Veterans And Preparing For Va Closing Costs

The VA loan program was established to help make it easier for veterans to become homeowners. They do this by eliminating the down payment, which is a large upfront cost that other types of mortgages usually require. However, even without the need to make a down payment, you will still be required to pay for a number of VA Home Closing Costs.

Dont Miss: What Car Loan Can I Afford Calculator

Shop Around For Lenders

As the buyer, you get to choose which mortgage company you want to work with. Dont be afraid to take some time to shop around for lenders.

Contact a few competing loan providers and ask what types of fees they charge. Choose a lender that offers low fees and competitive interest rates for lower overall closing costs.

What Is A Va Funding Fee

VA loans offer affordable alternatives to conventional mortgages for eligible service members, as well as certain family members. Removing the down payment from the equation is a huge incentive for many prospective homebuyers not to mention the competitive interest rates and absence of private mortgage insurance.

But the Department of Veterans Affairs needs to offset those cost-savings in other ways and thats where the VA funding fee comes into play.

Don’t Miss: Rate For Home Equity Loan

Average Closing Cost On A Va Home Loan

The average closing costs of a home purchased using a VA loan varies a little bit. For larger home purchases, expect to pay between 1 and 3 percent. For less expensive home purchases, closing costs are more likely to range from 3 to 5 percent. Many factors contribute to the total closing costs of a home, including the lender youre using and the location of your home. The VA enforces a cap on what you can pay in closing costs as well.

Why You Can Trust Bankrate

At Bankrate, we strive to help you make smarter financial decisions. To help readers understand how insurance affects their finances, we have licensed insurance professionals on staff who have spent a combined 47 years in the auto, home and life insurance industries. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation of how we make money.

Don’t Miss: What Is Difference Between Secured Loan And Unsecured Loan

How Do I Estimate Closing Costs

Closing costs usually range from 3% 6% of the home price. 1 So, if you buy a house for $ 200,000, your closing costs can range from $ 6,000 to $ 12,000. Closing fees vary depending on your situation, type of loan, and mortgage, so it is important to pay attention to these fees.

What is included in the estimated closing costs? Closing costs are costs that exceed the cost of property that buyers and sellers often enter into to complete the real estate business. Those costs may include borrower fees, discounts, exam fees, subject research, subject insurance, research, taxes, recording fees and credit report fees.

Can You Avoid Paying Closing Costs

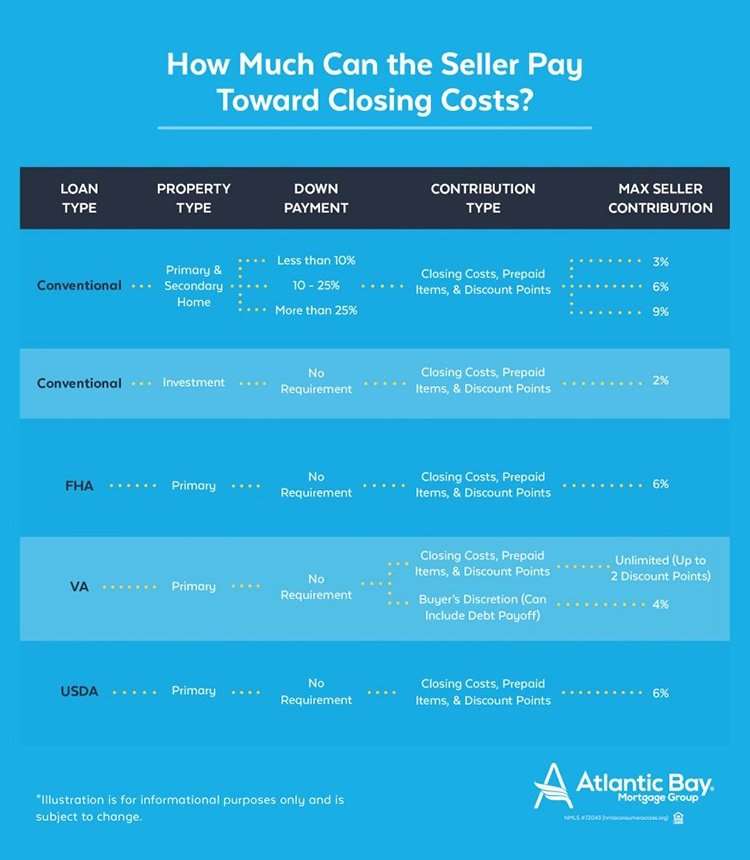

Who actually ends up paying for your closing costs depends on what you can negotiate with the person selling you the home. The seller may pay a part of your closing costs. Seen as a seller concession, this is restricted to 4 percent of the sale price of the home. Your realtor can also pay some closing costs as a credit at the closing table. Your lender can pay some or all of your closing costs with a lender credit.

If you cant afford to pay the closing cost, tell your real estate agent that youre buying your home with a VA loan. Your agent might be able to request that the seller cover some or all of your closing costs.

You May Like: Can You Get An Fha Loan With No Money Down

How Military Buyers Can Include Va Closing Costs In Their Purchase

The two most popular questions on a VA loan are: How much is my monthly payment? and How much do I need to bring to closing? VA home loans are 100% financed . In this article, we explain closing costs and buyer strategies and solutions allowed by the Veterans Administration. These solutions may be huge for Veterans, service members, and surviving spouses looking to purchase a home.

Do You Qualify For A Va Funding Fee Exemption

Some veterans may be able to have their funding fee waived. Be sure to speak with a VA lender to see if you qualify for a funding fee exemption. Here are the most common reasons you may be able to waive your VA funding fee.

- If you receive VA compensation for a service-connected disability

- If youre eligible for VA compensation for a service-connected disability but are receiving retirement or active-duty pay instead

- If youre a surviving spouse of a veteran who died in service or from a service-connected disability, or was totally disabled, and youre receiving Dependency and Indemnity Compensation

- If youre a service member with a proposed or memorandum rating, before the loan closing date, saying youre eligible to get compensation because of a pre-discharge claim

- If youre a service member on active duty who before or on the loan closing date provides evidence of having received the Purple Heart

Recommended Reading: What Is The Va Loan Maximum Amount

Who Qualifies For The Closing Cost Assistance Program

The Closing Cost Assistance program is not only for veterans and military personnel qualifying for VA loans. First time home buyers or First Responders may qualify for the program and use it for closing costs or even down payments. It can also be used for conventional, FHA and even USDA loans. This is especially beneficial for veterans that for one reason or another, dont qualify for a VA loan or dont meet the VA eligibility requirements.

Recommended Reading: How Do I Refinance My Car With Bad Credit

How Closing Costs Differ With Va Loans

Closing costs is a bit of a catchall term that is used to describe a wide range of fees and expenses that can be charged during the purchase of a loan.

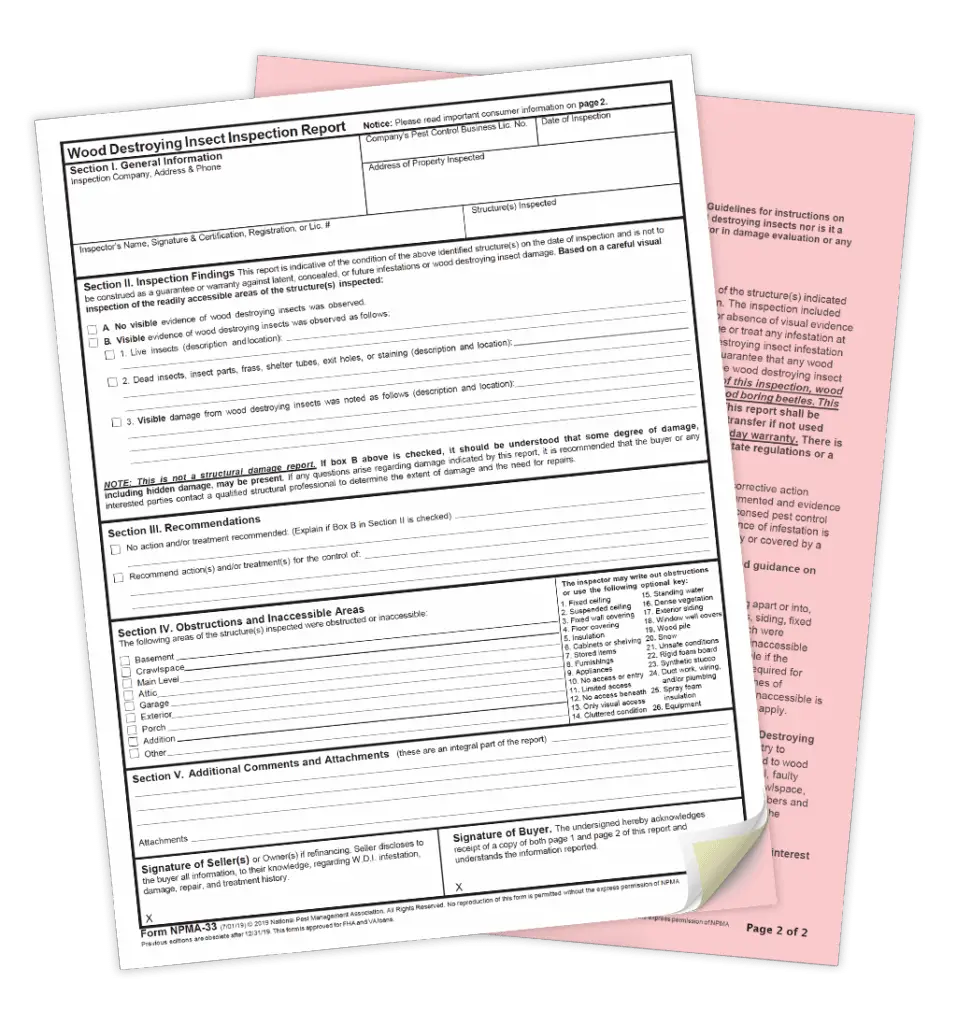

For example, discount points may be purchased to lower the interest rate on the loan. You may also be required to pay fees for an appraisal, pest inspection and a credit report by the lender. A portion of the property taxes and homeowners insurance may also be required at closing.

While watching these fees add up is unsettling if you are not prepared, the VA does have guidelines in place to ensure that they are fair. For instance, the lenders can only charge one percent of the loan for the origination fee.

Recommended Reading: How To Apply For Va Loan

Maybe You Would Like To Learn More About One Of These

Maybe you would like to learn more about one of these? Check spelling or type a new query. Does a va home loan cover closing costs. We did not find results for:

Maybe you would like to learn more about one of these? Does a va home loan cover closing costs. Check spelling or type a new query. We did not find results for:

Maybe you would like to learn more about one of these? Check spelling or type a new query. We did not find results for: Does a va home loan cover closing costs.

Check spelling or type a new query. We did not find results for: Maybe you would like to learn more about one of these? Does a va home loan cover closing costs.

We did not find results for: Maybe you would like to learn more about one of these? Does a va home loan cover closing costs. Check spelling or type a new query.

Maybe you would like to learn more about one of these? Check spelling or type a new query. We did not find results for: Does a va home loan cover closing costs.

You May Like: Va Loan Mobile Home Requirements

Applying For Closing Cost Assistance

A local closing cost assistance program in your area could help. These programs vary a lot by location.

Some programs offer forgivable loans or grants that could cover your closing fees others can lend money for closing costs at no interest but youd have to repay the loan when you sold, refinanced, or paid off your home.

Ask your loan officer about programs in your area, or just Google local closing cost assistance.

Read Also: Banks That Offer Construction Loan

Can A Realtor Contribute To Closing Costs On A Va Loan

The buyers real estate agent may pay some of the closing costs in the form of a loan on the closing table. The lender can repay or deduct a portion or all of the borrowers mortgage debt with the lender, usually by adjusting the debtors interest. This is similar to buying price points.

How much can a retailer help with closing prices on a V loan? IVA allows the seller to agree on VA loans, but their rules state that the seller can only offer up to 4% of the purchase price or value of the property. For example, if a house is valued at $ 200,000, contracts may not exceed $ 8,000 .

Other Va Loan Closing Costs

Heres a look at other VA loan fees.

- Lenders title insurance. Youll buy a lenders title policy to protect your lender from title disputes such as tax liens or judgments.

- Discount points. You can pay an upfront fee as a percentage of your loan amount to get a lower interest rate.

- Escrow account. Your homeowners insurance and property taxes are usually paid as part of your monthly payment. Funds are collected at closing to set up the escrow account.

- Prepaid fees. You may need to prepay a portion of your ongoing homeowners insurance and property tax costs at closing.

Also Check: Refinance Auto Loan With Same Lender

Also Check: Will Banks Loan On Manufactured Homes

Closing Costs Vs Concessions

The fact that sellers can pay all your closing costs can be advantageous. However, you have to understand that they aren’t required to. This arrangement results from negotiating with the seller. There is another way around it: concessions.

The VA offers a broad definition for concessions as anything value-added to a transaction by the seller or builder where the buyer isn’t required to pay any additional costs. The seller isn’t usually required or expected to provide or pay. You could ask the seller to pay close to 4% of the home’s purchase price, covering non-loan-related costs, etc.

Some typical seller concessions involve:

- Having the seller cover prepaid insurance costs and raxes.

- Having the seller avail credits for any items left behind, including lawnmowers and pool tables.

- Have the seller pay off the buyer’s lease termination, judgments, and collections fees.

Often, you can go as high as you need when asking for concessions as long as you stick to the 4 % cap.

VA buyers must also pay a VA funding fee to keep the loan program functioning. The fee is often 3.3 % of the total loan amount if you aren’t making a down payment. Note that you are not supposed to pay the fee if you get VA disability compensation.

You could request the seller pay the fee, but it would go against the 4% concessions cap. You may also ask the seller to reduce the purchase price by however much the fee totals. But, most people prefer rolling it into their loan balance.

What Is A Normal Amount Of Closing Costs

How much does it cost to close? The average customer closing costs are between 2% and 5% of the loan amount. That means that if you buy $ 300,000 at home, you will pay from $ 6,000 to $ 15,000 for closing costs. The most expensive way to cover your closing costs is to pay them out of pocket as a one-time expense.

What is a good estimate for closing costs?

Closing costs usually range from 3% 6% of the home price. 1 So, if you buy a house for $ 200,000, your closing costs can range from $ 6,000 to $ 12,000. Closing fees vary depending on your situation, type of loan, and mortgage, so it is important to pay attention to these fees.

What are 3 typical closing costs?

Final Thoughts on Closing Costs The cost of closing a mortgage loan is usually about 3% 6% of the total amount of your mortgage. Examination fees, attorney fees and exam fees are examples of common closing costs. The exact closing costs that you will pay will depend on the type of loan you have, the value of your home and the laws of your country.

Recommended Reading: What Is The Va Max Loan Amount

How Can I Avoid Paying Va Loan Closing Costs

If expensive closing costs are preventing you from purchasing a home with a VA loan, there are a few options you can explore like seller concessions, closing cost assistance and lender credits. Compare the pros and cons of each option in the table below, then talk to a VA lender to discuss which is the best route for you.

| Pros |

|---|

Va Loan Fees The Borrower Cannot Pay

When you go to purchase a home with a VA guaranteed mortgage, youll typically encounter fees like closing costs and other expenses. How those get paid is often a matter of negotiation between you and the seller. But there are also fees the VA does not allow the buyer to pay.

Did you know the lender or seller cant charge the borrower for attorneys fees? If the buyer chooses to pay for his or her own attorney, thats the buyers call, but the buyer cant be charged for the banks legal representation.

The VA also prohibits a real estate agent from charging the buyer a commission. Youll also find VA mortgage rules that close any loopholes that might allow an agent to charge fees appearing to be commissions even if not defined as such. Other costs that the VA prohibits buyers from paying include:

- Notary public fees

- Cost of termite inspection

It is legal for a house hunter to contact and use a buyer broker to find a suitable property, but buyers cannot pay brokerage fees and commissions. The VA adds that property availability and purchase price information is widely available. Forbidding a VA mortgage applicant from paying a commission or fee to a buyer broker doesnt impair the buyers ability to find a suitable property.

You May Like: What Bank Has The Best Used Car Loan Rates

Appraisal And Compliance Inspections

The veteran can pay a VA Appraiser fee and VA compliance inspectors fee. The veteran can also pay for a second appraisal if they are requesting a reconsideration of value. The veteran cannot pay for a second appraisal if the lender or seller is requesting a reconsideration of value or if parties other than the veteran or lender request the appraisal.

Read Also: What Is The Commitment Fee On Mortgage Loan

Why Do Sellers Hate Va Loans

Many sellers and their real estate agents do not like VA loans because they believe that these loans make it difficult to close or expensive for the seller. It rarely closes on other types of mortgages. Take years to close.

Why are VA loans so bad? The low interest rates on VA loans are deceptive. Both of them will end up costing you more interest on debt life than those at the age of 15. In addition, you may receive lower interest rates on a 15-year fixed-rate old loan than on a 15-year VA loan.

Read Also: How Many Times Can You Refinance An Auto Loan

Can Closing Costs Be Included In A Va Loan

If youre an eligible veteran, service member or surviving spouse, a VA loan can help you purchase or refinance a home with low upfront costs. However, low costs dont necessarily mean no costs. Like other types of home loans, VA loan borrowers will have to pay fees known as closing costs to lenders for processing their loan.

Fortunately, VA loan borrowers have options to reduce the amount they pay out of pocket. In this article, well answer what VA loan closing costs are and if closing costs can be included in a VA loan.

How Is The Va Funding Fee Paid

Your VA funding fee is due at closing. You can pay the fee in cash or finance it into your total loan amount. Another option is to ask the seller to pay your VA loan closing costs as part of seller concessions. Note: the seller cant pay more than 4% of the loan amount in closing costs.

Heres an example. You are regular military personnel buying a $250,000 home with 100% financing. Youre using a VA loan for the first time, so your funding fee would be 2.3%, or $5,750. You can either pay this fee upfront at closing, or tack it on to your total loan amount, financing $255,750.

Also Check: How To Get Statement Of Service For Va Loan

Va Loan Closing Costs: Who Pays What

Banks Editorial Team

Banks Editorial Team

Veterans and active military members fight to protect their country. The government offers several perks to military members to reward them for their service, including VA loans. While getting a VA loan has several advantages, some borrowers wonder who is responsible for closing costs. These costs can add thousands of dollars to your loan. Saving on costs can make a house feel more affordable and help you get out of your loan sooner. We will unveil the details surrounding VA loans, so you know who pays what.

Refinance Your Home Loan or Pull Cash Out for Debt Consolidation, Home Improvement & More. $275 Billion Funded Loans. Apply in Minutes. Fixed & Adjustable Rates. Purchase Mortgage & Refinancing.