Advantages To Consolidating Federal Student Loans

The biggest advantage of consolidation is to simplify your repayments. If you have a student loan for each school year , putting these all together into one lump sum will have you making one payment each month instead of four. This makes bill paying at the end of the month much easier and you are less apt to forget to pay on one of these loans.

Another advantage to consolidation is decreasing your monthly payment. When you consolidate, you restart the length of your loan, which means you can repay your debt over a longer time. This will reduce your monthly minimum payment, but it will extend the length of time you are paying on this loan. If you are struggling with meeting all of your monthly payments, having a lower one will surely help your budget.

Weighing The Pros And Cons Of Consolidating Federal Student Loans

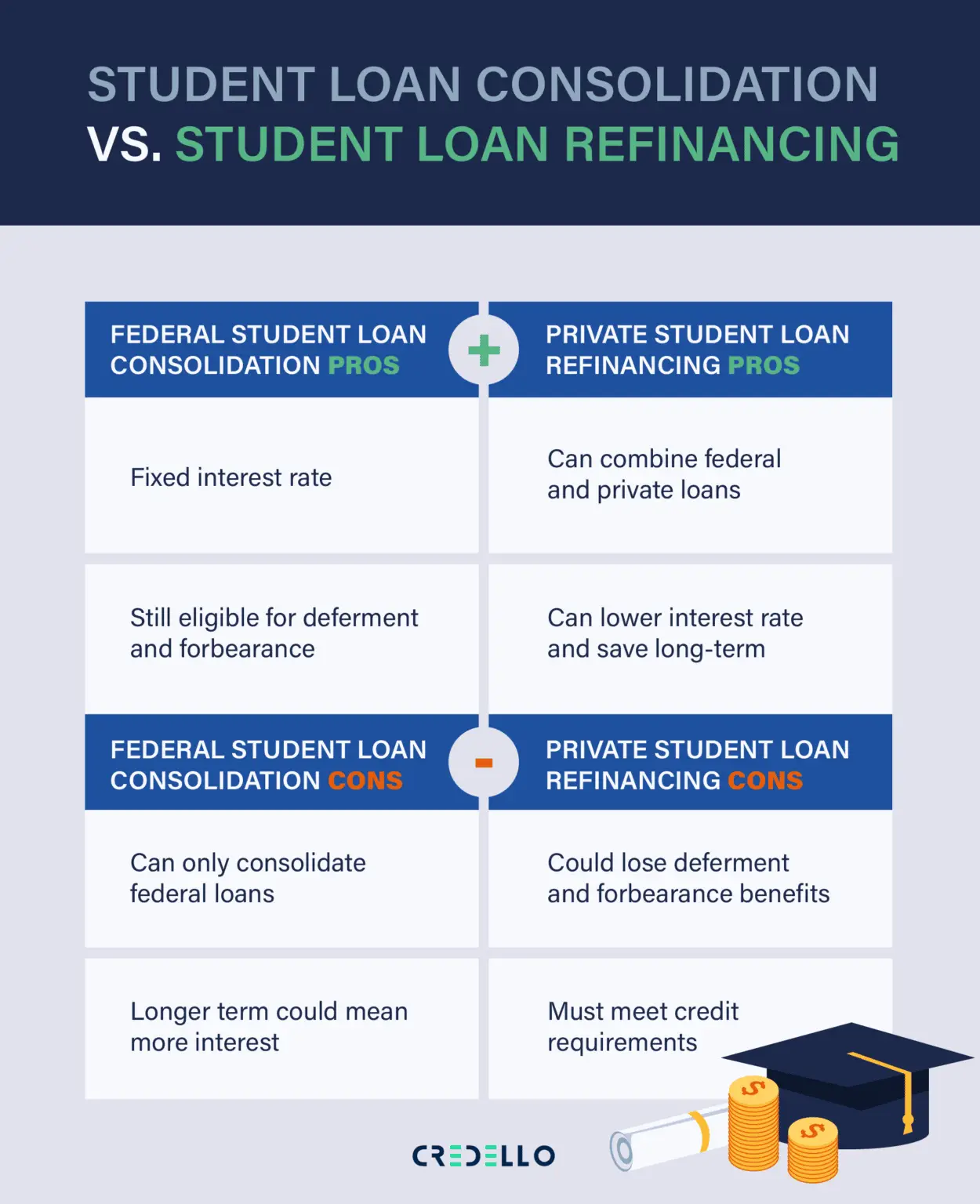

Student loans refinancing and student loan consolidation can be excellent tools for managing your debt. Theres no one-size-fits-all approach, so think carefully about your situation and your financial needs before deciding on a strategy.

Remember to ask yourself: What are the advantages and disadvantages of consolidating student loans, and pros and cons of student loan consolidation for federal loans, and how do they align with my student loan payoff goals?

If you believe that student loan refinancing is right for you, use Purefys Find My Rate tool to get quotes from multiple lenders.

SOC 2 Compliant

Cons Of Student Loan Refinancing

While student loan refinancing can offer many benefits, refinancing has its share of downsides as well. Here are a few of the cons of refinancing student loans to be aware of before making a decision.

If your student loans already happen to be private, many of these cons can be immediately taken off the table. But if your loans are from the federal government, carefully weigh the financial upside of refinancing against the federal benefits youll lose.

Also Check: Is My Home Loan Secured

Con: Consolidating Privately Means You Give Up Federal Loan Benefits

Make sure you understand all of the fine print before you refinance federal student loans.

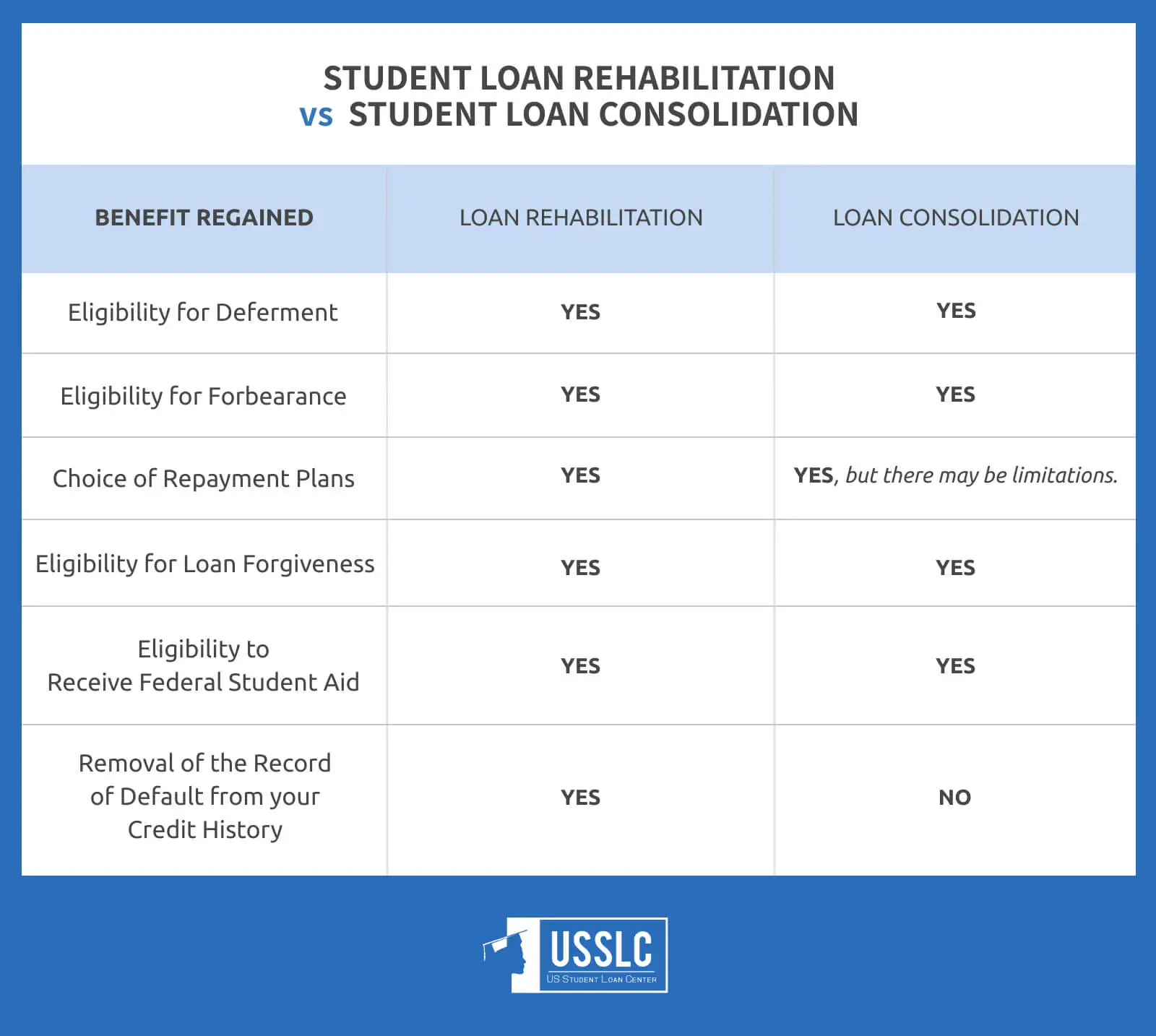

Federal loans often allow a host of deferment and forbearance options in case you lose your job or experience other financial hardships. They also offer income-driven repayment plans and loan forgiveness. Consolidating with a private refinanced loan could mean that you’ll forfeit those protections and opportunities under the terms of the new loan.

Con: Your New Interest Rate May Be Higher

The interest rate for your new Direct Consolidation Loan will be calculated based on a weighted average of the interest rates of your existing loan amounts and rounded up to the nearest one-eighth of a percent. That means that if you have some loans with much higher interest rates than others, you may pay more interest over the life of the loan than if you kept your initial repayment plan as it was.

Read Also: How To Take Name Off Car Loan

You Want A Lower Interest Rate

With Direct Consolidation Loans, your new interest rate on your consolidated loan is the weighted average of the interest rates on your old ones. In short, your interest rate will stay about the same.

If you want a lower rate, student loan refinancing makes more sense. If you have good credit and a steady income, you could qualify for a much lower rate, helping you save money.

How To Consolidate Student Loans

Do you feel weighed down by student loan debt? If so, you might consider consolidating or refinancing your loans to lower your monthly payments. In many cases, that can be a smart financial move. But before deciding to consolidate or refinance, it pays to take a close look at the pros and cons.

Federal student loan payments, including principal and interest, are automatically suspended through Dec. 31, 2022. The Department of Education stopped the collection of defaulted federal student loans or loans in nonpayment. Garnishment of wages and any offset of tax refunds and Social Security benefits have also been stopped through Dec. 31, 2022.

The loan payment suspension began as part of the pandemic response in March of 2020 and was instituted by former President Trump and the Department of Education.

You May Like: How To Get Loan From China Bank

Consolidation Can Make Repaying Your Student Loans Less Confusing

If you have multiple federal student loans with different servicers or due dates, consolidation can make managing your student loans easier by replacing your multiple loans with a single loan. This means that instead of managing multiple monthly payments from multiple servicers, you will have to manage just one payment from a single servicer.

Can Improve Credit Score

Applying for a new loan may result in a temporary dip in your credit score because of the hard credit inquiry. However, debt consolidation can also improve your score in a number of ways. For example, paying off revolving lines of credit, like credit cards, can reduce the credit utilization rate reflected in your credit report. Ideally, your utilization rate should be under 30%, and consolidating debt responsibly can help you accomplish that. Making consistent, on-time paymentsâand, ultimately, paying off the loanâcan also improve your score over time.

Don’t Miss: How To Get Your First Loan With No Credit

Pros Of Student Loan Consolidation

Extra Time For Payments

One of the obvious benefits of consolidation is that you can get extra time to pay the debt off. This ranges from 10-year terms for loans lower than $7,500 to 30 years for loans more than $60,000.

Lower Payments

Federal student loan consolidation may lower your monthly payments in one of two ways. First, the extended time to pay the loan off may result in lower payments. Second, federal consolidation means you are now eligible to pursue an income-driven repayment plan that could significantly lower monthly payments.

Save Your Credit

Consolidating federal debt into one loan with a new term does more than extend your time and lower your payments. If you were having trouble making payments before, consolidation can help you avoid going into default and/or jeopardizing your credit score.

S To Take If Consolidation Isnt Right For You

Only you can decide whether or not consolidating your student loans will make sense for your unique financial situation and goals. While it can bring a lot of good in making your student loans a little bit easier to manage, it can also bring some negatives which need to be considered.

If, after weighing the pros and cons listed above, you decide that student loan consolidation isnt for you, there are still some steps that you can take to make repaying your multiple student loans a little bit easier.

The first thing you should do is commit to keeping track of your student loans, whether thats by using a student loan spreadsheet or by signing up for an app or service that will keep track of your loans for you. By simply tracking your progress as you repay your student loans, you can dramatically decrease the chances that youll miss a payment, and youll have a better sense of the total amount that you owe.

In addition to tracking your progess, you should consider signing up for autopay. As long as youve got a steady paycheck and know youll have money each pay date, signing up for autopay means youll never miss a payment again. And it might even decrease your student loan interest rate by 0.25%. That might not seem like a lot, but depending on exactly how much you owe it could easily save you hundreds or thousands of dollars over the life of your loan.

You May Like: How Do Loan Modification Programs Work

How To Get Approved For Consolidating Your Student Loans

Students who have graduated, left school or dropped below half-time enrollment are eligible to consolidate their federal student loans. There are no credit requirements for federal student loan consolidation. However, there are several other requirements that limit who can apply for a direct consolidation loan:

- The loans you want to consolidate must already be in repayment or in the grace period, which lasts six months after you graduate, leave school or drop below half-time enrollmentdepending on the type of loan.

- In general, if you already consolidated a loan, you cant consolidate it again without also consolidating another eligible loan.

- The loans you want to consolidate cannot be in default unless you make three consecutive monthly payments on the loan prior to consolidation or agree to repay your new direct consolidation loan under one of several income-related repayment plans.

- Likewise, consolidating a defaulted loan thats being collected through wage garnishmentor in accordance with a court orderisnt permitted unless the garnishment order is lifted or the judgment vacated.

In contrast, private student loan refinancing has approval requirements similar to traditional loans. To qualify, lenders typically require a credit score in the upper 600s, a debt-to-income ratio under 50% and a demonstrated ability to repay the loan.

Cons Of Private Student Loan Consolidation

Private consolidation can be a smart way to tackle your debt, but there are some drawbacks to keep in mind:

- Youll lose federal benefits: If you refinance federal student loans, youll no longer be eligible for federal benefits like income-driven repayment plans, Public Service Loan Forgiveness, and federal forbearance and deferment programs.

- Interest rates can vary: With private loan consolidation, you can choose a variable or fixed interest rate loan. If you choose a variable rate loan, you should know that your variable rate can fluctuate over time, and could end up being higher than your loans original interest rate. And all private lenders offer different rates.

- Good to excellent credit required: To qualify for a low-interest loan, youll need to have good to excellent credit and a stable income. If your credit is less-than-stellar, or if your income is insufficient, you wont be able to qualify for a loan or you may have to settle for a higher interest rate.

Recommended Reading: Where To Get Best Car Loan Rates

The Grace Period Could Be Lost

A grace period is offered on most federal loans before you have to begin making payments. Borrowers consolidating multiple student loans into a Direct Consolidation Loan may lose any remaining grace periods on their original student loans .

Depending on when you took out these student loans and how much time is left in their respective grace periods, this could end up costing you more money or force you to start repayment earlier than expected, says Tiller. For example, if one of your previous loans has an 18-month grace period but it takes 24 months for your consolidation loan to repay all of the old ones, that could cost you more money.

Lender And Bonus Disclosure

All rates listed represent APR range. Commonbond: If you refinance over $100,000 through this site, $500 of the cash bonus listed above is provided directly by Student Loan Planner.

CommonBond Disclosures: Refinancing

Offered terms are subject to change and state law restriction. Loans are offered by CommonBond Lending, LLC , NMLS Consumer Access. If you are approved for a loan, the interest rate offered will depend on your credit profile, your application, the loan term selected and will be within the ranges of rates shown. If you choose to complete an application, we will conduct a hard credit pull, which may affect your credit score. All Annual Percentage Rates displayed assume borrowers enroll in auto pay and account for the 0.25% reduction in interest rate. All variable rates are based on a 1-month LIBOR assumption of 0.15% effective Jan 1, 2021 and may increase after consummation.

CommonBond Disclosures: Private, In-School Loans

Student Loan Planner® Disclosures

Read Also: Payday Loan No Credit Check

What Is Student Loan Consolidation

Student loan consolidation is the process of taking multiple federal student loans and combining them into a single, new federal student loan. The resulting loan is called a Direct Consolidation Loan, which will carry an interest rate equal to the weighted average of all of the loans that youve consolidated.

Depending on your needs and goals, you can choose to consolidate all of your federal student loans, some of them, or even just two, while leaving the others as is.

Complete A Consolidation Loan Application

After gathering the necessary documentation, complete a Direct Consolidation Loan Application and Promissory Note. This free application can be submitted online or in hard copy and includes the following sections:

- Choose Loan & Servicer. The first section of the loan application requires you to select which loans to consolidate and then calculates the new consolidated loan amount and interest rate. This is also where youll request a grace period and choose a loan servicer.

- Choose Repayment. Federal student loan repayment options depend on the types of loans youre consolidating and your financial status. This section of the application calculates your estimated monthly payments under several plans using your income, family size and tax status. Finally, youll be asked to choose a repayment plan before moving on to the next section of the application.

Check out this application demo for step-by-step guidance throughout the application process.

You May Like: Can You Get An Fha Loan Through An Llc

Scholarships For International Students

MPOWER offers various scholarships for international students seeking to gain an education in the U.S. or Canada. Many scholarships come with restrictions and entry fees that limit accessibility, but MPOWER created scholarships that are widely accessible to international students. Apply today and begin your future of studying abroad!

Should You File For Bankruptcy

If youre overwhelmed with debt you cant repay, or maybe your mortgage is underwater and youve exhausted all other options, filing for bankruptcy may be a wise decision.

Keep in mind that the degree of financial relief you receive from bankruptcy will depend largely on the type of debt youre saddled with. Bankruptcy wont discharge child support debt, most back taxes or other debt resulting from legal obligations. And, student loan debt is notoriously difficult to discharge, though the Department of Education recently indicated its considering whether to make bankruptcy an option for student loan borrowers.

A can help evaluate your current financial situation and determine whether bankruptcy is the best course of action. Meeting with a credit counselor may end up being necessary anyway, as anyone filing for bankruptcy is required to receive credit counseling from a government-approved agency as part of the process.

You also should consult a bankruptcy attorney about whether to file. A lawyer can advise on which of your debts can be dealt with through bankruptcy, and whether to file Chapter 7 bankruptcy or Chapter 13 bankruptcy .

If you decide to file Chapter 7, you must demonstrate eligibility through a means test, which evaluates your debt, expenses and income to determine whether you truly cant afford to repay what you owe.

Recommended Reading: Fla Servicing Student Loan Forgiveness

Student Loan Integration Benefits

- Combining the student education loans helps make lifestyle convenient. According to when you went along to college and you can what kinds of fund you grabbed aside, you might have to juggle several money each month. Merging means that you just need to bother about that college student loan fee each month. Keep in mind that individual student loans cannot be consolidated which have federal financing.

- Student loan consolidation may help include your credit report. Why dont we imagine you have taken out seven subsidized financing and you can 7 unsubsidized fund-that per session. Before you consolidate, you might still only get one statement and come up with you to payment for the lender. However ,, as much as your credit score is concerned, for every financing are noted just like the another obligations. Therefore, for those who miss one commission, this may in fact let you know on your credit history since 16 missed repayments!

- When you yourself have Stafford fund that were applied for ahead of , your own fund probably have a changeable price. Consolidating the individuals fund carry out protect a fixed interest and protect facing upcoming interest rate expands.

- For those who combine your finance, you may have education loan repayment alternatives that would permit you to help you extend your instalments more than a longer period of time. This might allow you to generate faster repayments.

Qualify For Special Loan Plans

If you consolidate loans other than Direct Loans, such as FFEL, Perkins loan, & HRSA loans, it may give you access to additional income-driven repayment plan options and Public Service Loan Forgiveness . This could also reduce your monthly payment.

This is a KEY reason why consolidation can make sense for someone. If you have FFEL loans and are working towards PSLF, those loans will NOT be forgiven. Only Direct loans qualify for loan forgiveness.

Another key reason to consolidate would be to make specific loans qualify for an income-driven repayment plan. Direct loans are eligible to be calculated under the ICR, REPAYE, and PAYE plans. If youve got some loans in your loan list that dont qualify, those will be calculated differently under IBR , making your payment slightly higher.

Read Also: Who Qualifies For Fha 203k Loan

May Reduce Monthly Payment

When consolidating debt, your overall monthly payment is likely to decrease because future payments are spread out over a new and, perhaps extended, loan term. While this can be advantageous from a monthly budgeting standpoint, it means that you could pay more over the life of the loan, even with a lower interest rate.

Could Raise Your Interest Rate

If you qualify for a lower interest rate, debt consolidation can be a smart decision. However, if your credit score isnât high enough to access the most competitive rates, you may be stuck with a rate thatâs higher than on your current debts. This may mean paying origination fees, plus more in interest over the life of the loan.

Read Also: How To Negotiate Student Loan Payments