Starting Early: The Value Of College Savings

For the most part, you can’t apply for grants, scholarships or loans until a student nears high school graduation. But you can start saving for college at any time. In fact, college savings estimator and working with a financial advisor can aid you with that discussion by helping you determine your needs and contribution options for a savings plan.

Every dollar you save is a dollar you won’t have to find in grants, scholarships, loans or work-study programs later. Thanks to compounding interest and the tax benefits of 529 educational savings plans, those dollars might be worth even more.1 But applying for these types of financial student aid can help lessen the burden of increasing college costs.

Whats The Difference Between Student Loans And Financial Aid

The biggest difference between student loans and financial aid is that student loans are required to be paid back with interest.

Financial aid such as grants or scholarships do not need to be paid back.

Your priority when it comes to financial aid should be grants and scholarships. However, they are often times harder to get.

Are Financial Aid And Student Loans The Same

Sometimes these terms are used interchangeably, but they arent the same thing. Knowing the difference can inform the type of financial assistance you choose, and it can affect your finances while youre enrolled and after school. So, lets take a look.

- Financial aid: Financial aid usually doesnt need to be repaid. The money can come from the Department of Education, private organizations, schools or states.

- Student loans: Student loans must be repaid with interest. The money can come from federal or private lenders.

While financial aid may seem like the obvious, go-to choice, not all financial aid is free .

The amount of financial assistance you receive cant be more than what it costs to attend your school or program. Your school will keep track of all the financial aid you receive along with any student loans you have. Schools may even request that you let them know about any money you receive in outside scholarships so the schools aid doesnt exceed what it costs to attend.

You May Like: Grant Loans For Small Business

Federal Vs Private Student Loans

There are two types of : federal student loans and private student loans. If youre trying to figure out how youre going to pay for school, youve likely thought about both. Federal and private student loans are not the same and its important to know the difference.

Federal student loans are made and funded directly by the federal government. To apply, you need to complete the Free Application for Federal Student Aid .

Sometimes referred to as non-federal or , are made and funded by private lenders, such as banks and online lenders.

But when it comes to paying for college no matter if youre an undergraduate student, a graduate student, or a parent theres more to know about federal vs. private student loans. Lets look at each one in more detail.

Already applied for federal student loans and dont have enough money for college? Apply for a private student loan today.

Pros And Cons Of Unsubsidized Loans

Similar to subsidized loans, there are pros and cons to unsubsidized borrowing. Heres a look at some of the considerations:

- Pro: Accessible to more students. Because it is not necessary to demonstrate financial need, unsubsidized loans are open to more borrowers.

- Pro: Larger borrowing amounts available. For undergraduate students, the borrowing limit is $34,500, while for graduate students it is $20,500 per academic year.

- Con: Interest begins accruing immediately. This means you will have a larger amount of student loan debt once you complete schooling.

- Con: Higher interest rates than unsubsidized loans. The current interest rate on these loans is 6.54%

Recommended Reading: How Much Loan Can I Get On 60000 Salary

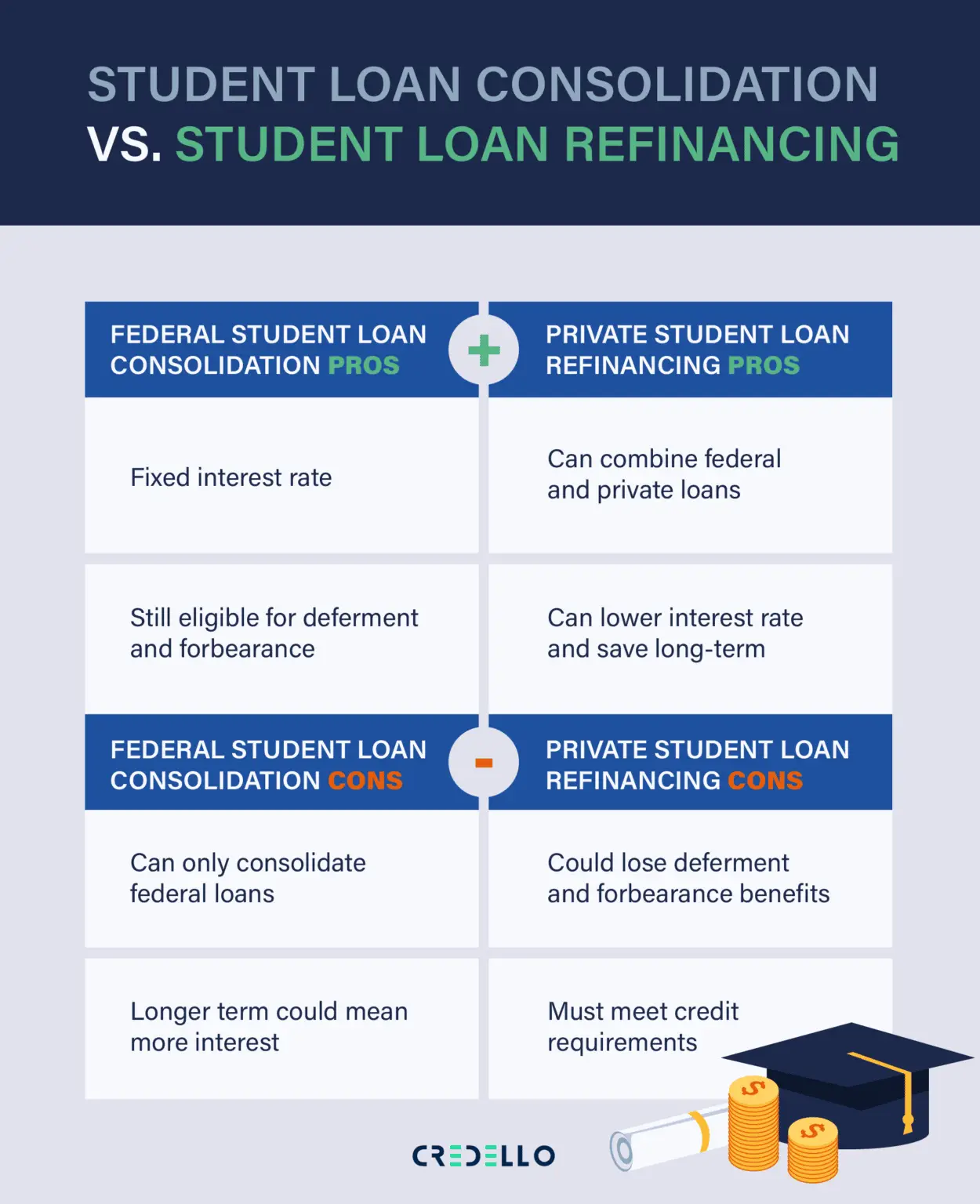

Refinancing Federal Loans To Private

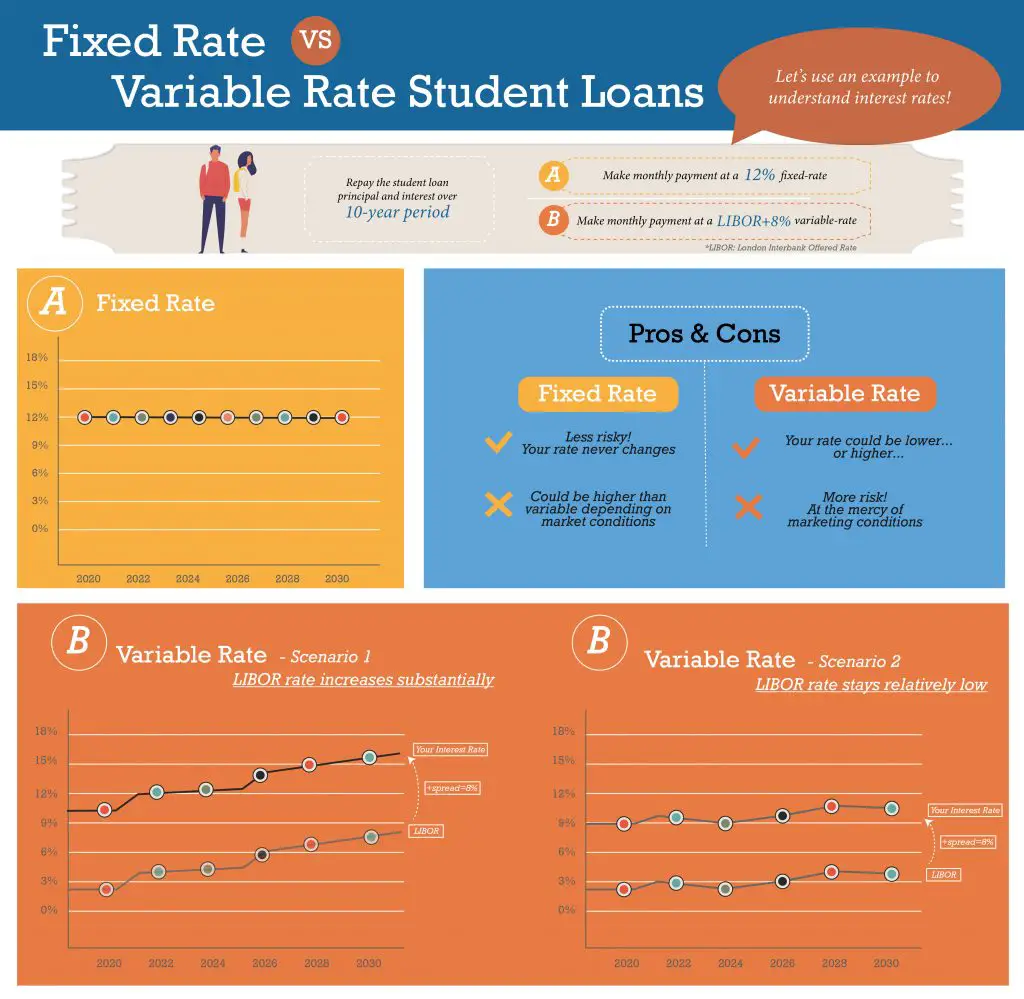

In some cases, borrowers might choose to refinance federal loans to private. This option is usually exercised to obtain a lower interest rate or to release a cosigner from their obligation to the loan. However, when you switch from a federal repayment program to a private one, your loan might be subject to the fluctuations of variable interest rates and you will no longer be eligible for the protections and benefits, like income-based-repayment and loan forgiveness.

Many Financial Aid Award Letters Are Misleading

Many financial aid award letters and notifications blur the distinction between grants and loans.

Grants and scholarships are gift aid, which is money to pay for college that does not need to be repaid or earned through work. Student loans are not free money.

Financial aid award letters often list grants and loans together, without distinguishing between them. Loans are listed without markers that identify them as loans, such as the interest rate, monthly loan payment or total payments.

How is a family to know that a cryptic abbreviation, such as L or LN, signifies a loan? Some loans are identified by a name that doesnt even include the word loan or an acronym. Most students do not have any experience with debt.

Many colleges see the financial aid award letter as a type of marketing, not counseling. The purpose from their perspective is to explain how the student can pay the college bills even when the college costs are unaffordable, even with financial aid.

Some award letters subtract the loans from the college costs, as though they reduce the college costs. When families look at the bottom-line cost, they do not realize that the financial aid award letter includes debt, often a considerable amount of debt. Families need to know how much they are really going to have to pay for college, not a fictitious net cost.

Increasing awareness of student loan debt is the first step in exercising restraint in borrowing.

Also Check: Can You Get An Fha Loan On New Construction

What Is Financial Aid For College

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

More on navigating student aid:

Todays skyrocketing college tuition prices mean most families cant afford the whole bill on their own. Financial aid can help fill in the gaps. Here’s what you need to know:

Student Loans Do Not Make College More Affordable

Some colleges claim that student loans make college more affordable, in that student loans provide cash-flow assistance, allowing the family to pay the college bills. But, this does not reduce the net price, which would make the cost more affordable. Rather, it just spreads the costs out over time.

Colleges promote student loans because it serves the colleges financial interests, not because it is in the students best interests. Without student loans, most students would not be able to pay the college bills, just like most families would not be able to buy a home without a mortgage.

Student loans cost a college a lot less than grants. Every dollar of a grant costs the college a dollar, but every dollar of a student loan costs the student about two dollars by the time the debt is repaid, with no cost to the college.

Even if student loan debt were a form of financial aid, colleges have no basis for asserting that student loans make college more affordable, because few, if any, colleges track whether their alumni are graduating with affordable debt.

Student loan debt is excessive if the total student loan debt at graduation exceeds the borrowers annual income. When total student loan debt exceeds annual income, the borrower will struggle to repay the debt over a 10-year repayment term.

Student loan debt is good debt, to the extent that it is an investment in the students future. But, too much of a good thing can hurt you.

See also:Complete Guide to Financial Aid and FAFSA

Recommended Reading: Best Place For Car Loan

How To Choose Between Subsidized And Unsubsidized Loans

Ultimately, subsidized loans are better for those with financial need, but they are also a wise choice simply to minimize the total amount of student debt you end up with after completing school. However, those who have larger borrowing needs than subsidized loans allow may find it necessary to supplement with unsubsidized loans.

Unsubsidized loans accrue interest from the day they are disbursed to the school and during all other periods regardless of loan status, says Betsy Mayotte, president and founder of the Institute of Student Loan Advisors , a 501 that offers advice and resources for students. For those reasons, subsidized loans are often less expensive over the long run for student loan borrowers, as they at least don’t have to contend with the interest that accrued while they are in school.

Follow Fortune Recommends on and .

EDITORIAL DISCLOSURE: The advice, opinions, or rankings contained in this article are solely those of the Fortune Recommends editorial team. This content has not been reviewed or endorsed by any of our affiliate partners or other third parties.

How To Apply For A Private Student Loan

Since private student loans are offered by banks and financial institutions , you apply directly to the lender.

Follow these instructions to apply for a private student loan:

It doesnt take long to fill out a private loan application online. If you apply for a loan with us, it only takes about 15 minutes to apply and get a credit decision.

Don’t Miss: New Conventional Loan Limits 2022

Federal Parent Loans For Undergraduate Students

Federal PLUS loans allow one parent with good credit and no federal student loans in default to borrow funds toward a dependents educational expenses. The dependent must be a degree-seeking undergraduate student enrolled in at least six credit hours.

The Direct Loan Servicing Center , a division of the U.S. Department of Education, processes KUs PLUS loans. To apply, visit studentaid.gov, then log in with the FSA ID used for the FAFSA.

The maximum amount a parent may borrow is the students cost of attendance, as determined by KU, minus any other financial aid received by the student. The Net Price Calculator can help calculate anticipated expenses and a specific amount to request.

A parent denied a PLUS loan may appeal the decision or reapply with an endorser, who would also be subject to a credit check. Their student is also eligible to request additional unsubsidized federal loans of up to $5,000, dependent on academic level, or up to the cost of attendance.

Direct Loan borrowers can find information about interest rates, origination fees, repayment plans, and more at studentaid.gov. The DLSC also provides correspondence regarding quarterly interest accrual and repayment options.

Financial Aid Vs Student Loans Compared

When comparing financial aid vs student loans, you need to be aware of the similarities and differences between financial aid vs student loans. Here are some key comparisons.

| Similarities | Differences |

|---|---|

| They can both be used to help fund education-related expenses. | Financial aid doesnt typically need to be repaid. Student loans must be repaid within a given loan term, plus interest. |

| FAFSA® must be filled out for financial aid and federal student loans. | Financial aid and student loans may be paid out differently. |

| Financial aid and student loans have certain eligibility requirements. | Some financial aid, like scholarships, may be awarded based on merit. Federal student loans can be both need and non-need based. Lending criteria on private student loans is determined by the lender. |

Also Check: What Is The Average Personal Loan Amount

Making The Best Decision For You: Subsidized Vs Unsubsidized Student Loans

Once you understand the differences between these two forms of financial aid for college students, it becomes easier to decide which is best for you.

For example, when choosing between a subsidized vs unsubsidized student loan, if you have financial need, the Department of Education will pay a portion of your interest. Depending on the amount of the loan, this can really add up.

On the flipside, if you opt for the unsubsidized student loan and you are an independent studentwhich essentially means that you are responsible for yourself financiallyyou can potentially borrow a higher amount.

As a first- or second-year undergrad, this amount is $6,000 versus $2,000 for dependent students. During subsequent years, the available amount for independent students increases to $7,000. In total, dependent students can borrow up to $8,000 in unsubsidized student loans. Independent undergrads can borrow as much as $34,500, with independent graduate or professional students able to borrow the most at $73,000.

The amount you can borrow on a subsidized student loan does not change based on your status as a dependent or independent student. It only changes based on your year of study. First-year undergrads can borrow up to $3,500. This amount increases to $4,500 the second year and $5,500 the third year and beyond.

For a refresher on dependent vs. independent college students, check out this blog article.

Consider Your Student Dependency Status

If youre not sure whether youre an independent or dependent student, check out the Department of Educations requirements. Once you know where you stand, youll know how youre affected.

Most important, knowing your dependency status can help you understand your maximum loan allowances, as well as your access to federal grants and tax deductions.

Keep in mind that, if you need more help paying for college after applying for federal loans and grants, you might consider private student loans.

Read Also: Will Switching Jobs Affect Home Loan

Unsubsidized Federal Student Loan

By contrast, unsubsidized federal student loans do accrue interest while the student is in school, beginning from the very first disbursement. However, they also have a six-month grace period after graduation before the student must begin making payments. These loans are not given out based on financial need, but still require a student to submit the FAFSA.

Interest rates for subsidized and unsubsidized federal loans are the same and remain fixed for the life of the loan. For undergraduate loans taken out between July 1, 2022, and June 30, 2023, the interest rate is 4.99%, and for graduate loans, the interest rate is 6.54%.

The total lifetime maximum amount of federal loans a dependent undergraduate student can take out is $31,000, but no more than $23,000 can be subsidized. The maximum amount an independent undergrad can take on is $57,500, with the same $23,000 cap on subsidized loans. Graduate and professional students can take on a lifetime total of $138,500 in federal student loans, and no more than $65,500 can be subsidized.

Types Of Financial Aid

Grants are financial aid dollars you dont have to pay back. You can get them from the federal government or your state government, and you typically have to have a financial need to qualify.

Scholarships also are financial aid dollars you dont have to pay back, but theyre typically based on your merit rather than your financial need. You can get scholarships from your college or university or private organizations, such as the local Elks Lodge.

Work-study is a federal program that funds part-time jobs for undergraduate and graduate students with a financial need. If you qualify for work-study, youll need to find an eligible work-study job on or near your campus and work to earn those dollars.

Federal student loans are fixed-interest-rate loans from the government. The direct loan program is the main federal loan program. Undergraduate students can borrow direct subsidized or unsubsidized loans. Graduate students can borrow direct unsubsidized or direct PLUS loans, and parents can borrow direct PLUS loans.

Private student loans are fixed- or variable-rate loans from a bank or credit union. To qualify, you typically need a good credit score or a co-signer who has good credit. Your rate will vary depending on your or your co-signers credit.

» MORE:How to get a student loan

You May Like: Get Pre Approved For Home Loan

Financial Aid Vs Scholarships: How They Differ

As you start to explore your college funding options, you may wonder about the difference between financial aid and scholarships. Read on to learn more.

Zina Kumok

If you’re just starting to explore your college funding options, things can get complicated pretty quickly. There are a number of related terms, and the differences between them arent always clear.

In this article, we’ll look at two topics that often get confused: scholarships and financial aid. We’ll outline the differences, explain their importance and help you understand where everything fits into the bigger college funding picture.

College Funding Options: Financial Aid Vs Student Loans

Paying for college is complicated. Todays students often draw upon multiple sources of funding, from scholarships to loans to federal financial aid. Since the funding options you choose now can impact your financial future for years to come, its important to know what youre getting.

The term financial aid can be confusing for many parents and students. Its often misused as a blanket term for all sources of college funding, including student loans. Theres a big difference between a federal grant and, for example, a private student loan.

You May Like: What Kind Of Auto Loan Can I Get

Identify Your True College Costs

Every college will include an estimated total cost of attendance somewhere on your award letter. While tuition and fees are typically the same for all students, housing, meals, books, supplies and other costs can vary based on your planned spending for college.

Instead of using the schoolâs averages for those amounts to determine how much attending that school will cost you, create a personalized list of expenses so you can understand your true net price. Take into account whether youâll be living on or off campus any specialized equipment youâll have to buy for your major whether youâll rent or buy used textbooks and any additional costs like child care, transportation and cell phone bills.

The collegeâs financial aid website can give you an idea of the average cost of on-campus housing, meals and books, and you can use a budget template like the CFPBâs to list your additional monthly expenses. Once youâve come up with a total, youâll be able to determineâafter taking into account grants, scholarships and work-study youâve receivedâhow much money youâd have to borrow to make up a shortfall.