When Does Debt Consolidation Make Sense

Debt consolidation may make sense for you if:

- You can qualify for a consolidation loan: You’ll generally need good credit as well as proof of income. If you can’t qualify based on your own financial profile, you may need a co-signer.

- You’re able to reduce the interest rate on your current loans by consolidating: It generally makes little sense to take a consolidation loan at a higher rate than your current debt, as you’d make repayment more expensive over time because of higher interest payments.

- You can afford the new monthly payments on your consolidation loan: You don’t want to borrow money if you’ll struggle to make the monthly payments.

- You have a solid financial plan: If you dont have one, consolidation could be risky if it simply makes you feel you’ve made progress on debt repayment when you’ve actually just moved your loan balance somewhere else. It’s also dangerous if you don’t have your spending under control and get deeper into debt once your consolidation loan frees up credit.

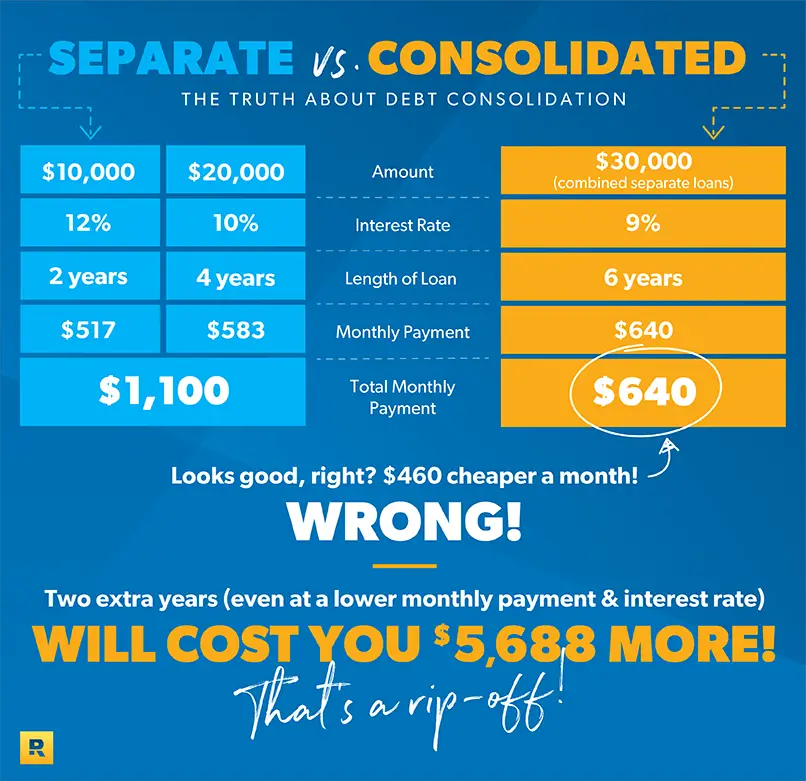

- You understand total repayment costs on your consolidation loan: Don’t focus solely on lowering your monthly paymentyou could make your loan cost more over time even with a lower paymentif you extend your repayment timeline.

Some debt consolidation loans come with high fees or prepayment penalties. These should be avoided as they could make repayment costs higher.

Things Debt Consolidation Means To You

Debt consolidation is used to improve financial problems for people with a lot of debts.

This is a good strategy to get your finances in order. This is one way to meet your financial goals over time. There are different types of debt consolidation.

So, it is important to ask what does consolidation mean for me? and figure out how it may impact your financial future.

Keep reading to learn what you need to know about consolidation and your financial situation.

Could Lower Interest Rate

If your credit score has improved since applying for other loans, you may be able to decrease your overall interest rate by consolidating debtsâeven if you have mostly low-interest loans. Doing so can save you money over the life of the loan, especially if you donât consolidate with a long loan term. To ensure you get the most competitive rate possible, shop around and focus on lenders that offer a personal loan prequalification process.

Remember, though, that some types of debt come with higher interest rates than others. For example, credit cards generally have higher rates than student loans. Consolidating multiple debts with a single personal loan can result in a rate that is lower than some of your debts but higher than others. In this case, focus on what youâre saving as a whole.

You May Like: How Do I Find Out My Student Loan Number

May Reduce Monthly Payment

When consolidating debt, your overall monthly payment is likely to decrease because future payments are spread out over a new and, perhaps extended, loan term. While this can be advantageous from a monthly budgeting standpoint, it means that you could pay more over the life of the loan, even with a lower interest rate.

You May Pay More In Interest Over Time

Even if your interest rate goes down when consolidating, you could still pay more in interest over the life of the new loan. When you consolidate debt, the repayment timeline starts from day one and may extend as long as seven years. Your overall monthly payment may be lower than youâre used to, but interest will accrue for a longer period of time.

To sidestep this issue, budget for monthly payments that exceed the minimum loan payment. This way, you can take advantage of the benefits of a debt consolidation loan while avoiding the added interest.

Also Check: Can I Refinance My Debt Consolidation Loan

Balance Transfer Credit Card

A balance transfer credit card can help you pay down your debt and minimize your interest rate if you have multiple credit card debts. Like a debt consolidation loan, a balance transfer credit card transfers multiple streams of high-interest credit card debt onto one credit card with a lower interest rate.

Most balance transfer credit cards offer a 0 percent APR introductory period, typically lasting anywhere from 12 to 21 months. If you can pay off all or most of your debt during the introductory period, you could save thousands of dollars in interest payments.

However, if you have a large outstanding balance after the period, you may find yourself in more debt down the road, as balance transfer credit cards tend to have higher interest rates than other forms of debt consolidation.

Best for: Borrowers who can afford to pay off credit cards quickly.

Key takeaway: Balance transfer credit cards make it easier to pay off your credit card debt and save a sizable amount in interest.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: Does Home Equity Loan Hurt Your Credit

The Challenges Of Debt Consolidation Loans

- You could end up paying a higher rate of interest on your debt consolidation loan. If it has a longer term, you may also pay more overall.

- Depending on the size of your original debt, you may end up taking out a consolidation loan which is larger than all of your combined debts.

- You may have to pay hidden or extra fees to clear your existing debts.

Please remember that its important to calculate exactly how much is already being paid back each month on existing loans and then compare it to the consolidated payment. If the payment is higher, it might not be a good idea to switch, even if a single repayment is easier to manage.

Is A Debt Consolidation Loan Good Watch Out For This Trap It Catches Most People

More and more people are asking a very important question. Is a debt consolidation loan a good idea? Are they good for your finances? The answer depends on your situation, but to properly answer this question, we should first let you know about the hidden downside of consolidation loans that many people dont see until its too late.

The downside to debt consolidation is that it can fool you and promote unhealthy financial habits. When people consolidate their debts, they often feel really good about themselves and their finances. Theyre pleased that theyve taken action on their debt. They know theyve made a smart move by reducing the interest theyre paying, and their finances are so much easier to manage with one monthly payment. Many times this monthly payment is lower than their previous payments, so now theyve got extra breathing room in their finances and a little more money to spend. Life now seems so much easier.

Dont let this happen to you. Create a budget today and make sure you are spending less money each month than you earn. As your life gets busier, following a budget will keep you on track and prevent you from slowly slipping into debt as your expenses increase.

Don’t Miss: What Is California Jumbo Loan Amount

Explore Your Debt Consolidation Options

- How it works: Once you know your numbers, you can start looking for a new loan to cover the amount you owe on your existing debts. If you’re approved for the loan, you’ll receive loan funds to use to pay off your existing debts. Then you start making monthly payments on the new loan.

- Consider your options. Wells Fargo offers a personal loan option for debt consolidation. With this type of unsecured loan, your annual percentage rate will be based on the specific characteristics of your credit application including an evaluation of your credit history, the amount of credit requested and income verification. Some lenders may have secured loan options which may offer a slightly lower interest rate, but keep in mind you are at risk of losing your collateral if you fail to repay the loan as agreed.

- Use our online tools. Wells Fargo customers can use the Check my rate tool to get personalized rate and payment estimates with no impact to their credit score. Funds are often available the next business day, if approved

What Does Debt Consolidation Mean

Debt consolidation means combining some or all of your debts into one new account with a single monthly payment. It doesnât erase your debt. But if youâre able to secure a lower interest rate, it may lead to lower monthly payments. And combining debts could also simplify how many different payments you have to make each month.

Ideally, debt consolidation can help you better manage your debt and pay it off more quickly.

Also Check: How Much Can I Get Approved For Usda Loan

How Debt Consolidation Works

Debt consolidation is the process of using different forms of financing to pay off other debts and liabilities. If you are saddled with different kinds of debt, you can apply for a loan to consolidate those debts into a single liability and pay them off. Payments are then made on the new debt until it is paid off in full.

Most people apply through their bank, , or credit card company for a debt consolidation loan as their first step. It’s a good place to start, especially if you have a great relationship and payment history with your institution. If youre turned down, try exploring private mortgage companies or lenders.

are willing to do this for several reasons. Debt consolidation maximizes the likelihood of collecting from a debtor. These loans are usually offered by financial institutions such as banks and , but there are other specialized debt consolidation service companies that provide these services to the general public.

How A Personal Loan Can Improve Your Credit

A personal loan can improve your score in the following ways:

- It lowers your credit utilization ratio. Paying down credit card debt lowers your a comparison of your cards’ balances and credit limits. Credit utilization can have a big impact on your credit scores, and a lower utilization is best.

- You’ll have fewer accounts with balances. If you’re paying off other loans and credit cards, you’ll have fewer accounts with a balance, which could be good for your score.

- You’ll potentially add to your credit mix. Having a mix of revolving and installment accountsyour could also be good for your score.

- It will help establish a positive payment history.Making your loan payments on time can add more positive payment history to your credit report.

Don’t Miss: What Loan Can I Get To Buy Land

Your Behavior With Money Doesnt Change

Most of the time, after someone consolidates their debt, the debt grows right back. Why? Because they dont have a game plan for sticking to a budget and spending less than they make. In other words, they havent established good money habits for staying out of debt and building wealth. Their behavior with money hasnt changed, so why should they expect their debt status to change too?

Debt consolidation doesnt fix any problems. It just shuffles them around.

Whats A Debt Consolidation Loan And Where To Get Help

Some people arent sure what a debt consolidation loan is, or what the best way to consolidate credit card debt may be for their situation. Contact us for expert advice and guidance about the best consolidation options for car loans, credit card debt, personal loans and more. Speak with an experienced Credit Counsellor. We will help you find the right solution before its too late. Speaking with one of our non-profit Credit Counsellors is completely free and confidential. No matter how complicated your situation may be, they will provide you with information so that you can figure out the best solution.

You May Like: How Much Do Loan Processors Make Per Loan

Control Your Loans And Debts Through Consolidation

What does it mean to consolidate a loan? Taking several existing personal loans, payday loans, and other debts and combining them into a single new loan can be a great way to make your overall debt levels more manageable and easier to pay off. Consolidating loans, especially those with high interest rates and short payment horizons, may be just what you need to get your financial house back in order. Talk to a trusted financial expert and see if debt consolidation is a good choice for you.

How Consolidation Loans Are Issued

When you receive a traditional debt consolidation loan, the company lending you the money either uses the funds to pay out the debts you jointly agree will be paid off, or they deposits the funds it in your bank account and it is then your responsibility to pay out the debts or bills you wish to consolidate with the loan proceeds.

Don’t Miss: Can Mortgage Insurance Be Removed From An Fha Loan

Can Improve Credit Score

Applying for a new loan may result in a temporary dip in your credit score because of the hard credit inquiry. However, debt consolidation can also improve your score in a number of ways. For example, paying off revolving lines of credit, like credit cards, can reduce the credit utilization rate reflected in your credit report. Ideally, your utilization rate should be under 30%, and consolidating debt responsibly can help you accomplish that. Making consistent, on-time paymentsâand, ultimately, paying off the loanâcan also improve your score over time.

Con: You Might Not Save Money

Consolidating your federal loans is a strategic move to help you manage your debt. If your repayment term is extended, your monthly payment will be lower but youll pay more interest over time.

If you consolidate with the federal government, your new interest rate will be the weighted average of your federal loans’ interest rates, rounded up to the next one-eighth of the percentage point.

Private refinancing could lower your interest rate and thus lower your payment or shorten your repayment term.

Also Check: Is Parent Plus Loan Federal

What Is A Consolidation Loan

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

If youre juggling multiple debts, you might be able to simplify repayment with a debt consolidation loan. As long as you qualify, a consolidation loan lets you combine your debts into a new loan with more favorable terms than you had before. Not only can you streamline your debts into a single monthly payment, but you might also be able to lower your monthly bill and save money on interest.

While there are benefits to debt consolidation, though, it isnt right for everyone.

Heres what you need to know if youre thinking about consolidating your credit card or other debt with a consolidation loan:

What Does It Mean To Consolidate A Loan

If youre struggling with the amount of debt youre carrying right now, from car and personal loans to credit cards, then youre in good company. Americans overall are mired in debt in fact, American households are carrying $14.6 trillion in debt right now, with the average American buried under debts totaling over $90,000. Consumers seeking to get their debts under control use many different methods to address them, including debt consolidation. While debt consolidation is a way to address all of a borrowers credit cards, it can be an effective way to deal with automobile and personal loans as well. So, what does it mean to consolidate a loan?

Also Check: Can You Keep Your Car Loan In Chapter 7

How Much Does It Cost To Consolidate Your Debt

The cost of debt consolidation depends on which method you choose, but each one of them includes either a one-time or monthly fee. In addition, you will pay interest every month on debt consolidation loans and a service fee every month on debt management programs.

Generally speaking, the fees are not overwhelming, but should be considered as part of the overall cost of consolidating debt.

Alternative Options To Debt Consolidation

Taking out further loans if youre already in debt is not always the best way to manage your money, especially if it encourages even more borrowing on top of the consolidated loan. You may also not be able to get a consolidated loan if you have a poor credit history.

It is possible to arrange something called a Debt Management Plan, which is an agreement between a borrower and their lenders on how debts will be repaid. This will be arranged by a third party and may involve some kind of set-up or handling fee.

There are providers that do this for free, such as StepChange, Payplan and National Debtline. These plans can be useful for people who are struggling to make repayments in the short-term and need to rearrange how they pay.

For people in more serious debt, it may be necessary to consider insolvency procedures like a Debt Relief Order or an Individual Voluntary Arrangement. Both of these options are formal procedures which prevent creditors taking legal action for a period of time.

Don’t Miss: How To Loan An Audible Book