What If I Need Another Copy Of My Irs Form 1098

To file your taxes, you are not required to include a copy of your IRS Form 1098-E. However, you do need the amount from the form to know how much paid interest to deduct. To access the form electronically, log in to your Nelnet.com account. Once youre logged in, click Documents and select Tax Info.

I Am A Member Of The Us Military Am I Eligible For Any Special Federal Student Loan Benefits

Nelnet is grateful to those who serve or have served our country, and we recognize the sacrifices you have made. As a member of the U.S. military, youre entitled to special benefits provided by the U.S. Department of Education and the U.S. Department of Defense. To learn more about these benefits, see Resources for Servicemembers.

What Is A Grace Period

This is a six-month period of time after youve left school before youre required to start making payments on your Direct Subsidized and Unsubsidized loans. For graduate and professional students with Grad PLUS loans, you have a similar six-month deferment period after leaving school before you begin repayment. For more information about grace and other stages in a student loan life cycle, see Stages of a Student Loan.

Read Also: What Does Va Loan Mean

Why Do You Ask Me For My Complete Mailing Address Phone Number And Email Address When You Call Me

When we talk with you, we want to ensure we have your most current information. In part, this is because we need to make certain we only discuss account details with the correct parties associated with your loan. In addition, in the Borrower’s Rights and Responsibilities section of the promissory note you signed for your loan, you promised to provide your servicer with your most current contact information to help us reach you with important account notifications.

Can I Have Automatic Monthly Payments Debited From A Spouses Or Parents Bank Account

No. Automatic monthly payments may only be debited from a bank account for which you are the account holder. A third party can, however, quickly and easily make a one-time payment by logging in to their free online authorized payer account at Nelnet.com First, you need to set up the person as an authorized payer. For more information about setting up an authorized payer, go here. Any authorized payer can also mail a payment, pay through their bank with its bill pay service, or make a payment over the phone.

Recommended Reading: How Much House Can I Afford With Fha Loan

Borrower Defense To Repayment

According to the Higher Education Act, if your college or university misled you or engaged in illegal activity, you can seek out loan forgiveness.

Historically, this forgiveness option had been rarely used. However, in 2017 the Department of Education reviewed its borrower defense policies and announced new guidance.

As of the end of 2020, 61,511 borrower defense applications have been approved out of 338,062 total applications received. Learn more about borrower defense loan forgiveness at StudentAid.gov.

How To Make Repayment

Income-Driven Repayment Plans

Income-driven repayment plans are a good choice if your monthly payment feels high in relative to your income. There are four income-driven repayment plans obtainable, all of which come with diverse options based on your needs. Each of these reimbursement plans is suitable for Public Service Loan Forgiveness.

Revised Pay As You Earn Repayment

This plan is for Direct Loans only, and comprises of a regular monthly payment amount centered on your adjusted gross income, family size, and total eligible federal student loan balance. Your steady monthly payment amount will usually be 10 percent of your optional income. This plan allows you to be suitable for loan forgiveness if you meet the following standards:

- You should Make a suitability payments for like 20 years for undergraduate-level only debtors or 25 years for graduate-level borrowers

- Have only undergraduate-level federal student loans

- Or for 25 years if you have at least one qualified graduate-level federal student loan

Please take note that some student loans are not qualified for this plan, including Federal Family Education Loan Program Loans, as well as Federal Direct Parent PLUS and Federal Direct Consolidation Loans covering at least one Federal Parent PLUS Loan. Qualified student loans can be placed on the REPAYE Plan after they are in a repayment rank.

Pay As You Earn Repayment

Income-Based Repayment

CSN Team.

Recommended Reading: How Much Will The Va Home Loan Give Me

Meet Nelnet Federal Student Loan Services

We have a decades-long history of providing high-quality, customer-focused federal loan services and support to the Department of Education. Our reliable, flexible, scalable federal loan servicing solution is supported by operational expertise with highly complex programs, leading to compliant, risk-free servicing and positive borrower and government outcomes.

Temporary Expanded Public Service Loan Forgiveness

If you applied for PSLF and were denied because some or all of your 120 payments didnt qualify, you still have another option .

The government saw that PSLF guidelines werent initially clear, so they created Temporary Expanded PSLF .

TEPSLF gives borrowers a second chance to qualify for loan forgiveness. To take advantage of this TEPSLF opportunity, you must have:

- Submitted a PSLF application and been denied because some or all payments werent made under a qualifying repayment plan.

- Had at least 10 years of full-time employment approved by MOHELA.

- Met requirements for the last 12 months worth of payments before applying for TEPSLF, including the last payment before applying .

- Made 120 qualifying payments under TEPSLF standards while working full-time for a qualifying employer.

If you were denied PSLF because of a technicality or issue with your student loan repayment, its worth looking into TEPSLF to see if you qualify. Not all loans qualify for TEPSLF, so be sure to look at all of the stipulations before pursuing this option.

Don’t Miss: State Of The Union Student Loans

Nelnet To Locate Higher Lakes Academic Mortgage Features

by andrew authaccount | Jan 2, 2023 | Uncategorized |

Nelnet to locate Higher Lakes Academic Mortgage Features

Nelnet and you will High Lakes have also been working together for pretty much 2 years to develop a separate, world-class servicing system to own authorities-owned student loans using a joint venture. The fresh new upkeep platform under development commonly make use of modern technology so youre able to effortlessly size for additional frequency, cover customers suggestions, and you may support improved borrower sense efforts. The efficiencies attained from the leverage one program to own government-owned fund help millions more individuals offers High Ponds and you may Nelnet chances to spend money on strategies to next augment debtor experiences.

Shifting into growth of the state-of-the-ways mortgage maintenance platform commonly allow us to supply the finest possible experience having consumers while the our very own groups come better together with her, said Joe Popevis, president off Nelnet Varied Options . NDS is the owner of Nelnet Servicing, Nelnets upkeep team, and also will own Great Lakes repair providers. That online payday loans Mississippi it purchase boosts our very own technology consolidation and you will collaboration, making us throughout the most powerful position youll be able to to enhance the development of your own the new system.

Potential Changes To Nelnet

The federal government announced in June 2020 that it would undergo a major restructuring of its loan servicer agreements. The agreement would only include five major servicers. Nelnet was excluded. But Nelnet was one of six companies that were retained as loan servicers when the restructuring was announced in October 2021, with greater oversight to protect borrowers.

Read Also: Can I Build My Own House With An Fha Loan

What If I’m Behind On My Payment Or Anticipate Having Some Difficulty Making My Payment

If youre having trouble making payments or worried that making your payments could become difficult, contact Nelnet right away. We can help you take advantage of options that may be available to help you lower payments or postpone your payments . Log in to your Nelnet.com account and click Repayment Options.

Direct Plus Loans For Parents

Parents may choose to offset the cost of higher education by obtaining loans to help pay for those expenses.

Benefits: PLUS loans can help cover the educational expenses not met by federal student aid. Additionally, parents can defer payment on loans until after the student’s graduation. As these loans are not need-based, parents don’t need to demonstrate financial need to apply.

Eligibility: Eligibility depends on a modest credit check. An endorser may be required if the borrower has adverse credit. Some schools require that a FAFSA be completed before a PLUS loan can be awarded, but some do not.

You May Like: Current Apr For Car Loan

How Do I Log In To My Nelnetcom Account

If you’re a borrower and you want to make a payment on your loan, explore repayment options, or view loan details, visit our Log In page and enter your username and password.

If you’re making a payment on someone’s behalf, visit our Log In page, select “Make a Payment for Someone Else,” and enter your username and password.

Do Parents With Parent Plus Loans Get A Grace Period

Although Parent PLUS Loans dont have a grace period, borrowers with PLUS Loans disbursed on or after July 1, 2008, might be eligible to postpone payments while the parent or student is in school and up to six months after graduation or when they drop below half-time enrollment status. For more information about Parent PLUS Loans, including the option to postpone payments, see Stages of a Student Loan.

Recommended Reading: Government Loan For Small Business

What Is The Process For Applying For An Income

When you apply online via your Nelnet.com account for an IDR Plan, you will be directed to log in to StudentAid.gov, where you can submit your application to us. Through the online application, you have the option to securely transfer your Adjusted Gross Income information from your federal tax form to your online application using the IRS Data Retrieval Tool.

Please note, if you elect to send alternative documentation of your income or indicate on your application that the Adjusted Gross Income from your tax return doesn’t reflect your current income, you must send supporting income documentation to the address or fax number below before we can review and process your repayment plan request.

Nelnet Fax: 866.545.9196

How Can I Change My Repayment Plan

To explore options or make changes to your repayment plan, contact us, log in to your Nelnet.com account, or see Repayment Plans. You can also visit the office of Federal Student Aid’s website at StudentAid.gov to review other options like consolidation.

You may prepay your loan at any time without penalty, regardless of repayment plan.

To learn more about the various repayment plans you may be eligible for, log in to your Nelnet.com account and click Repayment Options.

Don’t Miss: How Long To Get Approved For Parent Plus Loan

Get More Help For The Road Ahead

Backed by a company thatâs helped over 30,000,000 students successfully navigate repayment, Nelnet Bank was established to help make your educational dreams a reality. This strong background helps us offer a wealth of knowledge and educational funding solutions that give you an advantage at every step.

How Will I Know You Have Received And Processed My Final Payment To Pay Off My Loan In Full

Within about 30 days after you have paid your loan in full, we will mail a letter confirming the payoff to the address we have on file for you. You dont need to make a special request for this letter. You also can confirm your loan balance by logging in to your Nelnet.com account and clicking Loan Details.

Don’t Miss: How To Get Rid Of School Loan Debt

You Dont Recognize Your Security Image

If you dont recognize the security image on the Enter Password page, you may have entered a username that does not belong to you. Click Back to enter your username again. If you dont remember your username, visit Forgot Username.

If you are still unable to access your account, call us at 888.486.4722 for assistance.

How Would A Deferment Or Forbearance Impact Auto Debit And Incentives

Automatic monthly payments are not debited during deferment or forbearance. If the 0.25% auto debit interest rate reduction incentive or an on-time payment incentive is active on the account, it may become inactive during the deferment or forbearance period, and may return to an active status once your deferment or forbearance ends, depending on your lenders guidelines *. If your account is set up for auto debit when your deferment or forbearance ends, the auto debit will resume.

*Certain lenders, including the U.S. Department of Education, suspend the .25% interest rate reduction when your loan is not in an active repayment status. back

You May Like: Rolling Closing Costs Into Loan

Release Of Information To 3rd Party Vendors

For schools that are working with an external vendor and wish to release their borrower information through Nelnets Nsight program, they must complete the attached School Authorization for Release of Information to Vendor form and return it to Nelnet. Additionally, vendors that will be working on the schools behalf to pull borrower information must complete the Vendor Remote Access Agreement Nsight form and return it to Nelnet .

Completed forms can either be scanned and emailed to Nelnets School Service Center at or faxed to 888.274.9876. The School Service Center will notify both the school representative and the vendor representative once all required forms are received and the set-up is complete. Once both forms have been received, most user set-ups should be completed within 3 business days.

School Authorization for Release of Information to Vendor: This form should be completed by the school and returned to Nelnet. Please be sure to complete all requested information to help ensure timely processing of the request.

Vendor Remote Access Agreement Nsight: This form should be completed by the vendor and returned to Nelnet. Please be sure to complete all requested information to help ensure timely processing of the request. Note: if vendor has returned a completed agreement form to Nelnet in the past, they do not need to submit another one.

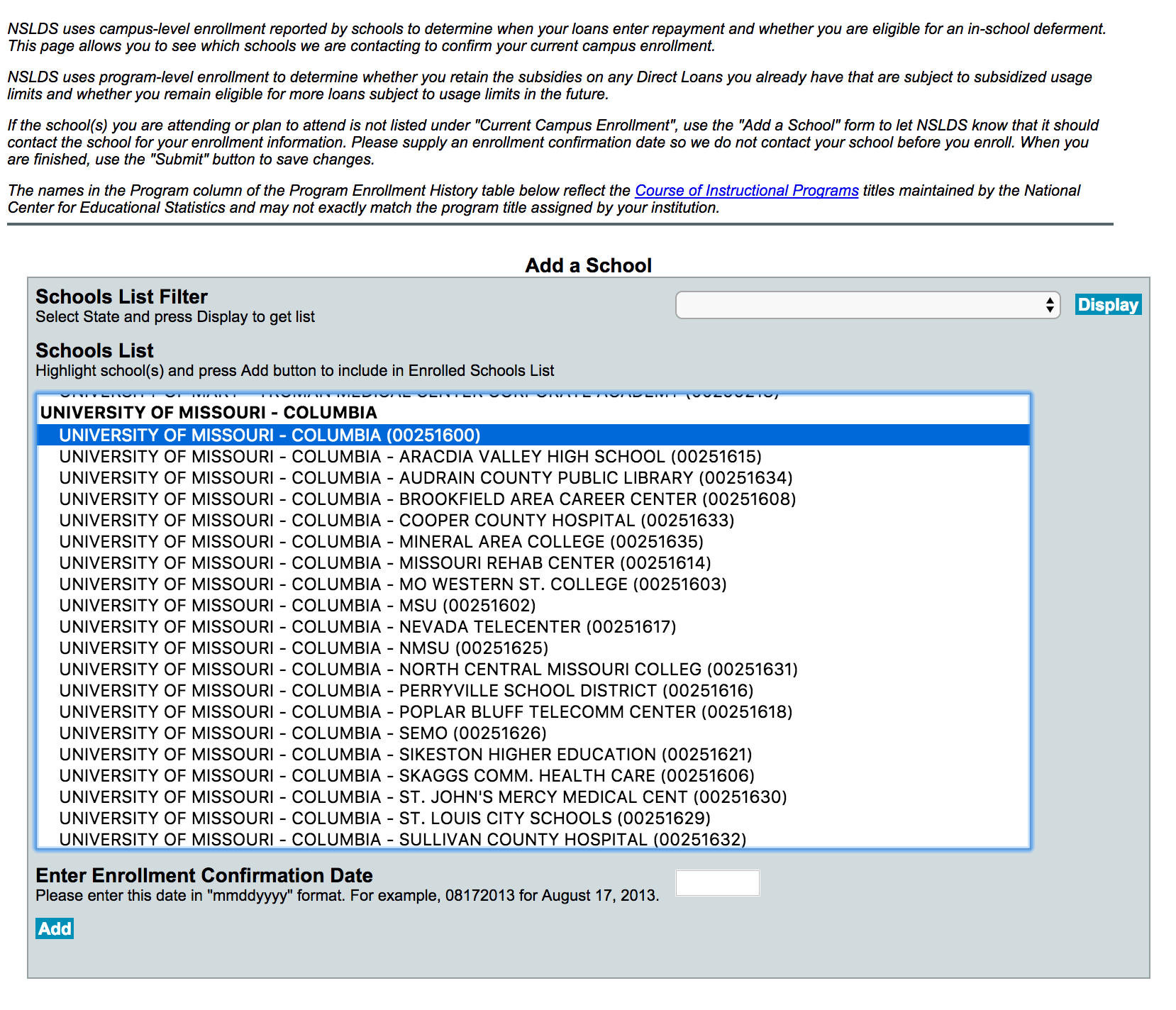

Servicer Of Your Federal Student Loans

Your federal student loans may or may not all be with Nelnet or another servicer. It’s important that you know which servicer provides customer service for each of your student loansand it’s simple to verify. You can access all of your federal student loan data at StudentAid.gov by logging in with your FSA ID. To create or update an FSA ID, visit FSAID.ed.gov.

You May Like: Loan Amortization Schedule With Extra Payments

Nelnet Makes It Easy To Stay Up To Date On Your Student Loan Information

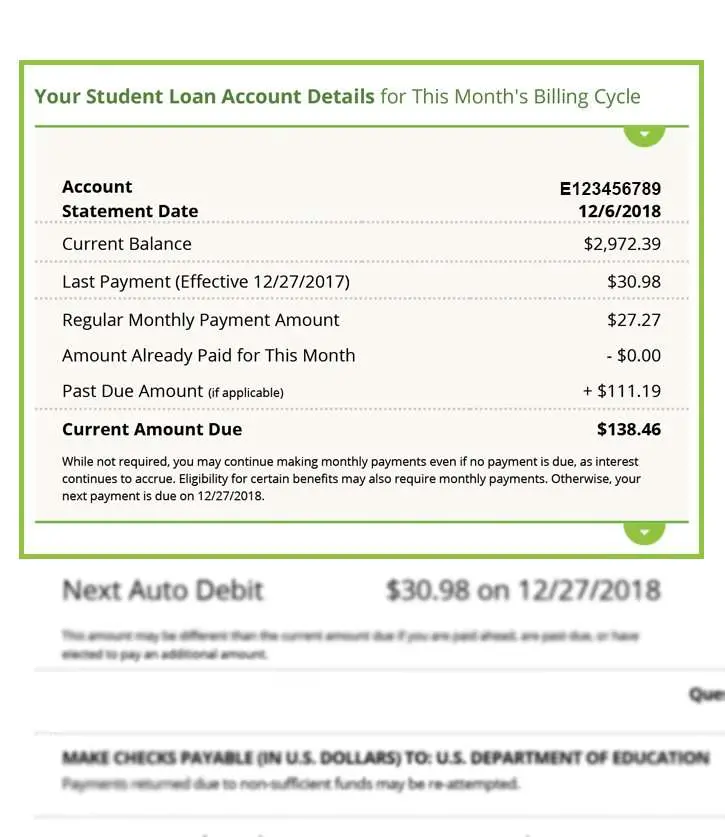

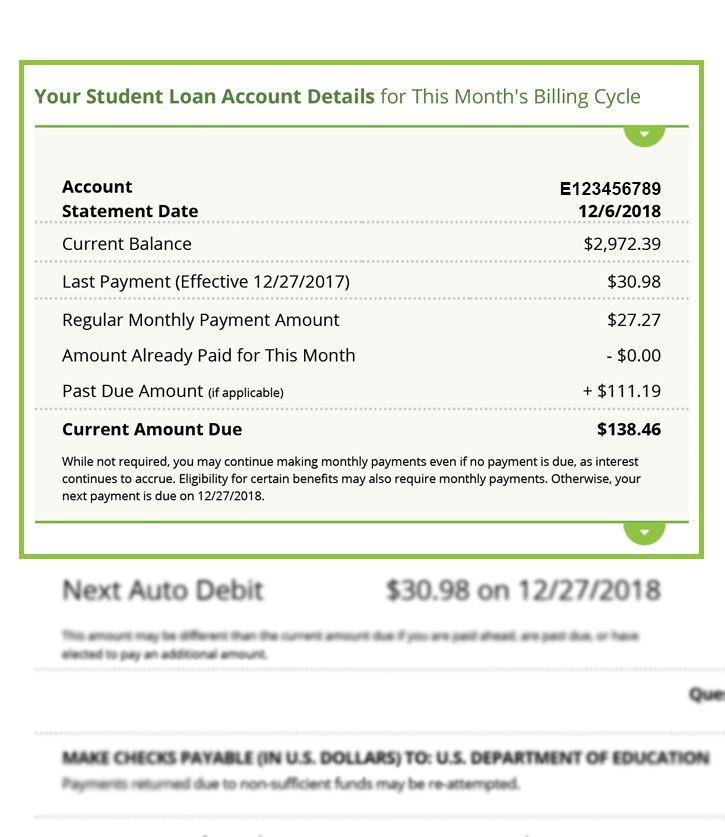

Nelnet sends monthly billing statements for each account approximately three weeks before your due date, either via a paper statement sent to your address or electronically to your Nelnet.com account . If you are currently in school, in your loans grace period, in a deferment, or in forbearance, you may not receive a monthly statement.

Access Your Student Loan Wherever You Are

We’re available wherever you need us, allowing you to access your student loan information 24/7. You can download our mobile app to get payment notifications, sign up for text alerts, and access our website from your mobile device, tablet, or desktop. We want to give you the best user experience possible.

Also Check: Do Reserves Get Va Loan

Your Student Loan Servicer

We’re here to process your loan payments and help you find lower monthly payment options if you need them. Learn what we do.

Upload Documents Without Logging in to Your Account

Do you need to upload a document? There’s no need to log in. Fill out our form with the requested information and attach your document.

How To Contact Nelnet For Help

There are other ways to contact Nelnet in addition to using your online account. You can email Nelnet through its online email form by providing your personal details and your comment or request.

Nelnets phone number is 888-486-4722. Service is available from 8 a.m. to 10 p.m. ET, Monday through Friday.

Nelnets mailing address for general correspondence is P.O. Box 82561, Lincoln, NE 68501-2561.

Don’t Miss: How Can I Apply For Personal Loan

Can I Have My Payment Applied To Interest Or Principal Only

No. For loans in repayment status, once a portion of a payment is allocated to a specific loan group, payments are applied to individual loans proportionally to fees first *, then to interest, and then to principal. If you are on an Income-Based Repayment Plan , payments are applied to interest, then to fees *, and then to principal. For loans not in repayment status, payments are first allocated to outstanding interest and fees . * For more information about how payments are applied to your student loans, see How Payments are Allocated.

*The U.S. Department of Education does not assess late or returned payment fees. back

You May Have More Than One Servicer: How To Find Out

If you have loans with more than one servicer, you will need to make a payment to each. If you’re not sure which servicers have your loans, go to StudentAid.gov and log in with your FSA ID, or call the Federal Student Aid Information Center at 800.433.3243.

It’s your responsibility to be aware of the number of student loans that have been taken out in your name, the amount owed, the timing of repayment, and where to send payments. If you make two or more monthly student loan payments, it may be wise to consider consolidating them into one loan.

Don’t Miss: How Much Home Loan Eligibility Calculator