your return free of charge then it could equate to an easy way to get instant cash.

You May Like: How To Get Marriage Loan

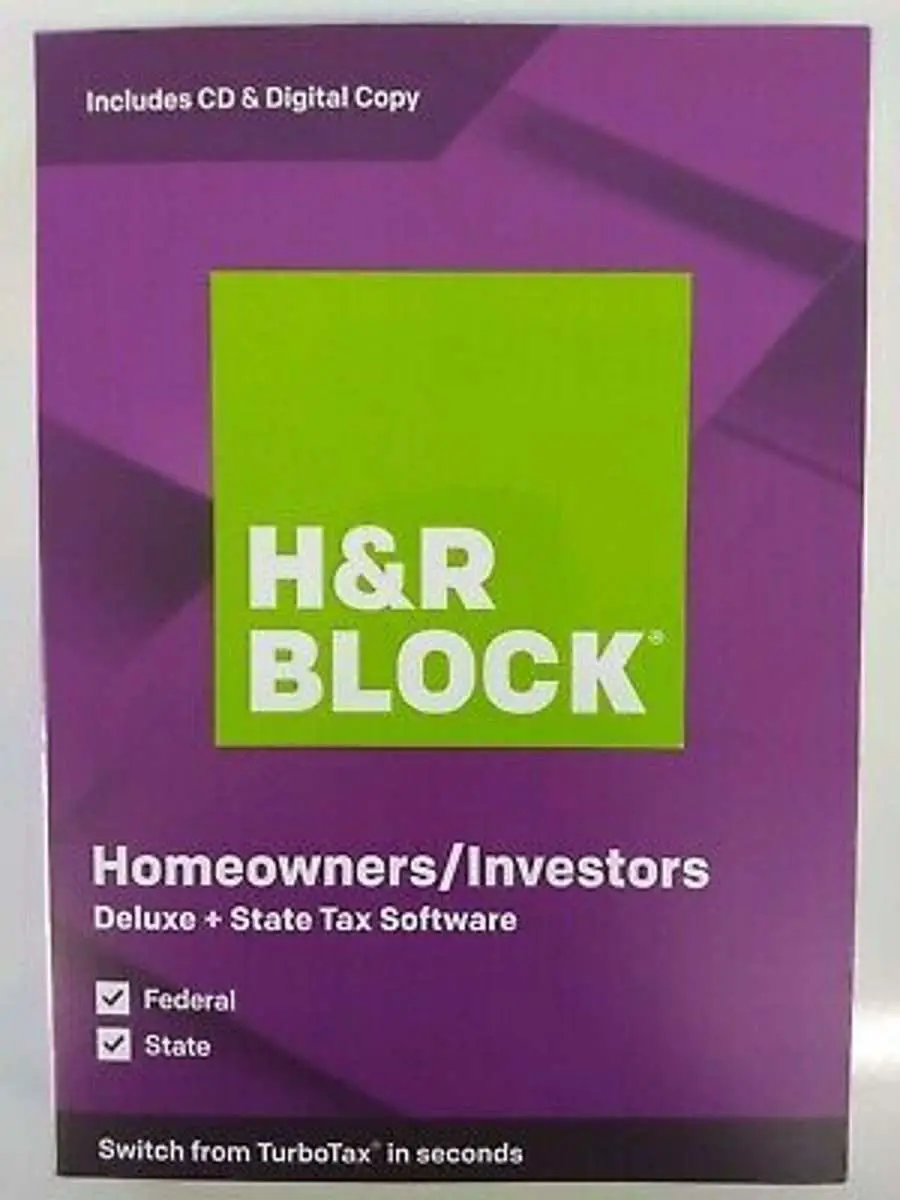

H& r Block Tax Refund Emerald Advance Loan For 2021 2022

H& R Blocks Emerald advance loan is being offered in amounts of $500, $750, $1,250, and $3,500. Some taxpayers depend on their tax refunds to

MetaBank issues H& R Blocks refund advance loan. Minimum tax refund amount: $500. Loan amounts: $250,

You could get a Refund Advance loan for up to $3500 in minutes of filing your tax return. Offer ends Feb. 28. Apply today: hrblock.io/RefundAdvance.

Tax Refund Advance : : : H& r Block Weston Lakes Plaza

You could get a Refund Advance Loan* up to $3000 in January when you file your taxes with H& R Block. Why wait weeks for your refund? With a Refund Advance, you

The loans are interest-free and are available to those who file their taxes early with H& R Block. To qualify for the loan, you must be eligible

Read Also: When Should You Refinance Your Car Loan

What Is A Tax Refund Advance

A tax refund advance is a short-term loan that gives you access to your cash sooner than the IRS or your state tax agency can get it to you. If you’re approved, you can get a lump sum loaded onto a debit card or deposited in your bank account, usually the same day. You can typically get up to half your refund amount early.

When the IRS or your state tax agency distributes your refund, the lender will automatically be repaid the amount you borrowed and the remaining money will be sent to you.

Here’s an example: You file your taxes and the tax preparer estimates your refund will be $3,000. You apply for a refund advance loan and get approved for $1,500. You’ll get that money within 24 hours. Later, the IRS will distribute your $3,000 refund to the lender, who will claim their $1,500 and send the rest to you.

H& r Block Announces Tax Refund Advance Of Up To $3000

The Refund Advance, a no-interest loan offered for a limited time at participating offices, is repaid from the clients federal or state income

Similar to H& R Blocks tax refund loan, TurboTaxs refund advance is only available during certain months. Jackson Hewitt. Jackson Hewitt offers

Millions of H& R Block Inc. customers who relied on short-term loans backed by their expected tax refunds will not have that option this year

Also Check: How To Find Loan Sharks Online

H& r Block Refund Advance Loans

H& R Block advertises $0 fee, 0% APR loans. Its Refund Advance loans are available now through February 28 in five amounts, from $250 to $3,500. H& R Block says most loan funds are made available the same day you apply for them. But, take note: The funds are only made available to you via an H& R Block Emerald Prepaid Mastercard.

The H& R Block Refund Advance loan is open to H& R Block customers who e-file through a participating H& R Block office. Eligibility is also determined in part by how much you are expected to receive in your federal refund.

Where Can I Get An Advance On My Tax Refund

No-fee refund advance loans are available to filers who are 18 or older at H& R Block, TurboTax, and Jackson Hewitt.

You have to apply for the loan after you file your tax return, meaning you only get one shot at approval . The company’s partner bank will review your application and may consider your tax payment history as well as review your . Applying for the loan shouldn’t affect your .

Always look at the interest rate. Many predatory lenders will market personal loans as refund advances during tax season, but they’ll charge excessive interest rates and fees. The options outlined here are free, though you might be required to pay for tax preparation prior to applying for the loan and ATM fees to get cash off the refund debit card.

Also Check: Is Interest From Home Equity Loan Tax Deductible

There Are No Credit Scores To Worry About When You Deal With H& r Block Axos Bank Is The Lender In This Case The Approval Process Works Differently From A Conventional Personal Loan

The main piece of criteria is how much youre entitled to based on your tax return. All you need to provide is evidence of your refund through your taxes and appropriate identification.

Its a different type of loan because its a type of advance. And the loan time usually only lasts a couple of months at the most.

H& r Blocks Refund Advance

If you need your refund now, you may want to consider filing with H& R Block. H& R Block offers something it calls Refund Advance. Its a short-term loan worth $250, $500, $750, $1,250 or $3,500 depending on your refund amount. So if you expect a refund of $600, you can apply for a $500 refund advance. It is available from Jan. 4, 2022 to Feb. 28, 2022.

H& R Block charges no interest on the loan. There also arent any finance charges or fees. All you need to do is complete a loan application. You will receive the funds for your loan, in most cases, on the same day that the bank approves your application. The loan will be on an H& R Block Emerald Prepaid Mastercard.

There are just a couple of caveats. One is that you will need to file your taxes in person at an H& R Block store. Refund Advance is not available for online filers. The second thing to keep in mind is that you will need to pay for the tax-filing service. This is more expensive in person than it is online. You may pay $200 or more just for the filing, depending on the complexity of your return.

Read Also: What Is An Asset Based Loan

How To File With H& r Block Today

H& R Block doesnt just offer a refund advance loan with no application fees and 0% interest. They also offer a tax platform that can be used by most American taxpayers.

They have a range of forms that are available for Americans with simple to complex tax affairs. It couldnt be easier to create an account and get started with them today.

It only takes minutes to start on your taxes, and its even faster if youve used them in the past because you can simply import your previous information.

Tax Refund Loan Alternatives

You could get a lower rate on the same size loan elsewhere and then use your refund to pay it off.

Loan apps provide a low- or no-fee advance on your paycheck. You can typically borrow up to $250, and the app will withdraw the advance amount from your bank account on your next payday. However, loan apps may charge a subscription fee, a fee to get funds faster or ask for an optional tip. These apps can be helpful if you need funds quickly, but they arent a long-term solution.

Payday alternative loans. Some credit unions allow their members to access payday alternative loans from $200 to $2,000, depending on the type of loan. These loans have a maximum APR of 28%, with application fees capped at $20.

Online loans. Some online lenders offer small personal loans starting at $1,000 with next-day funding after approval. Rates range from 6% to 36%, and qualifications vary by lender. Good- or excellent-credit borrowers with high incomes and little existing debt qualify for the lowest rates.

Also Check: Can I Roll My Closing Costs Into My Va Loan

Who Should Use The H& r Block Emerald Refund Advance

You should always consider whether a refund advance is right for you. Even though this is a no risk loan because you cant spend more than your loan amount and the interest rate is 0%, you still need to figure out if this is the correct move for you.

We always recommend thinking about whether you really need the money right now. Unless you have an emergency expense to take care of, you may decide that its not worth applying for a refund advance.

Its widely expected that refund advances will be far more popular this year, though, due to the additional waiting time for receiving refunds. However, you cant truly decide until you have a rough idea of how much you could get back through your taxes this year.

Jackson Hewitt Refund Advance

Jackson Hewitt is incredibly simple and easy to use, and has both DIY filing and options to work with a tax pro to complete your return. But, there’s no free version, even for simple tax situations.

Like H& R Block, Jackson Hewitt’s refund advance loan is issued by MetaBank.

| Minimum refund for eligibility |

Recommended Reading: What Kind Of Loan Do You Get For An Rv

How Do I Apply

Before, you could only apply by meeting with a tax adviser in person at an H& R Block location. But to accommodate for the coronavirus outbreak, you can now apply online. Follow these steps to get started:

You may receive an approval decision and funding on the same day you apply. If approved, your advance funds will be available on a prepaid Mastercard the H& R Block Emerald Card.

What documents do I need to apply?

H& R Block doesnt list any specific documents you should bring with you when you apply for a tax refund advance. However, it does state you will need to bring appropriate identification call ahead to see what types of identification qualify.

Expecting more than $3,500? Read our guide to tax refund advances to compare other options out there.

How Do Tax Refund Loans Work

You submit an application for the tax refund loan when you file your tax return.

Most tax preparers work with a bank that lends the funds. For example, MetaBank issues tax refund loans for H& R Block and Jackson Hewitt.

Tax loans dont usually have the same credit score requirements as unsecured loans, but the bank may review an applicants credit profile without affecting their credit score.

Qualification can also depend on the amount of your expected refund. These loans require identity verification, a review of your status with the IRS and other debts you owe.

Once approved, you can typically access the loan amount quickly on a prepaid card, which could come with restrictions and fees of its own, or the funds will be deposited into your bank account.

The tax preparer will deduct the loan amount and interest from your refund when the IRS releases it.» MORE:Lower cost funding alternatives in a crisis

Don’t Miss: How To Find Out Old Loan Account Numbers

Alternatives To Refund Anticipation Loans

Have you ever thought about simply getting a personal loan? I know this might sound a bit weird, but you might get more money, a better interest, and an all around better deal.

A personal loan can be a great way to pay off high interest credit card debt, consolidate multiple loans, get your car or house fixed, and more. The helpful feature about these loans is that you have a set payback period – versus having to do your taxes and then waiting for the return.

We recommend shopping for a personal loan on Credible. Credible is a comparison site, where you can see what different options you might qualify for online – in just 2 minutes. You can borrow anywhere from $1,000 to $50,000, with APRs as low as 3.99% . That’s a great deal .

Check out Credible and see if it makes sense for you here.

Can You Get A Refund Anticipation Loan With Bad Credit

Good question and the answer is: it depends. There are some companies who claim to give anticipation loans without a credit check others will require credit checks and some may charge higher fees if you have bad credit.

If youre planning on getting an anticipation loan, your best bet is to simply call and ask the tax prep service provider you plan on going to about the details beforehand.

You can also opt to try for a personal loan. Check out Credible here:

Also Check: How To Get Rid Of Pmi On Loan